5G From Space Market Research, 2033

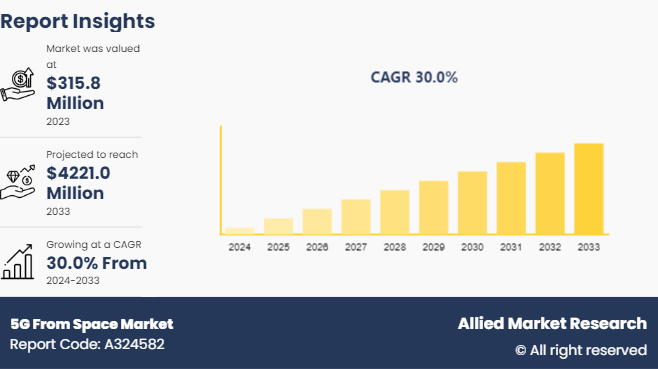

The global 5G From Space Market Size was valued at $315.8 million in 2023, and is projected to reach $4221.0 million by 2033, growing at a CAGR of 30% from 2024 to 2033.

Market Introduction and Definition

The concept of 5G from space implies the development and utilization of 5G satellite networks technology, enabling global connectivity even in remote and undeveloped areas. Rather than relying solely on domestic cellphone towers and infrastructure, this approach makes use of satellite communication systems to capitalize on the benefits of 5G, particularly high-speed internet, low latency, and huge mutual dependence.

5G from space technology provides remote connectivity by offering high-speed internet accessibility to remote areas. The technology helps in disaster recovery by making sure that the network is durable and capable enough to ensure continuous emergency response. 5G from space technology is also utilized in internet of things (IoT) devices that require pervasive coverage. The technology also helps in providing connectivity to ships and airplanes. In addition, the technology helps in improving communication capability for different military organizations.

Various developments in the satellite industry such as improvements in low earth orbit (LEO) and medium earth orbit (MEO) satellites have accelerated the growth of 5G from space industry.

Key Takeaways

The5G From Space Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major 5G from space industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious 5G From Space Market Growth objectives.

Key Strategies and Developments

On April 15, 2023, SpaceX (U.S.) launched first satellite in low Earth orbit (LEO) to operate on the 5G cellular standard. The satellite is known as the "Groundbreaker". The satellite is designed to communicate with terrestrial cell towers and fill gaps in data networks worldwide.

On November 16, 2023, Lockheed Martin launched an experiment to demonstrate 5G connectivity from space. The experiment is part of a larger project, known as 5G.MIL, that the company started in 2020 in response to military demand for high-speed wireless communications. By dividing the 5G cellular technology into space, the company aims to develop an all-domain network and a seamless communications web between space assets, aircraft, ships, and ground forces.

In July 2022, Ericsson, Qualcomm, and Thales collaborated and launched an initiative to deploy 5G NTN using low Earth orbit satellites for global coverage in remote areas.

In July 2023, Telesat successfully launched the low earth orbit (LEO) 3 demonstration satellite, which features Ka- and V-band payloads, aimed at advancing customer and vendor testing campaigns in preparation for the deployment of the full lightspeed network. The Lightspeed network is composed of 198 advanced LEO satellites designed to provide global, high-capacity, low-latency broadband connectivity.

In April 2023, EchoStar Corporation launched the construction of a 28 low Earth orbit satellite constellation in partnership with Astro Digital, aiming to deliver global internet of things (IoT) and machine to machine (M2M) services by 2024.

Lynk Global launched the world's first 5G cellular base station in space in September 2022, aiming to enhance mobile connectivity through satellite technology.

Key Market Dynamics

The growth of the 5G from space market is driven by increase in demand for pervasive and reliable connectivity, particularly in remote and underserved regions, coupled with advancements in satellite technology such as Low Earth Orbit (LEO) satellites that offer higher data throughput and lower latency. However, this market faces restraints including high initial investment costs, technical complexities in integrating satellite & terrestrial networks, and regulatory challenges related to spectrum allocation & coordination. Despite these obstacles, there are numerous intriguing possibilities for IoT app development, disaster-resistant communications, and improved global internet coverage, all of which have the potential to spur innovation and industry growth in the future.

The growing need for dependable connection, particularly in rural and disadvantaged areas, is a major factor propelling the 5G from space market. However, in case of IoT integration, online education, telecommuting, and other applications where businesses and consumers need constant high-speed internet, traditional terrestrial networks are frequently unable to provide these demands due to infrastructure and geographic constraints. By offering broad coverage, low latency, and high data throughput, satellite-based 5G networks provide an effective solution that closes the digital divide and improves global connection. Due to this demand, satellite technology is witnessing large investments and developments, telecom operators and satellite providers are forming collaborations, and the deployment of 5G from space solutions is growing.

Network Speed Table of Thales Group

Network | Speed |

3.5G/DC-HSPA+ | 42.2 Mbps |

4G/LTE | 100 Mbps |

4G/LTE Cat.4 | 150 Mbps |

4G/LTE Advanced | 1000 Mbps |

5G | 10000 Mbps |

Market Segmentation

The 5G from space market is segmented into component, application, and region. By component, the market is bifurcated into hardware and service. By application, the market is divided into enhanced mobile broadband (EMBB) , ultra reliable and low latency communication (URLLC) , massive machine type communication (MMTC) . By region, the market is analyzed across North America, Europe Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

On 4th October 2022, Cape Canaveral Space Force Station launched Atlas V rocket. The rocket consists of SES-20 and SES-21 satellites for Federal Communications Commission (FCC) . The satellites made by Boeing will enable Societe Europeene des Satellites (SES) , a leading satellite operator to transfer data and television transmission services to around 120 million American households.

The launch is part of an FCC program to clear a portion of C-band spectrum and enable wireless operators to deploy 5G services across the adjoining U.S.

On February 6, 2024, China launched two experimental satellites to explore integrated space and ground communication technologies. First is China Mobile 01 satellite, co-developed by the state-owned telecommunication operator China Mobile and the Chinese satellite internet company Ubinexus It is the world's first signal processing satellite equipped with a land-space 5G operating system. The other test satellite, is Xinghe (Star Core) , features a distributed autonomous architecture for 6G which was jointly developed by China Mobile and the Innovation Academy for Microsatellites of Chinese Academy of Sciences.

A document establishing the China Satellite Network Group Co., Limited, popularly referred to as the National Gridor Star Network, was released by the Chinese government on April 26, 2021. The Chinese government established this central company with the aim of expediting the advancement of satellite-based internet connectivity. With the creation of the star network, China has taken a major step forward in the global satellite internet industry. The network's goal is to build a scaled network that can offer broadband internet access and other communication services by deploying various satellites. This signifies that?China and the rest of the globe have joined the 5G from space track.

In August 2023, The UK government launched a new £160 Million ($204.7 Million) fund to back satellite-based solutions that could fill the gaps in the UK’s 5G network. The fund launches as Virgin Media becomes the first UK telco to launch a “plug-and-play” 5G switch for enterprise networks.

Competitor Analysis

The major players operating in the 5G from space market include SES SA., Qualcomm Technologies, OneWeb, Boeing, Space X, Lockheed Martin Corporation, Ericsson, Omni space, Rhode & Schwarz, Lynk Global, Echostar Corporation, China Aerospace Science & Technology Corporation, China Satellite Network Group Company Limited, Thales Alenia Space, Gilat Satellite Networks, Sateliot, Keysight Technologies Inc., Lynk Global, and Telesat.

The other players include Kepler Communications, Anritsu, Fossa Systems, Amazon Kuiper, OQ technology, AST Space Mobile, Nelco, Gatehouse, and ZTE Corporation.

The key player in the market adopted product launch, and collaboration strategies to increase their 5G From Space Market Share in the global 5G from space market industry.

Industry Trends

RTL Deutschland launched a private 5G campus network from Deutsche Telekom in time for the UEFA EURO 2024. RTL Deutschland is the first company in Germany to supply its production studios with 5G through its own network. Deutsche Telekom’s business solution is expected to make TV production even more flexible.

In September 2023, Vodafone and AST Space Mobile successfully completed a space-based 5G voice call. The call took place from Hawaii to José Guevara, a Vodafone engineer in Spain. The call was made using an unmodified Samsung Galaxy S22 smartphone and AST Space Mobile’s Blue Walker 3 test satellite. Blue Walker 3 is the largest commercial communications array deployed in low Earth orbit.

In May 2024, the 5G Standalone (5G SA) network of O2 Telefónica Germany was hosted by Amazon Web Services (AWS) . Telco verified that it is expected to be launching its 5G Cloud Core, which will be developed fully in the cloud with technology from suppliers Amazon Web Services (AWS) and Nokia. The network is projected to be able to provide ultra-low latency for advanced 5G services, according to the carrier, after launch.

In January 2023, France issued €750 million ($81, 65, 36, 250) call for 5G and 6G projects. The French government is supporting research and development (R&D) projects on advanced 5G and future network generations. The projects are expected to focus on three areas, including R&D work on 5G & 6G, cybersecurity & resilience for mobile networks, and improving the environmental impact of telecom networks.

Key Sources Referred

Space.com

Space News

Federal Times

CGTN News

Registration China.com

Vodafone.com

DataCenterDynamics.com

5GObservatory.eu

Techmonitor.ai

Ericsson

Lynk

Echostar

Telesat

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 5g from space market analysis from 2024 to 2033 to identify the prevailing 5g from space market opportunities.

The market research is offered along with information related to key drivers, restraints, and 5G From Space Market Opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the 5g from space market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global 5g from space market trends, key players, market segments, application areas, and market growth strategies and 5G From Space Market Forecast.

5G From Space Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4221.0 Million |

| Growth Rate | CAGR of 30% |

| Forecast period | 2024 - 2033 |

| Report Pages | 264 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Gatehouse, Lynk Global, Eutelsat OneWeb, China Aerospace Science & Technology Corporation, Anritsu, AST Space Mobile, SES SA., ZTE Corporation, Telesat, Amazon Kuiper, Keysight Technologies Inc., Fossa Systems, Qualcomm Technologies, Boeing, Kepler Communications, China Satellite Network Group Company Limited, Lockheed Martin Corporation, Space X, Rhode & Schwarz, OQ technology, Ericsson, Echostar Corporation, Nelco, Sateliot, Thales Alenia Space, Gilat Satellite Networks, Omni space |

The transition from internal combustion engines to electric power is a significant trend. Advances in battery technology, such as lithium-ion batteries, offer longer life, faster charging times, and more efficient power management compared to traditional lead-acid batteries. This shift not only reduces the carbon footprint but also lowers operational costs over the vehicle's lifetime.

The enhanced mobile broadband (eMBB) segment is the leading application of 5G From Space Market. This was primarily due to the widespread adoption of mobile devices and the increasing demand for high-speed internet connectivity, driving the need for enhanced mobile broadband services.

North America is the largest regional market for 5G From Space. This is due to the 5G technology adoption and innovation, leading to the development and deployment of space-based communication systems.

$4221.5 Million is the estimated industry size of 5G From Space.

SES SA., Qualcomm Technologies, OneWeb, Boeing, Space X, Lockheed Martin Corporation, Ericsson are the top companies to hold the market share in 5G From Space.

Loading Table Of Content...