Anchoring And Fixing Market Research, 2032

The global anchoring and fixing market was valued at $10.8 billion in 2022, and is projected to reach $18 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032. Anchoring refers to the act of securing or fastening something in place. It often involves using a device or structure to provide stability and prevent movement. In the context of cognitive psychology and behavioral economics, anchoring refers to a mental bias where individuals rely too heavily on the first piece of information they receive (the "anchor") when making decisions. Subsequent judgments are then based on this initial reference point, even if it is irrelevant or arbitrary. Fixing generally means the act of making something stable, secure, or immobile. It can involve repairing or restoring something to a proper or functional condition.

The anchoring and fixing market is closely tied to the construction and infrastructure sectors. As these industries experience growth, there is an increased demand for products that can securely anchor and fix various components of structures, such as buildings, bridges, and roads. Rapid urbanization is leading to the development of new cities and the expansion of existing urban areas. This trend fuels the demand for construction projects, boosting the need for anchoring and fixing products to ensure the stability and safety of structures. Moreover, the construction industry, including residential, commercial, and industrial construction, has a direct impact on the demand for anchoring and fixing solutions. As construction activities increase, so does the requirement for reliable and durable anchoring products. The enforcement of strict building codes and safety standards by regulatory authorities drives the adoption of high-quality anchoring and fixing market growth of products. Compliance with these standards is crucial for ensuring the structural integrity and safety of buildings and infrastructure. With a growing emphasis on safety and durability in construction, there is a heightened demand for anchoring and fixing solutions that can withstand various environmental conditions and loads. Products that offer long-term reliability and reduced maintenance requirements are particularly sought after.

Implementing anchoring or fixing measures often involves regulatory actions. The use of materials and substances in anchoring and fixing methods can have environmental implications. Regulatory compliance may require the use of environmentally friendly or low-impact materials and proper waste disposal practices. Adherence to environmental regulations can add complexity to projects and limit the choice of materials and methods. Meeting these requirements may involve careful consideration and selection of materials to minimize environmental impact. Safety is a primary concern in industries involving anchoring and fixing market overview, leading to strict safety standards set by regulatory bodies. Compliance with safety regulations may necessitate additional safety measures and equipment, increasing project costs and complexity. Building codes and standards are crucial for ensuring the structural integrity and safety of buildings and infrastructure.

The advancements in materials science can lead to the development of stronger and more durable anchoring and fixing solutions. This is particularly important in industries such as construction, where the demand for high-performance materials is constant. Innovations in materials can result in lighter yet equally robust anchoring and fixing solutions. This is especially beneficial in applications where weight is a critical factor, such as aerospace or automotive industries. Lighter materials can contribute to fuel efficiency and overall cost savings. The market can capitalize on the growing emphasis on sustainability by developing eco-friendly anchoring and fixing solutions. Sustainable materials, such as recycled or bio-based materials, can appeal to environmentally conscious consumers and businesses. Integration of smart technologies, such as sensors and IoT devices, into anchoring and fixing solutions can provide real-time monitoring capabilities. This allows for proactive maintenance and reduces the risk of failures, enhancing overall safety and reliability. Smart technologies enable the collection of data regarding the performance of anchoring and fixing solutions. This data can be analyzed to identify patterns, predict potential issues, and optimize the design and maintenance processes, leading to more informed decision-making. These major factors are projected to offer growth for key players operating in the anchoring and fixing market opportunity during the forecast period.

The key players profiled in this report include Bayshield International IBM, Bostik (Arkema), Elmrr, Five Star Products Inc., Fosroc Inc., Gantrex, GCP Applied Technologies Inc., GRUPA SELENA, Henkel AG & Co. KGaA and LATICRETE International Inc.. Investment and agreement are common strategies followed by major market players. For instance, In December 2021, GCP Applied Technologies Inc. entered into a definitive agreement pursuant to which Saint-Gobain will acquire all the shares of GCP Applied Technologies for USD 32.00 per share, in cash, in a transaction valued at approximately USD 2.3 billion (approximately EUR 2.0 billion).

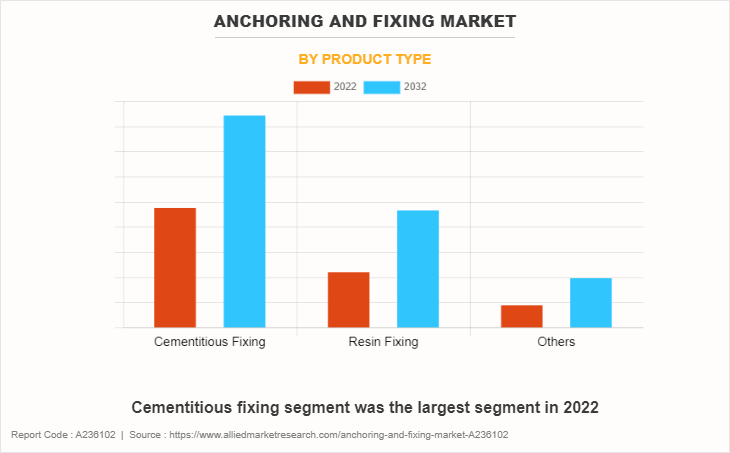

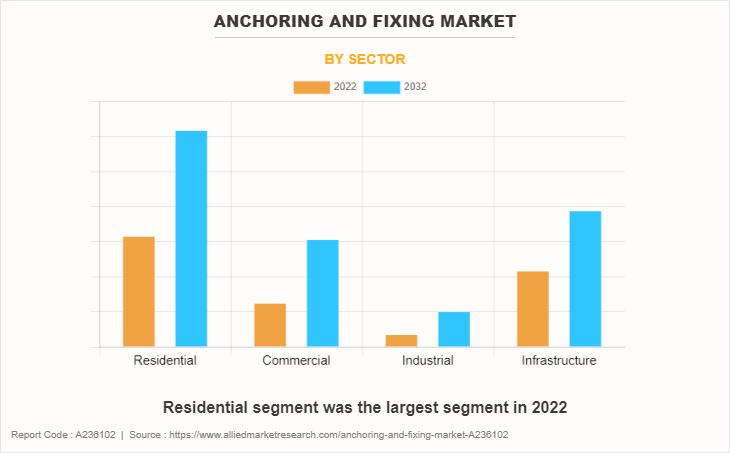

The anchoring and fixing market is segmented based on product type, sector channel, and region. By product type, the market is divided into cementitious fixing, resin fixing and others. By sector, the market is classified into residential, commercial, industrial, and infrastructure. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The anchoring and fixing market is segmented into Product Type and Sector.

By product type, the cementitious fixing sub-segment dominated the market in 2022. The demand for cementitious fixing solutions is closely tied to the overall growth in the construction and infrastructure sector. As construction activities increase, there is a greater need for reliable and durable anchoring and fixing solutions, driving the demand for cementitious products. Urbanization leads to increased construction of buildings, bridges, and other infrastructure projects. As urban areas expand, the need for secure and long-lasting fixing solutions becomes crucial, contributing to the growth of the cementitious fixing segment. Investments in industrial projects, such as manufacturing facilities, power plants, and refineries, often require robust anchoring and fixing solutions. Cementitious fixings are preferred in many industrial applications due to their strength and durability. Building codes and regulations often require specific standards for construction materials and methods. The use of cementitious fixing solutions may be mandated or recommended to meet safety and structural integrity requirements, driving market growth. Continuous advancements in material science and technology contribute to the development of improved cementitious fixing products. Innovations that enhance performance, ease of use, and environmental sustainability can drive market adoption. These are predicted to be the major factors driving the anchoring and fixing market size during the forecast period.

By sector, the residential sub-segment dominated the global anchoring and fixing market share in 2022. The level of construction activity in the residential sector is a key driver. Higher construction rates, whether due to population growth, urbanization, or other factors, can increase the demand for anchoring and fixing products. The development of infrastructure projects, such as residential complexes, housing estates, and related facilities, can significantly impact the demand for anchoring and fixing solutions. Changes in building regulations and codes may require the use of specific anchoring and fixing systems to ensure compliance with safety standards. This can drive market demand as builders and contractors seek compliant solutions. Innovations in anchoring and fixing technologies can drive market growth. Improved and more efficient products may gain popularity, especially if they offer cost savings or enhanced performance. The overall economic health of a region or country plays a crucial role. During periods of economic growth, there is typically increased construction and infrastructure development, boosting the demand for anchoring and fixing products. The occurrence of natural disasters in a region may lead to increased retrofitting and reconstruction efforts, driving the demand for anchoring and fixing solutions.

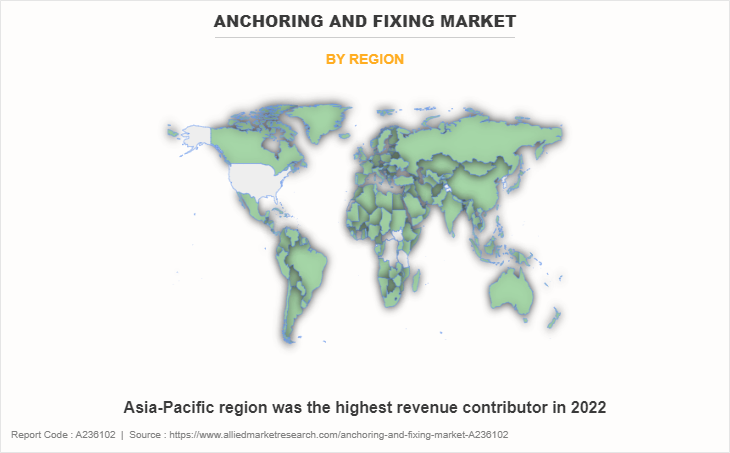

By region, Asia Pacific dominated the global anchoring and fixing market in 2022. The Asia Pacific region has been experiencing rapid urbanization and infrastructure development. Construction projects, including residential, commercial, and industrial buildings, often require anchoring and fixing solutions. The demand for these products is closely tied to the overall construction and infrastructure development in the region. Economic growth in the Asia Pacific region is a significant driver for various industries, including construction. As the economy grows, there is an increased need for new infrastructure and housing, which, in turn, boosts the demand for anchoring and fixing solutions. The ongoing trend of urbanization in many Asia Pacific countries leads to increased construction activities. Urban areas often require the development of high-rise buildings, bridges, and other critical structures, all of which may require anchoring and fixing solutions. Increasing emphasis on safety standards and environmental regulations can drive the demand for high-quality anchoring and fixing products that comply with these standards.

Impact of COVID-19 on the Global Anchoring and Fixing Industry

- The COVID-19 pandemic had a significant impact on the anchoring and fixing market. The pandemic has led to disruptions in supply chains worldwide due to lockdowns, travel restrictions, and factory closures. This has affected the production and availability of raw materials and finished products used in the anchoring and fixing industry.

- Many construction projects were delayed or put on hold as a result of lockdowns, labor shortages, and social distancing measures. This, in turn, impacted the demand for anchoring and fixing products.

- The demand for construction and building materials shifted during the pandemic. While some sectors, like residential construction, experienced growth due to increased demand for housing, others, like commercial construction, faced challenges. The specific impact on the anchoring and fixing market would depend on its reliance on these different sectors.

- The construction industry has seen an increased adoption of technology to facilitate remote work and project management. This could impact the way anchoring and fixing products are marketed, sold, and integrated into construction projects.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anchoring and fixing market analysis from 2022 to 2032 to identify the prevailing anchoring and fixing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anchoring and fixing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anchoring and fixing market trends, key players, market segments, application areas, and market growth strategies.

Anchoring And Fixing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Product Type |

|

| By Sector |

|

| By Region |

|

| Key Market Players | Bayshield International, Fosroc Inc., Henkel AG & Co. KGaA, Five Star Products Inc., GCP Applied Technologies Inc., Bostik (Arkema), GRUPA SELENA, LATICRETE International Inc., Elmrr, gantrex |

The growing demand for anchoring and fixing products is closely tied to the construction industry. Economic growth, urbanization, and infrastructure development can drive the need for these products, which is estimated to generate excellent opportunities in the anchoring and fixing market.

The major growth strategies adopted by the anchoring and fixing market players are investment and agreement.

Asia Pacific is projected to provide more business opportunities for the global anchoring and fixing market in the future.

Bayshield International IBM, Bostik (Arkema), Elmrr, Five Star Products Inc., Fosroc Inc., Gantrex, GCP Applied Technologies Inc., GRUPA SELENA, Henkel AG & Co. KGaA and LATICRETE International Inc.are the major players in the anchoring and fixing market.

The cementitious fixing sub-segment of the type acquired the maximum share of the global anchoring and fixing market in 2022.

Construction industry and manufacturing sector are the major customers in the global anchoring and fixing market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global anchoring and fixing market from 2022 to 2032 to determine the prevailing opportunities.

The residential and commercial real estate development can contribute to the demand for anchoring and fixing products, especially in the context of securing structures and ensuring safety., which is estimated to drive the adoption of anchoring and fixing.

The rising Increasing awareness of environmental sustainability may lead to the development and adoption of eco-friendly anchoring and fixing solutions.

Loading Table Of Content...

Loading Research Methodology...