Aerated Chocolate Market Research, 2033

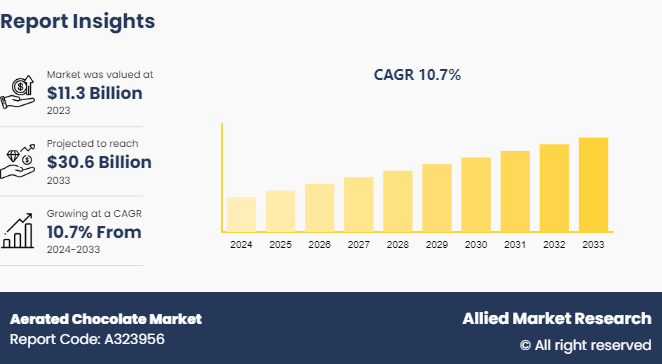

The global aerated chocolate market size was valued at $11.3 billion in 2023, and is projected to reach $30.6 billion by 2033, growing at a CAGR of 10.7% from 2024 to 2033.

Market Introduction and Definition

The texture of aerated chocolate is lighter and fluffier than traditional solid chocolate as it has been injected with air bubbles. This aeration procedure allows for novel product experiences while also improving the taste. Chocolate bars, truffles, and other confections are among the products in the market for aerated chocolate. This specialty market serves customers looking for unusual textures and decadent delights. Technological developments in chocolate manufacturing, the market's influence from growing premium and gourmet chocolate trends, and the growing desire of consumers for new culinary experiences are the factors driving the aerated chocolate market growth.

Key Takeaways

- The aerated chocolates market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major aerated chocolate industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

There has been a notable surge in the aerated chocolate market due to a variety of factors that impact the aerated chocolate market share. The growing desire from consumers for creative and decadent confectionery products is one of the main factors. Customers looking for new food experiences find aerated chocolate appealing due to its distinct mouthfeel and texture. Aerated chocolate is regarded as lighter and less dense, which corresponds with the desires of health-conscious consumers who still want to enjoy sweet confections without excessive consumption. Thus health and wellness play a crucial role in driving the market growth.

The development of production technology, which has made manufacturing aerated chocolate for producers easier and more affordable, is another important trend. Better results in terms of product quality and shelf stability have been achieved by the increased capacity to generate uniform air bubbles inside the chocolate matrix. This advancement in technology facilitates production scalability and aids in addressing growing consumer demand.

The strategic moves taken by significant companies in the confectionery sector also influence market dynamics. Companies are spending money on advertising initiatives that emphasize the special qualities of aerated chocolate in an effort to raise customer knowledge and interest. In addition, innovation and product diversification introducing new tastes, and using healthier ingredients, for example, are crucial strategies used to appeal to a wider range of customers.

Regarding distribution, the growth of retail channels and online platforms has improved product accessibility and fueled market expansion. Further driving market expansion is the ease with which consumers can browse and buy a wide range of aerated chocolate products because of the growing prevalence of e-commerce.

However, obstacles like volatile raw material costs and strict laws governing the quality and safety of food can affect market dynamics. Despite these obstacles, the aerated chocolate market share is expected to expand due to factors such as persistent innovation, consumer desire for distinctive confectionery experiences, and industry leaders' business strategies.

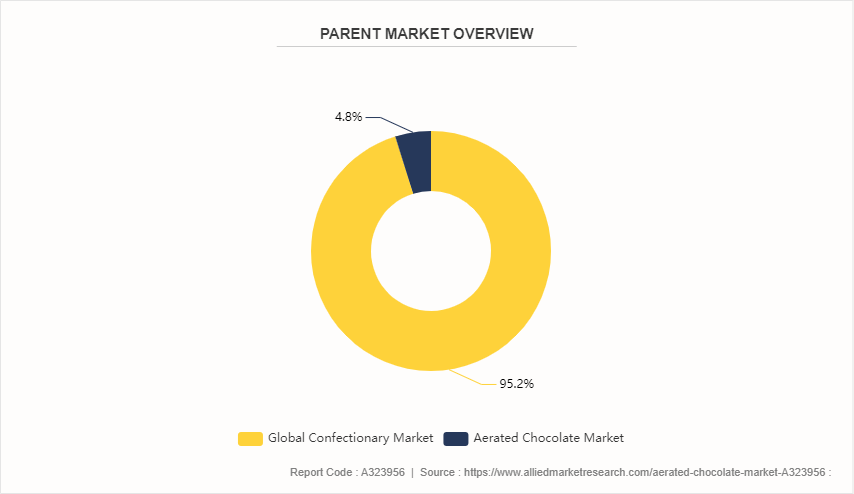

Parent Market Overview of the Global Aerated Chocolate Market

The market for sweet food products, such as chocolates, candies, gums, and desserts, is larger than the market for aerated chocolate. Consumer indulgence, growing disposable incomes, and ongoing product developments are some of the drivers driving the confectionery business. Its distinct sensory experience and calorie count have made aerated chocolate, which is characterized by a light and frothy texture, increasingly popular. Globally, the aerated chocolate segment of the confectionery industry has grown and expanded due to the efforts of major companies in the market, who use marketing methods and various offerings to grab customer interest.

Market Segmentation

The aerated chocolate market size is segmented into type, aeration method, distribution channel, and region. On the basis of type, the market is divided into dark chocolate, milk chocolate, and white chocolate. As per the aeration method, the market is segregated into chemical aeration and mechanical aeration. On the basis of distribution channel, the market is bifurcated into offline and online. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The aerated chocolate market has been growing steadily on a global scale, with notable regional variations driven by market maturity, economic conditions, and cultural preferences. The market leader in North America is the U.S., due to a strong demand for high-end, innovative confectionary products. Aerated chocolate's appeal is attributed to high disposable incomes and a taste for unique flavors and textures. Though its market is smaller than that of the U.S., Canada makes a substantial contribution as well.

The market for aerated chocolate is well-established in Europe, especially in nations like the UK, Germany, and Switzerland. With a long history of chocolate consumption and a strong preference for aerated varieties due to companies like Cadbury and Nestlé, the UK leads the region in this area. Renowned for their extensive chocolate history, Germany and Switzerland have a robust demand, with an increasing inclination towards ingredients obtained sustainably and organically.

The aerated chocolate market is expanding rapidly in the region of Asia-Pacific due to shifting dietary habits, urbanization, and increased disposable incomes. The two main markets are China and Japan. Japanese customers have a taste for chocolate products that are distinctive and innovative, especially aerated variations. The market is growing significantly in China as a result of increased Western influence and the rising appeal of chocolate among younger consumers.

The aerated chocolate market forecast for Latin America is varying, with some nations like Brazil and Mexico exhibiting modest development. Although consumer preferences and economic volatility affect the industry, there is a steady rise in demand for high-quality and creative chocolate products.

The aerated chocolate market is still developing throughout the Middle East and Africa. due to its comparatively higher consumption of confectionary products, South Africa leads the region in this regard. However, decreased per capita chocolate consumption and financial constraints are limiting the market as a whole.

The aerated chocolate market, therefore, shows a variety of regional aspects. While growing markets in Asia-Pacific and Latin America propel growth through rising urbanization and shifting consumer lifestyles, mature markets in North America and Europe concentrate on innovation and premiumization.

Aerated Chocolate Industry Trends:

- Hershey's introduced a new range of aerated chocolate products in March 2023 to enter the premium chocolate market in the U.S. Targeting consumers who are concerned about their health, the new products come in variants with lower sugar content and additional natural flavors.

- In response to the rising demand for its aerated chocolate bars, Kinder Bueno, in China, Ferrero expanded its production facilities in Shanghai in July 2023. Ferrero's plan to localize production and improve distribution throughout important Chinese cities includes this expansion.

- The Asia-Pacific region's first aerated chocolate market was entered by Mondelez International in November 2022 with the introduction of Cadbury Dairy Milk Silk Oreo aerated chocolate bars in India. With this move, the region's expanding chocolate sector is expected to benefit from the popularity of both the Cadbury and Oreo brands.

Competitive Landscape

The major players operating in the aerated chocolate market include Alfred Ritter GmbH & Co. KG, Barry Callebaut AG, Cargill, Incorporated, Chocoladefabriken Lindt & Sprungli AG, Ferrero International S.A., Hershey Foods Corporation, Kraft Foods Group, Inc., Mars Incorporated, Meiji Co., Ltd., Mondelez International, Inc., Morinaga & Co., Ltd., Nestle S.A., Puratos Group, TCHO Ventures, Inc., and Valrhona.

Recent Key Strategies and Developments

- In August 2023, Mars Inc. expanded its product line and improved its distribution network in the US market by acquiring a local company making aerated chocolate.

- In October 2023, Nestlé launched its aerated chocolate brand, Aero, in China, capitalizing on its worldwide experience to capture the expanding chocolate industry in the area.

- In December 2023, Godiva capitalized on seasonal demand and trends for luxury chocolate by launching a limited-edition line of aerated chocolate truffles in specific Asia-Pacific markets.

Key Sources Referred

- National Confectioners Association (NCA)

- European Association of Chocolate, Biscuits and Confectionery Industries (CAOBISCO)

- International Cocoa Organization (ICCO)

- Institute of Food Technologists (IFT)

- Confectionery Manufacturers Association of Australia (CMAA)

- Federation of Cocoa Commerce Ltd (FCC)

- Fine Chocolate Industry Association (FCIA)

- Association of Chocolate, Biscuit and Confectionery Industries of the EU (CIUS)

- World Cocoa Foundation (WCF)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerated chocolate market analysis from 2024 to 2033 to identify the prevailing aerated chocolate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerated chocolate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerated chocolate market trends, key players, market segments, application areas, and market growth strategies.

Aerated Chocolate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 30.6 Billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Aeration Method |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Alfred Ritter GmbH & Co. KG, Cargill, Incorporated, Chocoladefabriken Lindt & Sprungli AG, Hershey Foods Corporation, Ferrero International S.A, Mars Incorporated, Barry Callebaut AG, Meiji Co., Ltd, MONDELEZ INTERNATIONAL, INC., Kraft Foods Group, Inc. |

The global aerated chocolate market size was valued at USD 11.3 billion in 2023, and is projected to reach USD 30.6 billion by 2033.

The global aerated chocolate market is projected to grow at a compound annual growth rate of 10.7% from 2024-2033 and to reach USD 30.6 Billion by 2033.

The major players operating in the aerated chocolate market include Alfred Ritter GmbH & Co. KG, Barry Callebaut AG, Cargill, Incorporated, Chocoladefabriken Lindt & Sprungli AG, Ferrero International S.A., Hershey Foods Corporation, Kraft Foods Group, Inc., Mars Incorporated, Meiji Co., Ltd., Mondelez International, Inc., Morinaga & Co., Ltd., Nestle S.A., Puratos Group, TCHO Ventures, Inc., and Valrhona.

North America dominated and is projected to maintain its leading position throughout the forecast period.

The global aerated chocolate market is witnessing several upcoming trends driven by evolving consumer preferences and innovative product developments. One significant trend is the increasing demand for premium and artisanal aerated chocolates, where manufacturers are focusing on high-quality ingredients and unique flavors to cater to a more discerning consumer base.

Loading Table Of Content...