Animal Wound Care Market Overview

The global animal wound care market was valued at $1.4 billion in 2023, and is projected to reach $2.9 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033. The growth of the animal wound care market is driven by the increasing adoption of companion animals, rising pet healthcare expenditure, and a growing awareness of animal health and welfare. Additionally, the rise in animal injuries due to road accidents, surgeries, and fights, along with the expansion of veterinary clinics and animal shelters, is fueling demand for wound care products.

Market Size & Future Outlook

- 2023 Market Size: $1.4 Billion

- 2033 Projected Market Size: $2.90 Billion

- CAGR (2024-2033): 7.54%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The major factors driving the growth of the animal wound care market are rising pet ownership and increased awareness of animal health. The surge in prevalence of chronic conditions and injuries in pets drives demand for effective wound care solutions. In addition, increased spending on companion animals and a rise in animal healthcare expenditures contribute to market growth. The expansion of veterinary clinics and hospitals, coupled with heightened focus on animal welfare, further fuels the demand for specialized wound care products.

What is Meant by Animal Wound Care

Animal wound care products are essential in managing injuries and promoting healing in pets and livestock. These products include a range of solutions designed to address several types of wounds, from minor cuts and abrasions to more severe lacerations and surgical incisions. These products include surgical and therapy devices that cater to various aspects of wound management. Surgical products often involve advanced techniques and materials for treating open wounds, lacerations, or surgical incisions. They include sutures, wound closure devices, and hemostatic agents that help control bleeding and facilitate tissue repair. Therapy devices, on the other hand, focus on ongoing care and recovery. These include negative pressure wound therapy systems, which apply controlled suction to promote healing, and several types of bandages and dressings that protect wounds from infection and promote an optimal healing environment.

Key Takeaways

- The animal wound care market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major animal wound care industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives

Key Market Dynamics

According to animal wound care market forecast analysis the key factors driving the growth of the market rise in the pet ownership, increased healthcare spending on companion animals, development in the veterinary healthcare infrastructure. According to 2024 article by European Pet Food Industry Federation, about 50% of households owns one or more pets. In addition, according to the 2021–2022 National Pet Owners Survey, 70% of all U.S. households include a companion animal. As more individuals and families embrace pets as integral members of their households, the demand for high-quality and effective wound care products has surged. Pet owners are increasingly willing to invest in advanced veterinary care to ensure their animals receive optimal treatment for injuries and illnesses. This growing awareness and willingness to spend on pet health and well-being have propelled the market for animal wound care products, including bandages, topical treatments, and advanced healing solutions. In addition, the increased frequency of veterinary visits and pet care services has led to greater utilization of specialized wound care products. Thus, the rise in pet ownership is expected to drive the animal wound care market growth.

Furthermore, increased healthcare spending on companion animals has emerged as a significant driver for the animal wound care market. As pet ownership continues to rise, so does the focus on the health and well-being of these animals, mirroring the human healthcare trend where pet owners are investing more in preventive and therapeutic care for their furry companions. According to 2022 report by North American Pet Health Insurance Association, the total number of pets insured in the U.S. at year-end 2021 was 3.9 million, a 28% increase since 2020. This heightened expenditure encompasses a range of services, from routine veterinary check-ups to advanced treatments for injuries and illnesses. Veterinarians and pet owners are now more inclined to seek out specialized wound care solutions that promote faster healing and improve the overall quality of life for pets. Thus, the increased healthcare spending on pet animals is expected to drive the animal wound care market size.

Furthermore, the increase in livestock also contributes to the growth of the market. As the global demand for meat, dairy, and other animal products rises, livestock farming has expanded to meet these needs. This expansion not only increases the number of animals but also elevates the incidence of injuries and infections among them. With more live stocks being raised, the frequency of wounds whether from accidents, fights, or other causes naturally rises. This surge in injuries creates a higher demand for effective wound care products.

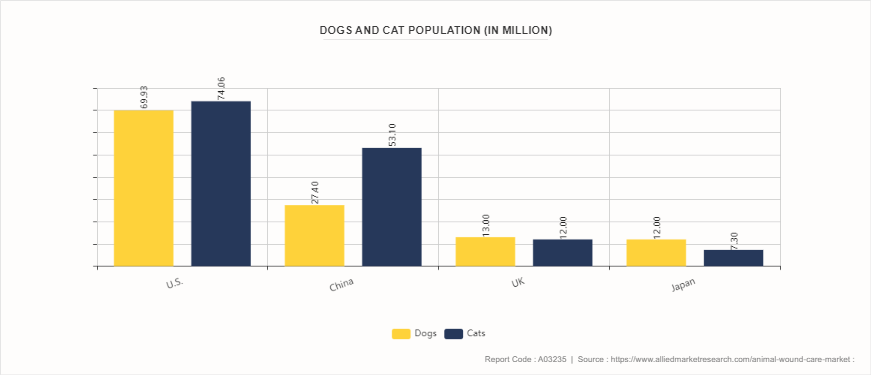

Growing Pet Population

The rise in pet population is a significant driver for the animal wound care market. As pet ownership continues to grow globally, with an increasing number of households adopting pets, the demand for comprehensive animal healthcare solutions, including wound care products, is rising correspondingly. More pets mean more potential for injuries and medical conditions that require attention, thereby increasing the need for effective wound care treatments. Pet owners are becoming more aware of the importance of timely and proper medical care for their animals, leading to a higher demand for advanced wound care products designed specifically for pets. In addition, the growing trend of treating pets as family members has fueled the expenditure on their healthcare, including specialized wound care. This heightened focus on pet health and well-being is driving growth in the animal wound care market.

Animal Wound Care Market Segmentation

The animal wound care market is segmented into product, animal type, end user, and region. By product, the market is classified into surgical and therapy devices. By animal type, the market is divided into companion and livestock. By end user, it is segregated into hospitals & clinics and homecare. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the Animal Wound Care market share in 2023. This is attributed to fact that North America, particularly the U.S. and Canada, has well-established veterinary infrastructure, including state-of-the-art clinics and hospitals. This infrastructure supports advanced wound care technologies and therapies for animals. The region has one of the highest rates of pet ownership in the world. This high density of pet owners increases the demand for veterinary services, including wound care products. Furthermore, pet owners in North America tend to spend significantly on their pets' health and well-being. This trend is reflected in the growth of the animal wound care market, as owners are willing to invest in advanced treatments for their pets.

In the Asia-Pacific region, rapid market expansion owing to surge in pet ownership, particularly in countries like China and India. This rise in pet ownership is driving demand for animal wound care products. Furthermore, rising disposable incomes in Asia Pacific countries are leading to greater spending on pet health and wellness. Pet owners are increasingly willing to invest in high-quality veterinary care, including wound care products. Moreover, the veterinary services sector is expanding rapidly in Asia Pacific, with the establishment of new veterinary clinics and hospitals. This expansion improves access to animal wound care products and services.

- According to 2022 Pet Ownership and Demographic Sourcebook published by the American Veterinary Medical Association (AVMA) , Dog ownership in the U.S household increased by 6% from 2016 to 2020. According to the same report, the veterinary care expenditure of household with dogs only was estimated to be $367.

- According to a 2022 report by the North American Pet Health Insurance Association, total premium volume for pet insurance in the U.S. was nearly $2.6 billion.

- According to the 2022 annual report by European Pet Food Industry Federation (FEDIAF) , around 26 % of households own at least one cat and 24 % of households own at least one dog.

- According to Agriculture and Agri-Food Canada, Govt of Canada, the pet population in India has increased significantly by a compound annual growth rate (CAGR) of 11.7% from 22.1 million pets in 2018 to 38.5 million pets in 2023.

Industry Trends

- According to U.S. Bureau Of Labor Statistics, in 2021, in U.S. pet related expenditure costed around $100 billion.

- Trupanion, a pet insurance company, observed 1.3 million pet insurance enrollments as of June 2022.

- According to 2022 report by American Veterinary Medical Association, about 45% of households own dogs and 26% household own cats

- According to 2022 Global State of Pet Care report Europe and U.S. combined has about 117 million pet dog population and about 177 million pet cat population

Competitive Landscape

The major players operating in the animal wound care market include animal wound care market report summarizes top key players overview as Quotient Limited, B. Braun Melsungen AG, Medtronic Plc, 3M, Johnson & Johnson, Virbac, Advancis Veterinary Ltd., Innovacyn, Inc., Vernacare, Neogen Corp., KeriCure, Inc. Other players in the animal wound care market are Advancis Veterinary Ltd, Virbac, Bayer AG and Robinson Healthcare.

What are the Recent Key Strategies and Developments

- In September 2021, Neogen Corp. acquired CAPInnoVet, Inc., an Atlanta-based companion animal health business that offers pet medications. This acquisition offered the company an opportunity to enter the retail market.

- In May 2021, Virbac launched Prurivet, a new topical gel for the management of pruritus (itching) in dogs and cats. It provides relief from itching caused by various skin conditions, such as allergies and dermatitis.

- In March 2021, Dechra launched Vetivex Veterinary Intravenous Fluids, a range of sterile solutions for fluid therapy in animals. These fluids are specifically formulated to meet the needs of distinct species and support hydration and electrolyte balance.

- In January 2023, Elanco Animal Health acquired Nutriquest's U.S. marketed products, inventory, pipeline products, and workforce. This strategic move aims to enhance Elanco's nutritional health offerings and explore antibiotic alternatives for livestock, including swine, poultry, and cattle.

- In March 2021, Vernacare acquired Robinson Healthcare, a transaction that is expected to increase the group’s annual turnover.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the animal wound care market analysis from 2024 to 2033 to identify the prevailing animal wound care market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the animal wound care market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global animal wound care market trends, key players, market segments, application areas, and market growth strategies.

Animal Wound Care Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.9 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product |

|

| By Animal Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Innovacyn, Inc, Medtronic plc, Johnson & Johnson, 3M Company, Virbac S.A., Vernacare Limited, Quotient Limited, Neogen Corporation, B. Braun Melsungen AG, Advancis Veterinary Ltd |

The forecast period for Animal Wound Care Market is 2024-2033.

The global animal wound care market was valued at $1.4 billion in 2023

The base year is 2023 in Animal Wound Care Market

The market value of Animal Wound Care Market is projected to reach $2.9 billion by 2033

Major key players that operate in the Animal Wound Care Market are Quotient Limited, B. Braun Melsungen AG, Medtronic Plc, 3M, and Johnson & Johnson

Loading Table Of Content...