Alloy Wheels Market Overview

The global alloy wheels market size was valued at USD 17.6 billion in 2021, and is projected to reach USD 31.6 billion by 2031, growing at a CAGR of 6.2% from 2022 to 2031. Rising demand for stylish, lightweight, and high-performance wheels in passenger and luxury vehicles drives the alloy wheel market. Growing automotive production and consumer preference for enhanced aesthetics and fuel efficiency further boost growth.

Key Market Trend & Insights

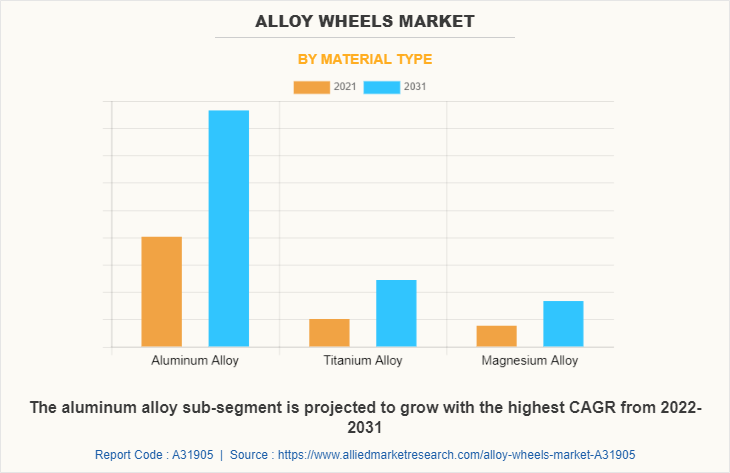

- Material Type: Aluminum alloy segment led the market in 2021 and is expected to maintain dominance through the forecast period.

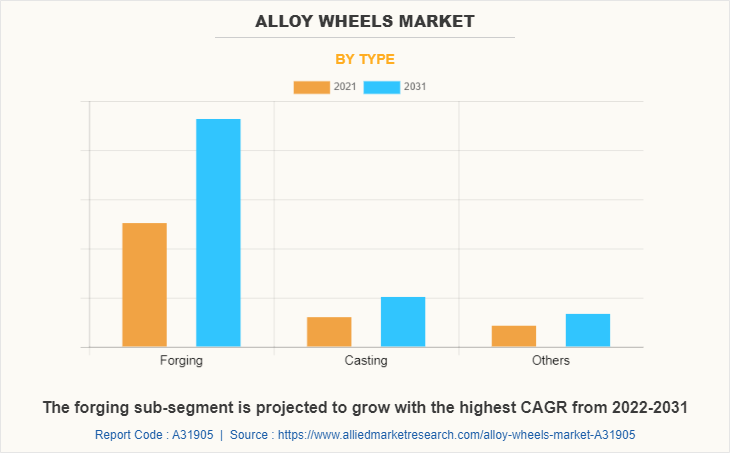

- Type: Forging segment dominated in 2021 and is projected to witness the fastest growth in the coming years.

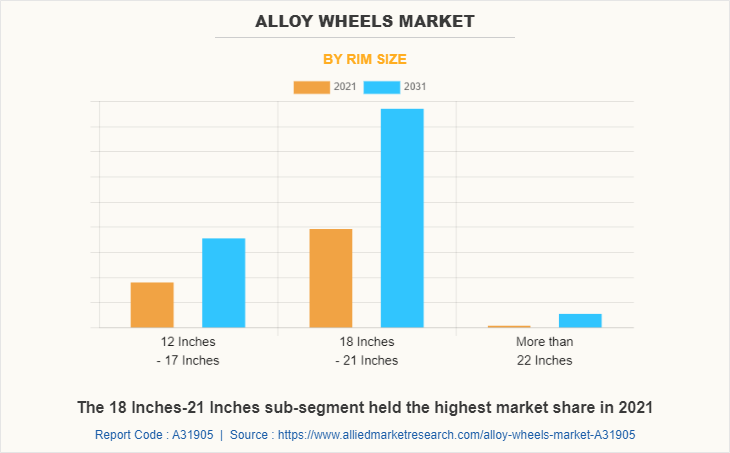

- Rim Size: 18–21 inches segment was the top revenue generator in 2021 and is expected to grow at the fastest pace ahead.

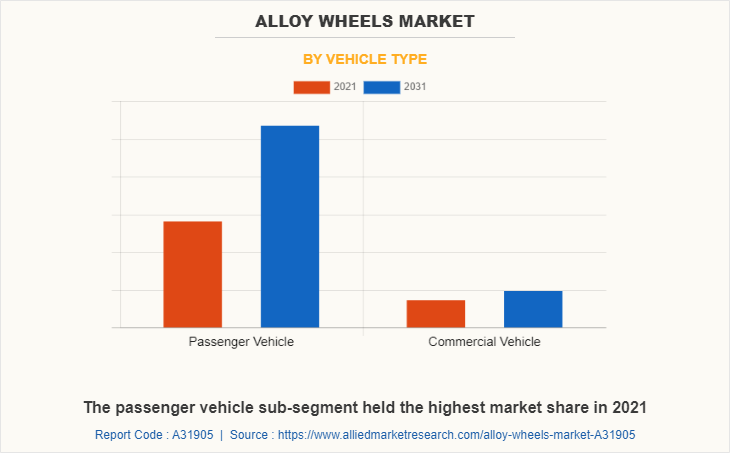

- Vehicle Type: Passenger vehicles held the largest share in 2021 and are set to retain market leadership.

- Region: North America led the market in 2021, while Asia-Pacific is forecast to record the fastest CAGR.

Market Size & Forecast

- 2031 Projected Market Size: USD 31.6 billion

- 2021 Market Size: USD 17.6 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 6.2%

Introduction

Alloy wheels are lightweight wheels made of aluminum alloys that have a high weight-to-strength ratio. These alloy wheels are commonly found in automobiles, sports cars, and other light commercial vehicles. The aluminum wheel has good corrosion resistance, high-speed stability, and less wear at lower working speeds.

Alloy wheels are made of an alloy of aluminum, carbon epoxy, E-glass epoxy, titanium, and magnesium. Due to their lighter weight, alloy wheels are different from standard steel wheels. Lightweight wheels, such as alloy wheels, can significantly improve a car's control. The rising need for lightweight, fuel-efficient cars, the inclination of consumers for fashionable, customized cars, and the expansion of the automotive sector are some of the majors factors attributed to the significant growth of the global alloy wheels market.

Due to their high price, alloy wheels may not be the best choice for buyers on a tight budget who value affordability more than style and functionality. Furthermore, people wishing to enhance their vehicle may find the expense of alloy wheels to be prohibitive.

Car lovers favor alloy wheels since they not only improve the vehicle's appearance but also offer better performance, greater fuel economy, and lighter weight. Additionally, there is a considerable need for alloy wheels in emerging economies like China, India, and Brazil due to the expansion of the automotive sector in these countries. Additionally, the popularity of customizing automobiles has increased demand for alloy wheels.

Which are the Top Automotive Alloy Wheel companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive alloy wheel industry.

- Steel Strips Wheels Limited

- Status Wheel

- RONAL GROUP

- CMWheels

- MHT Luxury Wheels

- Enkei International, Inc.

- BORBET GmbH

- Maxion Wheels

- UNIWHEELS Group

- Superior Industries

Market Segmentation

The alloy wheels market is segmented on the basis of material type, type, rim size, vehicle type, and region. By material type, the market is divided into aluminum alloy, titanium alloy, and magnesium alloy. As per type, the market has been categorized into forging, casting, and others. According to rim size, the market is classified into 12 Inches - 17 Inches, 18 Inches - 21 Inches, and More than 22 Inches. Depending on vehicle type, the market is divided into passenger vehicle and commercial vehicle. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The 18 inches -21 inches sub-segment dominated the global market in 2021 and is anticipated to continue its dominance over the forecast period. The 18 inches - 21 inches low-profile tires provides best experience to the drivers in handling the curves. This is because running around bends requires tighter steering that is more reliable due to the tire's lower flexibility and stickier tire compound. The sidewall of 18- to 21-inch tires is often thinner, which keeps a lot more stiffness on the road. Some vehicles' drivers may notice a minor improvement in cornering handling thanks to the enhanced rigidity. During the analysis timeframe, these factors are projected to accelerate the expansion of the 18 inches–21 inches sub-segment.

By vehicle type, the passenger vehicles sub-segment dominated the market in 2021 and is anticipated to continue its dominance over the forecast period. The growth is majorly attributed to the rapid growth in the sales of the passenger vehicle in the recent years.

By material type, the aluminum alloy sub-segment held the highest market share in 2021 and is anticipated to continue its dominance over the forecast period. Aluminum alloy wheel is the lightest alloy wheel among the types of alloy wheels. Aluminum alloy wheel weighs almost 20% lesser than the other alloy wheels which makes it more preferable for the customers and this is the main factor for the growth of the aluminum alloy wheels.

By type, the forging sub-segment dominated the global alloy wheels market share in 2021. These wheels are stronger, longer-lasting, and corrosion- and oxidation-resistant thanks to the forging process. In addition, the wheel's structural integrity is preserved. The performance and fuel economy of a vehicle are both improved with forged wheels. The ideal option when aluminum components need to exhibit maximum strength and performance while being lightweight is forged aluminum since it is strong. Forging improves chemical consistency and increases structural strength by reducing internal gaps and gas pockets that degrade metal components.

By region, North America dominated the global alloy wheels market in 2021. The Asia-Pacific alloy wheels market is rapidly growing during the projected period and is anticipated to lead the automobile wheel market. China and India are primarily responsible for this expansion. Due to the largest population density in the world, with two densely populated countries, China and India, the region will have the biggest worldwide demand for automobiles during the projected period, accounting for nearly 60% of the world's vehicles. People's income levels are rising extremely quickly in this region as well. The Asia-Pacific region has the maximum population of middle-class residents who are concerned about automobile fuel efficiency. The fuel economy is anticipated to increase as the vehicle's overall weight decreases.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alloy wheels market analysis from 2021 to 2031 to identify the prevailing alloy wheels market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alloy wheels market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alloy wheels market trends, key players, market segments, application areas, and market growth strategies.

Alloy Wheels Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 31.6 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Type |

|

| By Rim Size |

|

| By Vehicle Type |

|

| By Material Type |

|

| By Region |

|

| Key Market Players | Enkei Corporation, Steel Strips Wheels Ltd (SSWL), RONAL GROUP, BORBET GmbH, MAXION Wheels, Stamford Sport Wheels, MHT Luxury Wheels, CITIC Dicastal Wheel Manufacturing Co, Fuel Off-Road Wheels, Superior Industries International, Inc., TSW Alloy Wheels |

Analyst Review

An increase in demand for alloy wheels has various reasons but the key factor for the rapid growth in the adoption of alloy wheels is the light weight of the wheels. The light weight of the wheels plays a major role in the overall performance of the vehicle as these wheels helps in increasing the fuel economy of the vehicle. Additionally, these wheels are much stronger as compared to the steels wheels. These factors are anticipated to drive the alloy wheels market in the forecast period. The high cost incurred with the procurement of the alloy wheels is the key factor that is anticipated to hamper the market growth over the projected timeframe. Additionally, alloy wheels are much costlier to buy, manufacture, and repair. The demand for lightweight alloy wheels is expected to further augment due to the growing popularity of green vehicles and the increasing trend toward lowering carbon emissions. This, in turn, offers lucrative opportunities to alloy wheels market players to produce eco-friendly alloy wheels and meet the rising demand.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by 2031, followed by Europe, North America, and LAMEA. R&D initiatives for the integration of AI are the key factors responsible for the leading position of Asia-Pacific and Europe in the global alloy wheels market.

Growing demand for fuel-efficient vehicles and weight reduction to drive the market growth.

The major growth strategies adopted by the alloy wheels market players are investments and manufacturing.

Asia-Pacific will provide more business opportunities for the global alloy wheels market in the future.

Steel Strips Wheels Limited, Status Wheel, RONAL GROUP, CMWheels, MHT Luxury Wheels, Enkei International, Inc., BORBET GmbH, Maxion Wheels, UNIWHEELS Group, and Superior Industries are the major players in the alloy wheels market.

The car manufacturers as well as wheel manufacturers are the major customers in the global alloy wheels market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global alloy wheels market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...