Anodic Aluminum Oxide Wafer Market Research, 2031

The global anodic aluminum oxide wafer market was valued at $75.4 million in 2021, and is projected to reach $576.6 million by 2031, growing at a CAGR of 22.7% from 2022 to 2031.

Anodic aluminum oxide or AAO is a self-organized material with honeycomb-like structure formed by high density arrays of uniform and parallel nanopores. AAO is formed by electrochemical oxidation (anodization) of aluminum in the conditions that balance the growth and the localized dissolution of aluminum oxide. In the absence of such dissolution, dense anodic alumina films are formed with limited thickness. The diameter of the nanopores can be controlled with great precision from as low as 5 nanometers to as high as several hundred nanometers, with pore length from few tens of nanometers to few hundred micrometers.

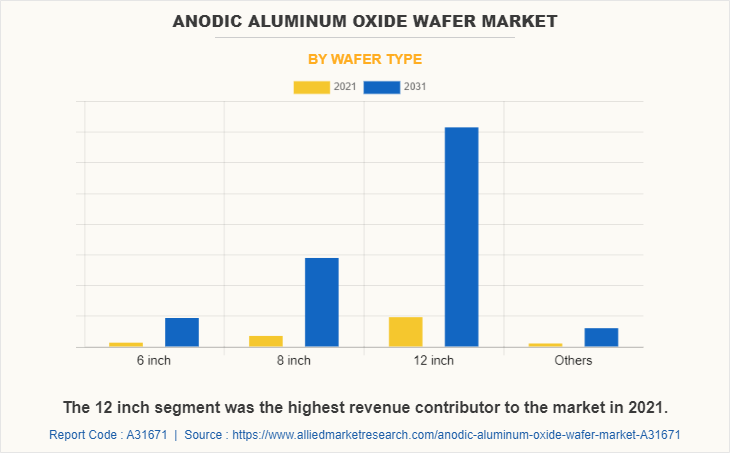

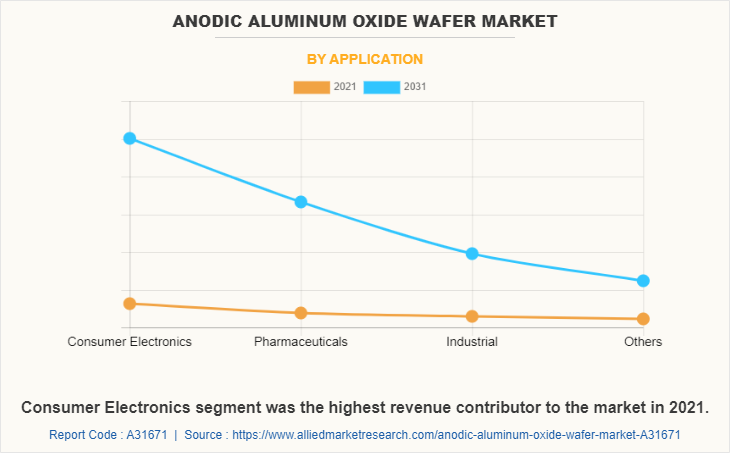

The anodic aluminum oxide wafer market is segmented into Wafer Type and Application.

By wafer type, the market is divided into 6 inch, 8 inch, 12 inch and others. The 12 inch segment was the highest revenue contributor to the market in 2021.

By application, it is segmented into consumer electronics, pharmaceuticals, industrial and others. The consumer electronics segment was the highest revenue contributor to the market in 2021.

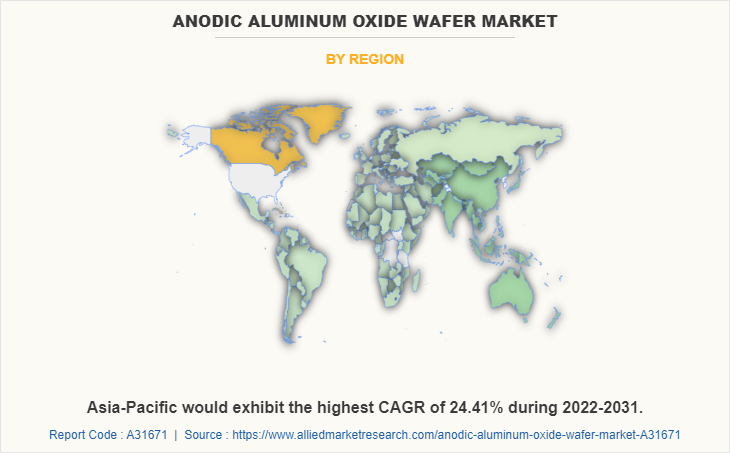

Region wise, the anodic aluminum oxide wafer market trends are analyzed across North America (the U.S., Canada), Europe (UK, Germany, France and rest of Europe), Asia-Pacific (China, Japan, India and rest of Asia-Pacific) and LAMEA (Latin America, the Middle East, and Africa).

North America is one of the key contributors to the anodic aluminum oxide (AAO) wafer market, owing to technological advancements, innovations, and investments in the respective industry. Wide acceptance and usage of semiconductor chips and ICs across North America is due to increase in need for smart technologies and devices. Furthermore, high investment by the U.S. government in industrial robotics and advanced defense equipment, such as controlling systems in aircraft and image sensors used in surveillance, is the factor that drives the anodic aluminum oxide wafer market.

The growth of anodic aluminum oxide wafer market in Europe is mainly driven by the increase in adoption of semiconductor technology in the automotive industry. Moreover, this region has technologically advanced countries, out of which most are developed and in developing phase.

Asia-Pacific is leading the anodic aluminum oxide wafer market and is expected to be the fastest growing region in the near future, with the highest CAGR. This region is the fastest economically growing region globally. It is the most lucrative market for semiconductor technologies due to the availability of high-end enhanced technologies, increase in demand for smart electronics, and growth in manufacturing industries. Asia’s hold on the global semiconductor market has grown so strong that sanctions on China’s chip production have become a source of shortages around the world. South Korea and Taiwan’s leading players, such as Samsung and the Taiwan Semiconductor Manufacturing Corporation (TSMC), are strong contenders for the anodic aluminum oxide wafer market in the coming years.

Latin America and the Middle East are the key regions for the overall semiconductor industry in the LAMEA region. Rise in demand for enhanced technologies in countries, such as Dubai, Abu Dhabi, Oman, Jordan, and others, is expected to be opportunistic for the growth of the anodic aluminum oxide wafer market.

The significance of AAO in nanoscience and nanotechnology is underpinned by the potential to control its nanoscale structure and chemistry over large area and in practical formats, enabling development of new materials and products with desired properties and performance.

Anodic aluminum oxide (AAO) features its interesting nanoporous structure which is capable of being used as a template for nanopatterning, highly anisotropic nanowire fabrication, and MEMs devices fabrication. The use of AAO wafers for optical sensors is also a significant application that can innovate biomedical research, with AAO based optical biosensors having features such as high selectivity, specificity, and reusable. The most common optical methods which utilize AAO include Surface-Enhanced Raman Scattering (SERS), Surface Plasmon Resonance (SPR), reflectometric Interference Spectroscopy (RIfS), and Photoluminescence Spectroscopy (PL).

AAO has illustrated a high level of controllability with other benefits such as cost efficiency, no toxicity, tunable pore density, and a highly ordered structure. Due to its formation, AAO is a desirable nanostructure for use as a scaffold which would require good cell adhesion and ensure proliferation. The high surface-to-volume ratio of this nanomaterial also supports natural biological behavior and roles of cells. The controllable pore size of anodic aluminum oxide further aids the suitability of AAO within native tissue.

Significant factors that impact growth of the anodic aluminum oxide wafer market share include surge in adoption of consumer electronics devices. Moreover, rise in in demand for ultra-thin wafers is expected to drive the market growth. However, rise in concerns related to complexities in manufacturing might hamper growth of the anodic aluminum oxide wafer market size. On the contrary, rise in use of wafers in the automotive industry offers potential growth opportunities for the anodic aluminum oxide wafer market growth.

Competitive analysis and profiles of the major anodic aluminum oxide wafer industry players, such as Bonnell Aluminium, Dajcor Aluminum Ltd, Monocrystal, CoorsTek Inc., Superior Metal Technologies, LLC, InRedox LLC, Alupco, Prevost, PAC-CLAD and Lorin Industries, Inc. are provided in this report.

Bonnell Aluminium, Dajcor Aluminum Ltd, Monocrystal, CoorsTek Inc., Superior Metal Technologies, LLC and Lorin Industries are the major players holding a prime share in the anodic aluminum oxide wafer market. Top market players have adopted various strategies, such as product launches, contracts, and others to expand their foothold in the anodic aluminum oxide wafer market.

In April 2021, Kentucky Gov. Andy Beshear awarded Perry County Fiscal Court more than $2 million in grants for an expansion at Dajcor Aluminum, a Canadian manufacturer of extruded and fabricated aluminum products based at the Coalfields Industrial Park in Hazard. This expansion includes facility improvements and the purchase of new equipment. With new capabilities, Dajcor will be able to add a natural oxide layer to their products, which increases resistance to corrosion and wear, and creates a lasting aesthetic appearance. Adding the anodize line to their operations will increase production capacity, decrease production time and lower cost.

In October 2022, Lorin Industries announced that its Anodized Aluminum products feature antimicrobial properties. For those of you who want surface protection and minimal bacteria collection on surfaces, consider the benefits of Lorin Anodized Aluminum. In addition to all of the other benefits of anodized aluminum, Lorin’s proprietary anodizing process delivers antimicrobial properties backed by independent lab testing. Engineers and application experts at Lorin believe that Lorin Anodized Aluminum is a preferred material for reducing surface bacterial collection.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anodic aluminum oxide wafer market analysis from 2021 to 2031 to identify the prevailing anodic aluminum oxide wafer market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anodic aluminum oxide wafer market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anodic aluminum oxide wafer market trends, key players, market segments, application areas, anodic aluminum oxide wafer market forecast and market growth strategies.

Anodic Aluminum Oxide Wafer Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 576.6 million |

| Growth Rate | CAGR of 22.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 173 |

| By Wafer Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | CoorsTek Inc., InRedox LLC, Dajcor Aluminum Ltd, Superior Metal Technologies, LLC, Bonnell Aluminium, Prevost, Lorin Industries, Inc., Alupco, Monocrystal, PAC-CLAD |

Analyst Review

The anodic aluminum oxide (AAO) wafer market is expected to leverage high potential for consumer electronics, pharmaceuticals and industrial industry verticals. The current business scenario has witnessed an increase in demand for AAO, particularly in developing regions, owing to rising adoption of AAO in the industries. Companies in this industry have adopted various innovative techniques such as mergers and acquisitions to strengthen their business position in the competitive matrix.

The anodic aluminum oxide (AAO) wafer market has steadily gained traction, owing to rise in demand for enhanced technologies in high-end automation across industries and integration of IoT, AI, in different industrial applications including manufacturing and others.

Apart from anodic aluminum oxide (AAO) wafer manufacturing companies operating in the market, service providers are the key participants and largely contribute toward growth of the overall anodic aluminum oxide (AAO) wafer market. Service providers use different technologies and materials to provide customized anodic aluminum oxide (AAO) wafer products. Key players profiled in the report include anodic aluminum oxide (AAO) wafer market players, such as Bonnell Aluminium, Dajcor Aluminum Ltd, Monocrystal, CoorsTek Inc., Superior Metal Technologies, LLC, InRedox LLC, Alupco, Prevost, PAC-CLAD and Lorin Industries, Inc.

The Anodic Aluminum Oxide Wafer Market is expected to grow at a CAGR of 22.65% during the forecasted period.

Major applications of the Anodic Aluminum Oxide Wafer are in consumer electronics, pharmaceuticals, industrial and others.

Asia-Pacific is estimated to be the largest regional market for Anodic Aluminum Oxide Wafer in 2021.

The global Anodic Aluminum Oxide Wafer Market was valued at $75.4 million in 2021

The major players in the Anodic Aluminum Oxide Wafer Market include as Bonnell Aluminium, Dajcor Aluminum Ltd, Monocrystal, CoorsTek Inc. and others.

Loading Table Of Content...