Advanced Process Control (APC) Market Research, 2033

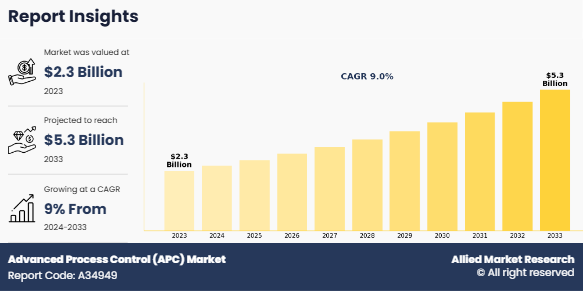

The global advanced process control (APC) market was valued at $2.3 billion in 2023, and is projected to reach $5.3 billion by 2033, growing at a CAGR of 9% from 2024 to 2033.

Advanced Process Control (APC) refers to a set of sophisticated techniques and technologies used in industrial process control systems to enhance performance and efficiency. Unlike basic process controls, which handle simple operations, APC systems use advanced algorithms to predict future process behaviors and make necessary adjustments for optimal performance. APC is commonly used in industries with continuous processes, such as chemical, petrochemical, oil and mineral refining, food processing, pharmaceuticals, and power generation.

Advanced Process Control (APC) is widely used across industries to enhance operational efficiency, reduce costs, and improve product quality. In the oil and gas sector, APC optimizes refinery processes by regulating flow rates, pressure, and temperature to maximize output. In pharmaceuticals, it ensures precise chemical reactions for consistent drug quality. The food and beverage industry leverages APC to maintain uniformity in production and minimize waste. Power plants utilize APC to optimize energy output and reduce emissions. Additionally, it is critical in metals and mining for improving ore recovery rates. By providing real-time monitoring and adjustments, APC drives productivity and sustainability across diverse industrial applications.

The growing emphasis on energy efficiency across industries is a key driver for the Advanced Process Control (APC) market. Businesses are striving to reduce operational costs and carbon footprints, aligning sustainability goals and regulatory mandates. APC systems optimize energy consumption by monitoring and adjusting process parameters in real-time, ensuring minimal wastage. For instance, in chemical plants, APC systems regulate temperatures and pressures to maintain efficient energy use. Similarly, in power generation, APC enhances the performance of turbines and boilers. As energy prices rise and environmental regulations tighten, industries increasingly turn to APC solutions to achieve cost-effective, sustainable operations, driving significant growth in the market.

However, the high initial costs associated with implementing APC systems act as a major restraint in the market. Advanced Process Control solutions require significant investments in software, hardware, system integration, and skilled personnel for installation and maintenance. For smaller enterprises or industries with tight budgets, these costs can be prohibitive, delaying adoption. Additionally, implementing APC systems often necessitates plant downtime for integration, leading to temporary production losses. These challenges are particularly pronounced in developing regions where financial and technical resources may be limited. As a result, high implementation costs pose a barrier to widespread adoption, particularly among cost-sensitive end users.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into APC systems presents a significant growth opportunity. AI and ML enhance the predictive capabilities of APC by analyzing vast datasets to identify patterns and anomalies, enabling better decision-making. For example, AI-driven APC can predict equipment failures and optimize maintenance schedules, reducing downtime and operational costs. Furthermore, ML algorithms improve the adaptability of APC systems, making them more efficient in handling dynamic processes. This integration is especially beneficial in complex industries such as oil & gas and pharmaceuticals, where real-time adjustments are critical. The growing adoption of AI and ML technologies is expected to revolutionize APC solutions, driving innovation and market expansion.

Segment Overview

The advanced process control market is segmented on the basis of components, technology, end user, and region.

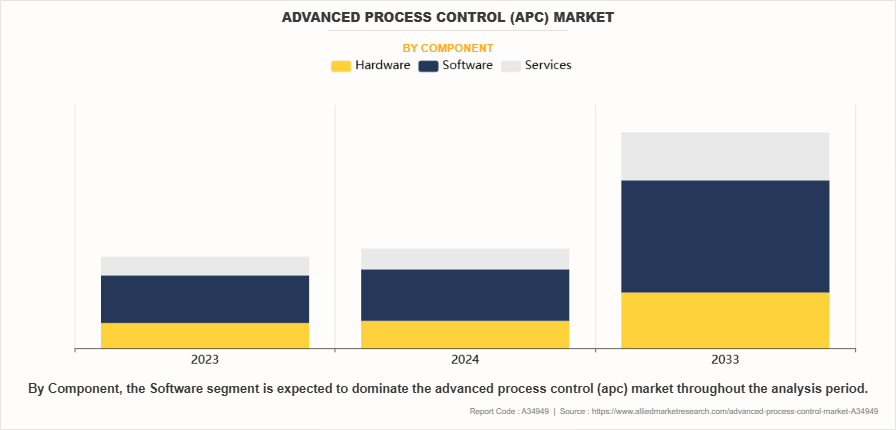

On the basis of Components, the Advanced Process Control (APC) Market Outlookis divided into hardware, software, and services.

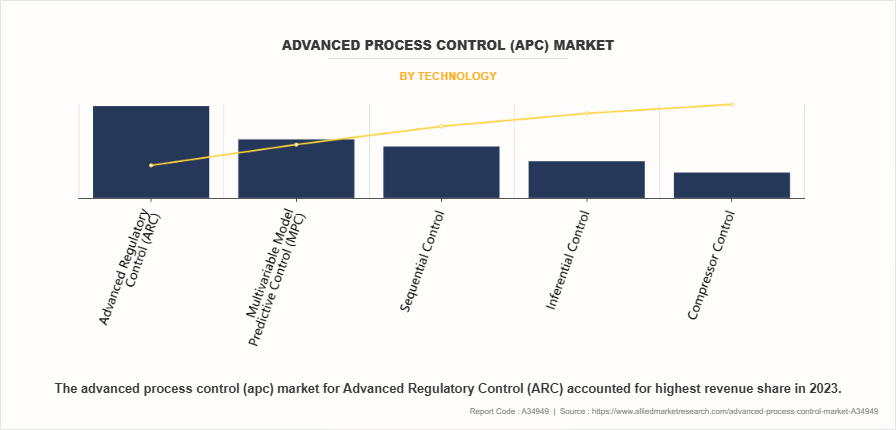

Based on Technology, the Advanced Process Control (APC) Market Forecast is segmented into Advanced Regulatory Control (ARC), and Multivariable Model Predictive control (MPC), Sequential control, Inferential control, and Compressor control.

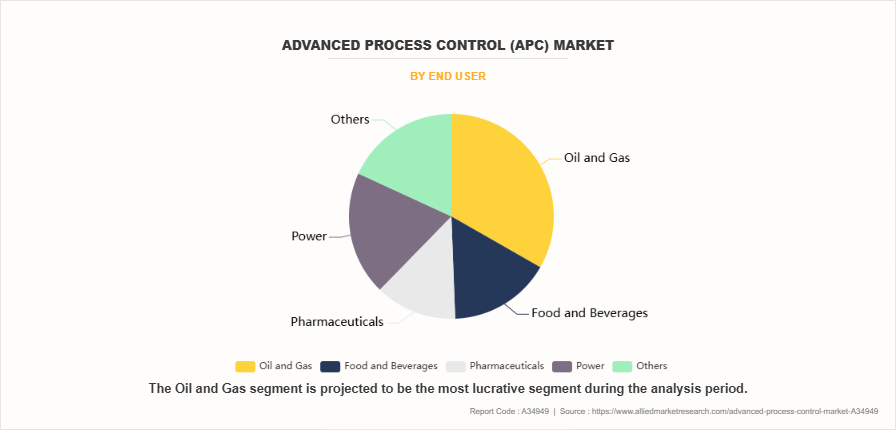

On the basis of end user, the Advanced Process Control (APC) Market Size is classified oil & gas, food & beverages, pharmaceuticals, power, others.

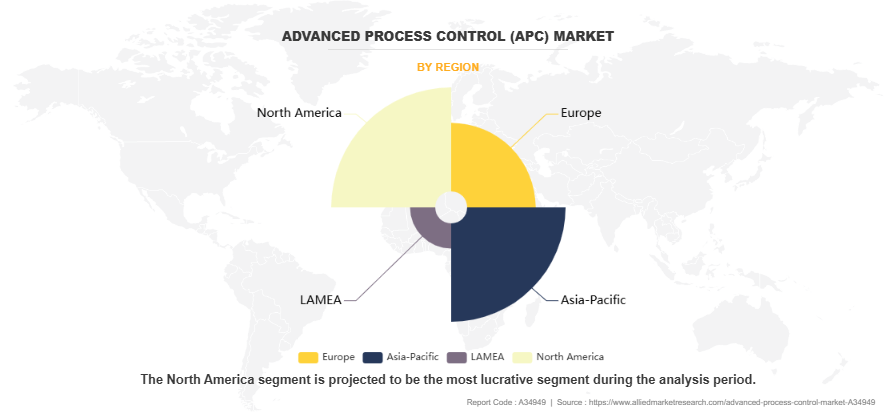

On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), LAMEA (Latin America, Middle East, Africa).

Competitive Analysis

The key players in the Advanced Process Control market are General Electric Company, Siemens AG, ABB Ltd., Rockwell Automation Inc., Honeywell International Inc., Onto Innovation, Inc., Yokogawa Electric Corporation, Emerson Electric Corporation, Schneider Electric, and SAP SE. Product launch and acquisition business strategies were adopted by the major Advanced Process Control (APC) Market players in 2023.

Recent Developments in Advanced Process Control (APC) Industry

- In February 2024, GE Vernova, a subsidiary of General Electric Company, unveiled Proficy, an innovative AI-powered software designed to help manufacturers achieve sustainability goals while enhancing productivity and profitability. This advanced solution integrates operational and sustainability data, enabling industrial companies to optimize resource utilization and ensure compliance with climate-related regulations.

- In March 2024, Yokogawa Electric Corporation announced the launch of OpreX Robot Management Core, a software application designed to integrate and manage various mobile robots performing plant maintenance tasks traditionally handled by humans. This solution aims to enhance safety and efficiency in manufacturing operations by enabling unified control of different robot types and facilitating the initial steps toward autonomous plant operations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the Advanced Process Control (APC) market segments, current trends, estimations, and dynamics of the advanced process control (apc) market analysis from 2023 to 2033 to identify the prevailing advanced process control (APC) market opportunity.

- The market research is offered along with information related to Advanced Process Control (APC) Market key drivers, Advanced Process Control (APC) Market restraints, and Advanced Process Control (APC) Market opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced process control (apc) market share segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Advanced Process Control (APC) Market Growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the Advanced Process Control (APC) market players.

- The report includes the analysis of the regional as well as global advanced process control (apc) market trends, key players, Advanced Process Control (APC) Industry segments, application areas, and Advanced Process Control (APC) market growth strategies.

Advanced Process Control (APC) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.3 billion |

| Growth Rate | CAGR of 9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 333 |

| By Component |

|

| By Technology |

|

| By End user |

|

| By Region |

|

| Key Market Players | ABB Ltd., Yokogawa Electric Corporation, Schneider Electric, Emerson Electric Corporation, SAP SE, Onto Innovation, Inc., Siemens AG, General Electric Company, Rockwell Automation Inc., Honeywell International Inc. |

Analyst Review

The global advanced process control (APC) market is poised for substantial growth in the coming years, driven by rise in adoption of automation and digitalization across industries. Industries such as oil & gas, chemicals, and power generation are leveraging APC technologies to optimize operational efficiency, reduce costs, and enhance process accuracy. With rising global energy demand, APC solutions have become indispensable in refining operations and energy-intensive manufacturing processes, offering precise control and real-time optimization. The integration of advanced algorithms, machine learning, and artificial intelligence in APC further boosts its adoption, enabling industries to predict anomalies, improve process stability, and achieve higher yields.

Another factor that drives the growth of the advanced process control (APC) market is rise in emphasis on sustainability and environmental compliance. Governments and regulatory authorities globally are emphasizing the need for industries to adopt cleaner and more efficient technologies to reduce their carbon footprints. APC systems help industries comply with these regulations by minimizing energy consumption, reducing waste, and enhancing overall resource efficiency. The pharmaceutical and food & beverage industries are also emerging as key end-users, utilizing APC to ensure consistent product quality, meeting stringent regulatory requirements, and streamline production processes.

Region-wise, Asia-Pacific is expected to dominate the market, driven by rapid industrialization, expanding manufacturing activities, and growing investments in infrastructure development. North America and Europe are also key contributors, benefiting from technological advancements and early adoption of APC solutions. The market is further driven by rise in demand for customized solutions and advancements in software capabilities, allowing seamless integration with existing process control systems. As companies across sectors recognize the long-term benefits of APC systems, the market is set to witness robust growth, with significant opportunities for innovation and technological advancement in the years to come

Integration of artificial intelligence (AI) and machine learning (ML) technologies and the growing adoption of the Industrial Internet of Things (IIoT) are the upcoming trends of Advanced Process Control (APC) Market in the globe

Oil and Gas is the leading application of Advanced Process Control (APC) Market

Asia-Pacific is the largest regional market for Advanced Process Control (APC)

In 2023, $2.3 billion was the estimated industry size of Advanced Process Control (APC)

General Electric Company, Siemens AG, ABB Ltd., Rockwell Automation Inc., Honeywell International Inc., Onto Innovation, Inc., Yokogawa Electric Corporation, Emerson Electric Corporation, Schneider Electric, and SAP SE are the top companies to hold the market share in Advanced Process Control (APC)

Loading Table Of Content...

Loading Research Methodology...