The global airport automation market was valued at $10.8 billion in 2022, and is projected to reach $19.6 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

Report Key Highlighters

- The airport automation market studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth goals.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The airport automation market share is marginally fragmented, with Honeywell International Inc., Amadeus It Group Sa, Collins Aerospace, Daifuku Co., Ltd., Wipro, NEC Corporation, Siemens, Thales, Vanderlande Industries B.V., and SITA. Major strategies such as contracts, partnerships, product launches, and other strategies of players operating in the market are tracked and monitored.

Airport automation refers to the application of cutting-edge devices and software to optimize and simplify a variety of airport operations. Airport automation aims to lower operating costs, guarantee safety, boost passenger experience, and increase efficiency. Furthermore, passengers may print their boarding tickets and check in independently without help from airline workers due to automated kiosks and self-service check-in stations. Automated technologies such as self-boarding gates and electronic boarding passes can also be used at boarding gates.

Automated baggage handling systems move bags from check-in to the aircraft and vice-a-versa, quickly and effectively with the use of conveyor belts, barcode scanners, and sorting devices. As a result, there is less likelihood of misplaced or handled luggage. In addition, to control aircraft movement on the ground and within the airspace, automation is used in air traffic control towers and centers. This covers the application of sophisticated software for air traffic control, automated communication tools, and radar systems.

The airport automation market size is expanding due to several factors, including rising passenger traffic and the need for efficiency, stricter security regulations and compliance with laws, decreased costs, and improved operational efficiency. However, high initial implementation costs and workforce displacement concerns act as barriers for the growth of the market. Moreover, integration of artificial intelligence (AI) and rise in utilization of data-backed decision-making are expected to create ample opportunities for the growth of the market during the forecast period.

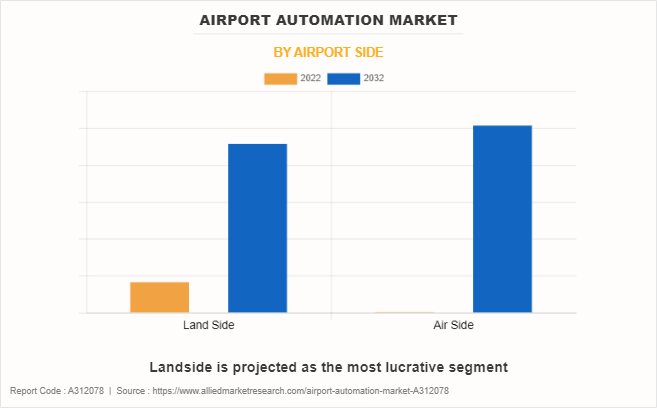

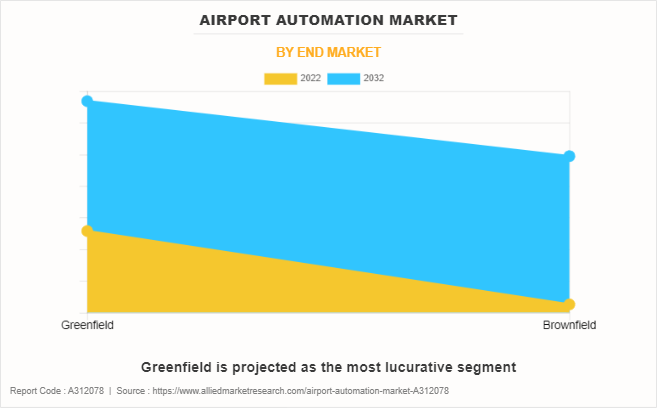

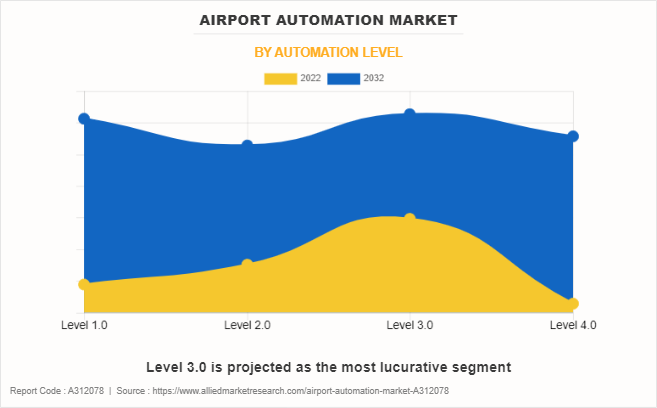

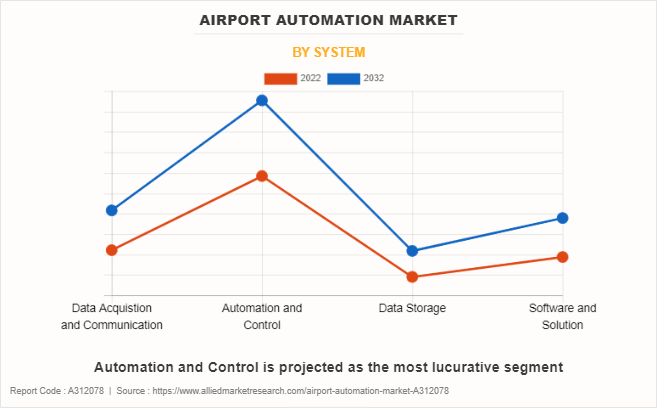

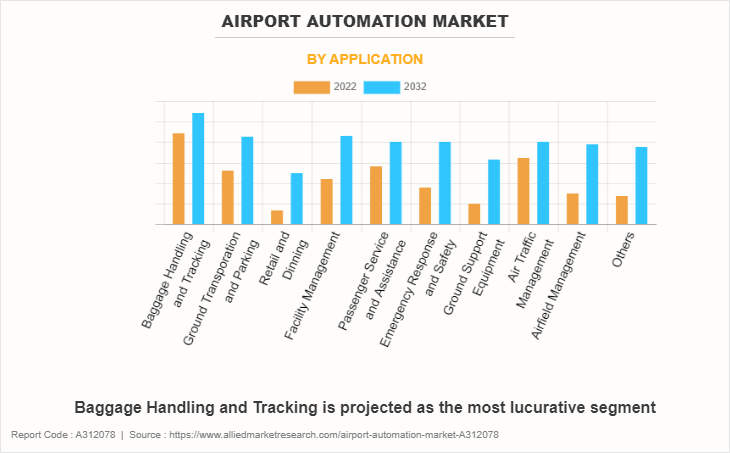

The airport automation market cap is segmented on the basis of system, application, airport side, end market, automation level, and region. By airport side, it is bifurcated into land side and air side. By system, it is divided into data acquisition and communication, automation and control, data storage, and software and solution. By application, the market is classified into baggage handling and tracking, ground transportation and parking, retail and dinning, facility management, passenger service and assistance, emergency response and safety, ground support equipment, air traffic management, airfield management, and others. By end market, it is bifurcated into greenfield and brownfield. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the airprt automation industry report include Amadeus It Group Sa, Collins Aerospace, Daifuku Co., Ltd., Honeywell International Inc., NEC Corporation, Siemens, SITA, Thales, Vanderlande Industries B.V., and Wipro.

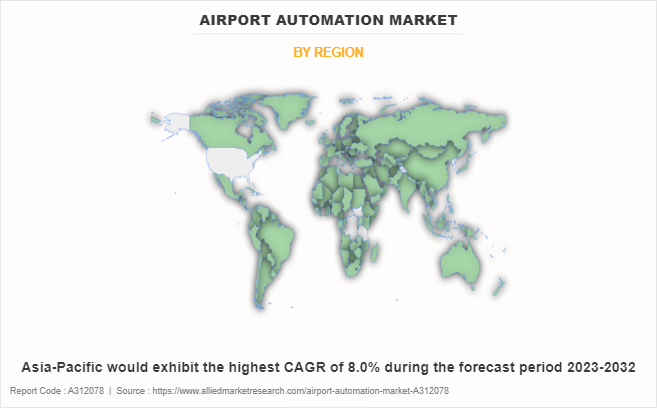

Aisa-Pacific is a major participant in the airport automation market research, owing to rapid economic growth, surge in air passenger traffic, substantial infrastructure development, proactive adoption of technological advancements, government support, and focus on enhancing the overall passenger experience in the region, especially in China. Air travel has increased dramatically in the Asia-Pacific region due to rise in disposable income, urbanization, and expansion of the middle class. Furthermore, the Asia-Pacific region has made significant investments to update and grow their airport infrastructure. Airports used automation to improve capacity and streamline operations as they dealt with the problem of handling more passengers. Modern automation technologies are frequently included in new airport construction projects and the extension of existing facilities to increase overall efficiency.

Therefore, airports have adopted advanced aprons to improve efficiency. For instance, in July 2023, Vanderlande and airport operator, Avinor, formed an innovation partnership to explore ways to fully automate the last mile of the baggage handling process. Furthermore, Vanderlande is expected to supply two innovative solutions, namely, BAGLOAD for integrated robot loading and FLEET Batch for the transportation of ULDs. These solutions will be dropped at Oslo Gardermoen Airport in Norway. The goal of this partnership is to enhance the efficiency and reliability of baggage handling, benefiting the airport industry.

Rise in passenger traffic and demand for efficiency

Airports are witnessing rise in passenger traffic as more individuals choose to travel by air, for both local and international trips. Thus, preventing traffic jams and delays requires effective management of high passenger loads. Furthermore, airport operations are made more efficient by automation technology including baggage handling systems, self-service kiosks, and automated check-in systems. These developments shorten wait times for passengers and improve the overall effectiveness of operations. Moreover, by facilitating quick and easy procedures, automation in airports can improve the traveler's experience. Self-service options provide travelers with more control over their travel experience by letting them handle tasks such as baggage drop and check-in. In addition, airport automation has the potential to reduce expenses for airlines as well as airports. Tasks that would typically need a sizable workforce can be handled by automated technology, which lowers labor costs and boosts overall operational efficiency.

The aviation sector is always adopting new technologies to fulfill the increasing needs of automation for passengers and remain competitive. Modern airport operations heavily rely on automation, which includes robotics, artificial intelligence, and data analytics. Furthermore, the integration of advanced technologies such as biometrics and facial recognition into automation can improve security protocols at airports. Better monitoring and management of security protocols, which guarantee passenger safety, can also be facilitated by automated systems.

Technological improvements lead to a revolution in the global aviation business. Many airports are spending money on automation solutions to keep up with such developments and offer travelers a smooth, technologically advanced travel experience. In addition, improving operational efficiency is a common step in the process of reducing the environmental effect of air travel. Decreased resource waste and carbon footprints are two ways that automation can support more environmentally friendly operations. Therefore, rise in passenger traffic and rise in demand for efficiency increase the demand for airport automation, thus driving airport automation market growth.

Enhanced security requirements and regulatory compliance

Airports globally are always improving their security protocols in response to new and emerging security concerns. Automation technologies are essential for improving the precision and effectiveness of security checks such as biometric identification, facial recognition, and advanced screening systems. Furthermore, Aviation authorities and regulatory agencies impose strict rules and regulations to ensure the security and safety of air travel. Airport operators are required to follow the rules, and automation technologies help them do so by providing dependable and consistent security protocols.

The use of biometric technologies, such as fingerprint and facial recognition, improves the accuracy of identification verification procedures. Accelerating passenger screening reduces waiting periods and traffic while simultaneously enhancing security. In addition, technologies for automated baggage and passenger screening are more effective than manual procedures at identifying possible security risks. Such technologies frequently use X-rays, sophisticated imaging, and other sensor-based systems to spot forbidden goods or questionable activities. Therefore, enhanced security requirements and regulatory compliance are driving the demand for airport automation market trends.

High initial implementation costs

Airport automation implementtion frequently necessitates major infrastructure improvements and modifications. To smoothly incorporate automated systems into current operations, airports might need to make investments in new terminals, machinery, and technology. Furthermore, purchasing advanced automation technology, such self-service kiosks, automated baggage handling systems, and biometric systems, includes significant up-front costs. The financial resources of airport operators may be strained by the acquisition and application of cutting-edge solutions.

Airport automation processes might be difficult to integrate into the operating procedures and infrastructure of an airport. Rise in implementation costs can be caused by the requirement for specialized solutions, software integration, and ensuring that they work with legacy systems. In addition, airport staff frequently need to receive maintenance and operation training to implement new automation technology. Training initiatives add to overall expenses, as it requires more time and resources. Moreover, to ensure that automated systems meet aviation and security regulations, there may be an increased expense. It is frequently necessary to make continuing investments in system updates and security measures to achieve and maintain compliance with industry laws. Therefore, high initial implementation costs hamper the growth of the airport automation industry analysis.

Hostility to change and workforce displacement concerns

Airport stakeholders and employees may be hesitant to accept automation as they are afraid of the future or worry about their job security. Within a company, criticism might originate from frontline employees, middle management, and even certain decision-makers. Furthermore, when automation is used at airports, concerns about job displacement are common. Workers can be concerned that automation technologies such as automated check-in systems and self-service kiosks will supplant traditional jobs and cause the workforce to decrease. Moreover, integrating automation technology will need a different skill set than what the current workforce has. Workers may worry about their job security and employability if they believe they lack the skills needed to adjust to new technologies.

If labor unions that represent airport employees believe automation projects could harm the job security or working conditions of their members, they may oppose them. Finding common ground and negotiating agreements can be difficult, which hinders the seamless implementation of airport automation. Therefore, opposition to change and workforce displacement concerns is hampering the growth of the airport automation market report.

Integration of Artificial Intelligence (AI) and Data Analytics

AI systems are capable of analyzing huge amounts of data to find trends and anomalies that can point to security risks. The proactive detection of threats may be improved by integrating AI with data analytics, biometric recognition, and surveillance technologies to create a more secure airport environment. Furthermore, analytics driven by AI can track how well different airport equipment and systems are working. AI can anticipate when equipment is likely to break by evaluating past data, which enables proactive maintenance and minimizes downtime. Predictive maintenance is a cost-effective and operational optimization technique.

Passenger experience may be optimized and made more personalized with the use of AI. AI-powered chatbots and virtual assistants may answer questions, help with navigation, and provide passengers with real-time information. AI is also capable of analyzing traveler behavior to enhance the effectiveness of airport services and layouts. In addition, to improve line management, AI systems can examine data from immigration, security, and other passenger processing points. This contributes to shorter wait times, better passenger flow, and increased productivity. Therefore, integration of AI and data analytics offers lucrative opportunities for the growth of the airport automation market.

Impact of Russia-Ukraine War on Airport Automation Industry

Geopolitical tensions and conflict between Russia and Ukraine are expected to cause economic uncertainty in the impacted regions. Budgets and plans for implementing automation solutions may be impacted by economic instability, which may also have an impact on the choices made by airports, airlines, and technology suppliers about investments. Furthermore, projects pertaining to the expansion and upgrading of airports, among other infrastructure development initiatives, may be postponed or delayed in areas where there is a conflict between Russia and Ukraine. This may affect how new automation technologies are implemented. Moreover, the airport automation market depends on an international supply chain for a variety of components and technology. Supply chains may be disrupted by the Russia-Ukraine war, delaying the production and delivery of automation equipment.

The Russia-Ukraine war reduced business and tourist traffic to the impacted regions, which may be the outcome of conflict and geopolitical concerns. The urgency and priority of airport automation initiatives may be impacted by decrease in passenger volume. Moreover, airport automation may emphasize security measures in reaction to geopolitical concerns resulting from the Russia-Ukraine war, which could lead to greater investments in technologies linked to surveillance, access control, and threat detection. This may have an indirect effect on how other automation projects are prioritized.

Recent Developments in the Airport automation Industry

- In November 2021, Honeywell expanded the NAVITASTM software suite to enhance airport operations, which will help airport operators and air navigation service providers make more informed and accurate decisions across airside operations, from approach to gate. It enables automation and digitization of air traffic services to help achieve efficient ground movement, improve situational awareness, control and monitoring of airside and Air Traffic Management (ATM) equipment, information management, and integration.

- In November 2023, Sanad announced a partnership with Thales, to expand service into airport security, and digital operation.

- In October 2023, Thales expanded its TopSky-ATC air traffic control automation solution with two new applications. The first application, Controller Pilot Data Link Communications (CPDLC) allows clear and secure dialogue between pilots and controllers. Also, Automatic Dependent Surveillance Contract (ADS-C) automatically transmits aircraft flight status reports to ATM systems on the ground.

- In October 2023, Aurrigo partnered with IAG to provide autonomous solutions for UK airports. The partnership is expected to begin with a four-month evaluation and simulation phase to explore the use of the company’s autonomous vehicles in a controlled environment.

- In July 2021, Bangalore International Airport partnered with IBM for digital and IT transformation. It is expected to provide best-of-breed IT solutions to create a new “Airport in a Box” platform, which will support transforming the end-to-end travel experience for passengers at BLR Airport.

- In April 2023, CGI partnered with Fraport AG to accelerate automation with the help of the digitization of operations at Frankfurt Airport. Its aim is to enhance Frankfurt Airport's customer experience and increase its overall competitiveness through new digital business models and technologies.

KEY BENEFITS FOR STAKEHOLDERS

- This study presents the analytical depiction of the global airport automation market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall airport automation opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global airport automation with a detailed impact analysis.

- The current airport automation is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Airport Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 19.6 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Airport Side |

|

| By End Market |

|

| By Automation Level |

|

| By System |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amadeus IT Group SA, Daifuku Co., Ltd., Honeywell International Inc., Vanderlande Industries B.V., Siemens, Collins Aerospace, Wipro, NEC Corpoaration, SITA, Thales |

Contactless passenger journey, Biometric technology integration, and robotic process automation are the upcoming trends of airport automation market in the world.

Baggage Handling and Tracking is the leading application of airport automation market.

Asia-Pacific is the largest regional market for airport automation..

$9,540.7 million is the estimated industry size of airport automation.

Amadeus It Group Sa, Collins Aerospace, Daifuku Co., Ltd., Honeywell International Inc., NEC Corporation, Siemens, SITA, Thales, Vanderlande Industries B.V., and Wipro. are the top companies to hold the market share in airport automation.

Loading Table Of Content...

Loading Research Methodology...