Medical Laser Market Research, 2032

The global medical laser market was valued at $5.8 billion in 2022, and is projected to reach $17.1 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032. The growth of the medical laser market is driven by rise in prevalence of chronic diseases, and high adoption of medical lasers by healthcare professionals. According to a 2023 report by the National Library of Medicine, lasers are used in the majority of fields in medicine, especially in dermatology and ophthalmology, but also in surgery. Furthermore, according to 2022 report by U.S. Department of Health and Human Services, Laser surgery can be used to remove dilated blood vessels and redness, hairs, improve skin texture and cellulite, improve loose skin from aging.

Medical lasers are powerful devices that emit intense beams of focused light to perform a wide range of diagnostic and therapeutic functions in the field of medicine. Medical lasers have become essential tools in various medical applications, such as surgery, dermatology, ophthalmology, and dentistry. Medical lasers are highly versatile and offer precision in targeting specific tissues or cells, making them invaluable in procedures like laser eye surgery, skin resurfacing, and the removal of tumors or lesions.

Key Takeaways:

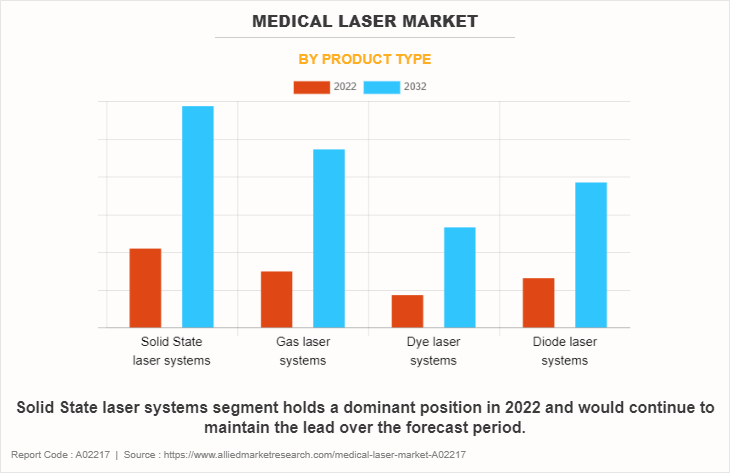

By product, the solid-state laser systems segment was the highest contributor to the market in 2022.

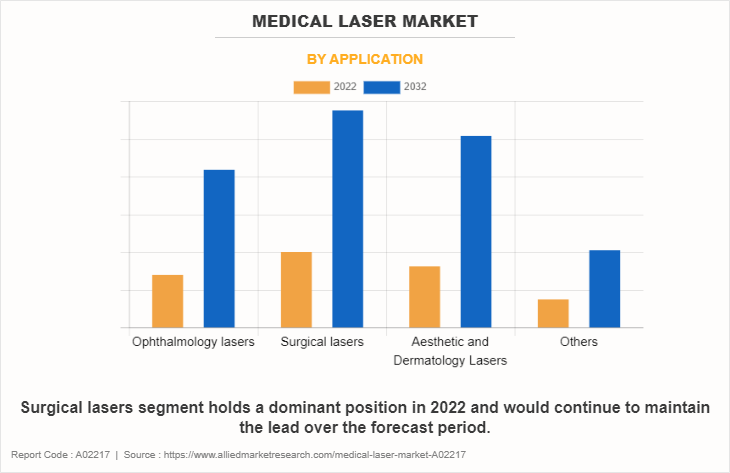

By application, the surgical laser segment was the highest contributor to the market in 2022. However, aesthetic and dermatology lasers is expected to register fastest growth during the forecasted period.

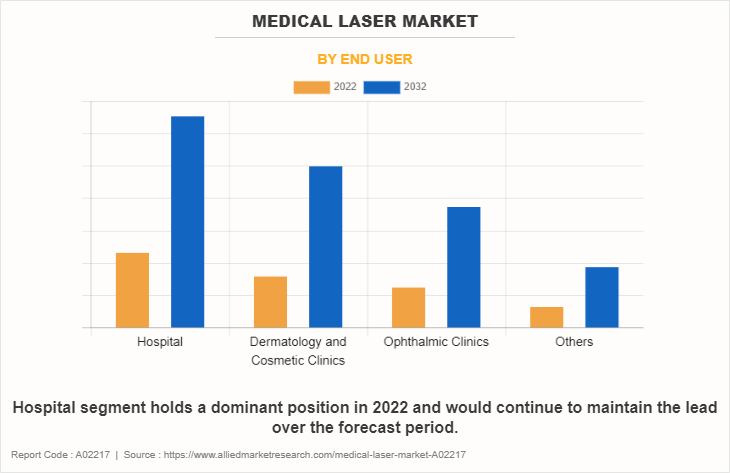

By end user, the hospitals segment dominated the Medical Laser Market Share in 2022, However, dermatology and cosmetic clinics is expected to register fastest growth during the forecasted period.

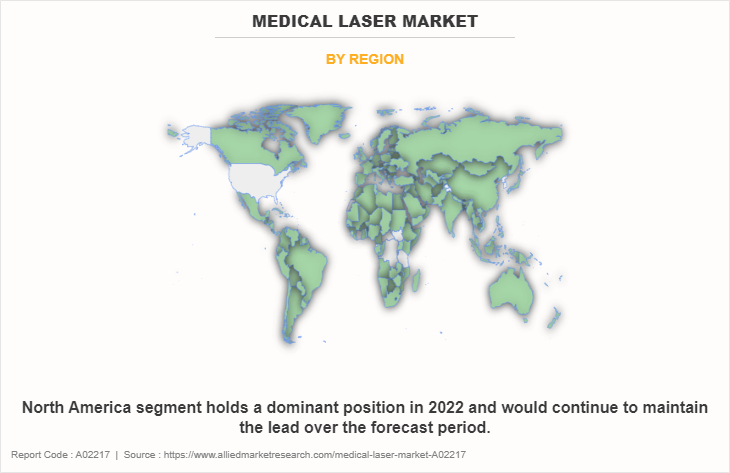

By region, North America garnered the largest revenue share in 2022. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period

Market Dynamics

The Medical Laser Industry is expected to grow significantly, owing to surge in prevalence chronic diseases and rise in adoption of medical lasers by healthcare professionals, and high number of cosmetic surgeries performed globally.

The Medical Laser market has witnessed a significant surge in recent years, attributed to the escalating prevalence of chronic diseases. This rise in chronic health conditions, such as cardiovascular diseases, cancer, and various dental disorders, has necessitated the development and adoption of advanced medical technologies to meet the growing healthcare demands. For instance, according to 2023 report by American Cancer Society, a nationwide non-profit organization dedicated to eliminating cancer, it was estimated that the skin cancer is one of the most common types of cancer with 5.4 million basal and squamous cell skin cancers are diagnosed each year in the U.S. Medical lasers have emerged as a powerful tool in the diagnosis, treatment, and management of these chronic ailments.

They offer precise and minimally invasive procedures, reducing patient discomfort and recovery times. For instance, in the field of oncology, lasers are used for tumor ablation and precision surgery. Furthermore, in recent years, the global healthcare landscape has experienced a notable increase in chronic conditions such as diabetic retinopathy, age-related macular degeneration, glaucoma, and various dental ailments. For instance, according to 2022 report by National Eye Institute, an agency of the U.S. Department of Health and Human Services, it was reported that scatter laser surgery is the preferred treatment options by doctors for treatment of advanced diabetic retinopathy.

In addition, in dentistry, lasers are employed for procedures like gum disease treatment, tooth whitening, and oral surgery. These technologies offer reduced post-operative discomfort, faster recovery times, and improved outcomes for patients.

Thus, the rise in prevalence of chronic diseases is expected to drive the growth of the market.

Furthermore, the adoption of medical lasers by healthcare professionals has witnessed a remarkable rise in recent years and is expected to contribute significantly to the growth of the market. Medical lasers have revolutionized the field of minimally invasive surgeries, offering precise and less invasive alternatives to traditional surgical procedures. These lasers provide surgeons with enhanced precision, enabling them to target specific tissues with minimal damage to surrounding structures, reducing patient pain, and shortening recovery times. Moreover, medical lasers have found extensive applications in the fields of dermatology and ophthalmology, where they are used for procedures like tattoo removal, skin resurfacing, and vision correction. The ability of medical lasers to precisely target and treat pathological tissue is instrumental in improving patient outcomes. Thus, owing to its precise targeting and minimal invasive nature the medical lasers there has been as surge in adoption of medical lasers by healthcare professionals.

The high number of cosmetic surgeries performed globally has emerged as a major driver for the medical laser market. In recent years, there has been a significant surge in the demand for cosmetic procedures, ranging from minimally invasive treatments like laser hair removal and skin rejuvenation to more complex surgeries such as liposuction and facelifts. One of the key reasons behind this phenomenon is the growing emphasis on personal appearance and the desire for self-enhancement, driven by factors like social media influence and the desire for a youthful and flawless look.

Medical lasers have played a pivotal role in the field of cosmetic surgery due to their precision and effectiveness in addressing various aesthetic concerns. Laser technology is used in procedures like laser liposuction, where it enables surgeons to target and remove unwanted fat with minimal invasiveness and quicker recovery times. Additionally, lasers are widely used for skin resurfacing, scar revision, tattoo removal, and the treatment of vascular lesions. Thus, the rise in the number of cosmetic surgeries globally is expected to drive the growth of the Medical Laser Market Size.

However, high cost of medical laser devices is the major restraints for the market growth. Moreover, the expanding applications of lasers across clinical areas presents a pivotal growth opportunity for the Medical Laser Industry.

The 2023 global recession poses challenges for the medical laser market. Reduced healthcare spending due to budget constraints from governments and individuals may impact device purchases. Layoffs at medical tech companies, such as Boston Scientific Corporation, hinder innovation, and high inflation in 2022 raised production costs for medical device manufacturers.

Segmental Overview

The medical laser market is segmented on the basis of product type, application, end use, and region. By product type the market is classified solid state laser systems, gas laser systems, dye laser systems, and diode laser systems. By application, the market is categorized into ophthalmology lasers, surgical lasers, aesthetic and dermatology lasers, and others. By end user, the market is divided into hospital, dermatology and cosmetic clinics, ophthalmic clinics, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, and rest of LAMEA).

By Product Type:

The medical laser market is categorized into solid state laser systems, gas laser systems, dye laser systems, and diode laser systems. The solid-state laser systems segment dominated the global Medical Laser Market Share in 2022 and is anticipated to continue this trend during the Medical Laser Market Forecastperiod. This is attributed to its their ability to generate precise and controlled output wavelengths, essential for targeting specific tissues or chromophores in medical procedures.

By Application:

By application, the market is categorized into ophthalmology lasers, surgical lasers, aesthetic and dermatology lasers, and others. The surgical laser segment dominated the global Medical Laser Market Size in 2022 owing to prevalence of cancer and advancements in tumor ablation technology. However, aesthetic and dermatology lasers are expected to register fastest growth owing to high adoption of medical lasers for the cosmetic applications.

By End User:

On the basis of end user, the market is categorized into hospital, dermatology and cosmetic clinics, ophthalmic clinics, and others. The hospital segment dominated the market in 2022, owing to rise in demand of medical laser in major surgeries such tumor removal surgery in the hospitals. However, dermatology and cosmetic clinics is expected to register fastest growth owing to rise in number of cosmetic procedures to enhance aesthetic appearance of an individual.

By Region:

On the basis of region, the Medical Laser Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America had the highest market share in 2022, owing to presence of major key players, and rise in prevalence of chronic diseases. However, Asia-Pacific is expected to exhibit fastest growth during the forecast period, owing to government initiatives for treatment of ophthalmic disorders, and improving the healthcare system.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the medical laser market, such as Bausch Health Companies, Inc, Boston Scientific Corporation, Koninklijke Philips N.V, Novartis AG, Biolase Inc, Iridex corporation, Artivion, Inc, Lumibird Medical, Candela Corporation and Cynosure, LLC. Major players have adopted product approval and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the medical laser market.

Recent Product Approval in the Medical Laser Market

In June 2023, Candela Corporation announced The Vbeam 595 nm pulsed dye laser, a recognized gold standard for vascular treatment, receives a ground-breaking FDA clearance for the treatment of port wine stains and hemangiomas in the pediatric population.

In March 2023, Candela Corporation announced that the PicoWay laser system has received FDA clearance and Health Canada licensing for expanded indications, including the challenging condition of melasma.

In February 2023, Bausch + Lomb Corporation a fully owned subsidiary of Bausch Health Companies, Inc. announced that the U.S. Food and Drug Administration (FDA) has approved the ML6710i photodynamic laser for equivalent use with Bausch + Lomb’s VISUDYNE (verteporfin for injection) photodynamic therapy (PDT) for the treatment of patients with predominantly classic subfoveal choroidal neovascularization, or the creation of abnormal choroidal blood vessels, due to Age-related Macular Degeneration.

In January 2022, Koninklijke Philips N.V announced the FDA has granted De Novo Clearance for Philips IVC Filter Removal Laser Sheath, CavaClear, to remove an IVC filter when previous methods of removal have failed. CavaClear is the first and only FDA-cleared solution for advanced IVC filter removal.

In July 2021, Koninklijke Philips N.V announced the FDA has granted Breakthrough Device Designation (BDD) for a laser-assisted inferior vena cava (IVC) filter removal device. The proposed device is intended for ablating tissue to remove an IVC filter when previous methods of removal have failed.

Recent Acquisition in the Medical Laser Market

In September 2021, Boston Scientific Corporation announced the close of its acquisition of the global surgical business of Lumenis LTD., a privately held company that develops and commercializes energy-based medical solutions. The Lumenis surgical business includes premier laser systems, fibers and accessories used for urology and otolaryngology procedures.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical laser market analysis from 2022 to 2032 to identify the prevailing Medical Laser Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical laser market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical laser market trends, key players, market segments, application areas, and market growth strategies.

Medical Laser Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.1 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Koninklijke Philips N.V., Iridex corporation., Artivion, Inc., Cynosure Inc, Lumibird Medical, Biolase Inc, Boston Scientific Corporation, Novartis AG, Bausch Health Companies, Inc., Candela Corporation. |

Analyst Review

The medical laser market has been experiencing robust growth and transformative advancements in recent years. This sector has evolved beyond its traditional applications in ophthalmology and dermatology to include a wide range of medical disciplines, including oncology, cardiology, and dentistry. The increasing adoption of minimally invasive procedures, driven by patient demand for faster recovery and reduced scarring, has fueled the demand for medical lasers. In addition, the global aging population, coupled with the rising prevalence of chronic diseases, has provided a substantial customer base for laser-based medical solutions. Moreover, the convergence of AI with laser technology holds great promise for personalized treatments and improved patient outcomes. While the market is highly competitive, it offers substantial opportunities for innovative companies to carve out niches and enhance their competitive positions.

The total market value of the Medical Laser Market is $5,753.77 million in 2022.

The forecast period in the report is from 2023 to 2032.

North America is the largest regional market for Medical Laser.

There are 10 Medical Laser manufacturing companies are profiled in the report.

The top companies that hold the market share in Boston Scientific Corporation, Koninklijke Philips N.V, Novartis AG, Biolase Inc, and Iridex corporation.

The base year for the report is 2022.

Yes, Medical Laser companies are profiled in the report.

Yes, the competitive landscape included in the Medical Laser Market report.

Loading Table Of Content...

Loading Research Methodology...