Anti-Drone Market Overview, 2031

The global anti-drone market size was valued at $1.3 billion in 2021, and is projected to reach $14.6 billion by 2031, growing at a CAGR of 27.9% from 2022 to 2031.Anti-drone technology, also known as counter-unmanned aircraft system (UAS), counter-drone, C-UAS, or counter-unmanned aerial vehicle (UAV) technology, refers to systems that are used to detect and/or disable unmanned aircraft. It is a customizable integrated system that consists of different equipment and solutions depending on the customer’s needs and requirements. It is used to prevent security breaches at private houses, prisons, commercial venues, government buildings, industrial installations, airports, border security, critical infrastructure, and military facilities. This system consists of modern technologies, including an electronically scanned array (ESA), staring radar, and micro-Doppler. It is generally designed based on individual demand for a different size, and range of the protection zone, the number of concurrent targets to track, and the ability to deal with environmental clutter.

U.S. is considered as pioneer in the anti-drone industry and has been investing heavily in R&D activities related to the anti-drone system. For instance, in January 2020, Department of Defense in U.S. awarded a contract of anti-drone systems to Anduril Industries. This contract worth $106 million for Anduril's anti-drone system, called as SkyDome is designed to detect and then counter unauthorized drones, providing military installations with strong and effective defense against potential threats from hostile drones.

Furthermore, China has proactively enhanced its competencies in anti-drone technology, with a specific focus on mitigating potential threats from drones, including those with illicit intentions. China has made swift progress across multiple facets of defense technology, notably in bolstering its anti-drone capabilities. This advancement underscores the nation's dedication to creating holistic solutions that address the ever-evolving landscape of security threats.

For instance, in 2021, China Electronics Technology Group Corporation (CETC), announced successful tests of its anti-drone laser weapon system. This indicated China's growing interest and investment in the anti-drone technology market. Moreover, in year 2021, CETC announced the successful tests of its latest anti-drone laser weapon system. This development indicates China's progress in the anti-drone technology sector and its investment in innovative solutions to counter airborne threats. This laser weapon system is designed to disable or destroy drones by targeting their critical components.

Both nations are actively competing to offer the most effective and advanced anti-drone solutions. This competition has driven technological advancements in the field.

In the anti-drone sector, U.S. and China are making significant contributions to the advancement and expansion efforts, both through competitive innovation and collaborative efforts. In the near future, the anti-drone market is expected to maintain its prominent role in guaranteeing safety and security in airspace. This continuous dynamic mirrors the changing landscape of security challenges in a world increasingly influenced by drone technology.

There has been an extreme increase in drone for recreational and commercial use globally. This has resulted in a considerable rise in incidents of public safety violations and notable government infrastructure. The detection and identification of these drones have been a considerable factor in security conservation, thereby accelerating anti-drone market growth. Drones with integrated cameras have unlocked opportunistic routes for professionals looking for a way to capture aerial photographs. However, the rising adoption of these unmanned aerial vehicles has led to increased government safety concerns. As troubles mount around the possible security threats drones may pose harm to both civilian and military entities, a new market for anti-drone technology is rapidly developing.

The integrated Anti-drone system consists of different combinations of UAV detection equipment (acoustic sensors, RF spectrum analyzers, video surveillance systems, drone detection radars,), drone neutralization equipment (stationary and mobile jammers, interception systems, counter-drone lasers, drone capture nets) and additional security solutions for enhanced level of protection (concealed threat detection systems, long range acoustic devices, security-related software, video acquisition and distribution systems, mobile security vans, IT infrastructure). Special integration software provides simultaneous use and smooth operation of different Counter-UAV solutions within one integrated system while data processing and visualization software helps to access the level of threat and take adequate response actions.

The factors such as increasing use of drone, rise in drone-related activities, and Emergence of various startup offering anti-drone system supplement the growth of the anti-drone market. However, detection effectiveness and anti-drone system is expensive are the factors expected to hamper the growth of the anti-drone market. In addition, advancement in anti-drone technology and technological developments in tackling drone swarms creates market opportunities for the key players operating in the anti-drone market.

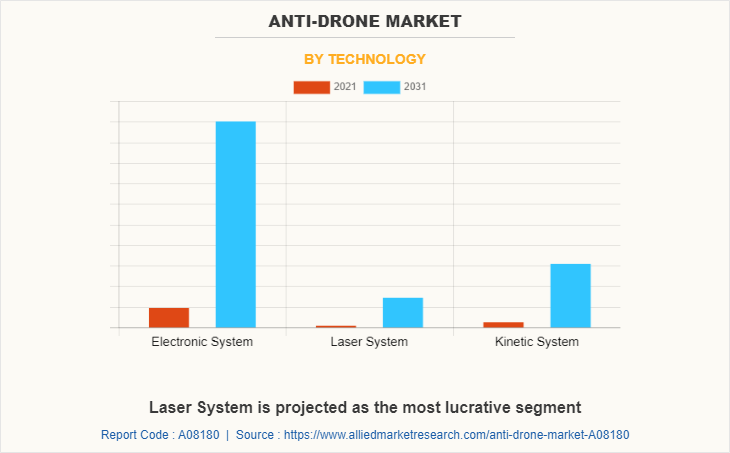

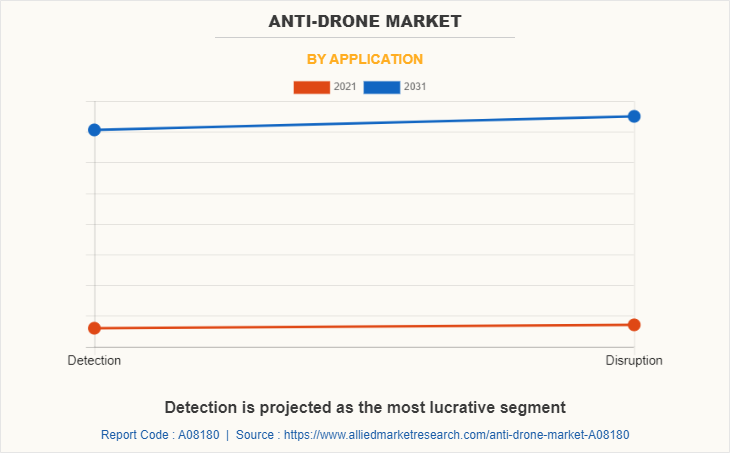

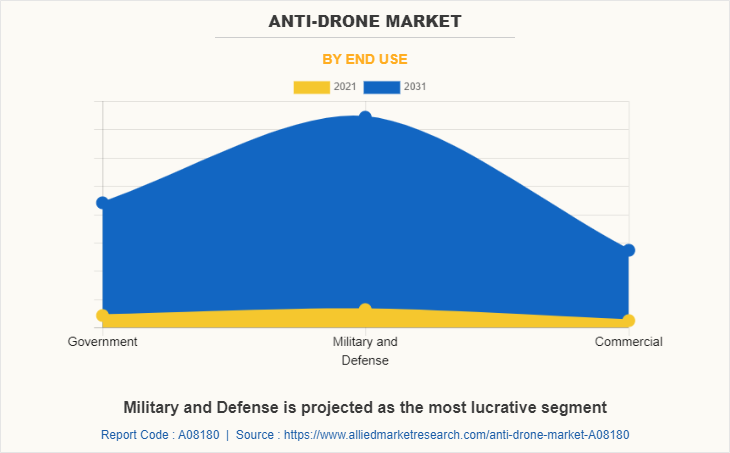

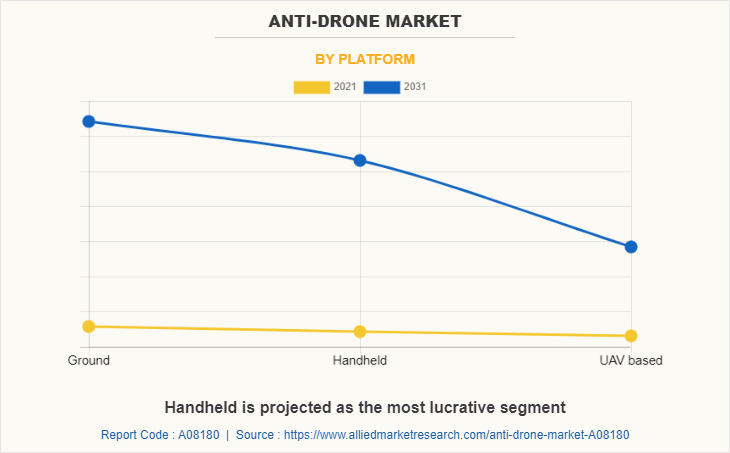

The anti-drone market is segmented into technology, platform type, application, end use, and region. By technology, the market is divided into electronic, kinetic and laser. By platform type, it is fragmented into ground, handheld and UAV-based. By application, it is categorized into detection, and disruption. By end use, it is further classified into government agencies, military and commercial. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the anti-drone market are DeTect, Inc., Advanced Radar Technologies, Blighter Surveillance Systems Limited, Dedrone, DroneShield Ltd, Lockheed Martin Corporation, Liteye, Raytheon Technologies Corporation, SAAB and Thales.

Increasing use of drone

The rise of anti-drone technology is largely due to the novel threats posed by the expanding use of drones particularly small, inexpensive systems in civilian and wartime environments. In the military sector, small drones have been increased rapidly at a rate that has worried many battlefield commanders and planners alike. According to the September 2019 report, at least 95 countries now possess drones, which can potentially furnish even poorly funded state actors with an aerial command of the battlespace that was previously only available to those possessing a sophisticated aircraft program. Drones are also increasingly becoming a weapon of choice for non-state groups that employ the technology for surveillance, battlespace management, propaganda, and aerial strike attacks, often to considerable effect. As a result of the proliferation of this technology, which is set to continue apace in the years ahead, counter-drone systems will become a ubiquitous weapon in all future conflicts. Thus, increasing use of drones is expected to further drive the demand in anti-drone market.

Rise in drone related accidents

The use of drones has increased drastically over the years, especially to ensure counterinsurgency, border safety, and to perform surveillance across commercial properties. Drones can recognize security and terrorism-related challenges and locate vulnerable zones that are prone to several risks. Drones are the latest force multiplier that can upgrade the abilities of security forces to monitor criminal activities and tackle evolving challenges in defense and homeland security. In addition, the commercialization of drones is being witnessed throughout the world, as they are often used by oil & gas companies, survey agencies, land & water resources protection agencies, and news agencies, which notably contributes toward the growth of the global drone defense system market.

Furthermore, falling prices of drones and their easy availability to the public act as the key driving forces of the market. In addition, increase in adoption of advanced drones to carry out aerial surveillance at restricted areas and public gatherings such as political rallies, sporting events, smuggling, terror missions, and other illegal activities boosts the market growth. In the last couple of years, the world has witnessed an increasing number of drone-related incidents. For instance, countries such as Saudi Arabia, the UK, Germany, India, Spain, France, and the U.S. have witnessed aerial surveillance done by unverified drones, attacks on oil reserves, and dropping of arms & ammunitions. Such incidents have experienced an exponential growth over the last five years, which notably augment the drone defense system market growth.

With the upsurge in manufacturing of drones throughout the world, adverse events are likely to increase exponentially, and it is of paramount importance for governments to safeguard their borders, people, and assets from the evolving nature of threats. If gone unchecked, drone-related threats may result in immense financial implications and loss of many lives throughout the world. Thus, rise in in malicious drone-related incidents has led to increase in use of drone defense technologies, which can spot and destroy the drones or make them nonfunctional. This acts as a major factor that fuels the growth of the global drone defense system market. Moreover, various companies have a wide range of counter-drone technologies that can detect, classify, alert, and destroy any foreign drones, which is anticipated to propel the market growth during the forecast period.

Detection Effectiveness

In March 2019, in a report, the U.S. Defense Innovation Unit stated that it has proven difficult to identify and mitigate threats using currently fielded anti-drone technologies. Every detection system has its drawbacks. For instance, Radar systems may struggle to pick out small drones & UAS flying very close to the ground, camera systems might confuse a drone with a bird or an airplane, electro-magnetic interference can degrade the detection capabilities of RF sensors, radar, certain RF systems, and EO/IR sensors must have a direct line of sight with the intruding drone to detect drones, and some detection systems may only be capable of providing a rough estimate of an incoming drone’s location. C-UAS detection systems must generate low levels of false negatives and false positives. This is difficult to achieve. C-UAS detection elements must be sensitive enough to detect all drones operating within the area of use, but systems that are too sensitive may create an overwhelming number of false positives, rendering the system unusable. According to the results of FAA (Federal Aviation Administration) counter-drone systems testing, distinguishing true positives from false positives in cluttered environments requires a high level of manpower. This factor may hamper the demand of the anti-drone market.

Advancement in anti-drone Technology

Drone technology itself is not standing still, and advances in this area will pose new challenges for anti-drone systems. As the unmanned aircraft systems market expands and the range of readily available aircraft types becomes more diverse, anti-drone systems need to be flexible enough to detect and neutralize drones that come in a wide variety of shapes and sizes. These could span from large, unmanned aircraft capable of carrying heavy payloads at extremely high speeds to low-flying micro surveillance drones that might only weigh a few grams. There are also individual technological advances emerging that pose unique challenges from an anti-drone perspective. Most notably in the near-term is the active research to develop drones that can operate in GPS-denied environments, which would be resilient to any kind of jamming (which is currently by far the most common interdiction method on the market). For example, according to Russian state media, the Russian military is planning to deploy GLONASS-free surveillance drones to the Arctic to track vessels across wide areas,30 while the U.S. Defense Advanced Research Projects Agency is developing autonomous, GPS-free multirotor drones that can travel at 20 m/s.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anti-drone market analysis from 2021 to 2031 to identify the prevailing anti-drone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anti-drone market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anti-drone market trends, key players, market segments, application areas, and market growth strategies.

Anti-Drone Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14.6 billion |

| Growth Rate | CAGR of 27.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 448 |

| By Technology |

|

| By Application |

|

| By End Use |

|

| By Platform |

|

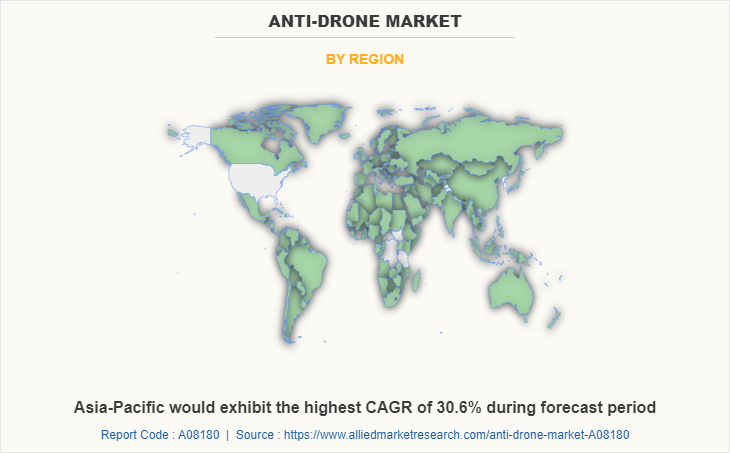

| By Region |

|

| Key Market Players | Thales, Dedrone, Advanced Radar Technologies, Raytheon Technologies Corporation, DroneShield, Liteye Systems Inc, SAAB, Blighter Surveillance Systems Limited, DETECT, INC., Lockheed Martin Corporation |

Analyst Review

Considerable development in the sales of drones globally has escalated the danger of breach of privacy, border surveillance, airport security, and illegal filming of secret objects. This creates a possible threat for society and critical infrastructure, which is regarded as one of the key factors propelling the demand for anti-drone systems to neutralize the risk productively. It is primarily designed to safeguard against security violation from drones that are being used for malicious or nefarious activities. For instance, in June 2021, high security area Indian air force base in Kashmir hit by two explosions. After that Indian Airforce ordered 10 anti-drones with laser-based directed energy weapons, which is intended to detect, track, identify, designate and neutralize hostile.

Anti-drone systems use three-dimensional (3D) airspace detection and provide sophisticated signal processing techniques to precisely detect and identify hostile drones. These drones can be provided with guns or explosives and utilized to gather intelligence and smuggle contraband on sensitive assets. Therefore, governing agencies of numerous countries are increasingly utilizing anti-drone systems to strengthen the security of sports arenas, borders, prisons, airports, military facilities, and public and government buildings. For instance, in July 2022, Qatar announced that it will use drones to help protect football stadiums from potential attacks during the FIFA World Cup 2022, Fortem Technologies will provide interceptor drones, to fend off potential attacks from other drones at football venues.

Apart from this, various companies are advancing new anti-drone systems for various applications. For instance, they are introducing multi-sensor systems with fusion algorithms, missiles, nets, and weighted lines that use a high-powered laser to provide a complete integrated solution for targeted drones. Due to increasing concerns of security risks, the demand for anti-drone systems is predicted to grow in residential areas, commercial venues, military, and industrial spaces.

The leading players operating in the anti-drone market are DeTect, Inc., Advanced Radar Technologies, Blighter Surveillance Systems Limited, Dedrone, DroneShield Ltd, Lockheed Martin Corporation, Liteye, Raytheon Technologies Corporation, SAAB and Thales.

the global anti-drone market was valued at $1.3 billion in 2021, and is projected to reach $14.57 billion by 2031, registering a CAGR of 27.9% from 2022 to 2031

Asia-Pacific is the largest regional market for Anti-Drone

Military And Defense is the leading application of Anti-Drone Market

Drone Detection are the upcoming trends of Anti-Drone Market in the world

Loading Table Of Content...