Anthracite Market Research, 2033

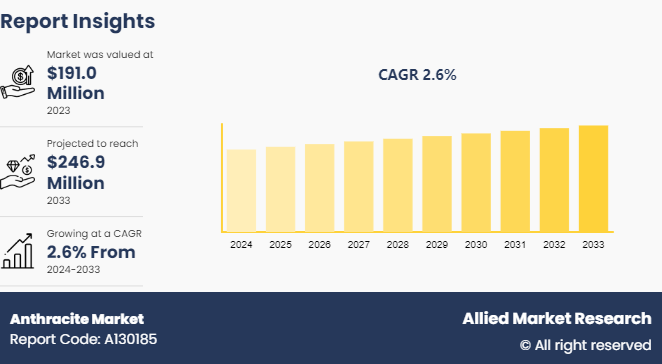

The global anthracite market was valued at $191.0 million in 2023, and is estimated to reach $246.9 million by 2033, growing at a CAGR of 2.6% from 2024 to 2033.

Market Introduction and Definition

Anthracite is a type of coal known for its high carbon content and low volatile matter, making it one of the highest-ranking coals in terms of carbon content and energy density. It is typically classified as a metamorphic rock due to its formation process involving the transformation of organic matter under high pressure and temperature over millions of years. Anthracite is recognized for its shiny black color and hard, brittle texture, distinguishing it from softer coals like bituminous and lignite.

Properties of anthracite include its high carbon content ranging from 86% to 98%, which contributes to its superior energy output per unit of weight compared to other coals. It burns with a clean, smokeless flame and produces a high heat output, making it desirable for heating applications and industrial processes. Anthracite is also characterized by its low sulfur and ash content, reducing emissions and environmental impact when used as a fuel source. Anthracite is primarily used in steel production, residential heating, water filtration, and as a source of industrial fuel due to its high quality and purity.

Key Takeaways

- The anthracite market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major anthracite industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The demand for anthracite is primarily driven by its high carbon content, which positions it uniquely in various industrial sectors. Anthracite, characterized by its high energy content and low moisture and volatile matter, is particularly valued in steel production. Its use in the steel industry is crucial due to its ability to produce high temperatures in blast furnaces, essential for converting iron ore into molten iron and subsequently into steel. Moreover, anthracite's high carbon content makes it a preferred fuel in industries requiring consistent and high-energy output, such as cement manufacturing and power generation. Its low sulfur content also contributes to reduced emissions compared to other types of coal, aligning with stringent environmental regulations in many regions. The growth of the anthracite market is further propelled by increase in urbanization and infrastructure development worldwide, particularly in emerging economies. As these economies expand their industrial base and construction activities, the demand for steel and other materials produced using anthracite is expected to rise, reinforcing its role as a key contributor to global energy and industrial markets.

The anthracite market faces challenges from the increasing substitution by alternative energy sources, which threatens to hamper its growth prospects. As global efforts intensify towards reducing greenhouse gas emissions and transitioning to cleaner energy sources, there is a growing shift away from coal-based fuels, including anthracite, in favor of renewable energy technologies such as wind, solar, and hydropower. One of the primary factors driving this substitution is the environmental impact associated with coal combustion, even though anthracite is considered cleaner burning compared to other coal types. Governments worldwide are implementing stricter environmental regulations aimed at reducing air pollution and carbon emissions, thereby incentivizing industries and consumers to opt for cleaner energy alternatives. Moreover, technological advancements in renewable energy have significantly lowered their costs and improved efficiency, making them increasingly competitive with traditional fossil fuels like anthracite.

This trend is further accelerated by policies promoting renewable energy deployment and carbon pricing mechanisms that penalize high-emission fuels. While anthracite remains valuable for specific industrial applications like steel production and heating due to its high carbon content and energy density, the ongoing substitution by alternatives poses a substantial challenge to its market growth in the broader energy landscape. Efforts to innovate and address environmental concerns will be crucial for the anthracite market to mitigate these challenges and sustain its relevance in the evolving energy mix.

Water filtration applications represent a promising and lucrative opportunity for the anthracite market. Anthracite, known for its high carbon content and low ash content, is particularly well-suited for use in water filtration systems. Its dense structure and natural filtration properties make it effective in removing impurities, sediment, and contaminants from water. In municipal water treatment plants, anthracite is commonly used in dual-media filtration systems alongside sand to improve water quality by trapping particles and facilitating the removal of organic matter. According to a report published by the National Institution for Transforming India (NITI Aayog) , in February 2021, India's wastewater treatment plants market stood at $2.4 billion in 2019 and is projected to reach $4.3 billion by 2025, owing to an increase in demand for municipal and sewage water treatment plants across the country.

Industrial applications also benefit from anthracite's ability to enhance water clarity and purity, supporting various processes from beverage production to wastewater treatment. The demand for effective filtration solutions increases as global concerns over water quality and scarcity continue to grow. Anthracite's role in providing reliable and efficient water filtration aligns with sustainability goals and regulatory requirements, further enhancing its market potential. Continued innovation in filtration technologies and expanding applications in emerging markets offer ample opportunities for growth and investment in the anthracite market.

Market Segmentation

The anthracite market is segmented into grade, application and region. By grade, the market is classified into standard grade, high grade, and ultra-high grade. By application, the market is divided into power stations, steel production, water treatment and filtration, fertilizer production and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the anthracite market include Atlantic Carbon Group Inc., Kizashi Carbon, Sibanthracite Group, Atrum Coal Limited, Blaschak Anthracite, Zhengzhou Coal Industry & Electric Power Co., Ltd., Gujarat Mineral Development Corporation Ltd., Xcoal Energy & Resources, Garcia Munte Energia SL., and Tata International Ltd.

Recent Key Strategies and Developments

- In August 2022, The Polish government has reached an agreement to obtain stakes in the anthracite mine operator Polska Grupa Gornicza (PGG) from four state utility companies. This move is aimed at modernizing the coal sector, which has historically been associated with high pollution levels. The Ministry of State Assets plans to acquire coal assets from utility firms such as Enea, PGE, and TPE, and transfer them to a newly established state-owned entity. According to the conditional agreement, the utility companies will sell their shares in PGG to the Polish government for a nominal amount of one Polish zloty (PLN) .

- In January 2022, Siberian Anthracite intends to procure sufficient wind-generated electricity to cover its entire energy requirements, marking a pioneering move as the first coal-mining company in Russia to do so. The Sibanthracite Group has finalized a power purchase agreement (PPA) with NovaWind, connecting to their wind farms situated in the southwest regions of Stavropol and Adygea. These include the Karmalinovskaya with a capacity of 60 MW, Bondarevskaya generating 120 MW, and Adygea producing 150 MW of renewable energy.

- In May 2021, García-Munté Energía launched the "Social Commitment" initiative, aimed at showcasing the company's charitable efforts and social projects.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The increasing coal production in the Asia-Pacific region is set to foster the growth of the anthracite market. Anthracite, valued for its high carbon content and low sulfur content, is in high demand for applications such as steel production and water filtration. As countries in Asia-Pacific ramp up coal production to meet industrial and energy demands, the availability of anthracite for these critical sectors is expected to grow, supporting the overall market expansion in the region.

- Coal-fired power plants derive energy from burning coal. India, ranked as the world's second-largest coal producer, primarily utilizes coal for electricity generation. According to statistics from the India Ministry of Coal as of July 2023, the country imported 87.97 million tons of coal, with total coal imports reaching 237.67 million tons during the 2022-23 period.

- As of April 2023, India's total installed coal generation capacity reached 205 GW, constituting 49.3% of its overall installed power generation capacity. The rising consumption of coal highlights its increasing utilization across the country. India finds coal abundant and cost-effective, making it a preferred choice for power generation by various utilities and companies in the sector.

- The Ministry of Power in India plans to commission the Patratu Super Thermal Project by the end of 2022. Located in Jharkhand, this project is designed to generate 4000 megawatts (MW) of electricity through coal-fired power generation. Coal has historically been a major contributor to India's electricity generation sector and continues to play a significant role in meeting the country's power demands.

- Furthermore, Tamil Nadu plans to complete the Uppur Thermal Power Project in Ramanathapuram, with a capacity of 1600 MW, by 2023. Owned by Tamil Nadu Generation and Distribution Corporation Ltd (TANGEDCO) , the project entails an investment of $1.7 billion.

- Therefore, Asia-Pacific is projected to emerge as a dominant force in the anthracite market throughout the forecast period.

Increasing global steel production will drive the growth of the anthracite market

Increasing global steel production is a significant driver for the growth of the anthracite market. Anthracite, with its high carbon content and low impurities, is essential in steelmaking processes, particularly in blast furnaces. The demand for steel rises as industrialization and infrastructure development continue to expand worldwide. This trend boosts the need for anthracite as a crucial component in the production of steel, reinforcing its position as a preferred raw material. The growth in steel production not only sustains the demand for anthracite but also drives investments and expansions in the anthracite mining and processing sectors globally.

Increasing coal production plays a pivotal role in driving the anthracite market

Increasing coal production significantly influences the anthracite market by ensuring sufficient supply to meet demand across various industries. Anthracite, known for its high carbon content and low impurities, is particularly sought after in sectors such as steel production and residential heating. As coal production rises, particularly in regions with abundant anthracite reserves, manufacturers can maintain stable supply chains and meet the growing global demand. This pivotal role underscores coal production's impact on the anthracite market's growth and sustainability.

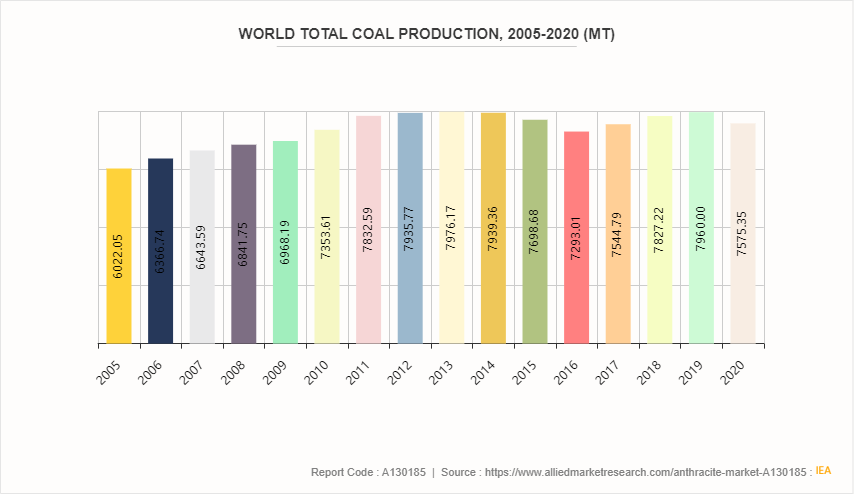

According to IEA, total world coal production decreased by 4.8% in 2020, after three years of growth. China was the only major producer that increased coal production in 2020, up by 1.1%. The declines that started at the beginning of the century in the U.S. and the European Union continued, most pronounced in Germany, Poland and Greece. Production growth in Russia, Indonesia, India and Turkey recently peaked and is now negative. Production dropped across all types of primary coal except anthracite, which saw a slight increase of 0.2%, pushed by Vietnamese production.

Industry Trends

- The increase in demand for fertilizer production is a key trend driving the growth of the anthracite market. Anthracite is utilized in the production of nitrogen-based fertilizers such as ammonium nitrate and ammonium sulfate. These fertilizers rely on anthracite as a fuel source in their manufacturing processes, benefiting from its high carbon content and energy efficiency. The demand for anthracite in fertilizer production is expected to continue increasing as global agricultural needs grow and fertilizer consumption rises.

- According to the USDA, China holds the title of the largest producer and exporter of fertilizers globally, accounting for 25% of the total global production. India follows as the world's second-largest consumer, having used 70 million metric tons of fertilizers in 2021. Despite ranking third in global fertilizer production, India relies heavily on imports to meet its domestic demand. India's fertilizer consumption is expanding rapidly, making it the fastest-growing market in this sector with expectations of substantial future growth.

- France stands out as one of the leading consumers of fertilizers in Europe, projected to hold a substantial 20.1% market share by the close of 2022. The market's value is anticipated to reach $9 billion by year-end, marking a 5.8% year-on-year growth. The adoption of advanced agricultural techniques is set to foster the demand for specialty fertilizers.

- Across South America, the cultivation area for major food crops has steadily expanded. Field crops dominated the fertilizers market in 2021, commanding a 95% market share. Key crops such as soybeans, corn, and sugarcane have experienced significant growth over the past two decades.

- In the U.S., the largest market in North America, fertilizers accounted for approximately 82.1% of the region's total market value in 2021. This dominance reflects the country's substantial agricultural land, encompassing about 73.6% of the total agricultural area in North America.

- All these factors are projected to increase the demand for fertilizer and are projected to boost the growth of the anthracite market.

Key Sources Referred

- Worldsteel Association

- IEA

- Our World In Data

- India Ministry of Coal statistics

- The Ministry of Power

- The National Institution for Transforming India (NITI Aayog)

- USDA

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anthracite market analysis from 2024 to 2033 to identify the prevailing anthracite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anthracite market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anthracite market trends, key players, market segments, application areas, and market growth strategies.

Anthracite Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 246.9 Million |

| Growth Rate | CAGR of 2.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Grade |

|

| By Application |

|

| By Region |

|

| Key Market Players | Atrum Coal Limited, Zhengzhou Coal Industry & Electric Power Co., Ltd., Kizashi Carbon, Tata International Ltd., Xcoal Energy & Resources, Garcia Munte Energia SL., Sibanthracite Group, Blaschak Anthracite, Gujarat Mineral Development Corporation Ltd., Atlantic Carbon Group Inc. |

The anthracite market was valued at $191.0 million in 2023, and is estimated to reach $246.9 million by 2033, growing at a CAGR of 2.6% from 2024 to 2033.

Growth in residential and commercial heating and increase in demand in steel production are the drivers of Anthracite Market in the globe.

The major players operating in the anthracite market include Atlantic Carbon Group Inc., Kizashi Carbon, Sibanthracite Group, Atrum Coal Limited, Blaschak Anthracite, Zhengzhou Coal Industry & Electric Power Co., Ltd., Gujarat Mineral Development Corporation Ltd., Xcoal Energy & Resources, Garcia Munte Energia SL., and Tata International Ltd.

Asia-Pacific is the largest regional market for Anthracite.

Steel production is the leading application of Anthracite Market.

Loading Table Of Content...