Airplane Parts Manufacturers Market Overview: 2023-2031

The global aerospace parts manufacturing market size was valued at $0.85 trillion in 2021, and is projected to reach $1.94 trillion by 2031, growing at a CAGR of 9.2% from 2022 to 2031. Aerospace parts manufacturing is the process of designing, producing, and assembling the components used in the construction of aerospace vehicles, including airplanes, helicopters, spacecraft, and missiles. This includes the manufacturing of various parts such as engines, wings, fuselages, landing gear, and other critical components. Aerospace parts manufacturing involves the use of specialized materials, precision machinery, and advanced technologies to ensure high quality, reliability, and safety. The manufacturing process involves several stages, including design, engineering, prototyping, testing, and production. The industry is highly regulated to ensure compliance with strict safety and quality standards set by national and international organizations.

The aerospace parts manufacturing market is segmented into Product Type and End User.

The aerospace industry is a vital sector of the global economy that comprises various applications, such as civil and military aviation, space exploration, and defense. The manufacturing of aerospace parts and components is an essential part of the aerospace industry. The aerospace parts manufacturing market is a dynamic and competitive industry that continuously evolves to meet the growth in demand for more advanced and efficient aerospace products. The Aerospace Parts Manufacturing Market is influenced by numerous factors such as advancements in technology, increase in demand for air travel, government initiatives, and environmental regulations.

The aerospace industry is constantly evolving with advancements in technology, such as 3D printing and advanced materials. The ability to innovate and adopt new technologies is crucial for aerospace parts manufacturers to remain competitive. Economic conditions, such as GDP growth, inflation, and interest rates, can impact the aerospace parts manufacturing market. During periods of economic growth, there is typically higher demand for air travel and an increased need for new aircraft and parts. The aerospace industry is heavily regulated, and manufacturers must comply with various safety and quality standards set by regulatory bodies such as the Federal Aviation Administration (FAA). Changes in regulatory requirements can impact on the manufacturing process and the costs associated with producing parts.

Factors such as increase in demand for commercial aircraft, rise in adoption of composite components, growth in need for military aircraft and advancement in technologies are the major drivers for aerospace parts manufacturing. Moreover, factors such as limited regulatory infrastructure, high cost of manufacturing aerospace parts, and lack of skilled people to manufacture aerospace parts restrain the growth of aerospace parts manufacturing market share. Furthermore, factors such as increase in adoption of 3D printing in aircraft manufacturing and increase in demand for lightweight & durable aerospace components create lucrative opportunities for the growth of the leading players of aerospace parts manufacturing products operating in the market.

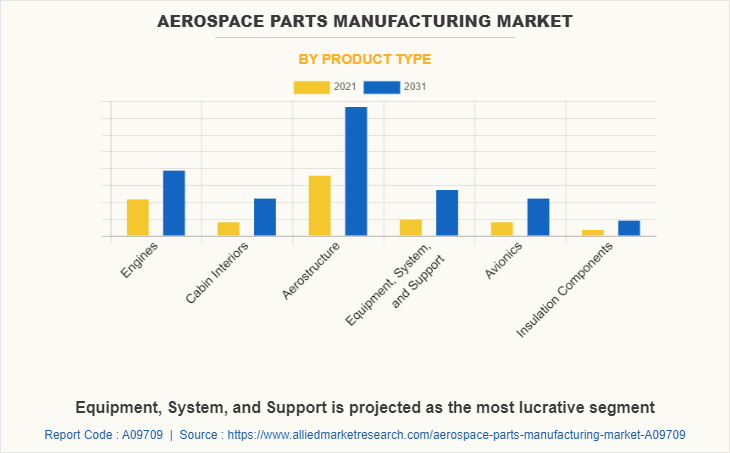

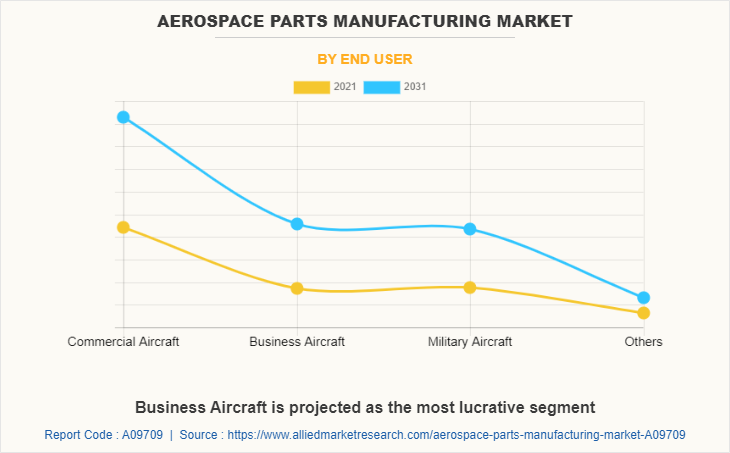

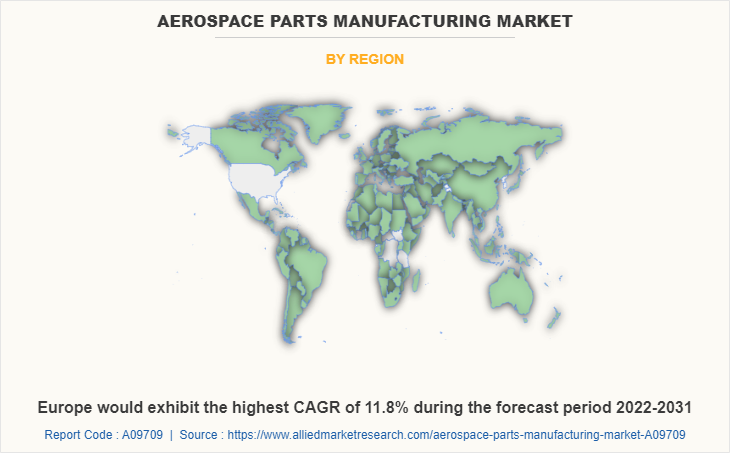

The aerospace parts manufacturing market is segmented on the basis of product type, end user, and region. On the basis of product type, it is divided into engines, cabin interiors, aerostructure, equipment, system & support, avionics, and insulation components. On the basis of end users, it is classified into commercial aircraft, business aircraft, military aircraft, and others. On the basis of region, the Aerospace Parts Manufacturing Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth drivers, restraints, and opportunities are explained in the study to better understand the market dynamics. This study further highlights key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The study features strategies adopted by key Aerospace Parts Manufacturing Market players to maintain their foothold in the market.

The aerospace parts manufacturing companies operating in the market are Boeing Co, Dassault Aviation SA, GE Aviation, Honeywell International Inc., Lockheed Martin Corp, Lufthansa Technik AG, Parker Hannifin, Rolls-Royce plc, Safran S.A., and Thales Group. These Companies have adopted product development, product launch, partnership among others as their key development strategies in the Aerospace Parts Manufacturing Market.

Increase in demand for commercial aircraft

There has been an increase in demand for commercial aircraft steadily over the past few decades, driven by several factors such as the growth of the global economy, the increase in popularity of air travel, and the expansion of the middle class in emerging markets. The global economy has grown at a steady pace over the past few decades, with many countries experiencing significant economic growth. This has led to an increase in the number of people who can afford to travel by air, driving up demand for commercial aircraft, thus impacting positively to aerospace parts manufacturing market.

The rise in sales for commercial aircraft had a significant impact on the aerospace industry, driving innovation and growth which has led the manufacturers to innovate in order to remain competitive. For instance, in February 2023, Air India had ordered a total of 470 civilian aircraft. This purchase is expected to revolutionize the fleet and onboard product of the airline and to eventually expand its global network. The growth of the global economy has also led to an increase in the demand for air cargo services. The demand for efficient and reliable cargo transportation has increased as more goods are produced and consumed globally.

The popularity of air travel has improved significantly over the past few years, driven by factors such as increase in disposable incomes, change in lifestyles, and the rise of low-cost carriers. As air travel has become more affordable and accessible, more people are choosing to travel by air for both business and leisure purposes. Moreover, the growth of the tourism industry has also contributed to the increasing demand for aerospace parts.

Emerging markets such as China, India, and Brazil have experienced significant economic growth over the past few decades, leading to an increase in demand for air travel. More people may afford to travel by air, leading to an increase in demand for commercial aircraft as the population of the middle class in these countries is rising. Many emerging countries have invested heavily in the aerospace industry, developing their own aircraft manufacturers and suppliers. This has led to an increase in the sales of aerospace parts across the globe.

Growth in need for military aircraft and advancement in technologies to boost the sales for aerospace parts manufacturing market

The aerospace parts manufacturing market is also driven by the growth in need for military aircraft. Governments invest in new military aircraft to ensure national security with tensions rising around the world and ongoing conflicts in various regions. According to a report by Purnea University, in 2022 the world expends $2.0 trillion amount in defense. The growth in need for military aircraft drives the Aerospace Parts Manufacturing Market, as manufacturers are required to produce the parts necessary to construct these new aircraft. This demand drives manufacturers to invest in modern technologies, streamline their production processes, and expand their operations to meet the growing demand.

The aviation industry is a significant contributor to greenhouse gas emissions, and as environmental regulations become increasingly strict, manufacturers are required to develop more environmentally friendly products. One-way manufacturers address these concerns through the use of lightweight materials. Composite materials, for example, are lighter than traditional metals and may lead to significant fuel savings and reduced emissions. The use of biofuels is more common in the aviation industry now, as these fuels may significantly reduce greenhouse gas emissions.

Manufacturers look for ways to improve their products, reduce costs, and increase efficiency with the aerospace industry becoming increasingly competitive. Advancements in technology help manufacturers to achieve these goals. For example, 3D printing technology has revolutionized the way parts are manufactured, enabling manufacturers to produce parts quickly and at a lower cost than traditional manufacturing methods. Furthermore, the use of robotics and automation in manufacturing reduces costs and improves efficiency, as these technologies may perform repetitive tasks with greater accuracy and speed than humans. Such huge demand for military aircrafts and rising advancement in technologies to increase the sales for aerospace parts manufacturing market.

Limited regulatory infrastructure

The aerospace industry is a highly regulated sector that is subject to various international, national, and local regulations. These regulations are put in place to ensure the safety and reliability of aircraft and their components, as well as to protect the environment and the public. However, one significant challenge facing the industry is limited regulatory oversight in the manufacturing of aerospace parts. Aerospace parts are critical components that ensure the safety and reliability of aircraft. These parts are subject to stringent regulations that dictate the materials used, manufacturing processes, and testing procedures. However, in many parts of the world, the regulatory oversight of aerospace parts manufacturing is limited or non-existent. This may have severe implications for the industry, including reduced safety and reliability of aircraft, lower standards for environmental protection, and reduced competitiveness.

Aerospace parts are critical components that ensure the safety and reliability of aircraft. These parts are subject to stringent regulations that dictate the materials used, manufacturing processes, and testing procedures. However, in many parts of the world, the regulatory oversight of aerospace parts manufacturing is limited or non-existent. This may have severe implications for the industry, including reduced safety and reliability of aircraft, lower standards for environmental protection, and reduced competitiveness.

There are several reasons for limited regulatory oversight in the aerospace parts manufacturing industry. One of the main causes is a lack of government investment in regulatory agencies. In many countries, the regulatory agencies responsible for overseeing the aerospace industry are underfunded and understaffed, which limits their ability to effectively regulate the industry. Another cause is the complexity of the industry itself. The aerospace industry is highly specialized, and the regulations that govern it may be complex and difficult to understand. This may make it challenging for regulatory agencies to keep up with the latest developments and to ensure that manufacturers are adhering to safety and quality standards. Such challenges in limited regulatory to impact negatively in aerospace parts manufacturing market.

Increase in adoption of 3D printing in aircraft manufacturing to favor growth

3D printing, also known as additive manufacturing, has revolutionized the manufacturing industry in recent years. This technology has enabled the production of complex geometries and the use of new materials, leading to increased efficiency and cost savings. The aerospace industry is no exception to this trend, and 3D printing is being increasingly used for aircraft manufacturing.

3D printing allows for the creation of complex geometries and shapes that cannot be produced using conventional manufacturing methods. This technology supports the production of lightweight components that are strong and durable, leading to improved aircraft performance. This may also reduce material waste and decrease the time and cost of producing complex parts. It eliminates the need for expensive tooling and molds, making it an attractive option for low-volume production. Prominent companies such as GE Aviation, Airbus, and Boeing had already started using 3D printing in aircraft manufacturing.

For instance, GE Aviation has 3D printed fuel nozzle for its LEAP engine of aircraft, which reduces weight and improves fuel efficiency. The company has also produced 3D printed titanium components for its GEnx engine, reducing weight and improving durability. Airbus has also been exploring the use of 3D printing in aircraft manufacturing for several years. The company has produced 3D printed parts for its A350 XWB aircraft, including brackets and ducts. Airbus has also partnered with Materialize, a leading provider of 3D printing software and services, to develop a 3D printed cabin partition that reduces weight and improves passenger comfort.

Boeing has also been using 3D printing in aircraft manufacturing. The company has produced 3D printed parts for its 787 Dreamliner aircraft, including wing trim parts and air ducts. The company has also partnered with Norsk Titanium, a leading producer of 3D printed titanium components, to produce titanium structural components for its 787 Dreamliner and 777X aircraft. The use of 3D printing in aerospace parts manufacturing is expected to continue growing in the coming years. While the technology is still in its initial stages of adoption, advancements in materials, printing speed, and certification standards are expected to accelerate the growth of aerospace parts manufacturing market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace parts manufacturing market analysis from 2021 to 2031 to identify the prevailing aerospace parts manufacturing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace parts manufacturing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace parts manufacturing market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Parts Manufacturing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1946.6 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Safran S.A., Lockheed Martin Corporation, Lufthansa Technik, Rolls-Royce plc, Boeing Company, Thales Group, PARKER HANNIFIN CORP, Honeywell International Inc., GENERAL ELECTRIC, Dassault Aviation |

Analyst Review

One of the major drivers of the aerospace parts manufacturing market is the demand for new aircrafts. Governments heavily in the development and production of advanced military aircraft that are capable of operating in a wide range of environments and under a variety of conditions as they seek to modernize their militaries and stay ahead of potential threats. This has led to a significant increase in demand for aerospace parts, as manufacturers seek to develop and produce new, more advanced components that may meet the needs of modern military forces. However, in the commercial aerospace industry, there is a growth in focus on the development of lighter, stronger, and more durable materials that may help to increase the performance and efficiency of an aircraft. This has led to the adoption of materials such as carbon fiber composites and advanced alloys, as well as the development of advanced technologies such as 3D printing and additive manufacturing.

Moreover, the aerospace parts manufacturing market is impacted by changes in geopolitical conditions and evolving military strategies. Military forces may need to adapt their strategies and equipment to meet these challenges as political tensions rise and new threats emerge. This may lead to changes in the demand for specific types of aircraft and components, as well as changes in the design and functionality of aircraft parts.

The aerospace parts manufacturing market is also focusing more on cybersecurity and data protection. There is a growth in need to ensure that these systems are secure and protected from cyberattacks as military aircraft become increasingly connected and reliant on advanced software and systems. This has led to the development of advanced cybersecurity technologies and the implementation of strict data protection protocols.

Increase in adoption of 3D printing in aircraft manufacturing, and the demand for lightweight & durable aerospace components are the upcoming trends of aerospace parts manufacturing market in the world.

Commercial aircraft is the leading end user segment in aerospace parts manufacturing market.

North America is the largest regional market for aerospace parts manufacturing.

The industry size of aerospace parts manufacturing market in 2021 is $0.85 trillion.

The growth rate of aerospace parts manufacturing market will be 9.2% for the span of next ten years.

Loading Table Of Content...

Loading Research Methodology...