Table Of Contents

- The Rise of FAST Platforms Amid Subscription Fatigue

- Platform Strategies: Bundling, Expansion, and Content Acquisition

- The Role of Traditional Broadcasters and Studios in FAST's Growth

- Monetization Trends: Ad Tech, Dynamic Insertion, and Viewer Targeting

- Content Differentiation: From Syndicated Libraries to FAST Originals

- Case Study: Pluto TV's Strategic Growth and Acquisition

- Background:

- Challenges:

- Strategic Partnership with Apex Growth:

- Results:

- Conclusion:

- Conclusion

Onkar Sumant

Koyel Ghosh

Thriving Without Subscriptions: The FAST Way to Grow Content and Revenue

The way people watch video content is changing fast, and Free Ad-supported Streaming TV (FAST) is leading the shift. At first, FAST was seen as just an extra option alongside paid streaming services. But now, it's becoming popular on its own by offering high-quality content for free. Unlike paid services like Netflix, FAST is free to watch because it earns money from ads.

The rise of FAST is not just about offering viewers a no-cost alternative. It reflects broader changes in audience behavior, advertiser priorities, and platform strategies. For instance, Pluto TV, one of the first to offer free streaming with ads, witnessed a big jump in users after 2020, showing that people were moving toward cheaper ways to watch TV. As traditional cable declines and SVOD services saturate, FAST is increasingly being recognized as a strategic pillar rather than an experimental offering.

The Rise of FAST Platforms Amid Subscription Fatigue

The subscription fatigue phenomenon has become a significant driver for the growth of FAST platforms. With people subscribing to more streaming services, the total monthly cost is starting to match or even exceed cable bills. To save money, many are open to using services with ads.

Big companies are clearly changing their strategies because of this trend. For example, Disney, historically reliant on premium subscription models through Disney+, announced in 2024 that it would expand its FAST offerings. This move came after observing that a significant portion of its subscriber churn stemmed from cost concerns rather than content dissatisfaction. By integrating FAST channels alongside its SVOD services, Disney aims to retain price-sensitive users while still monetizing viewership through advertising.

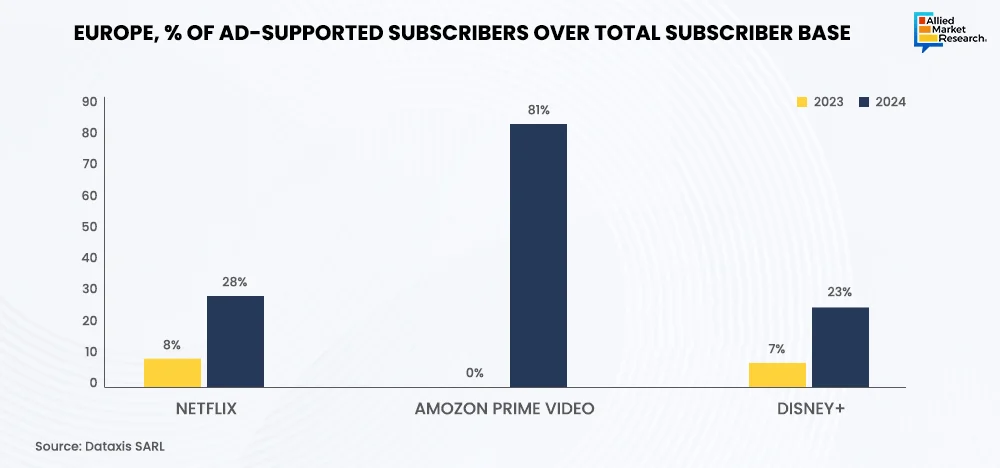

According to a 2025 report by Dataxis, hybrid video-on-demand (HVOD) services—streaming platforms offering both ad-supported and premium, commercial-free plans—experienced a 783% growth across Europe's top five streaming markets. This surge was significantly influenced by Amazon Prime Video's decision to default users to its ad-supported tier, resulting in an 81% increase in adoption shortly after implementation. Other platforms like Netflix and Disney+ also saw substantial growth in their ad-supported plans, with increases of 28% and from 7% to 23% respectively in 2024. Additionally, telecom operators in countries such as the UK, Germany, France, and Portugal have been promoting streaming adoption by bundling these services with traditional TV and broadband packages.

Another notable example is how Warner Bros. Discovery blended its top content libraries into free, ad-supported platforms like Tubi and The Roku Channel in 2023. This move targets viewers who avoid new subscriptions but still enjoy trusted content brands. By offering popular shows and movies for free with ads, they reach a broader audience. This choice to mix studio content into FAST services reflects a big change in how major media companies are shaping their digital plans.

Tubi, a major FAST platform owned by Fox Corporation, has shown how popular free streaming is becoming. In 2024, it reached over 97 million monthly active users—a 30% jump from the year before—and became the top free streaming service in the U.S. based on total watch time. Viewers spent nearly 10 billion hours watching content on Tubi in 2024, showing strong interest in free, ad-supported entertainment. As many families face financial stress, the rise of platforms like Tubi shows how the no-cost model is changing the streaming world on a large scale.

Platform Strategies: Bundling, Expansion, and Content Acquisition

The evolution of FAST services is no longer limited to simply offering old content for free. Platform strategies have matured to include smart bundling, aggressive content acquisition, and targeted regional expansion. These decisions are being driven by both user engagement data and the growing competition among free streaming services to establish long-term loyalty.

A compelling example is Samsung TV Plus, which has quietly become one of the most widely distributed FAST platforms globally, available in over 24 countries and pre-installed on more than 500 million devices. Samsung’s bundling strategy leverages its hardware ecosystem — TVs, tablets, and smartphones — to give users frictionless access to curated FAST channels without requiring app downloads or logins. This tight integration with devices allows Samsung to collect granular engagement data while delivering targeted advertising natively, an edge few competitors possess.

Content acquisition has become a top priority. Paramount Global, through Pluto TV, has aggressively licensed legacy titles from its own archives and third-party providers. In 2022, Pluto TV added over 6,300 episodes of CBS programming, including series like NCIS and Survivor, which continue to perform well even years after airing. This repackaging of evergreen content into themed channels (e.g., “NCIS Channel,” “Reality Competition Channel”) creates a lean-back experience that mimics traditional TV while offering better targeting for advertisers.

Regional expansion is also unfolding. Rakuten TV has scaled its FAST operations across 42 European countries and now includes over 500 curated channels. Their approach — working with local telecom partners and advertisers — highlights how FAST is evolving beyond just content delivery to also become a node in localized distribution and monetization networks.

The Role of Traditional Broadcasters and Studios in FAST's Growth

While FAST services were initially considered disruptors, traditional broadcasters and studios have now become key participants — even enablers — of this format. Instead of competing with FAST models, content owners are embracing them as a means of content monetization, brand reinforcement, and inventory utilization.

For instance, NBC Universal’s launch of NBC News Now, a FAST channel offering 24/7 live and on-demand news coverage in 2019. Unlike SVOD offerings that focus on behind-the-paywall content, this channel extends NBC’s reach into a younger, cord-cutting demographic that consumes news in digital-first formats. It also enables the company to monetize through programmatic advertising and direct sales without cannibalizing its cable news arm.

Similarly, Warner Bros. Discovery, in January 2023, struck a multi-year deal with Tubi to bring more than 2,000 hours of WB content to these FAST services. The library includes titles such as Westworld and F-Boy Island, which had previously been removed from HBO Max due to cost-efficiency decisions. By distributing them via FAST, the studio maintains visibility for these shows while still generating ad revenue from passive viewers.

This rebalancing of content flow — from SVOD to FAST — indicates a broader recalibration in digital content economics. Rather than letting content lie dormant or disappear behind paywalls, studios are learning to extract long-tail value from legacy IP. As more conglomerates pivot toward this model, FAST is becoming an extension of the content life cycle, not just a cost-saving alternative.

Monetization Trends: Ad Tech, Dynamic Insertion, and Viewer Targeting

One of the most defining evolutions in the FAST ecosystem is how platforms are using advertising technology to transform monetization. What began as a simple ad-supported model is now driven by AI-enabled ad tech stacks, dynamic ad insertion (DAI), and deep viewer profiling, enabling monetization with the precision traditionally associated with digital display advertising.

Dynamic ad insertion is at the core of this evolution. Unlike legacy broadcasting models, where ad blocks were fixed and uniform, DAI allows for real-time, programmatic insertion of tailored ads based on viewer behavior and demographics. Platforms like Xumo, a joint venture between Comcast and Charter, have built proprietary technology to power DAI across both live and on-demand FAST channels. This not only increases fill rates but also ensures higher CPMs for advertisers through contextual relevance.

Viewer targeting is also becoming more refined. Sling Freestream, DISH’s FAST offering, leverages user registration data and cross-platform engagement analytics from the broader Sling ecosystem. This allows it to deliver addressable ads that cater to viewer preferences, with reporting capabilities that advertisers can tie back to conversion goals. In effect, FAST is shifting from being a volume-driven advertising space to one that increasingly supports performance-based advertising.

For example, LG Ad Solutions uses data from LG smart TVs to show targeted ads on free streaming channels (FAST). In a 2024 study, LG Ads found that its Screensaver Ads boosted brand awareness by 2.5 times more than the usual industry level. It also led to a 19.7-point increase in how likely adults aged 45+ were to consider the brand. Another campaign showed that when companies used a complete connected TV strategy—including video ads, native formats, and mobile content—brand awareness rose by 4.7 times, ad recall by 8.7 times, and brand consideration by 11.2 times. At the same time, it helped cut the cost per website visit. These results highlight how FAST, when paired with smart targeting and different ad formats, can give strong results in both branding and performance. Because of this, advertisers are now paying more attention to FAST channels when planning their media strategies

This granular monetization infrastructure marks a significant departure from traditional TV advertising and further strengthens the business viability of FAST platforms as performance media environments.

Content Differentiation: From Syndicated Libraries to FAST Originals

While FAST platforms initially relied heavily on syndicated content, there has been a strategic shift towards curating specialized channels to enhance viewer engagement and differentiate offerings.

Pluto TV, a leading name in free streaming, has been leading this change. In April 2025, Pluto TV launched "The Martha Stewart Channel," a 24/7 streaming channel featuring over 1,000 episodes of Martha Stewart’s lifestyle television content, including programs like Martha Stewart Living, Martha Bakes, and Martha Stewart's Cooking School. This move reflects Pluto TV's commitment to providing curated content that caters to specific audience interests.

Additionally, Pluto TV has introduced thematic channels aligned with cultural events and viewer preferences. For instance, in September 2023, the platform unveiled new channels and programming to celebrate "Comedy Month" and "Star Trek Day," offering marathons and special content blocks dedicated to these themes.

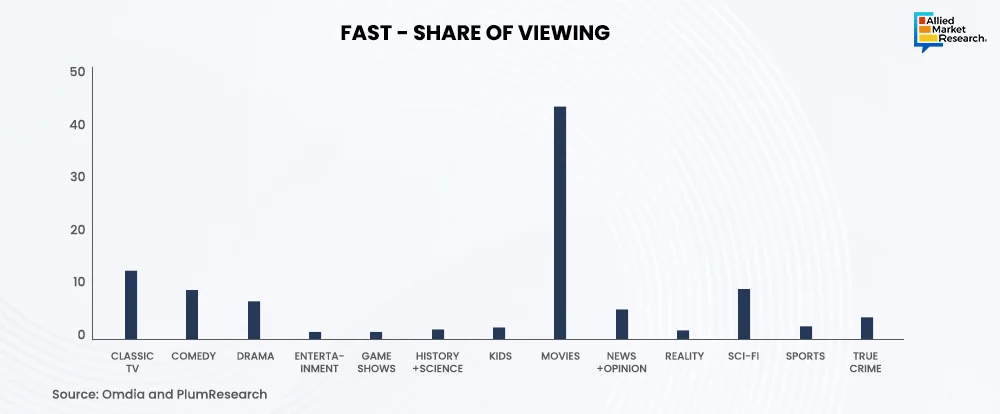

According to a 2024 analysis by Omdia and PlumResearch, 43% of all viewing on Pluto TV is attributed to its movie channels. Notably, six of the platform's top ten most-watched channels are dedicated exclusively to movies, highlighting the genre's significant appeal among viewers. This trend portrays the enduring popularity of movies within the Free Ad-Supported Streaming TV (FAST) landscape.

These efforts show that FAST platforms are trying to do more than just reuse old content. By creating curated channels and event-based programming, services like Pluto TV are enhancing the viewer experience, fostering brand loyalty, and attracting advertisers seeking targeted audiences.

Case Study: Pluto TV's Strategic Growth and Acquisition

Background:

Pluto TV, a pioneer in free ad-supported streaming television (FAST), faced significant challenges in a crowded streaming landscape. Despite offering a unique, no-subscription model, the company struggled to scale its user base and effectively deploy advertising spending. In 2017, Pluto TV partnered with Apex Growth to address these challenges and accelerate its growth trajectory.

Challenges:

- User Acquisition: Pluto TV's initial focus on app downloads as a key performance indicator (KPI) was insufficient for long-term growth.

- Advertising Efficiency: The company needed to optimize its advertising strategies to deploy millions of dollars in ad spend effectively.

- Competitive Landscape: The streaming space was becoming increasingly competitive, requiring innovative marketing approaches to stand out.

Strategic Partnership with Apex Growth:

Apex Growth, with its expertise in growth marketing and user acquisition, became a critical partner for Pluto TV. The collaboration focused on:

- Transitioning KPIs: Shifting the focus from app downloads to monthly active users (MAUs), providing a more accurate measure of user engagement and retention.

- Optimizing Advertising Spend: Implementing strategies to deploy advertising dollars efficiently, maximizing return on ad spend (ROAS).

- Creative Strategy: Developing engaging and targeted creative content to attract and retain users.

Results:

- User Growth: Pluto TV's MAUs increased from 6 million to 68 million.

- Market Positioning: The platform regularly outranked competitors like Netflix and Amazon Prime Video in the Free Entertainment category on the Google Play Store.

- Acquisition: In 2019, Pluto TV was acquired by ViacomCBS (now Paramount) for $340 million.

Conclusion:

The strategic partnership between Pluto TV and Apex Growth illustrates the importance of adapting marketing strategies to evolving industry dynamics. By focusing on user engagement metrics and optimizing advertising spend, Pluto TV successfully explored the competitive streaming landscape, leading to significant user growth and a successful acquisition.

Conclusion

The rise of Free Ad-Supported Streaming TV (FAST) has reshaped the media consumption landscape, offering a compelling alternative to subscription-based models. As viewers become more selective in their streaming habits and demand more flexible, cost-effective options, FAST services have emerged as a solution that caters to both content creators and audiences.

FAST platforms have grown through smart partnerships, focused content, and fresh ways to make money. Pluto TV uses themed channels, while Tubi offers top-quality shows to meet different viewer tastes. These platforms are using new tech like AI and machine learning to improve how they show content and ads, making the experience more personal and useful for each user.

Looking ahead, t FAST has great potential to grow, offering new ways to earn money, better ad targeting, and improved experiences for users. As people’s tastes change, FAST platforms will become important in shaping how streaming works, making good-quality content available for free to viewers all over the world.

The future of FAST is not only promising but a dynamic space where innovation, content, and advertising converge to meet the demands of an ever-changing market.

At Allied Market Research, our in-depth analysis of the Free Ad-Supported Streaming TV (FAST) landscape equips content providers, platform operators, and technology partners with actionable intelligence to explore this fast-evolving segment. By tracking changes in how viewers watch, improvements in advertising technology, and smart ways to share content, we help businesses find new growth opportunities and become more flexible. Whether you’re checking your money-making plans, boosting user interaction, or building key distribution partnerships, AMR’s insights provide the clear guidance you need to create strong, future-proof FAST services. Contact our specialists to turn streaming insights into sustainable growth.