Surgical Robotics Market Research, 2032

The global surgical robotics market size was valued at $78.8 billion in 2022, and is projected to reach $188.8 billion by 2032, growing at a CAGR of 9.1% from 2023 to 2032. Surgical robots offer significant advantages in minimally invasive surgery by enabling exceptionally precise manipulation of surgical instruments within constrained operation spaces, surpassing human capabilities. Robotic surgery is a procedure which involves the minimally invasive spectrum and represents an evolution in practice across numerous disciplines. Surgical robotics technology is used across various medical specialties, enabling surgeons to perform complex procedures through small incisions, resulting in reduced patient trauma, shorter recovery times, and enhanced patient outcomes.

Market Dynamics

Increase in demand and acceptance of laparoscopic or minimally invasive surgery (MIS) due to the benefits to patients and surgeons, such as better screening, greater precision, shorter hospitalization, reduced pain and discomfort which fuels the market growth. In addition, the surge in number of gynecological, neurological and urological diseases is the main factor that drives the surgical robotics market growth.

In addition, surgical robotics enable minimally invasive procedures, which involve smaller incisions, reduced trauma to surrounding tissues, and quicker recovery times which propels the market growth. Patients are increasingly seeking procedures that result in less pain and shorter hospital stays, and surgical robots fulfill these demands which support the market growth. For instance, the Senhance Surgical System by TransEnterix is designed for minimally invasive surgeries. It enhances precision and control for procedures such as hernia repairs and gallbladder removal, leading to shorter hospital stays and faster recoveries. Thus, the rise in adoption of minimally invasive procedures fuels market growth.

Many surgical robotic systems incorporate advanced visualization technologies, such as high-definition 3D imaging and augmented reality. These technologies grant surgeons a clearer view of the surgical site, enhancing their ability to visualize complex anatomical structures and perform intricate tasks. The growth of the surgical robotics market is expected to be driven by availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases, and surge in demand for advanced surgical robotics products.

Furthermore, the increase in need for automation in the healthcare industry and the shifting trend towards advanced robotic surgeries fuel market growth. Moreover, untapped economies such as Brazil, India, China and other developing economies will create lucrative surgical robotics market opportunity.

The demand for surgical robotics is not only limited to developed countries but is also being witnessed in the developing countries, such as China, and India, which fuel the growth of the market. Factors such as rise in the number of surgeries drive the adoption of robotic technologies across different specialties, contributing to the robust growth of the surgical robotics market. For instance, according to the National Center for Biotechnology and Information (NCBI), in 2022, around 1,918,030 new cancer cases are projected to occur in the U.S.

Furthermore, as the global population ages, there is a greater need for surgical interventions to address age-related health conditions which boost market growth. Surgical robots assist surgeons in handling the complexities of these procedures, allowing for safer and more effective outcomes in elderly patients. Moreover, initially limited to specific procedures, robotic technologies are now being adapted for a broader spectrum of surgeries across various medical fields, including cardiac, neurology, urology, gynecology, and more. This versatility attracts hospitals and clinics aiming to offer comprehensive robotic surgical services which is expected to drive the market growth.

High initial costs associated with acquiring and implementing robotic systems, including infrastructure and training, pose a financial challenge for many healthcare facilities which may impede market growth. Regulatory complexities and concerns regarding patient safety, as well as the need for rigorous clinical validation of robotic procedures, slow down the adoption process. In addition, the intricate nature of surgical robotics necessitates specialized training for surgeons, potentially leading to a shortage of skilled professionals. These factors collectively hinder the rapid expansion of the surgical robotics market.

Recessions may slow down the growth of the surgical robotics market due to financial constraints, cautious adoption, and shifting priorities. However, the extent of the impact depends on various factors, including the severity and duration of the recession, the overall healthcare spending environment, and the value proposition of robotic technologies in improving patient care.

Segmental Overview

The surgical robotics industry is segmented into component, surgery type, and region. By component, the market is categorized into systems, accessories, and services. On the basis of surgery type, the market is segregated into gynecology surgery, urology surgery, neurosurgery, orthopedic surgery, general surgery, and other surgeries. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

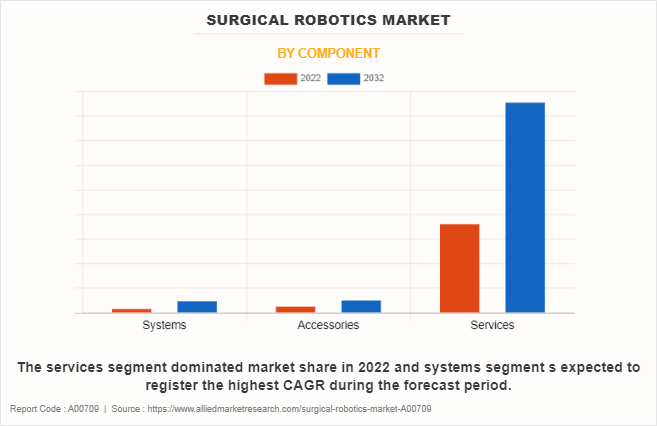

By Component

The services segment dominated the global surgical robotics market share in 2022 and is expected to remain dominant throughout the forecast period, owing to rise in number of surgical robotics procedures performed as they provide the precision, accuracy, and improved patient outcomes, coupled with the increase adoption of surgical robotics technology .However, systems segment is expected to register the highest CAGR during the forecast period, owing to rise in technological advancements and increase in demand for advanced robotic surgical systems.

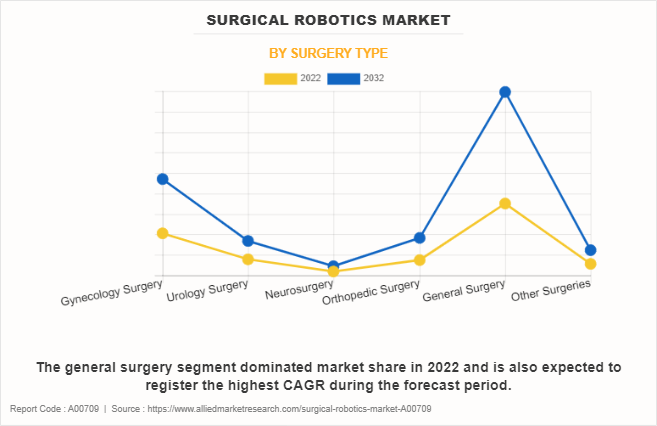

By Surgery Type

The general surgery segment dominated the global surgical robotics market share in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to versatility and effectiveness of surgical robotics in a wide range of genral surgery procedures, increase in patient demand for minimally invasive surgeries, and ongoing advancements in technology.

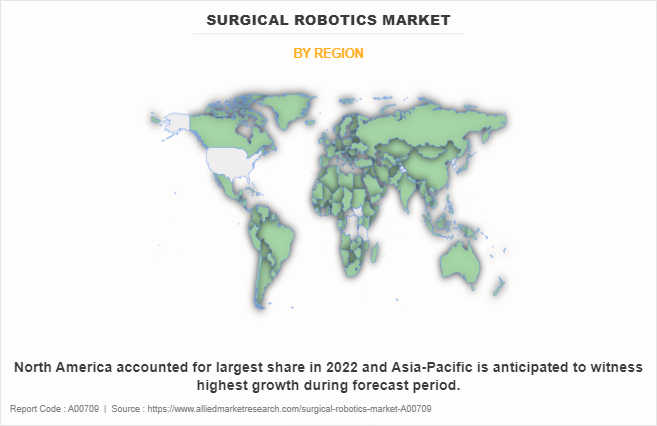

By Region

The surgical robotics market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the surgical robotics industry in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Smith & Nephew Plc., Medtronic plc, and Stryker Corporation and advancement in manufacturing technology of surgical robotics in the region drive the growth of the market.

In addition, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of advanced surgical robotics products are expected to drive the market growth. Furthermore, product launch, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the surgical robotics market forecast period. The market growth in this region is attributable to the growing infrastructure of industries, rise in prevalence of chronic diseases, such as cancer and cardiovascular conditions, has driven the need for sophisticated surgical interventions, which surgical robotics provide. Moreover, the increase in awareness and acceptance of minimally invasive procedures among patients in the Asia-Pacific region along with the benefits offered by surgical robotics propels the market growth in this region.

Competition Analysis

Competitive analysis and profiles of the major players in surgical robotics, such as Smith & Nephew plc, Medtronic plc, Stryker Corporation, Intuitive Surgical, Inc., Renishaw plc, Midea Group Co., Ltd., Johnson & Johnson, Accuray Incorporated, CMR Surgical Ltd., and Zimmer Biomet Holding, Inc. There are some important players in the market such as Asensus Surgical US, Inc. and others. Major players have adopted product launch, collaboration and product approval as key developmental strategies to improve the product portfolio of the surgical robotics market.

Recent Product Launches in the Surgical Robotics Market

- In November 2022, Smith+Nephew, the global medical technology company, announced the introduction of its JOURNEY II ROX Total Knee Solution, a reverse hybrid construct for total knee arthroplasty. This new procedural product solution aims to provide surgeons with the clinical advantage of an advanced bearing material and anatomic design combined with the efficiency1 and potential long-term tibia fixation of a cementless knee.

- In February 2022, Smith+Nephew the global medical technology business, announced the commercial launch of its next generation handheld robotics platform, the CORI Surgical System, in Japan.

- In July 2021, Smith+Nephew, the global medical technology business, announced the launch of its Real Intelligence suite of enabling technology solutions including its next generation robotics platform, the CORI Surgical System, in India.

- In November 2021, Smith+Nephew, the global medical technology business, announced the launch of CORI handheld robotics, an advanced system for both total and partial knee arthroplasties.

- In May 2022, CMR Surgical the global surgical robotics business announced the launch of its Versius Surgical Robotic System in Brazil and marking the launch of CMR Surgical in Latin America (LatAm).

- In October 2020, CMR Surgical (CMR) announced the launch of its Versius Surgical Robotic System at Argenteuil Hospital, a leading public health center based near Paris, France.

Recent Acquisition in the Surgical Robotics Market

- In November 2020, Medtronic completes acquisition of Medicrea. This acquisition expands Medtronic's Artificial Intelligence and Data Capabilities and becomes the first company to offer an Integrated Spine Solution Including AI-Driven Surgical Planning, personalized spinal implants and robotic assisted surgery.

Recent Collaboration in the Surgical Robotics Market

- In November 2022, CMR Surgical (CMR), the global surgical robotics business announced a collaboration agreement with Ethicon, a Johnson & Johnson MedTech company, to expand choice across surgical robotics and advanced laparoscopic instruments.

Recent Product Approvals in the Surgical Robotics Market

- In October 2021, Medtronic plc, the global leader in medical technology, announced that it has received CE Mark for the Hugo robotic-assisted surgery (RAS) system, authorizing the sale of the system in Europe. CE Mark approval is for urologic and gynecologic procedures, which make up about half of all robotic procedures performed.

- Auris Health, Inc., a subsidiary of Ethicon, Inc., a Johnson & Johnson MedTech company, announced that its MONARCH Platform received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for endourological procedures.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surgical robotics market analysis from 2022 to 2032 to identify the prevailing surgical robotics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surgical robotics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surgical robotics market trends, key players, market segments, application areas, and market growth strategies.

Surgical Robotics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 188.8 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 235 |

| By Component |

|

| By Surgery Type |

|

| By Region |

|

| Key Market Players | Stryker Corporation., Zimmer Biomet Holding, Inc., Intuitive Surgical, Inc., Medtronic plc, Smith & Nephew plc, CMR Surgical Ltd., Accuray Incorporated, Johnson & Johnson, Midea Group Co., Ltd., Renishaw plc. |

Analyst Review

This section provides various opinions of surgical robotics market. Increase in demand for surgical robotics systems & accessories and rise in awareness about importance of surgical robotics products are expected to offer profitable opportunities for the expansion of the market. However, high cost associated with the surgical robotic systems hinders the market growth.

In addition, surge in the prevalence of chronic diseases, such as gynecological diseases, urological disorders, and cardiac diseases, rise in R&D activities of medical device manufacturers, and a surge in awareness regarding the potential benefits of surgical robotics systems drive the global surgical robotics market growth. In addition, adoption of surgical robots across the globe is supplemented by rise in awareness about the advanced surgical solutions, rise in government initiatives, and improved healthcare infrastructure in developing regions.?

Furthermore, North America dominated the market share in 2022 owing to the increase in prevalence of chronic diseases along with rise in geriatric population and presence of major key players in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in healthcare awareness, and growing geriatric population that are suffering from chronic diseases.

The base year is 2022 in surgical robotics market.

The total market value of surgical robotics market is $78.8 billion in 2022.

The market value of surgical robotics market in 2032 is $188.8 billion.

The forecast period for surgical robotics market is 2023 to 2032.

Intuitive Surgical, Inc., Stryker Corporation, Medtronic plc, and Smith & Nephew plc held a high market position in 2022.

The surgical robotics market is expected to continue growing, with ongoing innovation in robotic technology, rise in demand for minimally invasive surgeries, advancements in technology, the need for improved surgical outcomes, and expansion into new surgical specialties.

Surgical robotics refers to the use of robotic systems to assist surgeons in performing various types of surgical procedures. These systems are designed to enhance precision, control, and dexterity during surgery.

Loading Table Of Content...

Loading Research Methodology...