Advanced Authentication In Financial Services Market Research, 2031

The global advanced authentication in financial services market was valued at $4.6 billion in 2021, and is projected to reach $18.5 billion by 2031, growing at a CAGR of 15.3% from 2022 to 2031.

Advanced authentication is a different technique for confirming a computer system user's identification. Examples include biometric systems, hardware tokens, and software tokens. These non-traditional techniques of identity verification are employed in addition to more conventional ones such as usernames and passwords.

Furthermore, advanced authentication refers to authentication using methods other than the standard login ID and password for user identification and authentication. This includes biometric systems, user-based public key infrastructure (PKI), smart cards, software tokens, hardware tokens, paper (inert) tokens, or "Risk-based Authentication". Risk-based authentication include a software token element made up of a number of factors, including network information, user information, and positive identification.

Businesses are increasingly using advanced authentication for payment to function more quickly, cut down on transaction time, and enhance security. In addition, to make sure the business runs securely, they are entailed with complex security authentication features to increase the security of payment systems. This factor notably drives the advanced authentication in financial services market growth.

However, high acquisition costs and security risks of the payment terminals hinder the growth of the advanced authentication in financial services market. On the contrary, technological advancements in the payment sector such as inclusion of machine learning (ML) and automations are expected to fuel the growth of the advanced authentication in financial services market in upcoming years. Moreover, increase in adoption of wireless handheld POS terminal by restaurants and healthcare industry for streamlining the transactions through biometrics is anticipated to provide lucrative opportunities for the market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the advanced authentication in financial services market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the advanced authentication in financial services market outlook.

The advanced authentication in financial services market is segmented into Type, Enterprise Size and Authentication Method.

Segment Review

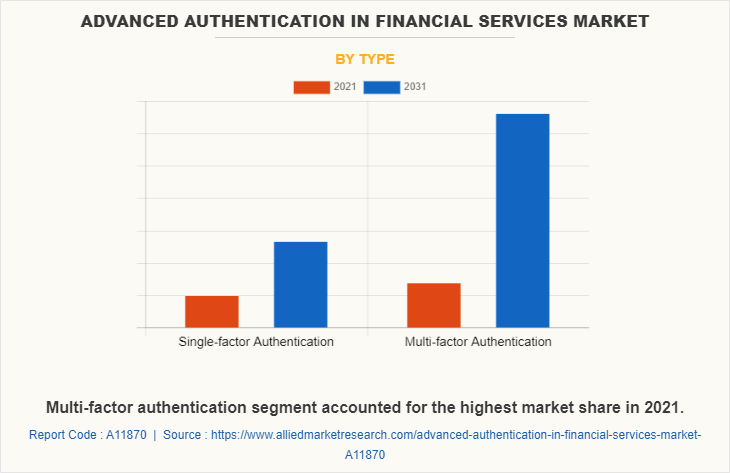

The advanced authentication in financial services market is segmented on the basis of solution, enterprise size, authentication type, and region. On the basis of solution, it is categorized into single factor authentication and multi-factor authentication. On the basis of enterprise size, it is classified into large enterprise and small and medium-sized enterprises. On the basis of authentication type, it is divided into smart cards, biometrics, mobile smart credentials, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the multi-factor authentication segment acquired major advanced authentication in financial services market size in 2021. This is attributed to the rise in cyberattacks and security breaches, as well as the proportionately higher rate of online fraud. This is prevented by deploying multi factor authentication (MFA) systems in the employees' smartphones and computer devices to verify the identity of the user.

By region, North America held the largest advanced authentication in financial services market share in 2021. This is attributed to the presence of various biometric payment solution providers and high adoption of the same. Furthermore, a number of efforts have been taken by the regional banks to encourage the use of biometric payment cards for transactional purposes. Banks provide a variety of promotions and discounts to draw in both new and returning consumers.

The advanced authentication in financial services market analysis includes the profiles of key players operating in the advanced authentication market in financial services such as Fujitsu, Thales, NEC Corporation, Broadcom, Dell Inc., Valid Soft Group, Secur Envoy Ltd., Ping Identity, Mastercard, NetMotion Wireless, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the advanced authentication market in financial services.

Country Specific Statistics & Information

Developing countries such as India and South Korea are increasingly targeted by the key players to develop and launch the biometric payment features into the existing range of products. For instance, in August 2022, Samsung Electronics and MasterCard have signed MoU as a part of which the two companies will be launching payment cards with built-in fingerprint sensors. Hence, the two companies will be launching payment experiences while reducing physical contact with payments terminal.

Furthermore, according to an article published in October 2022, merchants across the U.S. are expected soon to be able to accept biometric payments authenticated by a customer’s fingerprint using a point-of-sale (POS) solution launched by payment processing provider Green Payments. The solution is anticipated to allow users to link different payment options stored in a digital wallet including credit cards, bank accounts, and cryptocurrencies to individual fingers and then make in-store purchases at the POS by tapping the relevant finger on a biometric sensor.

During the COVID-19 pandemic, advanced authentication in financial services market demand has increased as there was surge in preference for cashless transactions. The COVID-19 pandemic increased the requirement for POS terminals equipped with radio frequency identification, biometric technology, and other technologies that accept payments through contactless chip cards and digital interface cards due to the need for contactless payments. The growth of advanced authentication in financial services market systems during the pandemic had enabled the interaction of customer relationship management (CRM) as well as other financial solutions for organizations. Thus, the pandemic had a moderate impact on advanced authentication in financial services industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced authentication in financial services market forecast from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of advanced authentication in financial services market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced authentication in financial services market segmentation assists in determining the prevailing advanced authentication in financial services market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global advanced authentication in financial services market trends, key players, market segments, application areas, and market growth strategies.

Advanced Authentication in Financial Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.5 billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Type |

|

| By Enterprise Size |

|

| By Authentication Method |

|

| By Region |

|

| Key Market Players | Dell Inc., Absolute software corporation, SecurEnvoy Ltd, Thales, mastercard, Broadcom Inc., Ping Identity, Fujitsu, NEC Corporation, ValidSoft Group |

Analyst Review

A lot of advancements has been witnessed in the field of biometrics over the past few years. Fingerprint payment is observed by many as the most effective and safe method of individual identification. Furthermore, it is described as the automatic technique of recognizing or confirming the identity of a living person in particular centered on physiological trait. In addition, biometrics is a quickly developing technology that is extensively used in a lot of fields including forensics. It can be used for criminal identification & prison security and has the potential to be employed in a huge array of civilian relevance projects.

Biometrics can be exercised to check illegal access to ATMs, cellular phones, smart cards, desktop PCs, workstations, and computer networks. It can play a huge role to make business safe from scammers and cyber-attacks. In addition, biometric payment is especially useful during banking transactions carried out by telephone and internet or electronic banking. In automobiles, biometric technology can replace keys with keyless entry devices. Moreover, biometric technology can ensure fast and reliable protected access to information. Currently, techniques such as password verification have a lot of issues, causing people to write them down and forget them at times, which leads to stealing and hacking. Therefore, these factors play a major role in the growth of advanced authentication in financial services market.

Facial recognition technology is increasingly being used in the U.S., companies such as Delta Airlines use it for passenger check-in. Airports are planning to use the technology; for instance, officials at Miami International Airport have face recognition for all international flights. Apple has it on its iPhones, while in Portland, Oregon, it is used to unlock the doors for customers in stores. Furthermore, facial recognition technology is employed in countries such as China, Singapore, the UAE, and Japan. Moreover, according to BBC, China reportedly uses 200 million surveillance cameras, one camera for every seven of its citizens.

In 2021, about 400 million new cameras were installed in the country. The cameras were intended primarily for security and traffic control purposes. China also uses this technology in schools. In July 2021, the South China Morning Post reported that the country is working on the world's most powerful facial recognition system – one able to identify any of its 1.3 billion citizens within three seconds.

Therefore, with such advancements, the advanced authentication in financial services market is subjected to grow at a rapid pace in the upcoming years. Some of the key players profiled in the report include Fujitsu, Thales, NEC Corporation, Broadcom, Dell Inc., Valid Soft Group, Secur Envoy Ltd., Ping Identity, Mastercard, NetMotion Wireless, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The advanced authentication in financial services market is estimated to grow at a CAGR of 15.3% from 2022 to 2031.

The advanced authentication in financial services market is projected to reach $18.52 billion by 2031.

Enhanced security in payment services, increasing penetration of internet and growth in adoption of digital payments majorly contribute toward the growth of the market.

The key players profiled in the report include reinsurance market analysis includes top companies operating in the market such as Fujitsu, Thales, NEC Corporation, Broadcom, Dell Inc., Valid Soft Group, Secur Envoy Ltd., Ping Identity, Mastercard, NetMotion Wireless, Inc.

The key growth strategies of advanced authentication in financial services market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...