Advanced Orthopedic Technologies Market Research, 2033

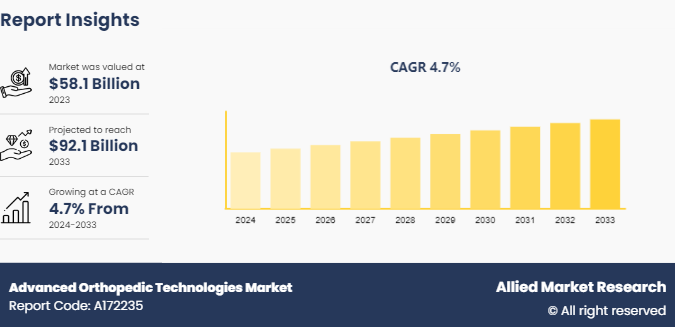

The global advanced orthopedic technologies market size was valued at $58.1 billion in 2023, and is projected to reach $92.1 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033. The major factors driving the market growth include the rising prevalence of musculoskeletal disorders and injuries, increasing aging population requiring joint replacements and other orthopedic interventions, and continuous advancements in medical technology improving the effectiveness and outcomes of orthopedic treatments.

Market Introduction and Definition

Advanced orthopedic technologies include cutting-edge innovations in orthopedic medicine aimed at enhancing patient outcomes and improving surgical precision. These technologies include state-of-the-art implants, prosthetics, robotics, computer-assisted surgical systems, and advanced imaging techniques. Designed to treat a variety of musculoskeletal conditions such as fractures, arthritis, and sports injuries, they offer superior durability, biocompatibility, and functionality. Advanced materials such as titanium alloys and bioresorbable polymers, along with minimally invasive surgical techniques, facilitate faster recovery and better overall patient care, making them integral to modern orthopedic practice.

Key Takeaways

- The advanced orthopedic technologies market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major advanced orthopedic technologies industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The rise in prevalence of orthopedic disorders, such as osteoarthritis, osteoporosis, and sports injuries, due to aging populations, sedentary lifestyles, and increasing participation in sports and recreational activities which drives the demand for orthopedic devices and propels the advanced orthopedic technologies market growth. These conditions often require surgical intervention or long-term management, creating a substantial demand for advanced orthopedic technologies. For instance, the aging population in many developed countries is a significant demographic driver as older adults are more prone to conditions such as joint degeneration and fractures. Advanced technologies that offer durable joint replacements, effective pain management solutions, and improved rehabilitation options are crucial in meeting the healthcare needs of this demographic segment.

In addition, growing technological advancements encompass a variety of areas such as implants, prosthetics, surgical instruments, imaging techniques, and rehabilitation devices which further boost the advanced orthopedic technologies market size. For example, the development of advanced materials such as titanium alloys and bioresorbable polymers has revolutionized the durability and biocompatibility of orthopedic implants, leading to better outcomes and reduced complications for patients.

Furthermore, patient preferences for minimally invasive procedures and quicker recovery times are also influencing the growth during the advanced orthopedic technologies market forecast period. Modern patients are more informed and proactive about their healthcare choices, preferring treatments that offer reduced pain, minimal scarring, and faster rehabilitation. Advanced orthopedic technologies, such as minimally invasive surgical techniques and personalized implants created using 3D printing, align with these preferences by providing effective solutions with fewer complications and shorter hospital stays. This patient-centric approach not only improves satisfaction but also accelerates market growth as healthcare providers adopt these advanced technologies to meet patient expectations.

However, the high costs associated with advanced orthopedic technologies restrain the market growth. The development, production, and implementation of cutting-edge devices, implants, and surgical tools require substantial investment, leading to higher prices for end-users. This limits accessibility, particularly in low- and middle-income regions where healthcare budgets are constrained, and patients are unable to afford expensive treatments.

On the other hand, emerging markets with improving healthcare infrastructures and rising healthcare expenditures present new avenues for market expansion. The growing trend towards minimally invasive procedures provides an advanced orthopedic technologies market opportunity.

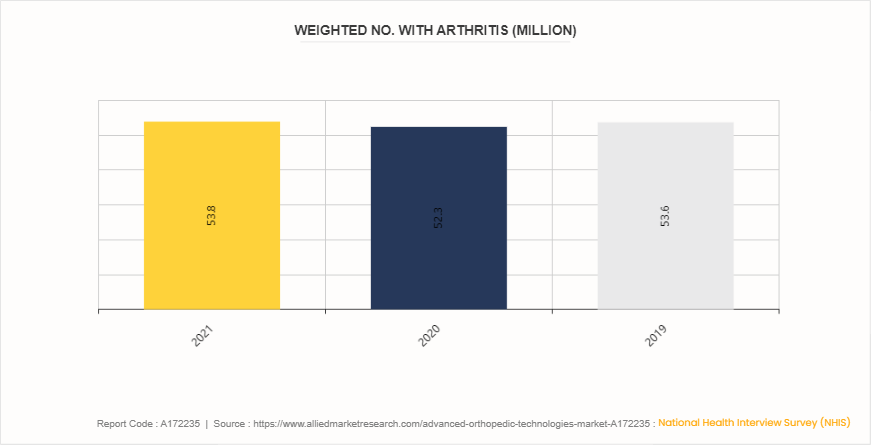

Prevalence statistics for arthritis in U.S.

According to the National Health Interview Survey (NHIS) , in 2021, 53.8 million adults reported living with arthritis, slightly higher compared to 52.3 million in 2020 and similar to 53.6 million in 2019. This chronic condition, characterized by joint inflammation, underscores a significant healthcare challenge, particularly as the population ages and lifestyles contribute to its prevalence. These statistics highlight a critical driver for the advanced orthopedic technologies market. As the number of individuals affected by arthritis continues to rise, there is an increasing demand for innovative orthopedic treatments and technologies. Advanced solutions such as minimally invasive surgeries, biocompatible implants, and robotic-assisted procedures play a crucial role in managing and improving the quality of life for arthritis patients and supports the market growth.

Market Segmentation

The advanced orthopedic technologies market analysis is segmented into product type, application, end user, and region. On the basis of the product type, the market is bifurcated into implants and regenerative products. By application, the market is classified into spine surgery, cranial & maxillofacial surgery, joint replacement surgery, and others. By end user, the market is divided into hospitals, ambulatory surgical centers, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America had significant advanced orthopedic technologies market share in 2023 owing to rise in prevalence of orthopedic disorders, substantial healthcare expenditure, strong adoption of advanced technologies, favorable reimbursement policies and a well-established healthcare infrastructure. In addition, rise in advancements such as robotics and artificial intelligence enhancing surgical precision and patient outcomes which further fuels the market growth in this region.

- In September 2023, an article published by the National Center for Biotechnology and Information (NCBI) , more than 1.5 million fractures each year occur due to osteoporosis in America. Approximately 50% of women and 25% of men aged 50 years and above are at risk of experiencing a fracture linked to osteoporosis. Thus, rise in incidence of fractures due to osteoporosis drives the growth of the advanced orthopedic technologies market.

- In February 2021, the U.S. Food and Drug Administration approved the Patient Specific Talus Spacer 3D-printed talus implant for humanitarian use. The Patient Specific Talus Spacer is the first in the world and first-of-its-kind implant to replace the talus—the bone in the ankle joint that connects the leg and the foot—for the treatment of avascular necrosis (AVN) of the ankle joint. FDA approvals for orthopedic devices drive the growth of the advanced orthopedic technologies market.

However, the Asia-Pacific region growing rapidly due to its large population base, increasing prevalence of chronic diseases, and rapidly improving healthcare infrastructure, with countries such as China, India, and Japan. LAMEA is expected to grow steadily due to improving healthcare access and increasing investments in healthcare infrastructure.

Industry Trends

- An article published by Australian Institute of Health and Welfare in 2023, estimated that 6.9 million or 27% of people in Australia were affected by chronic musculoskeletal conditions, based on self-reported data from the Australian Bureau of Statistics (ABS) 2020–21 National Health Survey (NHS) . This rise in prevalence of orthopedic disorders led to a surge in demand for advanced orthopedic technologies, driving market growth.

- An article published by National Center for Biotechnology and Information (NCBI) in 2023, globally, 494 million people had other musculoskeletal disorders in 2020. Thus, the rise in number of individuals affected by these conditions led to surge in need for innovative treatments, such as advanced implants, prosthetics, and surgical tools, thereby contributes towards the market growth.

Competitive Landscape

The major player operating in the advanced orthopedic technologies industry are Arthrex, Inc., Johnson & Johnson, Globus Medical, Abbott, ?B. Braun SE, Stryker, Exactech, Inc., Zimmer Biomet Medtronic, and Corin Group. Other players in the advanced orthopedic technologies market include Shalby Advanced Technologies, Inc.

Recent Key Strategies and Developments in Advanced Orthopedic Technologies Industry

- In May 2023, B. Braun launched its newest laparoscopic AESCULAP EinsteinVision 3.0 FI during International Society for Gynecologic Endoscopy (ISGE) Annual Meeting 2023 at Sanur, Bali.

- In May 2023, Stryker announced the launch of its Ortho Q Guidance system, enabling advanced surgical planning and guidance for hip and knee procedures, easily controlled by the surgeon from the sterile field. The system combines new optical tracking options via a redesigned, state-of-the-art camera with sophisticated algorithms of the newly launched Ortho Guidance software to deliver additional surgical planning and guidance capabilities. When used with Ortho Q, the Ortho Guidance software for Express Knee, Precision Knee and Versatile Hip serves as a planning and intraoperative guidance system that enhances procedural speed and efficiency through a smart, streamlined workflow.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced orthopedic technologies market analysis from 2024 to 2033 to identify the prevailing advanced orthopedic technology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced orthopedic technology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global advanced orthopedic technologies market trends, key players, market segments, application areas, and market growth strategies.

Advanced Orthopedic Technologies Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 92.1 Billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 233 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Arthrex, Inc. , Exactech, Inc., Corin Group, Medtronic, Globus Medical, B. Braun SE, Abbott, Stryker , Zimmer Biomet, Johnson & Johnson |

The total market value of advanced orthopedic technologies market is $58.1 billion in 2023.

The market value of advanced orthopedic technologies market in 2033 is $92.1 billion.

The forecast period for advanced orthopedic technologies market is 2024 to 2033.

North America domiated the market share in 2023, owing to rise in prevalence of orthopedic conditions, advanced healthcare infrastructure, significant investments in research and development, and a strong adoption rate of innovative medical technologies in the region.

The leading application of the advanced orthopedic technologies market is joint replacement, particularly hip and knee replacements.

The upcoming trends in the advanced orthopedic technologies market include the adoption of robotic-assisted surgeries for increased precision, the integration of 3D printing for customized implants, and the development of smart implants with real-time monitoring capabilities to enhance patient outcomes and recovery.

Driving factors for the advanced orthopedic technologies market include the increasing prevalence of musculoskeletal disorders and injuries, rising demand for minimally invasive surgical procedures, and technological advancements such as robotics and 3D printing enhancing treatment options and outcomes.

Advanced orthopedic technologies refer to innovative medical devices, treatments, and procedures used in the diagnosis, treatment, and management of musculoskeletal conditions and injuries.

Loading Table Of Content...