Ultrasound Devices Market Research, 2032

The global ultrasound devices market size was valued at $9.3 billion in 2022, and is projected to reach $15.4 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Ultrasound devices are advanced medical equipment that employ high-frequency sound waves, beyond the range of human hearing, to visualize internal body structures in real-time. They play a pivotal role in non-invasive medical imaging, offering valuable insights into various anatomical regions and physiological processes.

Ultrasound devices emit sound waves that penetrate the body and interact with tissues, generating echoes that are then transformed into detailed images. These images aid healthcare professionals in diagnosing a wide spectrum of medical conditions, monitoring treatment progress, and guiding minimally invasive procedures. The versatility of ultrasound devices extends across medical specialties, including cardiology, obstetrics, radiology, and more. Technological advancements, such as high-resolution transducers and 3D/4D imaging capabilities, continually enhance their diagnostic accuracy and usability, contributing to improved patient care and medical decision-making.

Market Dynamics

The ultrasound devices market size has experienced robust growth driven by several key factors such as prevalence of chronic diseases, the rise in demand for point-of-care testing, the increase in adoption of ultrasound devices in intraoperative settings, and the growth in awareness regarding early diagnosis play pivotal roles in propelling market expansion.

The increase in demand for point-of-care testing has fueled the adoption of ultrasound devices in various medical settings, from emergency rooms to primary care clinics which further drive growth during ultrasound devices market forecast. Point-of-care ultrasound systems provide real-time imaging at the bedside of the patient, enabling rapid diagnostic assessments and informed clinical decisions. These devices offer immediate visual information that aids in evaluating trauma, guiding procedures, and monitoring patient responses to treatment. The speed, convenience, and accuracy offered by point-of-care ultrasound are particularly valuable in critical situations where quick decisions are vital. This demand aligns with the focus of the healthcare industry on efficient and patient-centered care, driving the incorporation of ultrasound devices into point-of-care workflows.

Furthermore, ultrasound devices are increasingly being integrated into intraoperative settings, where they assist surgeons in making informed decisions during surgical procedures. Intraoperative ultrasound provides real-time imaging of anatomical structures and helps guide surgical interventions, ensuring precision and minimizing complications. This growth in adoption has transformed surgical approaches, enhanced outcomes, and reduced the need for invasive exploratory procedures. The ability to visualize tissue characteristics and assess surgical progress intraoperatively elevates the role of ultrasound devices as essential tools for surgical teams.

However, limited reimbursement policies and inadequate insurance coverage for certain ultrasound procedures can hinder patient access and adoption. In addition, the high initial costs associated with acquiring and maintaining advanced ultrasound equipment pose challenges for healthcare facilities, particularly in resource-constrained settings. Thus, anticipated to hamper the ultrasound devices market growth.

In the recession period the demand for medical devices, including ultrasound devices, demonstrates notable stability even amid economic downturns due to their indispensable role in diagnosing, treating, and monitoring health conditions. This resilience is reinforced by the upward trajectory of the aging population and the escalating prevalence of chronic ailments, both of which contribute to a sustained need for medical devices.

Moreover, the capacity of the medical device industry to withstand economic challenges is fortified by continuous technological progress. Ongoing innovations give rise to novel devices that elevate patient outcomes, optimize operational efficiency, and curtail healthcare expenditures. Certain medical technology firms defer capital outlays, particularly in R&D, prompted by concerns about recession-related uncertainties despite these advancements.

Consequently, the ultrasound devices market maintains a moderate level of vulnerability to economic recessions. The market can experience some degree of impact due to cautious R&D investments while the intrinsic importance of these devices for healthcare persists. However, the overarching factors of medical necessity, demographic shifts, and technological progression collectively contribute to its overall stability, even in the face of economic fluctuations.

Segmental Overview

The ultrasound devices market is segmented based on product type, device display, portability, application, and region. On the basis of product type, the market is bifurcated into diagnostic and therapeutic ultrasound systems. The diagnostic ultrasound systems are further segmented into 2D imaging systems, 3D & 4D imaging systems and Doppler imaging. The therapeutic ultrasound systems segment is further segmented into High-Intensity Focused Ultrasound (HIFU) and Extracorporeal Shockwave Lithotripsy (ESWL). On the basis of the type of device display, the market is categorized into color ultrasound devices and black & white (B/W) ultrasound devices. On the basis of portability, the market is categorized into, trolley/cart-based ultrasound devices and compact/handheld ultrasound devices. On the basis of application, the market is categorized into radiology/general imaging, obstetrics/gynecology, cardiology, urology, vascular, and other emergency clinical applications. On the basis of region, the ultrasound devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

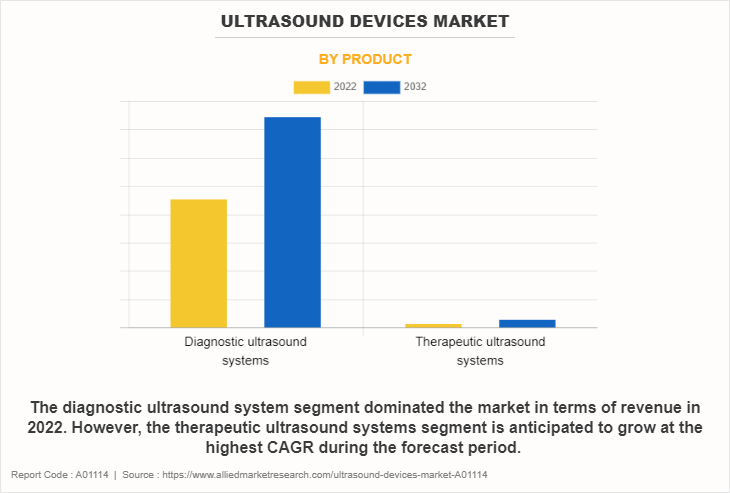

By Product Type

The ultrasound devices market is segmented into diagnostic ultrasound systems and therapeutic ultrasound systems. The diagnostic ultrasound system segment was the largest ultrasound devices market share in terms of revenue in 2022. Diagnostic ultrasound systems are extensively utilized in various medical fields such as cardiology, radiology, obstetrics, and musculoskeletal imaging. These systems provide a safe and non-invasive way to visualize internal structures. Their wide range of uses makes them essential in different healthcare environments, including hospitals and clinics.

However, the therapeutic ultrasound system segment is expected to register the fastest growth during the forecasted period. This is attributed to the potential of therapeutic ultrasound in medical therapies driving its popularity. The fact that therapeutic ultrasound is non-intrusive and can offer accurate and focused treatments has resulted in its wider use across different medical domains. Consequently, the demand for therapeutic ultrasound systems has increased.

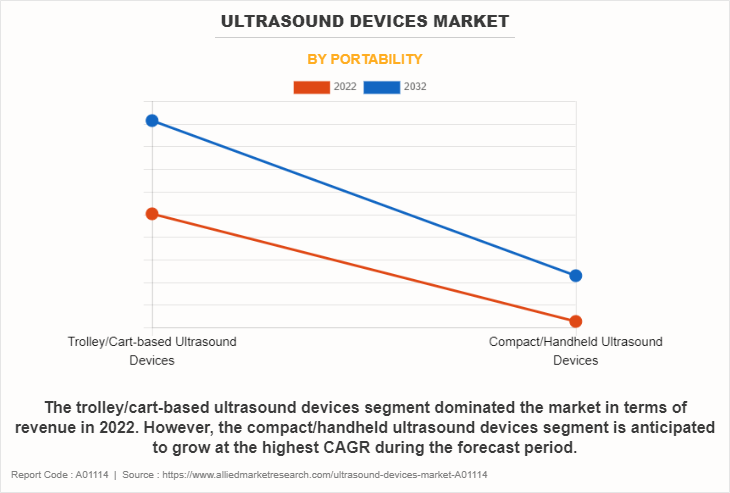

By Device Portability

The ultrasound devices market is segmented trolley/cart-based ultrasound devices and compact/handheld ultrasound devices. The trolley/cart-based ultrasound devices segment was the largest revenue contributor to the market in 2022, owing to their widespread adoption across various healthcare settings. Trolley/cart-based ultrasound devices are versatile and suitable for a wide range of clinical applications, including cardiology, radiology, obstetrics, and more.

However, the compact/handheld ultrasound devices segment is expected to register the fastest growth during the forecasted period. This can be attributed to the capability of portable ultrasound scanners to effectively detect various medical conditions and irregularities. The introduction of portability in ultrasound technology has paved the way for a growing need for these devices in situations where immediate on-site diagnosis is crucial. These scenarios include emergency medicine, anesthesiology, musculoskeletal issues, and critical care medicine.

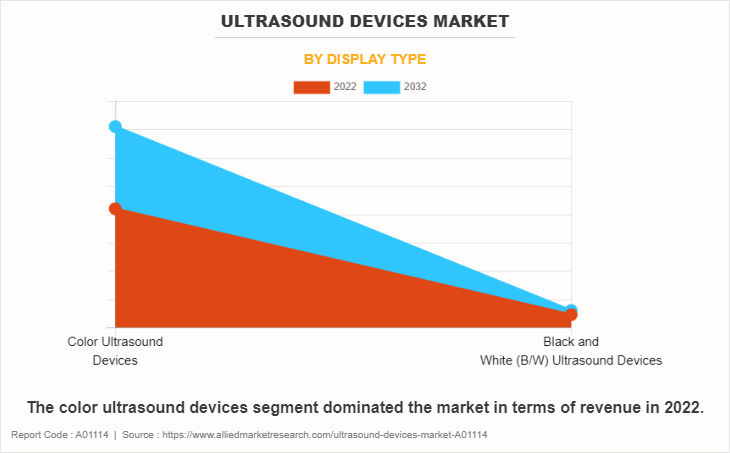

By Type of Device Display

The ultrasound devices market is divided into color ultrasound devices and black & white (B/W) ultrasound devices. The color ultrasound devices segment was the highest revenue contributor to the market in 2022 and is expected to remain dominant during the forecasted period. This is attributed to the significant advancements. Color ultrasound machines offer the ability to instantly display blood flow and tissue perfusion, thereby boosting the precision of diagnoses and assisting in the evaluation of vascular problems, heart conditions, and other medical ailments. The capability of this technology to distinguish between different flow speeds and directions provides healthcare practitioners with valuable information, ultimately leading to better patient treatment.

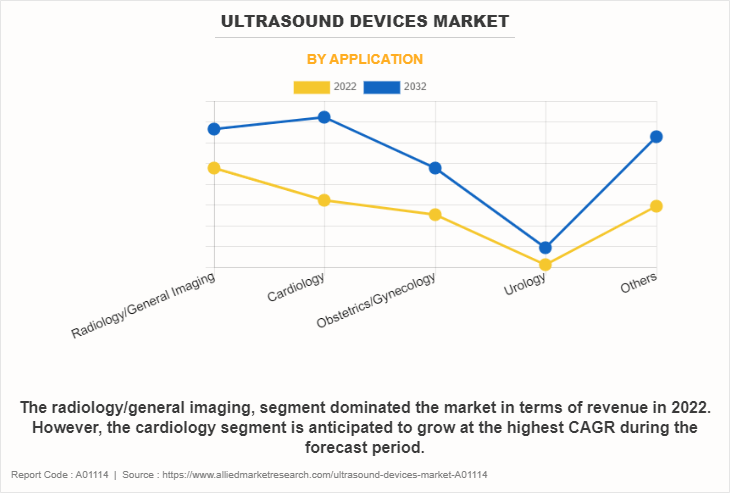

By Application

The ultrasound devices industry is classified into radiology/general imaging, obstetrics/gynecology, cardiology, urology, vascular and other emergency clinical applications. The radiology/general imaging segment held the highest market share in terms of revenue in 2022 and expected to maintain its dominance throughout the forecast period owing to the widespread use and diverse application of radiology across different medical fields are highly significant. It covers a broad spectrum of diagnostic techniques, spanning from evaluating injuries and illnesses to tracking the effectiveness of treatments. Furthermore, continuous progress in imaging technologies continues to boost the potential of radiology and general imaging, solidifying its enduring importance.

However, the OB/GYN segment is expected to exhibit the fastest CAGR in the ultrasound devices market during the forecast period owing to the growth in awareness about maternal and fetal health, there is a corresponding rise in the utilization of ultrasound devices for prenatal screenings, ensuring the well-being of both mother and child.

By Region

The ultrasound devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest ultrasound devices market share in terms of revenue in 2022, owing to high expenditure on R&D, presence of major players & their product availability, technological advancements, new products launch and well-established healthcare infrastructure in the region.

However, the Asia-Pacific region is projected to exhibit the highest CAGR in the ultrasound devices market during the forecast period. This growth is attributed to increase in geriatric population along with chronic disorder. Moreover, the improvement in healthcare infrastructure and increased initiatives in awareness and support for early diagnosis and treatment are anticipated to drive the market growth in this region.

Furthermore, a rise in research activities as well as the well-established presence of domestic companies in the region are expected to provide notable opportunities for market growth. In addition, a rise in contract manufacturing organizations within the region provides is expected to drive the market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the ultrasound devices industry such as Major players that operate in the market include Esaote SpA, Fujifilm Corporation, General Electric Company, Hitachi, Ltd., Konica Minolta Inc., Koninklijke Philips N.V., Mindray Medical International Limited, Samsung Healthcare, Siemens Healthineers AG, and Canon Medical Systems Corporation. key players have adopted strategy such as product approval, product launch, expansion, and acquisition to enhance their product portfolio.

Recent Product Approval in the Ultrasound Devices Market

In October 2022, Fujifilm corporation, received regulatory approval for its latest generation endoscopic ultrasound endoscope (EG-740UT) and achieves compatibility of its ultrasound endoscope line-up with the flagship ARIETTA Ultrasound system of Fujifilm Healthcare.

Recent product Launch in the Ultrasound Devices Market

In July 2022, GE Healthcare unveiled its most advanced ultrasound yet, the next-generation Voluson Expert 22. This latest addition to the award-winning Women’s Health portfolio of GE Healthcare utilizes graphic-based beam former technology, which produces higher quality images and offers greater flexibility in imaging functions. Innovative tools powered by AI ensure greater consistency in exams and decreased number of tasks. Customizable touch panels, color and lighting options provide a revolutionary user experience.

Recent Acquisitions in Ultrasound Devices Market

In December 2021, GE Healthcare announced that it has completed its previously announced acquisition of BK Medical, a leader in advanced surgical visualization, from Altaris Capital Partners, LLC. The companies entered into a definitive agreement for GE to purchase BK Medical for a cash purchase price of $1.45 billion on September 22, 2021.

Recent Expansion in Ultrasound Devices Market

In December 2022, Siemens Healthineers, launched a new Ultrasound manufacturing facility in Košice, Slovakia, its first in Europe, with an initial capacity of up to 120 systems per week. It is anticipated to use this new facility to expand manufacturing capabilities for its ultrasound products, including the Acuson Sequoia and the Acuson Redwood. These products can have a significant impact on how clinicians treat and monitor their patients.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ultrasound devices market analysis from 2022 to 2032 to identify the prevailing ultrasound devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ultrasound devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ultrasound devices market trends, key players, market segments, application areas, and market growth strategies.

Ultrasound Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.4 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 314 |

| By Product |

|

| By Portability |

|

| By Display Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hitachi, Ltd., ESAOTE SPA , Canon Inc., General Electric Company, Koninklijke Philips N.V., Fujifilm Corporation, Zimmer MedizinSysteme GmbH, Mindray Medical International Limited., Siemens Healthineers AG, Samsung Healthcare |

Analyst Review

The utilization of ultrasound devices is expected to witness a significant rise with increasing diagnoses of chronic diseases. The ultrasound devices market has piqued the interest of healthcare providers because of several benefits offered by these devices in diagnosis and treatment of clinical disorders coupled with the evolving indications for ultrasound devices. There have been remarkable technological advancements in ultrasound devices to provide advanced treatment options for the management of chronic disease patients.

Furthermore, in the North America region, several factors contribute to the growth of the ultrasound devices market. The rise in adoption of ultrasound devices for convectional applications, and the presence of key market players, with their robust product offerings, strengthens the market position. Furthermore, Asia-Pacific is anticipated to witness notable growth during the forecast period owing to the improving healthcare infrastructure and increased initiatives in awareness and support for early diagnosis and treatment are anticipated to drive the market growth in this region.

The total market value of ultrasound devices market is $9,277.73 million in 2022.

Top companies such as Fujifilm Corporation, Koninklijke Philips N.V, General Electric Company and Canon Medical Systems held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The forecast period for ultrasound devices market is 2023 to 2032

The diagostic ultrasound system segment is the most influencing segment in ultrasound devices market.These systems are widely employed across medical specialties such as cardiology, radiology, obstetrics, and musculoskeletal imaging, offering non-invasive and safe visualization.

The market value of ultrasound devices market in 2032 is $15,411.4 million

The base year is 2022 in ultrasound devices market .

The major factor that fuels the growth of the ultrasound devices market are technological advancements in ultrasound devices , rise in incidence of chronic diseases and rise in awareness for early disease diagnosis drive the growth of the global ultrasound devices market .

Ultrasound devices are a medical device that uses high frequency sound waves to emit an image of internal body parts of the person. Ultrasound is used in most abdominal, gynecological, obstetric, vascular, soft tissue, and other procedural applications.

Loading Table Of Content...

Loading Research Methodology...