Ambulatory Polysomnography Systems Market Research, 2031

The global ambulatory polysomnography systems market size was valued at $327 million in 2021, and is projected to reach $570.7 million by 2031, growing at a CAGR of 6% from 2022 to 2031. Polysomnography systems are used in sleep laboratories to record and analyze sleep studies that are set up and supervised by sleep medicine professionals. PSG equipment can be compared based on factors such as reporting, lab management software specifications, amplifier specs, video choices, and more.

The market for ambulatory polysomnography systems is expanding in direct proportion to the increased incidence of sleep disorders. The market for ambulatory polysomnography equipment has plenty of attractive potential to expand due to the rising frequency of various sleep disorders. According to a 2021 study by The Millennial Sleep Lab, the number of Americans who reported having insomnia increased from 6 per 10,000 in 2005 to 272 per 10,000 in 2019.

The majority of the populace, particularly in rural areas, is unaware of the dangerous implications of sleep apnea. Untreated sleep disturbances can lead to chronic illnesses such as heart failure, stroke, high blood pressure, diabetes, and obesity. This can lead to serious health problems like uncontrolled blood pressure, heart attacks, weakened and narrowed blood arteries in the kidneys, and aneurysms. A major portion of the population's lack of awareness regarding sleeping problems is anticipated to hamper the expansion of the ambulance Psg systems market in the near future.

The industry players are investing a lot of effort on the research and development of smart and unique strategies to sustain their growth in the market. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. For instance, in August 2020, SOMNOmedics GmbH acquired FDA approval to use SOMNOscreen HD, SOMNOscreen Plus, and SOMNOscreen Eco in children as young as two years old.

The key players profiled in this report include Koninklijke Philips N.V., Natus Medical Incorporated, Nihon Kohden Corporation, Nox Medical, Löwenstein Medical Technology GmbH + Co. KG., neurosoft, Cadwell Industries Inc., SOMNOmedics GmbH, Compumedics Limited, and Neurovirtual / Sleepvirtual.

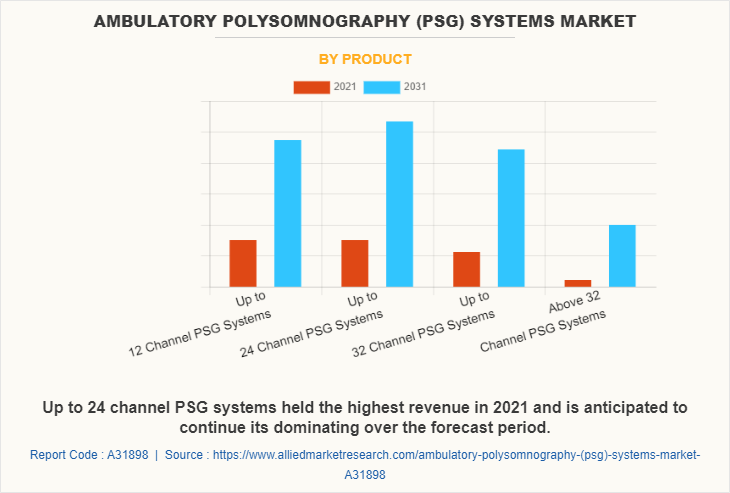

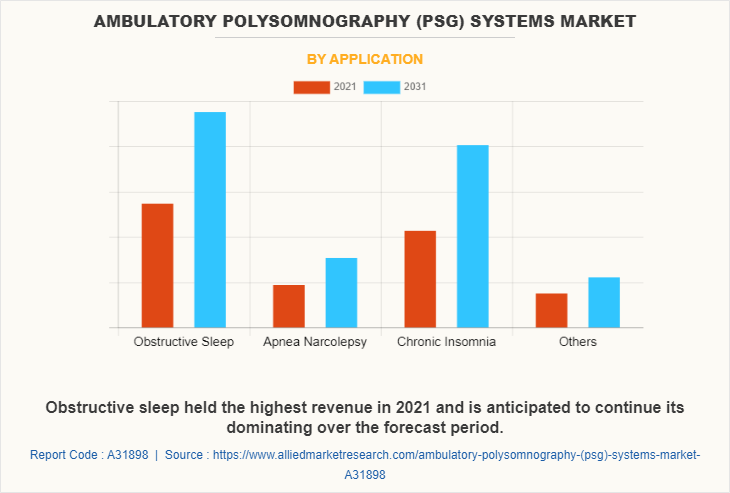

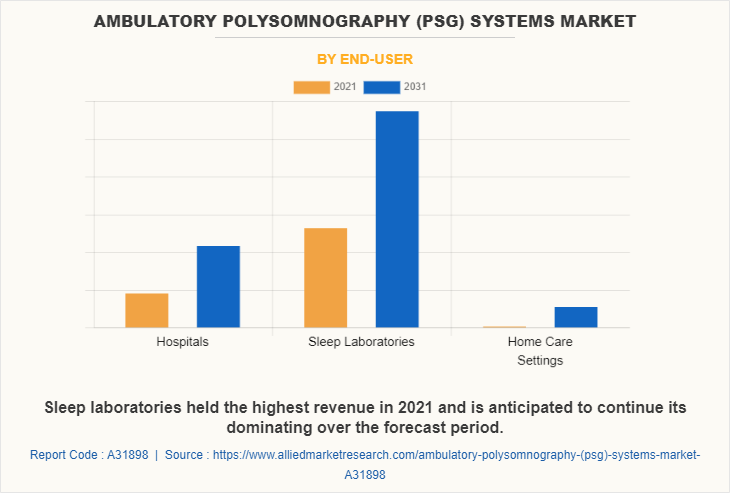

The global ambulatory polysomnography systems market is segmented on the basis of product, application and end user, and region. By product, the market is sub-segmented into Up to 12 channel PSG systems, up to 24 channel PSG systems, up to 32 channel PSG systems, and above 32 channel PSG systems. By application the market sub segment into obstructive sleep apnea, narcolepsy, chronic insomnia, and others. By end-user, the market is classified into hospitals, sleep laboratories, and home care settings. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The ambulatory polysomnography systems market is segmented into Product, Application and End-user.

By product, the up to 24 channel PSG systems sub-segment dominated the ambulatory polysomnography systems market size in 2021. Polysomnography systems are used in sleep laboratories to record and analyze sleep studies that are set up and supervised by sleep medicine professionals. PSG equipment can be compared based on factors such as reporting, lab management software specifications, amplifier specs, video choices, and more. The number of goods available in the range of up to 24 channel PSG systems is greater than the other 24 product categories, and hence this sector dominates the ambulatory polysomnography systems market Forecast period.

By application, the obstructive sleep apnea sub-segment dominated the global ambulatory polysomnography systems market share in 2021. Obstructive sleep apnea (OSA) is a problem in breathing during sleep. This occurs because of narrowed or blocked airways. The primary factors driving market growth include the high incidence of obstructive sleep apnea, increased occurrences of comorbidities linked with sleep apnea, and a growing elderly population prone to respiratory ailments. Furthermore, the rising prevalence of comorbidities associated with sleep apnea is boosting the use of diagnostic instruments. OSA has also imposed an economic burden on society as a result of the presence of a huge pool of undiagnosed patients, resulting in high collateral losses and public and private expenditure on management.

By end user, the sleep laboratories sub-segment dominated the global ambulatory polysomnography systems market share in 2021. Sleep studies generally take place in a sleep lab during normal sleeping hours. The goal is to record brain and body activity that happens during sleep so that sleep disorders can be diagnosed and treated. The growing number of sleep clinics and laboratories in the field of sleep medicine is a prominent contributor, and sleep laboratories are expected to account for more than half of the end-user sector in the projection period as well.

By region, North America dominated the global ambulance Psg systems market in 2021 and is projected to remain the fastest-growing sub-segment during the forecast period. Rising sleep disorder incidences, an increasing patient pool suffering from cardiovascular diseases, diabetes, and COPD, as well as technologically advanced healthcare facilities and better reimbursement facilities for such health conditions in the region, are some of the key factors driving market growth. According to the American Sleep Association, 50-70 million persons in the United States will have sleep apnea by 2021. Because the prevalence of sleep-related problems is relatively high in the United States, the need for diagnosis is also fairly high. Because ambulatory polysomnography devices provide patients with the most comfort and convenience, sales of PSG systems in the United States are strong and expected to rise in the future.

Impact of COVID-19 on the Global Ambulatory Polysomnography Systems Industry

- COVID-19 began in the Chinese city of Wuhan, Hubei province. The virus that causes the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) was spread among humans. Supply chains were interrupted as a result of international trade restrictions on pharmaceutical components and products.

- Additionally, COVID 19 is an infectious illness that causes flu-like symptoms like fever, coughing, and breathing difficulties. The COVID-19 pandemic has had a significant influence on the most important sectors of the ambulatory polysomnography systems industry by interfering with clinical studies and the patient medicine supply.

- The country prohibited trade with foreign countries and imposed travel restrictions, resulting in a drop in diagnostics and surgical procedures in the first half of 2020. Based on a 12-week period of peak interruption to hospital services caused by COVID-19, approximately 28.4 million elective surgeries were cancelled or postponed in May 2020, according to a study published in the British Journal of Surgery. There has been a considerable decrease in hospital and sleep laboratory-based sleep apnea diagnosis, impacting the ambulatory polysomnography systems market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ambulatory polysomnography systems market analysis from 2021 to 2031 to identify the prevailing ambulatory polysomnography systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ambulatory polysomnography systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ambulatory polysomnography systems market trends, key players, market segments, application areas, and market growth strategies.

Ambulatory Polysomnography (Psg) Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 570.7 million |

| Growth Rate | CAGR of 6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Product |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Compumedics Limited, Nox Medical, Koninklijke Philips N.V., Nihon Kohden Corporation, SOMNOmedics GmbH, neurosoft, Natus Medical Incorporated, Cadwell Industries Inc., Compumedics Limited, Löwenstein Medical Technology GmbH + Co. KG. |

Analyst Review

The growth of the global ambulatory polysomnography systems market is driven by significant increase in the incidence of sedentary lifestyle disorders, including obesity, diabetes, and hypertension, working in shifts & stressful working environments that cause sleep apnea, and various technological advancements in sleep apnea diagnostics devices.

Furthermore, the high cost of diagnosing sleep apnea is anticipated to hamper market expansion. For example, OSA is primarily diagnosed with a polysomnography device in an overnight sleep clinic, which normally costs between USD 1,000 and USD 3,000. Additional data interpretation fees are sometimes involved with these tests. It raises the patient's expense burden, which is expected to be an impediment to market expansion.

Aside from this, the market for ambulatory polysomnography equipment has a lot of room to develop because of the vast number of people with undiagnosed sleep apnea. In the United States, sleep apnea is a fairly common illness that frequently goes undetected, according to one of the research articles released by the National Centre for Biotechnology Information. The benefits this system offers over in-lab polysomnography systems are projected to propel the market for ambulatory polysomnography systems.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, North America, and LAMEA. The availability of advance therapeutics, higher spreading of awareness, and heavy expenditure by the government on healthcare are the key factors responsible for leading position of North America and Asia-Pacific in the global ambulatory polysomnography systems market.

With the rising application of artificial intelligence in PSG systems, the market is expected to have a confident outlook. Ambulatory PSG sleep studies are becoming a useful diagnostic tool for sleep disorders. Ambulatory PSG facilitates the performance of an overnight polysomnography examination that addresses the patient's comfort in his or her home. It gathers each and every piece of information required for a complete sleep diagnostic investigation. By transferring sleep studies from the laboratory to the house, these devices give sleep clinics the flexibility of wireless and portable PSG systems, allowing them to treat more patients. These factors are estimated to generate excellent opportunities in the ambulatory polysomnography (PSG) systems market.

The major growth strategies adopted by ambulatory polysomnography (PSG) systems market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global ambulatory polysomnography (PSG) systems market in future.

Koninklijke Philips N.V., Natus Medical Incorporated, Nihon Kohden Corporation, Nox Medical, Löwenstein Medical Technology GmbH + Co. KG., neurosoft, Cadwell Industries Inc., SOMNOmedics GmbH, Compumedics Limited, and Neurovirtual / Sleepvirtual and the major players in the ambulatory polysomnography (PSG) systems market.

Sleep Laboratories sub-segment of the end-use industry acquired the maximum share of the global ambulatory polysomnography (PSG) systems market in 2021.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global ambulatory polysomnography (PSG) systems market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...