Aircraft Refurbishing Market Summary

The global aircraft refurbishing market size was valued at $456.7 million in 2021, and is projected to reach $932.5 million by 2031, growing at a CAGR of 7.2% from 2022 to 2031. Factors such as rise in operations in the commercial aviation and increase in demand from emerging countries are anticipated to boost the growth of the global aircraft refurbishing market during the forecast period.

Key Market Trends and Insights

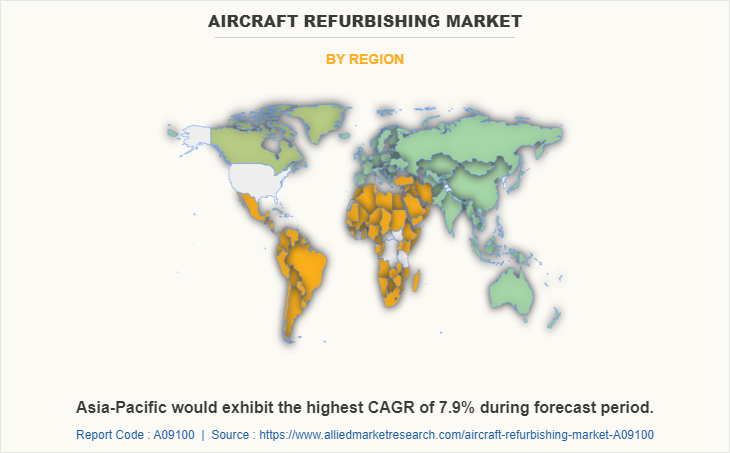

Region wise, Asia-Pacific generated the highest revenue in 2021.

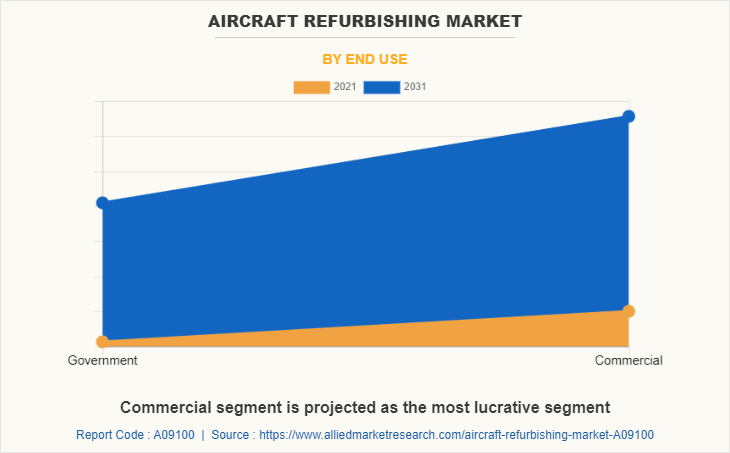

The global aircraft refurbishing market share was dominated by the commercial segment in 2021 and is expected to maintain its dominance in the upcoming years

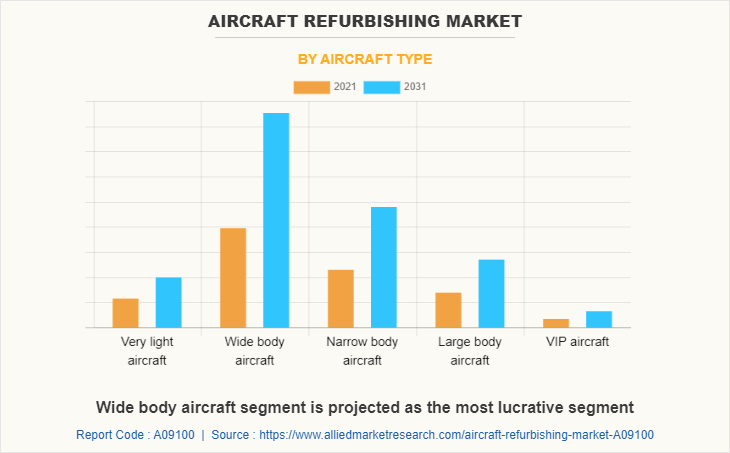

The wide body aircraft segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 456.7 Million

- 2031 Projected Market Size: USD 932.5 Million

- Compound Annual Growth Rate (CAGR) (2022-2031): 7.2%

- Asia-Pacific: Generated the highest revenue in 2021

Market Dynamics

Aircraft refurbishment is the process of replacement and maintenance of the aircraft, which includes inspection, overhaul, replacement, defect rectification, and embodiment modifications. The aircraft refurbishment companies are focused on providing innovative, fuel-saving, more durable, affordable and lighter-weight aircraft. Airline manufacturers are upgrading and refurbishing their existing aircraft fleets in order to integrate fuel efficient components in their aircrafts and provide customers comfort and convenience. For instance, 2021, Virgin Atlantic signed a deal with maintenance company Aeropeople Engineering Services to maintain the interiors of its global fleet of Boeing 787 and Airbus A330/A350 aircraft. The three-year, multi-million-pound contract saw a team of around 80 staff established at Heathrow Airport where, working in partnership with interiors service provider Cabinair, the airline was provided with an end-to-end service for cabin interior maintenance, repair, and refurbishment.

However, surge in production and deliveries of new aircraft and high maintenance cost of refurbished aircrafts are expected to hinder the growth of the global aircraft refurbishing industry during the forecast period. Moreover, rise in air travel activities & air traffic and increasing demand for premium aircraft cabins are expected to create an opportunity for the aircraft refurbishing market in near future.

Rise in operations in the commercial aviation

The commercial aviation industry consists of two segments, passenger aircraft and cargo aircraft. In recent years, both segments have performed well and have witnessed rapid rise in operations, which boosted the growth of the global commercial aircraft industry. With globally rising air passenger traffic, the industry has witnessed significant growth. However, the unprecedented occurrence of COVID-19 pandemic has affected the industry in terms of revenue growth.

Key aviation players around the world are finding ways to make aviation sector safer and reliable. Hence, rapid development has been witnessed in the commercial aircraft industry in the recent years. According to Boeing’s Commercial Market Outlook (CMO) 2020–2039, the 2021 CMO reflects that the global market is recovering rapidly. Surge in demand for domestic air travel is responsible for the recovery of the airliner industry amid the COVID-19 pandemic.

Furthermore, intra-regional markets are expected to open with full capacity, as health and travel restrictions ease, followed by return to pre-pandemic levels by 2023 to 2024 with respect to long-haul travel scenario. It mentions that in long term, market fundamentals and resilience are expected to drive the demand for more than 43,500 airplanes by 2040. Thus, all these factors collectively are expected to fuel the growth of the aircraft refurbishing market forecast.

Increase in demand from emerging countries

The emerging countries such as China, India, and Brazil are anticipated to create new growth opportunities for prominent players operating in the market. For instance, in September 2019, according to the Commercial Aircraft Corporation of China, Ltd., Chinese market was projected to witness a strong demand for commercial aircraft over the next 20 years. In addition, according to its market forecast report (2018-2037), 9,008 passenger aircraft valued at approximately $0.16 trillion (¥9 trillion) are estimated to be delivered. Latin American countries expand the aviation sector amid rise in air traffic. Thus, these developments are expected to foster the demand for aircraft refurbishment systems, which is expected to drive the market growth in Latin America region during the forecast period. The growth in aviation industry is expected to facilitate the demand for aircraft which in turn is propelling the demand for aircraft refurbishment. In addition, surge in MSMEs involvement in aircraft refurbishment and remodeling is expected to fuel the demand for airplanes. Moreover, increased demand for commercial aircraft enforces air fleet operators to adopt refurbished aircrafts in order to meet increased demand. Thus, increase in demand from emerging countries is expected fuel the aircraft refurbishing market demand in near future.

Increase in production and deliveries of new aircraft

Rise in delivery of aircraft as a part of fleet modernization program drive the aircraft refurbishing market. For instance, in January 2022, InterGlobe Aviation Ltd-run IndiGo received delivery of 18 aircrafts in October- December 2022, the highest quarterly number for both 2020 and 2021. Also, aviation companies adopt aggressive production plans to meet the higher output rates. For instance, in May 2021, Aerospace major Airbus SE announced increase in production of popular Airbus A320 planes. The company also planned to increase production of A220 planes to 14 planes per month. Demand for air freight has increased as air cargo transportation is perceived as means of diversification for expanding international trade. Aircraft manufacturers expand conversion lines by turning old passenger planes into freight carriers. For instance, in November 2021, Boeing announced plans of addition of three conversion lines for the market-leading 737-800BCF across North America and Europe. The company also signed a firm order with Icelease (Iceland aircraft lessor and aircraft trading entity) for eleven of the freighters. Boeing is set to increase its conversion lines capacity by 60% by 2022, while Airbus aims to triple its output of converted A321s and A330s by 2024. Accordingly, establishment of airline start-ups in Latin America and the Caribbean in the US (Avelo Airlines, Breeze Airlines), Europe (Norse Atlantic Airways), Middle East (Air Arabia Abu Dhabi and Wizz Air Abu Dhabi) and the Pacific (Bonza Airlines), promote the production of new commercial aircrafts. Thus, it further restrains the aircraft refurbishing market.

Increasing demand for premium aircraft cabins

The shift toward air travel continuously increases owing to conveyance and affordability offered to the consumers. According to the Bureau of Transportation Statistics, the US airlines & foreign airlines in the U.S. carried over 1,052.8 million service passengers in 2019, an increase of 3.9% when compared to 2018. Moreover, tourism has become a popular global leisure activity owing to rise of globalization and technological advances. According to United Nations World Tourism Organization, in 2019, the arrival of 5 billion international tourists was recorded worldwide. The projected 4% year-on-year increase in 2020 confirms significant growth in global tourism. Thus, growth in air travel activities and air traffic demand numerous new airports and require hundreds of efficient aircrafts. The refurbished aircrafts are expected fulfill this increasing demand. Refurbished aircrafts are cost effective than the new aircraft and provide similar benefits. Owing to this, airlines have adopted refurbished aircrafts in order to cut costs and minimize environmental impact. Owing to all these factors, the demand for aircraft refurbishing market is expected to grow significantly during the forecast period.

Segments Overview

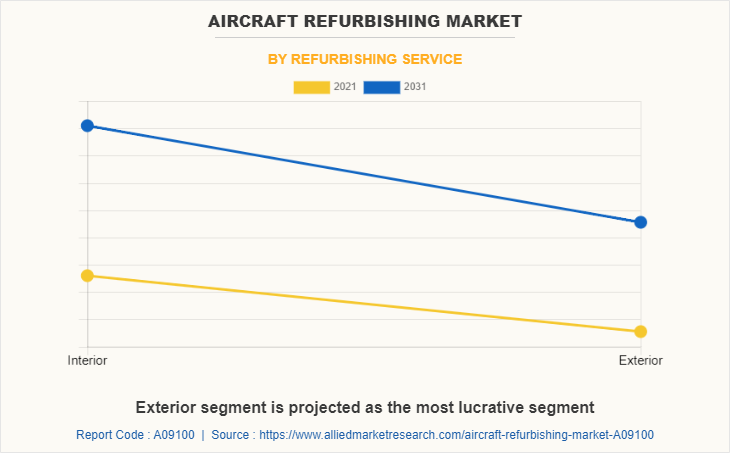

The aircraft refurbishing market is segmented on the basis of refurbishing service, aircraft type, type, end use and region. The refurbishing service segment is further divided as interior and exterior. By aircraft type, the market is classified into very light aircraft, wide body aircraft, narrow body aircraft, large body aircraft, and VIP aircraft. On the basis of type, it is divided into passenger to freighter, commercial aircraft cabin, and VIP cabin refurbishing. By end use, it is bifurcated into line government and commercial. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

The key players that operate in this aircraft refurbishing market are Autotrade Aviation Pvt. Ltd., AFI KLM E&M, Diehl Stiftung & Co. KG, Duncan Aviation Inc., Gulfstream Aerospace Corporation, Hong Kong Aircraft Engineering Company Limited, Jamco America, Inc., Jet Aviation AG, Lufthansa Technik AG, MAC Aero Interiors, Nextant Aerospace, Raytheon Technologies Corporation, Rose Aircraft Services, Inc., Sabreliner Aviation, Safran S.A., and SIA Engineering Company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft refurbishing market analysis from 2021 to 2031 to identify the prevailing aircraft refurbishing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft refurbishing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft refurbishing market trends, key players, market segments, application areas, and aircraft refurbishing market growth strategies.

Aircraft Refurbishing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 932.5 million |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 344 |

| By Refurbishing Service |

|

| By Aircraft Type |

|

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Nextant Aerospace, Zodiac Aerospace, Inc, Gulfstream Aerospace Ltd., Rose Aircraft Services, B/E Aerospace, SIA Engineering Co. Ltd, AFI KLM E&M, Hong Kong Aircraft Engineering Co. Ltd, Raytheon Technologies, Jet Aviation AG, Diehl Shiftung & Co. KG, Safran SA, Sabreliner Aviation LLC, Lufthansa Technik, Timco Aviation Services, Jamco America Inc. |

Analyst Review

The aircraft refurbishing market is expected to witness significant growth due to surge in air traffic along with implementation of safety improvement initiatives, making aircraft more reliable, efficient, and durable. Moreover, with increase in demand for air freight, the demand for refurbished cargo aircrafts has increased significantly. For instance, according to Boeing's World Air Cargo Forecast (2020–2039), the global fleet of freighters is expected to increase by more than 70% over the next 20 years. It also estimates that 2,610 freighters can be delivered by 2039, with around half of those replacing retired aircraft. Nearly two-thirds of these deliveries are anticipated to be conversions from passenger aircraft.

Factors such as rise in operations in the commercial aviation and increase in demand from emerging countries are anticipated to boost the growth of the global aircraft refurbishing market during the forecast period. However, surge in production & deliveries of new aircraft and high maintenance cost of refurbished aircrafts are expected to hinder the growth of the global aircraft refurbishing market during the forecast period. Moreover, rise in air travel activities & air traffic and increasing demand for premium aircraft cabins are expected to create an opportunity for the aircraft refurbishing market in near future.

To fulfil the changing demand scenarios, market participants are concentrating on business expansion to increase their geographic reach and customer base. For instance, in March 2022, Duncan Aviation Inc. announced to build additional hanger space at its existing MRO locations in Battle Creek, Michigan (BTL), and Lincoln, Nebraska (LNK). Moreover, in May 2022, Gulfstream Aerospace Corporation announced to expand completions operations at its St. Louis Downtown Airport facility for increasing production of custom cabinetry and exterior paint capacity for large-cabin aircraft.

In addition, market participants are continuously focusing on product development efforts to match changing end-user requirements and meet new business opportunities. For instance, in April 2020, Lufthansa Technik AG modified the Airbus A330-300 aircraft for cargo transport to transport medical goods to meet the growing demand for airfreight during the coronavirus crisis.

The key players that operate in this market are Autotrade Aviation Pvt. Ltd., AFI KLM E&M, Diehl Stiftung & Co. KG, Duncan Aviation Inc., Gulfstream Aerospace Corporation, Hong Kong Aircraft Engineering Company Limited, Jamco America, Inc., Jet Aviation AG, Lufthansa Technik AG, MAC Aero Interiors, Nextant Aerospace, Raytheon Technologies Corporation, Rose Aircraft Services, Inc., Sabreliner Aviation, Safran S.A., and SIA Engineering Company

The global aircraft refurbishing market was valued at $456.7 million in 2021, and is projected to reach $932.5 million by 2031, registering a CAGR of 7.2%. from 2022 to 2031.

The global aircraft refurbishing market to register a CAGR of 7.2% from 2022 to 2031.

Asia-Pacific is the largest regional market for aircraft refurbishing

Rise in operations in the commercial aviation, Increase in demand from emerging countries, Increase in production and deliveries of new aircraft, Increasing demand for premium aircraft cabins,

The key players that operate in this aircraft refurbishing market are Autotrade Aviation Pvt. Ltd., AFI KLM E&M, Diehl Stiftung & Co. KG, Duncan Aviation Inc., Gulfstream Aerospace Corporation, Hong Kong Aircraft Engineering Company Limited, Jamco America, Inc., Jet Aviation AG, Lufthansa Technik AG, MAC Aero Interiors, Nextant Aerospace, Raytheon Technologies Corporation, Rose Aircraft Services, Inc., Sabreliner Aviation, Safran S.A., and SIA Engineering Company.

Loading Table Of Content...