Air Traffic Control Market Research, 2033

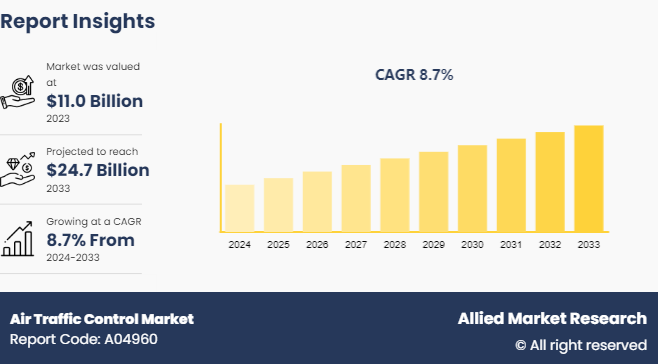

The global Air Traffic Control Market Size was valued at $11.0 billion in 2023, and is projected to reach $24.7 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Market Introduction and Definition

The Air Traffic Control (ATC) market refers to the industry segment that encompasses the technologies, systems, services, and infrastructure used to manage and control air traffic. This market includes a wide range of products and services designed to ensure the safe and efficient movement of aircraft within controlled airspace and on the ground at airports. The primary goal of air traffic control is to prevent collisions, organize and expedite the flow of air traffic, and provide information and support for pilots.

The ATC market comprises the sale, development, and deployment of systems, equipment, and services used to monitor, manage, and control air traffic. This includes radar systems, communication systems, navigation aids, automation systems, software solutions, and associated services that enable air traffic controllers to manage aircraft movements both in the air and on the ground.

The three main components of air traffic control are Air Route Traffic Control Centers (ARTCC) , Terminal Radar Approach Control (TRACON) , and Air Traffic Control Towers (ATCT) . Air Route Traffic Control Centers (ARTCC) facilities manage high-altitude en route traffic, covering large geographical areas and handling aircraft flying through controlled airspace. Terminal Radar Approach Control (TRACON) facilities manage air traffic within a terminal area, typically encompassing multiple airports. They handle the traffic within approximately 30 to 50 nautical miles of an airport, guiding aircraft during the arrival and departure phases of flight. Air Traffic Control Towers (ATCT) are located at airports that manage aircraft movements on the ground and near the airport, including takeoffs, landings, and taxiing.

Key Takeaways

The Air Traffic Control Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, Air Traffic Control Industryreleases, annual reports, and other such documents of major Air Traffic Control Industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

In February 2024, U.S. Air Force received air traffic control equipment placed on vehicles from Collins Aerospace to facilitate air traffic management in highly disputed areas. The units are complete air traffic control systems that can be readily transferred to accommodate harsher settings. They are known as Air Traffic Navigation, Integration, and Coordination Systems (ATNAVICS) . New Primary Surveillance Radars with notable range capabilities are incorporated into the systems.

In September 2023, Indira Sistemas S.A. launched Spanish air traffic management technology. The solution was created in collaboration with the Spanish air navigation provider. The solution, has an ergonomic and effective design, a larger display area, and pertinent information on new features for the control staff. Within the framework of the European iTEC alliance, iFOCUCS is also essential to facilitating the technological evolution of the Spanish air traffic control system (SACTA) .

In November 2023, Saab launched a new integrated digital tower solution (i-DTS) . The solution is aimed at large airports, initially as a mirror contingency tower to ensure they can maintain operations in the face of adverse events, but ultimately to develop into a system that could replace the traditional air traffic control (ATC) tower.

Key Market Dynamics

The global air traffic control (ATC) market is driven by the increasing air travel demand, advancements in aviation infrastructure, and the need for enhanced safety and efficiency in air traffic management. Key drivers include the rise in passenger and cargo air traffic, technological innovations in ATC systems such as automation and artificial intelligence, and government investments in modernizing airport infrastructures. However, the market faces restraints such as high implementation and maintenance costs, stringent regulatory requirements, and cybersecurity threats. Opportunities lie in the integration of next-generation communication, navigation, and surveillance technologies, expanding airspace capacity, and the growing adoption of unmanned aerial vehicles (UAVs) , which necessitate sophisticated ATC solutions.

With global economic Air Traffic Control Market Growth and increasing prosperity, air travel demand is rising steadily. This surge in passenger and cargo traffic necessitates more efficient and reliable air traffic management systems to ensure the safe and timely movement of aircraft. Air traffic control systems play a crucial role in managing this growing volume of air traffic by providing guidance, communication, and separation services to aircraft.

Ongoing advancements in aviation infrastructure, including the modernization of airports, navigation systems, and communication technologies, are driving the need for more sophisticated air traffic control solutions. New technologies such as satellite-based navigation systems and digital communication systems are gaining traction as they enable more precise and efficient air traffic management, reducing delays and enhancing overall system capacity.

Safety is paramount in aviation, and air traffic control systems are central to maintaining safe operations in the increasingly complex airspace environment. Advancements in air traffic control technology, such as automation, data analytics, and real-time monitoring capabilities, help to improve safety by providing controllers with better situational awareness and decision-making tools. In addition, increasing pressure to reduce environmental impact and operational costs necessitates more efficient routing and airspace utilization, driving the demand for advanced air traffic control solutions that optimize airspace capacity and reduce fuel consumption.

Market Segmentation

The aircraft cabin lighting market is segmented into aircraft type, fit, technology, end user, light type, and region. Based on aircraft type, the market is divided into commercial, military, and others. Based on fit, the market is bifurcated into retro-fit and line-fit. Based on technology, the market is divided into halogen, LED, and others. Based on the sales channel, the market is bifurcated into OEM and aftermarket. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

In May 2024, DFS Aviation Services launched its first Cloud-based air traffic control system in Germany. Phoenix Web Innovation is a cloud-based system that DFS Aviation Services GmbH (DAS) , a subsidiary of DFS Deutsche Flugsicherung GmbH, a German provider of air navigation services, has installed for air traffic control at the airport in Memmingen.

In March 2024, Airservices Australia launched the nation’s first purpose-built digital air control services at Western Sydney International Airport. Western Sydney is Australia’s first airport without a traditional air traffic control tower as Airservices Australia modernizes its air traffic management capabilities with safe and efficient digital technology. Western Sydney International (Nancy-Bird Walton) Airport (WSI) ?will operate as a digitized aerodrome, with more than 20 high-resolution cameras monitoring the airport and immediate airspace and beaming real-time vision to a centralized control room.

In November 2023, France adopted new Laws to limit air control strikes. The Assemblée Nationale's newly passed legislation does not forbid air traffic controllers from going on strike.?It does, however, require individual workers to give their employers at least 48 hours notice if they intend to take part in the walkout, in line with the current regulation for RATP, the public transportation provider in Paris, and SNCF railway employees. Employers can now plan particular strike schedules according to the number of available workers by requiring a 48-hour notice.

China Harbour Engineering Co. Limited constructed an air traffic management system in South Sedan. This project supports air traffic management cooperation between China and African countries and also supports infrastructure connectivity in the Belt and Road Initiative.

Competitive Analysis

The major players operating in the air traffic control market include BAE Systems Inc., (U.S.), Cyrrus Limited (UK), Indra Sistemas S.A. (Japan), Honeywell International Inc., (U.S.), L3Harris Technologies Inc. (U.S.), Raytheon Technologies (U.S.), Saab AB (Sweden), Leonardo S.p.A. (Italy), Thales Group (France), and, Westminister Group Plc. (UK) .These players adopted product launches, collaboration and other strategies to increase their Air Traffic Control Market Share.

The other players in the market include Collins Aerospace (U.S.), Nav Canada (Canada), Thales Group (France), National Air Traffic Services (NATS) (UK), Searidge Technologies (Canada), Serco Group (UK), Sky Soft-ATM (Switzerland), Atech (Brazil), Isavia ANS (Iceland) and Kongsberg Defence & Aerospace? (Norway).

Industry Trends

In April 2024, NAV CANADA and Canadian Aviation Electronics Limited (CAE) signed a strategic agreement to increase training capacity for crucial air traffic services professionals. Under this first-of-its-kind partnership in Canada, CAE instructors will deliver initial training for flight service specialists and air traffic controllers using NAV Canada’s training curriculum and courseware. The first classes will begin in the fall of 2024 at a new purpose-built Air Traffic Services Training Centre on CAE’s campus in Montreal.

In September 2023, Bidden-Harris administration invested $25 billion in airport infrastructure. The safety investment initiatives include surface awareness initiative, runway verification approach, and runway incursion device. All these initiatives are implemented to control the air traffic.

In December 2023, Thales Group, a leader in aerospace, defense, security, and digital identity, established an Air Traffic Management Service Center in Mexico. The center is responsible for monitoring air traffic management projects and supports the expansion of ATM services in Latin America.

On 23rd March 2023, National Air Traffic Services (NATS) fully implemented the West Airspace Deployment project. Encompassing 54, 000 square meters, the airspace above 7, 000 feet over southwest England and Wales was redesigned to facilitate easier, safer, and more effective flight in the future. This once-in-a-generation airspace improvement complements the UK government's Airspace Modernization Strategy and is a key component of the aviation industry's roadmap to provide a more sustainable future for air travel.

Key Sources Referred

NAV Canada

White House

Thales Group

Air Traffic Technology International

Air Services Australia

E Turbo News

Seetao

RTX.Com

Indracompany.com

Ainonline.com

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air traffic control market analysis from 2024 to 2033 to identify the prevailing air traffic control market opportunities.

The market research is offered along with information related to key drivers, restraints, and Air Traffic Control Market Opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the air traffic control market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global air traffic control market trends, key players, market segments, application areas, and market growth strategies and Air Traffic Control Market Forecast.

Air Traffic Control Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.7 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 253 |

| By Airspace |

|

| By Application |

|

| By Offerings |

|

| By Airport Size |

|

| By Sector |

|

| By Region |

|

| Key Market Players | Thales Group (France), Thales Group (France), Indra Sistemas S.A. (Japan), Westminister Group Plc. (UK), Raytheon Technologies (U.S.), Kongsberg Defence & Aerospace?(Norway), BAE Systems Inc. (U.S.), Isavia ANS (Iceland), L3Harris Technologies Inc. (U.S.), Sky Soft-ATM (Switzerland), Nav Canada (Canada), Atech (Brazil), Searidge Technologies (Canada), National air traffic services (NATS) (UK), Collins Aerospace (U.S.), Cyrrus Limited (UK), Serco Group (UK), Saab AB (Sweden), Honeywell International Inc. (U.S.), Leonardo S.p.A. (Italy) |

There is a global push to modernize air traffic control infrastructure to handle increasing air traffic volumes more efficiently and safely. This includes upgrading radar systems, and communication equipment, and implementing more advanced software solutions.

The hardware segment is the leading application of the Air Traffic Control Market. This is because effective communication systems are critical for ensuring safety and efficiency in air traffic management, as they facilitate real-time interactions between pilots and air traffic controllers.

North America is the largest regional market for Air Traffic Control. This is due to the well-established aviation infrastructure, high air traffic density, and significant investments in advanced ATC technologies.

$24.7 billion is the estimated industry size of Air Traffic Control.

BAE Systems Inc., (U.S.), Cyrrus Limited (UK), Indra Sistemas S.A. (Japan), Honeywell International Inc., (U.S.), L3Harris Technologies Inc. (U.S.), Raytheon Technologies (U.S.), Saab AB (Sweden), Leonardo S.p.A. (Italy), Thales Group (France), Westminister Group Plc. (UK), Collins Aerospace (U.S.), Nav Canada (Canada), Thales Group (France), National air traffic services (NATS) (UK), Searidge Technologies (Canada), Serco Group (UK), Sky Soft-ATM (Switzerland), Atech (Brazil), Isavia ANS (Icelan

Loading Table Of Content...