Ammonia Market Overview:

The global ammonia market was valued at $53.2 billion in 2023, and is projected to reach $87.7 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

Key Market Insights

- By Type: The market is bifurcated into aqueous and anhydrous.

- By Product Type: The market is segregated into green ammonia, blue ammonia, grey ammonia, and brown ammonia.

- By End Use: The market is divided into fertilizer, chemical, refrigeration, fibers, plastics, pharmaceuticals, paper & pulp, and others.

- By Region: The market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Size & Forecast

- 2033 Projected Market Size: USD 87.7 Million

- 2024 Market Size: USD 53.2 Million

- Compound Annual Growth Rate (CAGR) (2024-2033): 5.1%

How to Describe Ammonia

Ammonia is a compound composed of nitrogen and hydrogen (NH3) , known for its pungent odor and crucial role in agriculture, industry, and household products. Different types of ammonia include anhydrous ammonia, aqueous ammonia, and ammonia gas. Production methods typically involve Haber-Bosch process, combining nitrogen and hydrogen under high pressure and temperature. Applications span agriculture, plastic and textile manufacturing, cleaning agents, refrigerants, and as a precursor in pharmaceuticals. Ammonia's versatility and wide use shows its significance in global production and consumption across diverse sectors.

Key Takeaways

- The ammonia market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

How are Market Dynamics Shaping Industry Competition

The increase in demand for fertilizers is a primary driver in the ammonia market. Fertilizers are essential for enhancing agricultural productivity to meet the rising global food demand driven by population growth and changing dietary habits. With a growing global population, which is expected to increase by 25% from 2020 to 2050, the need for higher agricultural yields is imperative. Economic development and urbanization further amplify this demand as they shift agricultural practices from small-scale subsistence farming to larger, industrialized farming systems that rely heavily on fertilizers. In addition, wealthier populations tend to consume more meat and dairy products, which require more crop production and, consequently, more fertilizers. These factors contribute to a steady increase in global nitrogen fertilizer demand, projected to grow by 40% by 2050 in the Stated Policies Scenario. Moreover, the adoption of bioenergy crops, which often necessitate substantial fertilizer inputs, adds to this demand. Thus, the growing necessity for fertilizers to support food production and other agricultural needs is a significant driver of ammonia market dynamics.

Sustainability initiatives also drive the ammonia market growth. These initiatives aim to reduce the environmental impact of ammonia production and use, thereby promoting cleaner and more efficient processes. For instance, the EU Nitrogen Expert Panel and the 4R Nutrient Stewardship Initiative are focused on improving nitrogen use efficiency in agriculture. These programs encourage best practices in fertilizer application, aiming to optimize the amount, source, timing, and placement of nitrogen fertilizers. This not only enhances crop yields but also minimizes environmental damage such as waterway pollution and greenhouse gas emissions. In addition, the push for green ammonia production using renewable energy sources like wind and solar instead of fossil fuels aligns with global decarbonization goals. These sustainability efforts are increasingly supported by government policies and financial incentives, making them a significant market driver. The move towards sustainable practices in ammonia production and utilization reflects a broader trend of integrating environmental considerations into industrial processes, thus shaping the future dynamics of the ammonia market forecast.

Despite the robust growth drivers, the ammonia market faces several restraints. Market competition and fluctuations in raw material prices significantly impact production costs and market prices for ammonia. The major ammonia market share holders faces intense competition from both established producers and emerging technologies, which lead to price volatility. This competition affects the ability of ammonia producers to maintain stable prices and profit margins. Furthermore, the cost of raw materials, such as natural gas, is a major factor in ammonia production. Natural gas prices are highly variable, influenced by geopolitical events, supply disruptions, and changes in demand. When natural gas prices rise, the cost of ammonia production increases, which reduce profit margins or force producers to raise prices, potentially leading to reduced demand.

Moreover, the emergence of new technologies and production methods adds to the competitive pressure. For example, electrolysis and methane pyrolysis are being explored as alternative methods for ammonia production, which could disrupt the market dynamics if they become more cost-effective and widely adopted. This uncertainty in technology adoption and market acceptance create additional challenges for producers in planning and investment decisions. Overall, market competition and raw material price fluctuations are critical factors that influence the economic viability and stability of the ammonia industry??.

The shift towards sustainable agriculture represents a pivotal opportunity for the growth of ammonia market size. There is a growing push for agricultural practices that minimize ecological impact as global awareness of environmental issues intensifies. Ammonia plays a crucial role in sustainable agriculture through its use in the production of green fertilizers, which are essential for reducing the carbon footprint of farming activities. The development of near-zero-emission ammonia production technologies aligns with the broader goals of sustainability, offering a cleaner alternative to traditional methods. These technologies, although initially more expensive, are expected to benefit from economies of scale and technological advancements over time. Moreover, the increasing implementation of certification schemes and sustainability assessments, such as the Farm Sustainability Assessment and GLOBALG.A.P., incentivizes farmers to adopt greener fertilizers. This creates a market niche for premium, environmentally friendly agricultural products, allowing producers to command higher prices. As corporate sustainability commitments grow, major food producers and retailers are likely to drive demand for sustainably produced fertilizers, further integrating sustainable practices into the agricultural supply chain and presenting a lucrative opportunity for ammonia manufacturers??.

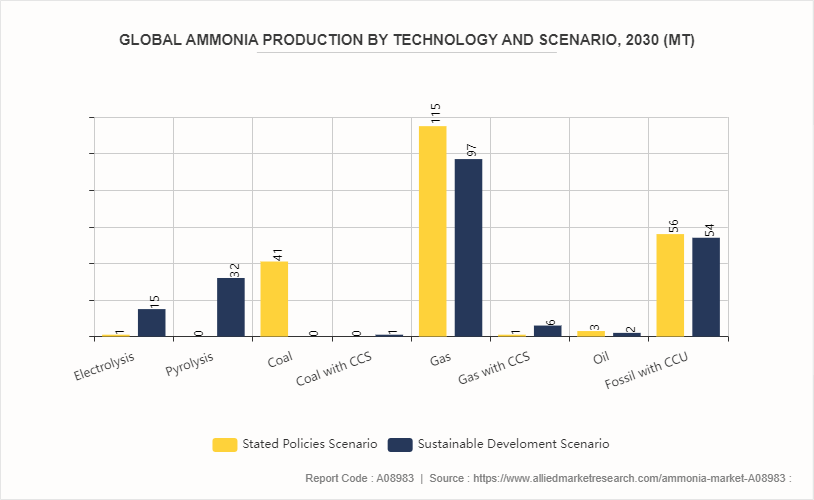

By 2030, varying technology pathways and scenarios are expected to influence global ammonia production. Ammonia production is expected to grow in the SDS and NZE scenario, with a significant shift towards low-carbon technologies. The electrolysis route, which produces ammonia from electrolytic hydrogen, is expected to become increasingly prominent in regions with access to low-cost renewable electricity and higher natural gas prices. Electrolysis production technology, CCS, and methane pyrolysis are expected to play key roles in reducing emissions? in the ammonia industry?. The production landscape is expected to also reflect regional dynamics. For instance, Asia Pacific largest ammonia-producing region, is expected to maintain its dominance, although its share is expected to decrease slightly. In contrast, production in regions like the Middle East, Central and South America, and Africa is expected to have stronger growth??. The deployment of CO2 capture technologies and the shift to hydrogen-based routes is expected to play a pivotal role in these regions, supported by declining costs of electrolyzers and pyrolysis technologies??. These advancements are expected to align with global efforts to meet emissions reduction targets by 2050, with ammonia production contributing significantly to this goal??.

Ammonia Market Segment Review:

The ammonia market is segmented into type, production type, end-use, and region. On the basis of type, the market is bifurcated into aqueous and anhydrous. On the basis of production type, the market is segregated into green ammonia, blue ammonia, grey ammonia, and brown ammonia. On the basis of end-use, the market is divided into fertilizer, chemical, refrigeration, fibers, plastics, pharmaceuticals, paper & pulp, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Leading Companies in Ammonia

Key market players in the ammonia market include CF Industries, Nutrien, Jinmei Group, Yihua Group, Qatar Fertilizer Co (QAFCO) , PetroChina Group, TogliattiAzot, EuroChem Group, Acron Group, Yangmei Group, Parsian Oil and Gas Development Group Co., and Indian Farmers Fertiliser Co-operative Limited (IFFCO) .

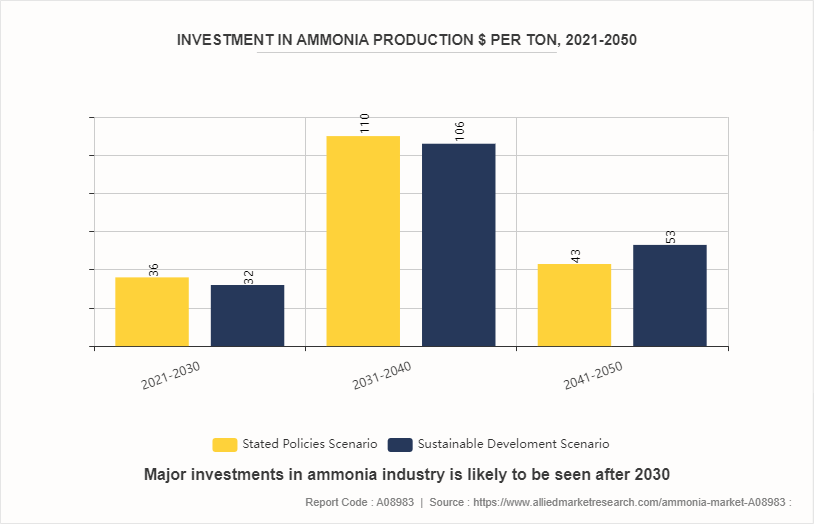

From 2021 to 2050, the ammonia industry is expected to require substantial investments to transition to more sustainable technologies. Under the Sustainable Development Scenario (SDS) , annual capital investments in process technologies for ammonia production is expected to average $14 billion. This figure rises slightly to $15 billion annually in the Net Zero Emissions by 2050 Scenario (NZE) ??. Both scenarios necessitate significantly redirecting funds from conventional technologies to near-zero-emission technologies. The cumulative investment for process equipment is estimated at around $400 billion in the SDS, with 30% allocated to hydrogen-based routes, including electrolyzers and synthesis units, and 50% to carbon capture and storage (CCS) routes, which include CO2 capture equipment and equipped steam methane reforming (SMR) units??. The nature of these investments differs greatly from those in the Stated Policies Scenario (STEPS) , which focuses more on mature technologies. Consequently, government support is expected to be crucial to mitigate the higher risks associated with investing in new technologies??.

Industry Trends

- Urea remains the dominant nitrogen-based product, constituting 60% of nitrogen applied to soils via fertilizers. Ammonia continues to be crucial across various industrial (non-fertilizer) applications including explosives, plastics, textiles, and pharmaceuticals.

- Global nitrogen demand increased by an average of 1.7% per year from 2010 to 2020, reaching 152 million tons (Mt) in 2020. Under the Stated Policies Scenario, demand for nitrogen is projected to increase by almost 40% by 2050, reaching 208 Mt. Total demand is expected to grow at a rate of 1.0% per year, with slower growth attributed to non-fertilizer applications.

- Fertilizer demand increased at an average rate of 0.9% per year since 2010 and continues at a similar pace. Increasing food, feed, and fiber demand in developing economies is a key driver.

- Non-fertilizer uses of nitrogen products grew at a faster rate of 4% per year from 2010 to 2020. Growth in this segment is expected to slow to 1.3% per year, influenced by shifts in industrial and manufacturing practices, particularly in China.

- China's economic transition towards higher-value manufacturing and consumption-led growth is impacting global nitrogen demand dynamics, contributing to slower growth in non-fertilizer applications.

Sources Referred

- IEA

- Ourworldindata

- Gasworld

- AICHE

What are the Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ammonia market analysis from 2024 to 2033 to identify the prevailing ammonia market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ammonia market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ammonia market trends, key players, market segments, application areas, and market growth strategies.

Ammonia Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 87.7 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 325 |

| By Type |

|

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Nutrien Ltd., TogliattiAzot, Hubei Yihua Group, Acron Group Limited, PetroChina Group, Qatar Fertilizer Company, CF Industries Holdings, Inc., EuroChem Group, Yangmei Group, Jinmei Group |

$53.2 Billion is the estimated industry size of Ammonia in 2023.

Green ammonia, hydrogen-based ammonia production, ammonia as a hydrogen carrier, sustainable ammonia production technologies are the upcoming trends of Ammonia Market in the globe

Fertilizer is the leading end-use of Ammonia Market.

Asia-Pacific is the largest regional market for Ammonia.

CF Industries, Nutrien, Jinmei Group, Yihua Group, and Qatar Fertilizer Company are the top companies to hold the market share in Ammonia.

Loading Table Of Content...