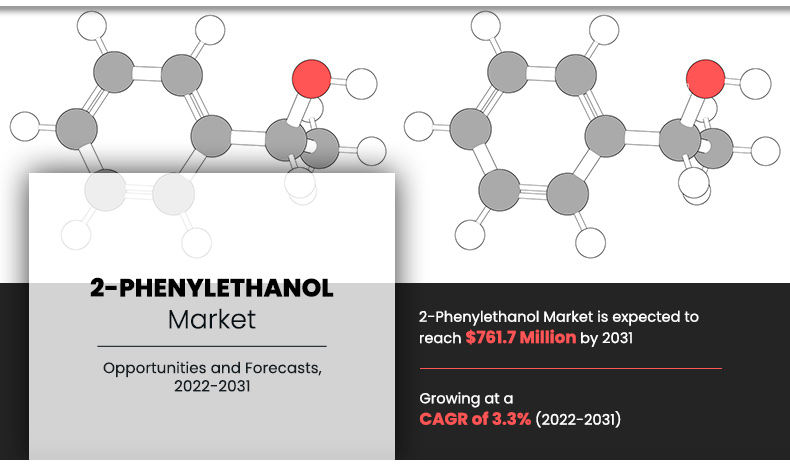

The global 2-phenylethanolmarket was valued at $491.7 million in 2021, and is projected to reach $761.7 million by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

2-Phenylethanol is translucent, clear, and slightly viscous. Cosmetics and personal care items such as shampoo, eye shadow, perfume, skin care, cologne, and foundation all contain phenethyl alcohol. As a result, cosmetics and personal care items are protected from spoiling by this ingredient.

2-Phenylethanol is further used in the production of fragrances. It has the capacity to eliminate microorganisms and function as a disinfectant, and as a result, it is utilized in cleaning and maintenance solutions. It preserves cosmetics and other personal care items from spoiling by inhibiting or stopping the development of microorganisms. In addition, 2-phenylethanol is responsible for the scent that it brings to products.

As 2-phenylethanol has many useful properties, including those of a scent and a preservative, it is majorly applicable in the field of cosmetics. Increase in consumer interest in new, interesting, and premium items, surge in the number of individuals in the upper middle class, increase in online beauty spending, and surge in world population of senior citizens are the primary factors driving the growth cosmetics market, and thus contributes toward the expansion of the 2-phenylethanol market.

However, availability of alternative products with similar or higher functional values is a major market restraint. Salicylic acid, a beta hydroxyl acid, is a popular alternative to 2-phenylethanol in skin care products. Salicylic acid is more effective in exfoliating the skin than 2-phenylethanol. Salicylic acid has been used in product formulations by a number of companies.

Furthermore, increase in consumer awareness regarding the benefits of natural components in cosmetics and personal care products represents potential growth opportunities for the 2-phenylethanol market. As a result, cosmetics and personal care product manufacturers are increasingly substituting natural ingredients for their synthetic counterparts.

The 2-phenylethanol market is segmented into type, end-use industry, and region. Depending on type, the market is categorized natural and synthetic. On the basis of end-use industry, the market is categorized into food & beverage, personal care & cosmetics, pharmaceutical, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the global 2-phenylethanol market include Apple Flavor and Fragrance Group Co., Ltd., Eternis Fine Chemicals Ltd., Firmenich SA, Harmony Organics Pvt Ltd, Kdac Chem Pvt Ltd, LyondellBasell Industries Holdings B.V., Matrix Scientific, Symrise AG, TCI America, and Yingyang (China) Aroma Chemical Group.

Other players operating in the 2-phenylethanol market are Alkyl Amines Chemicals Ltd. (AACL), Zhejiang Novorate Biotech Co., Ltd., Shanghai PuJie Fragrance Co., Ltd., and Vigon International, Inc.

By Type

Natural segment holds major market share and is projected to grow at a CAGR of 3.3%.

2-Phenylethanol Market, by Type

The natural segment accounted for the largest share of 67.80%. Natural 2-phenylethanol segment is estimated to grow at a CAGR of 3.3% during the forecasted period. This is attributed to increased demand for natural ingredients from many industries due to rise in health concerns among the population.

By End-use Indsutry

Personal Care and Cosmetics industry holds a major share and is projected as the most lucrative industry growing at around CAGR of 3.4%.

2-Phenylethanol Market, by End-use Industry

The personal care & cosmetics segment accounted for the largest share, i.e., 43.02%, and is expected to register a CAGR of 3.4%. This is attributed to increased demand for 2-phenylethanol by personal care and cosmetic sector as it acts as a preservative for the cosmetic products, is allergy-free, and does not cause any side effects.

By Region

Asia-Pacific holds a dominant position in 2021 and is projected as the most lucrative region.

2-Phenylethanol Market, by Region

Asia-Pacific contributed the 42.0% market share in 2021, and is projected to grow at CAGR of 3.4% during the forecast period, owing to increased demand from food & beverages and cosmetic & personal care industries.

KEY BENEFITS FOR STAKEHOLDERS

- The report provides in-depth analysis of the global 2-phenylethanol market along with the current trends and future estimations.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the global 2-phenylethanol market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the global 2-phenylethanol market growth.

- The qualitative data about market dynamics, trends, and developments is provided in the report.

IMPACT OF COVID-19 ON THE GLOBAL 2-PHENYLETHANOL MARKET

- COVID-19 has spread across the globe and effected almost all aspects of life.

- Some major economies that have suffered severely from the COVID-19 crises include Germany, France, Italy, Spain, the UK, and Norway.

- There is an uneven impact of COVID-19 pandemic on the 2-phenylethanol market, owing to implementation of lockdowns worldwide to halt spread of the virus. This resulted in shutting off of almost all operations, manufacturing, and distribution of all industries.

- This further decreased the demand for cosmetic products from beauty shops, which, in turn, has led to sluggish growth of the market.

- The demand–supply gap, disruptions in raw material procurement, and price volatility further hampered the growth of the chemical industry during the COVID-19 pandemic.

- The COVID-19 crisis has affected the chemical industry supply chain to a major extent; thus, having a major impact on raw material procurement.

- On the contrary, increase in demand for home and personal hygiene products due to the awareness regarding the cleanliness boosted the growth of the 2-phenylethanol market, which, in turn, tends to overcome the impact of COVID-19 on this sector.

- The future of the 2-phenyethanol market industry will be shaped by post pandemic changes in social, economic, trade, and political situations, as well as planned environmental regulatory reforms.

2-Phenylethanol Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | LyondellBasell Industries Holdings B.V., Matrix Scientific, Yingyang (China) Aroma Chemical Group, Kdac Chem Pvt., Ltd., TCI America, Eternis Fine Chemicals Ltd., Symrise AG, Apple Flavor and Fragrance Group Co., Ltd., Harmony Organics Pvt., Ltd., Firmenich SA |

Analyst Review

According to the insights of the CXOs of leading companies, the increased demand for cosmetic and personal care products is expected to drive the demand for 2-phenyethanol. Although Asia-Pacific has emerged as a lucrative region for investors, North America and Europe are perceived as mature markets for the personal care and cosmetics industry, owing to high growth rate, in terms of revenue. For instance, increase in demand for preservative in cosmetic products across the globe drives growth of the 2-phenyethanol market.

However, the availability of the alternate chemical for 2-phenyethanol hampers the growth of the market. The CXOs further added that, owing to the COVID-19 pandemic, there is a huge impact on production of 2-phenylethanol as the awareness among consumers regarding both personal and household hygiene increased. Thus, this is expected to foster the growth of the market.

Increased demand from end-use industry like packaging and paint & coating is boosting the demand for polyethylene wax market.

The global polyethylene wax market size was valued at $1.1 billion in 2021, and is projected to reach $1.5 billion by 2031, growing at a CAGR of 2.9% from 2022 to 2031.

DUEREX AG, Forplast, Innospec, Marcus Oil & Chemical, Merco, Nanjing Tianshi New Material Technologies Co., Ltd, Prakash Chemicals, SCG Chemicals PLC, and The International Group, Inc are the most established players of the polyethylene wax market

Plastic industry is projected to increase the demand for polyethylene wax.

By Type o Low Density Polyethylene (LDPE) Wax o High-Density Polyethylene (HDPE) Wax o Others • By Application o Plastics o Masterbatch o Hot Melt Adhesives o Coatings, Paints and Inks o Tire and Rubber o Others

Increased demand from packaging and paint & coating industry is the main driver of polyethylene wax market.

Hot melt adhesives and masterbatch applications are expected to drive the adoption of polyethylene wax market.

COVID-19 had negative impact on polyethylene wax market owing to decreased in demand from plastics and Paint & coating industry.

Loading Table Of Content...