3D Bioprinting In Medical Market Research, 2032

The global 3d bioprinting in medical market was valued at $1.1 billion in 2022, and is projected to reach $4.9 billion by 2032, growing at a CAGR of 15.5% from 2023 to 2032. The growth of the 3D bioprinting in medical market is driven by rise in R&D investment, increase in prevalence of chronic diseases, and advancements in 3D bioprinting technology. For instance, according to the report of National Association of Chronic Disease Directors 2022, nearly 60% of adult Americans have at least one chronic disease.

Key Takeaways

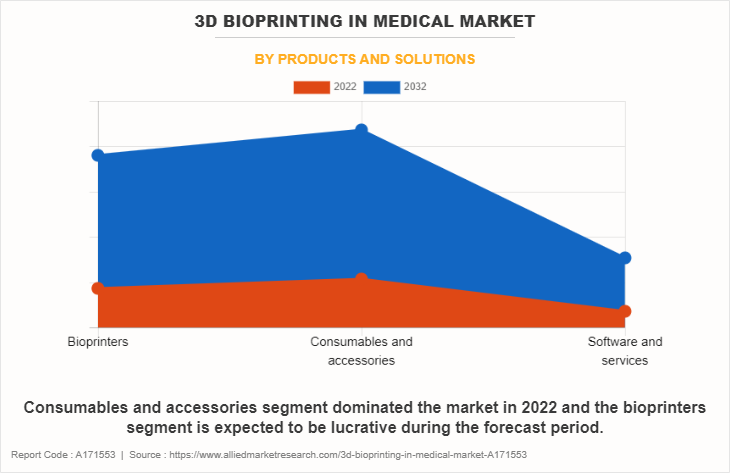

- By products and solutions, the consumables and accessories segment dominated the global market in 2022.

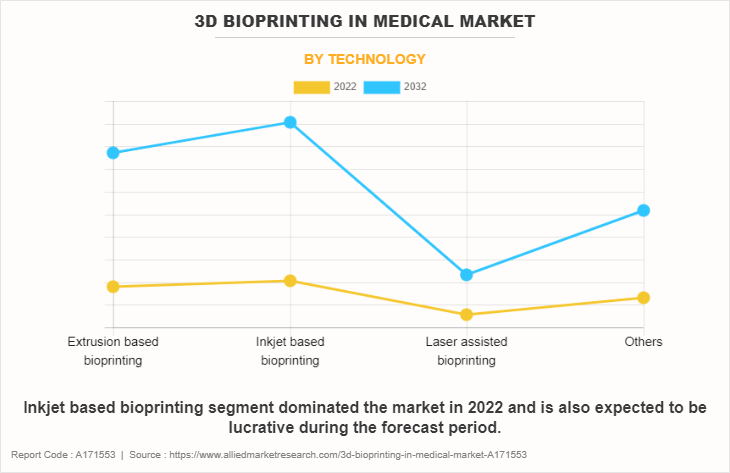

- By technology, the inkjet-based bioprinting segment dominated the global market in 2022.

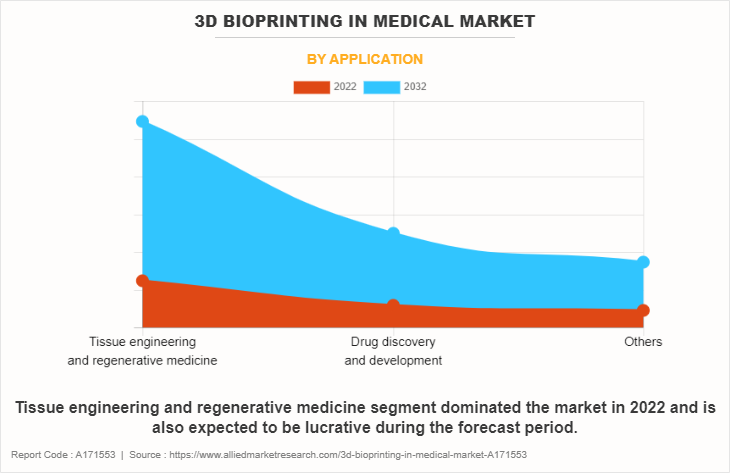

- By application, the tissue engineering and regenerative medicine segment dominated the global market in 2022.

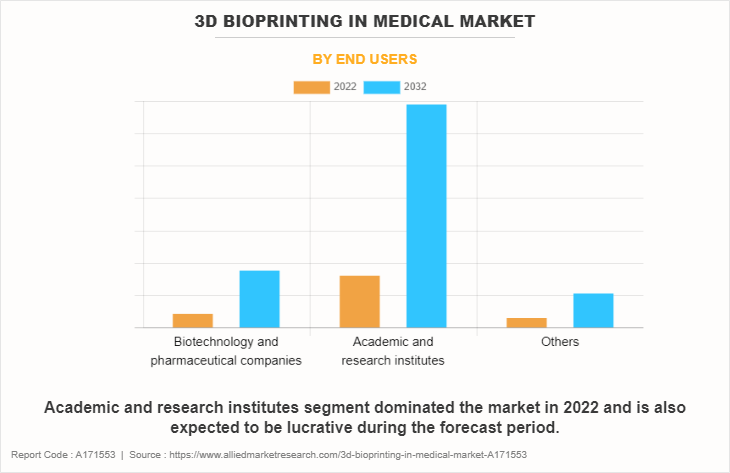

- By end user, the academic and research institutes segment dominated the market in terms of revenue in 2022.

- By region, North America dominated the market in terms of revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The 3D bioprinting process initiates with CT or MRI scans of the target organ, and the acquired image is uploaded into a computer, which generates a corresponding 3D blueprint using specialized software. This 3D data is integrated with histological information derived from microscopic analysis, resulting in a detailed layer-by-layer model of the organ. The compiled information, including the 3D model and material specifications, is inputted into the bioprinter. The printer interprets the blueprint and meticulously deposits biomaterial onto a receiving platform in a layer-by-layer fashion. Once the entire organ is printed, it is carefully removed from the printer and transferred to an incubator. This incubation period allows the printed structures to settle and stabilize, contributing to the development of a functional and viable organ.

Market Dynamics

The global 3D bioprinting in medical market driven by rise in prevalence of chronic diseases, coupled with the need for better models to study disease progression and develop targeted therapies, is boosting the demand for 3D bioprinting in disease modeling and drug testing applications. For instance, The Advanced Regenerative Manufacturing Institute (ARMI) receives more than $300 million in public-private investment from leading manufacturers, universities, nonprofit organizations, and the federal government to develop scalable manufacturing processes for engineered tissues and organs.

In addition, the increase in applications of 3D bioprinting in healthcare market, including tissue engineering, regenerative medicine, and 3D cell culture, are significant drivers for the market growth. Technology offers the potential to create functional tissues and organs for transplantation, providing solutions to the shortage of donor organs. For instance, in March 2022, CELLINK, a BICO Group company and CollPlant Biotechnologies developing innovative technologies and products for tissue regeneration and organ manufacturing, announced that they have signed a collaboration agreement. Thus, the rise in collaboration agreements for 3D bioprinting has supported the market growth.

The initial cost of 3D bioprinting equipment and technology is relatively high. This can be a limiting factor for smaller research institutions, laboratories, and companies with constrained budgets, hindering widespread accessibility which negatively impacted the 3D bioprinting in healthcare market growth.

In contrast, ongoing advancements in 3D bioprinting technologies such as improvements in precision, speed, and resolution, are providing market opportunity to market growth and are also the 3D Bioprinting in medical market trends. Innovations in bioink formulations, printer design, and fabrication techniques enhance the capability to create complex and functional tissue structures. For instance, in October 2023, CELLINK, a global leader in bioprinting technologies announced a pioneering innovation in the field of regenerative medicine and tissue engineering with the launch of CELLINK Vivoink, the first-ever medical-grade bioink specially designed to support researchers on their clinical translational journey.

A recession may lead to reduced demand and delayed purchases including pricing strategies, healthcare policies, and changes in consumer behavior, may influence the market dynamics. During economic downturns, there may be a reduction in government and private sector funding for research and development. This can impact the research initiatives and projects related to 3D bioprinting, potentially slowing down innovation and technological advancements. In addition, companies involved in 3D bioprinting may face budget constraints during a recession. This could lead to a slowdown in hiring, potential delays in product development, or a shift in priorities toward cost-cutting measures, impacting overall industry growth.

Despite these challenges, the 3D bioprinting in medical industry continues to experience moderate revenue growth owing to technological advancements in 3D bioprinting. Thus, the 3D bioprinting in medical market is moderately impacted by recession.

Segmental Overview

3D bioprinting in medical market analysis is segmented into products and solutions, technology, application, end user, and region. By products & solutions, the market is categorized into bioprinters, consumables & accessories and software & services. By technology, the market is classified into extrusion based bioprinting, inkjet-based bioprinting, laser-assisted bioprinting, and others. By application, the market is classified into tissue engineering & regenerative medicine, drug discovery & development, and others. By end user, the market is classified into biotechnology and pharmaceutical companies, academic and research institutes, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Products and Solutions

The consumables and accessories segment dominated the global 3D bioprinting in medical market share in 2022 and is expected to register the highest CAGR during the forecast period, owing to increase in demand for specialized biomaterials and supportive accessories, and advancements in bioprinting technology.

However, the bioprinters segment is expected to register the highest CAGR during the forecast period, owing to continuous advancements in bioprinting technology, enabling precise and scalable fabrication of complex biological structures for applications in tissue engineering and regenerative medicine. In addition, the increase in demand for personalized medicine and organ transplantation solutions further fuels the 3D bioprinting in medical market forecast.

By Technology

The inkjet-based bioprinting segment dominated the global 3D bioprinting in medical market share in 2022 and is expected to register the highest CAGR during the forecast period, owing to its precision, high-resolution capabilities, and suitability for a wide range of bioink formulations.

By Application

The tissue engineering & regenerative medicine segment dominated the global 3D bioprinting in medical market size in 2022 and is expected to register the highest CAGR during the forecast period, owing to its pivotal role in creating functional and personalized tissues and organs. As the demand for innovative solutions in organ transplantation and personalized medicine grows which supports the segment growth.

By End User

The academic and research institutes segment held the largest 3D bioprinting in medical market size in 2022 and is expected to register the highest CAGR during the forecast period, owing to its active involvement in cutting-edge research, development, and exploration of 3D bioprinting technologies. In addition, these institutions serve as hubs for foundational research, technology validation, and the training of professionals in the field which further support 3D bioprinting in medical market growth.

By Region

3D bioprinting in medical industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the 3D bioprinting in medical market in 2022 and is expected to maintain its dominance during the forecast period.

The presence of several major players, such as 3D Systems Corporation, Organovo Holdings, Inc., and advancement in manufacturing technology of 3D bioprinting in medicals in the region drive the growth of the market. In addition, well established infrastructure, significant investments in R&D, providing a conducive environment for the advancement and adoption of cutting-edge technologies like 3D bioprinting drive the market growth in this region.

Asia-Pacific offers profitable 3D bioprinting in medical market opportunity for key players operating in the 3D bioprinting in medical market, thereby registering the fastest growth rate during the forecast period, owing to the growing demand for advanced medical solutions, including regenerative therapies and tissue engineering, where 3D bioprinting plays a pivotal role.

Competition Analysis

Competitive analysis and profiles of the major players in 3D bioprinting in medical market, such Organovo Holdings, Inc., Cyfuse Biomedical K.K., BICO, REGEMAT 3D, Desktop Metal, Inc., Medprin, Shining 3D CollPlant Biotechnologies Ltd, Advanced Solutions, Inc. and 3D Systems Corporation are provided in this report. Major players have adopted product launch, partnership, agreement, acquisition, collaboration, expansion, and product upgrade as key developmental strategies to improve the product portfolio of the 3D bioprinting in medical market.

Recent Partnerships In The 3D Bioprinting in Medical Market

- In October 2023, Carcinotech and CELLINK announced a collaborative partnership to develop and commercialize protocols for the biofabrication of 3D bioprinted tumor models based on cancer cell lines that improve accuracy and rapidly speed up drug development processes, driving down development costs and enabling an improved output.

- In October 2023, CELLINK, a leading global provider of bioprinting technologies, and the University of California, San Diego (UCSD), a world-renowned research institution, are pleased to announce their partnership to establish a 3D bioprinting Centre of Excellence.

- In May 2022, CELLINK, has entered the most important distribution partnership in Latin America in 2022 with widely known supplier, CTR Scientific, to be their exclusive distributor in Mexico.

- In December 2020, CELLINK and Atelerix announced a partnership to bring to market Atelerix’s portfolio of innovative hydrogel biological encapsulation products, which preserve fragile biological samples for shipping at room temperature.

Recent Product Launches In The 3D Bioprinting in Medical Market

- In January 2023, CollPlant announced the launch of Collink.3DTM 50L, a recombinant human collagen (rhCollagen)-based bioink in a powder form for use in a wide range of 3D bioprinting applications.

- In November 2022, CollPlant, a regenerative and aesthetics medicine company developing innovative human collagen-based technologies and products for tissue regeneration and organ manufacturing, announced the Company is launching Collink.3D 90, a recombinant human collagen (rhCollagen)-based bioink for use in a variety of 3D bioprinting applications.

- In March 2022, CELLINK, A BICO Company, launched the BIO CELLX a novel system that automates 3D cell culture workflows by leveraging pre validated protocols. The BIO CELLX builds upon CELLINK’s impressive bioprinting portfolio utilizing proven technologies.

- In March 2021, CELLINK announced the launch of the BIO MDX Series, the next generation of bioprinters designed for high throughput biofabrication and precision 3D bioprinting for biomedical manufacturing, including biocompatible medical devices.

Recent Agreements In The 3D Bioprinting in Medical Market

- In April 2023, Stratasys Ltd. and CollPlant Biotechnologies announced a joint development and commercialization agreement to collaborate on the development of a solution to bio-fabricate human tissues and organs using Stratasys’ P3 technology-based bioprinter and CollPlant’s rh-Collagen-based bioinks.

- In November 2022, CollPlant, Tel Aviv University and Sheba Medical Center announced entering into a license and research agreement to co-develop rhCollagen-based 3D bioprinted human intestine model for drug discovery and personalized treatment of ulcerative colitis.

- In June 2021, 3D Systems and CollPlant Biotechnologies announced they have signed a co-development agreement for a 3D bioprinted regenerative soft tissue matrix for use in breast reconstruction procedures in combination with an implant.

3D Bioprinting in Medical Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.9 billion |

| Growth Rate | CAGR of 15.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 316 |

| By End users |

|

| By Products and solutions |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | REGEMAT 3D, CollPlant Biotechnologies Ltd, Advanced Solutions, Inc., Cyfuse Biomedical K.K., Desktop Metal, Inc., BICO, Organovo Holdings, Inc., 3D Systems Corporation, Medprin, Shining 3D |

Analyst Review

This section provides various opinions of top-level CXOs in the global 3D bioprinting in medical market. According to the insights of CXOs, the global 3D bioprinting in medical market is expected to exhibit high growth potential attributable to widespread adoption of 3D bioprinting, investments for development of better 3D bioprinters and upsurge in demand for sophisticated healthcare facilities and rise in healthcare expenditure drive the market growth. However, shortage of skilled professionals and high cost of 3D bioprinting in some regions limit the growth of 3D bioprinting in medical market.??

CXOs further added that the rise in the adoption rate of 3D bioprinting products, technological advancements in systems, augmented investments in R&D activities for 3D bioprinting, and increase in biomedical applications, thereby driving the market growth.?

Furthermore, North America is expected to witness largest growth, in terms of revenue, owing to widespread adoption of 3D bioprinting technology and collaborations between academic & commercial organizations. However, Asia-Pacific is anticipated to witness notable growth owing to a surge in incidence of chronic diseases and increase in awareness about 3D bioprinting.?

3D bioprinting is an innovative technology that involves the layer-by-layer deposition of biological materials to create three-dimensional structures, often replicating the architecture of living tissues and organs

Consumables and accessories segment dominated the market share in 2022, owing to increase in demand for high-quality materials and equipment, advancement of 3D bioprinting technology, bioinks and biomaterials are essential for creating biocompatible structures led to increased the demand for consumables and accessories in 3D bioprinting.

The growth of the 3D bioprinting in the medical market is driven by increase in demand for personalized medicine, advancements in biomaterials and bioink technology, organ and tissue shortages, and expanding applications in drug testing and regenerative medicine.

The total market value of 3D bioprinting in medical market is $1.1 billion in 2022.

BICO, 3D Systems Corporation, CollPlant Biotechnologies Ltd, and REGEMAT 3D held a high market position in 2022.

The market value of 3D bioprinting in medical market in 2032 is $4.9 billion.

The forecast period for 3D bioprinting in medical market is 2023 to 2032.

The base year is 2022 in 3D bioprinting in medical market.

Loading Table Of Content...

Loading Research Methodology...