Advanced Wound Care Market Research, 2032

The global advanced wound care market size was valued at $10.3 billion in 2022, and is projected to reach $17.8 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032.The growth of advanced wound care market is driven by rise in adoption of evidence-based treatments for chronic wounds, wide availability of advanced therapy devices and rapid increase in geriatric population. Moreover, increase in prevalence of chronic diseases such as diabetes & obesity and rise in disposable income in developing economies fuel the adoption of advanced wound care therapies. For instance, according to National Diabetes Statistics Report by Centers for Disease Control and Prevention (CDC), 2022, about 37.3 million people were estimated to suffer from diabetes in the U.S. As the number of people with diabetes continues to grow, so does the risk of developing diabetic foot ulcers, leading to higher demand for effective treatment options.

Market Introduction and Definition

Advanced wound care includes products that are used to treat chronic and acute wounds, such as burns, ulcers, and postoperative wounds. Advanced wound care products such as hydrogels, hydrocolloids, film & foam dressings, and alginates keep the wound hydrated to facilitate rapid healing. The advanced wound care products provide solutions to patients suffering from chronic wounds by offering them reasonably priced and readily accessible products. Moreover, the report covers information on therapy devices, such as negative pressure wound therapies (NPWT), oxygen & hyperbaric oxygen equipment, electromagnetic therapy devices, electrical stimulation devices, and pressure relief devices.

Key Takeaways

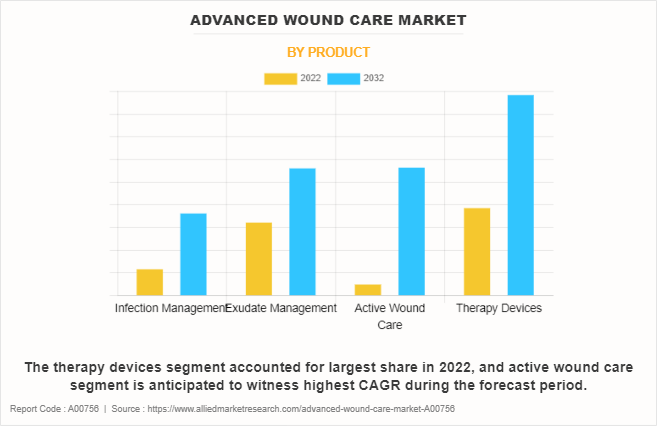

- On the basis of product, the therapy devices segment dominated the market in terms of revenue in 2022.

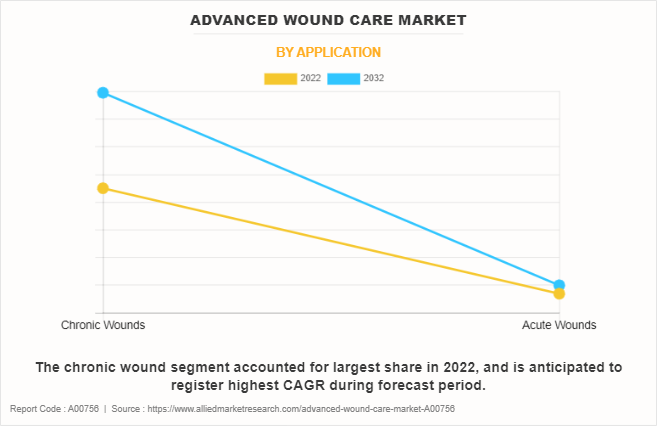

- On the basis of application, chronic wound segment accounted for largest share in terms of revenue in 2022 and anticipated to witness highest CAGR during the forecast period.

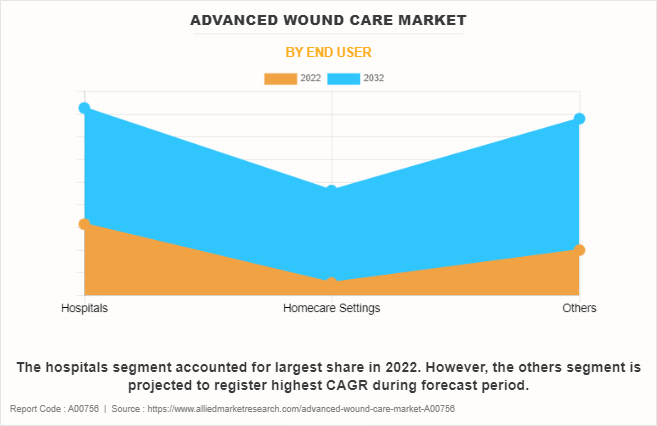

- On the basis of end user, the hospitals segment dominated the market in terms of revenue in 2022. However, the others segment is anticipated to grow at the highest CAGR during the forecast period.

- Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Key market dynamics

The major factors driving the advanced wound care market growth include increasing prevalence of diabetes, rise in geriatric population and technological advancements in wound care management products. The rise in global prevalence of diabetes is a significant driver for the advanced wound care market. Diabetes is a major risk factor for developing foot ulcers, and the growing number of diabetic patients increases the pool of individuals at risk. For instance, National Diabetes Statistics Report by Centers for Disease Control and Prevention (CDC) in 2022, stated that around 130 million adults are living with diabetes or prediabetes in the U.S. As the prevalence of diabetes continues to rise, there is a corresponding increase in the demand for effective diabetic foot ulcer treatment options.

In addition, advanced wound care products promote faster wound healing, and hence are gaining an edge over traditional wound care and closure products, which significantly contributes toward the growth of the market. Continuous advancements in advanced wound care & closure products are further expected to boost the market growth during the forecast period.

In addition, an aging population is another driver for the advanced wound care market. With advancing age, individuals are more susceptible to developing chronic conditions such as diabetes, peripheral neuropathy, and peripheral arterial disease, which increase the risk of foot ulcers. The growing number of elderly individuals drives the demand for specialized treatments and interventions for diabetic foot ulcers.

Further, advancements in wound care technologies have revolutionized the management of diabetic foot ulcers. Innovations in dressings, bioactive materials, negative pressure wound therapy (NPWT), and hyperbaric oxygen therapy (HBOT) have improved healing outcomes and accelerated wound closure. These technological advancements attract healthcare providers and patients, contributing to the growth of the advanced wound care market.

Moreover, government initiatives and support play a significant role in advanced wound care market opportunity. Governments and healthcare organizations across the globe are implementing programs to promote wound care management education, establish specialized diabetic foot clinics, improve access to healthcare services, and enhance reimbursement policies for wound care treatment. These initiatives aim to reduce the burden of foot ulcers and associated complications.

In addition, various organizations along with the government are counselling people regarding diabetes and available treatment options. E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, owing to a rise in preference of consumers for online shopping over traditional purchasing methods. Various animations through health apps to educate people regarding chronic wounds such as diabetic foot ulcer, venous leg ulcers & pressure ulcers and usage of wound care devices have contributed toward the growth of the advanced wound care market.

However, reimbursement policies may not adequately cover the costs of wound care treatment, leading to challenges in accessing and affording necessary interventions. Limited insurance coverage or inadequate reimbursement rates for wound care products, devices, and procedures can impact treatment options and patient outcomes. Improved reimbursement policies and expanded coverage could alleviate this restraint.

Market Segmentation

The advanced wound care market is segmented into product, application, end user and region. On the basis of product, the market is categorized into infection management, exudate management, active wound care and therapy devices. The infection management segment is further divided into silver wound dressings, non-silver dressings and collagen dressings. The exudate management segment is divided into hydrocolloids dressings, foam dressings, alginate dressings and hydrogel dressings. The active wound care segment is divided into skin substitutes and growth factors. The therapy devices segment is further bifurcated into negative pressure wound therapy (NPWT), oxygen and hyperbaric oxygen equipment, electromagnetic therapy devices and others.

Based on application, the advanced wound care market is categorized into chronic and acute wounds. The chronic wound segment is further segmented into pressure ulcers, diabetic foot ulcers, venous leg ulcers and arterial ulcers. The acute wound segment is further divided into burns & trauma and surgical wounds. On the basis of end user, the market is segregated into hospital, homecare settings and others. Region wise, the advanced wound care market growth is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

The therapy devices segment accounted for largest advanced wound care market share in 2022, owing to increase in presence of prominent players offering advanced therapy devices such as negative pressure wound therapy (NPWT) systems and electrical stimulation devices. This growth can also be attributed to the rise in number of regulatory approvals and the surge in awareness about wound care devices for effective wound management. On the other hand, the active wound care segment is anticipated to witness highest CAGR during the forecast period owing to rise in adoption of active wound care products such as skin substitutes, ongoing advancements in active wound care and demonstrated effectiveness of skin substitutes.

By Application

The chronic wound segment accounted for largest advanced wound care market share in 2022, and is anticipated to register highest CAGR during forecast period, owing to increasing prevalence chronic wounds such as diabetic foot ulcers & pressure ulcers, rising aging population and surging prevalence of chronic diseases such as diabetes and obesity. This has led to a growing demand for advanced wound care solutions.

By End User

The hospitals segment accounted for largest advanced wound care market size in 2022, owing to several factors, including the advanced infrastructure of hospitals, the presence of specialist expertise, inpatient care facilities, and a wide availability of treatment options for complex wounds. This makes hospitals a preferred choice for patients requiring intensive and complex treatment for chronic and acute wounds. However, the others segment is projected to register the highest CAGR during the forecast period owing to increase in number of specialty clinics that focus on complex wound treatment. The others segment includes various healthcare settings such as wound care centers, advanced wound care clinics, and homecare settings that provide specialized care for complex wounds outside traditional hospital settings.

Regional/Country Market Outlook

The advanced wound care market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for largest advanced wound care market size in 2022. This growth is attributed to factors such as rise in prevalence of chronic wounds such as diabetic foot ulcers, availability of well-developed healthcare infrastructure such as specialized wound care centers & diabetic clinics and growing emphasis on early detection & comprehensive management of diabetic foot ulcers.

Moreover, North American healthcare system has made significant investments in improving healthcare infrastructure and facilities, which has enabled better access to healthcare services and treatments for patients with diabetes. However, Asia-Pacific is expected to witness highest growth during the forecast period, owing to rise in prevalence of diabetes, increase in healthcare expenditure and surge in awareness about the importance of early detection and treatment of diabetic foot ulcer.

Presence of several major players, such as ConvaTec Group plc, 3M Company, Cardinal Health Inc., B. Braun SE, Integra LifeSciences Holdings Corporation and advancement in manufacturing technology for development of effective treatment options for complex wound in the region is expected to drive the growth of the advanced wound care market. In addition, various private organizations organize educating camps for awareness of complex wound and treatment options available across the globe. This is expected to drive the growth of the market. Furthermore, the presence of well-established healthcare infrastructure and rise in adoption rate of new treatment options such as offloading devices, negative pressure wound therapy (NPWT) and electrical stimulation devices for various types of wounds is expected to drive the market growth.

Asia-Pacific is expected to grow at the highest rate during the advanced wound care market forecast period. The market growth in this region is attributable to the presence of key players in the region. The Asia-Pacific region has made significant efforts in improving its healthcare infrastructure, including wound care facilities and specialized foot care centers. The establishment of comprehensive wound care centers, advancements in diagnostic technologies and access to modern treatment modalities drive the growth of the market. Asia-Pacific offers profitable opportunities for key players operating in the market, thereby registering the fastest growth rate during the forecast period, owing to the developments in industrial infrastructure, rise in in spending for wound care research, as well as well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competitive Landscape

Competitive analysis and profiles of the major players in the advanced wound care industry, such as ConvaTec Group plc, 3M Company, Cardinal Health Inc., Organogenesis Holdings Inc., Smith and Nephew plc., B. Braun SE, Coloplast, Integra LifeSciences Holdings Corporation, Molnlycke Health Care AB and MIMEDX Group, Inc., are provided in the report. Major players have adopted acquisition, contract, expansion, product upgrade, funding, product launch and product approval as key developmental strategies to improve the product portfolio of the advanced wound care market.

Recent Product Approval in Advanced Wound Care Market

In August 2022, Organogenesis, a leading regenerative medicine company, announced that it has received U.S., Food and Drug Administration (FDA) 510k Clearance for PuraPly MZ, a brand extension to the PuraPly product portfolio. PuraPly MZ leverages the innovative properties of our PuraPly technology engineered into a micronized (powdered) form to provide surgeons with an option for complex surgical wounds.

Recent Product Launch in Advanced Wound Care Market

In June 2021, Convatec launched Chlorasolv in Europe, a gentle wound debrider efficient against biofilm, within the recognized wound hygiene protocol care, designed to accelerate healing in hard-to-heal wounds.

Recent Acquisition in Advanced Wound Care Market

In December 2021, Essity acquired advanced wound care company in U.S., Hydrofera, developer of Blue Antibacterial Wound Dressings, an advanced line of wound care products designed to shorten healing times, lower treatment costs, and deliver better patient outcomes.

Recent Expansion in Advanced Wound Care Market

In December 2020, Molnlycke Health Care AB expanded its new UK distribution center, strengthening customers’ access to quality Mölnlycke products via a new, more robust supply chain solution delivering environmental benefits.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced wound care market analysis from 2022 to 2032 to identify the prevailing advanced wound care market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced wound care market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global advanced wound care market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the advanced wound care industry players.

- The report includes the analysis of the regional as well as global advanced wound care market trends, key players, market segments, application areas, and market growth strategies.

Advanced Wound Care Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.8 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 278 |

| By End User |

|

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | B. Braun SE, ConvaTec Group plc, Molnlycke Health Care AB, 3M Company, MIMEDX Group, Inc., Coloplast, Cardinal Health Inc., Smith & Nephew plc, ORGANOGENESIS HOLDINGS INC., Integra LifeSciences Holdings Corporation |

The total market value of advanced wound care market is $10.3 billion in 2022.

The market value of advanced wound care market in 2032 is $17.8 billion.

The forecast period for advanced wound care market is 2023 to 2032.

The base year is 2022 in advanced wound care market.

Top companies such as ConvaTec Group plc, 3M Company, Smith & Nephew plc., Coloplast, and Molnlycke Health Care AB held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The therapy devices segment is the most influencing segment in advanced wound care market owing to rise in number of key players offering advanced therapy devices such as negative pressure wound therapy (NPWT) systems and electrical stimulation devices, rise in regulatory approvals and growing awareness about wound care devices in wound care management

The major factors driving the growth of advanced wound care market are increase in prevalence of chronic wounds, rise in prevalence of chronic conditions such as diabetes & obesity and technological advancements have significantly transformed the landscape of wound care.

Advanced wound care refers to a specialized approach in wound management that goes beyond basic dressings and includes a range of advanced techniques, products and therapies designed to optimize the wound healing process, reduce the risk of infection and improve outcomes in the treatment of acute and chronic wounds.

Loading Table Of Content...

Loading Research Methodology...