Anti-Obesity Drugs Market Research, 2032

The anti-obesity drugs market size was valued at $1,605.36 million in 2022 and is estimated to reach $4,439.34 million by 2032, exhibiting a CAGR of 10.7% from 2023 to 2032. Obesity is a medical condition in which excess body fat has accumulated to an extent that it may cause a negative effect on health. It is generally defined as having a body mass index (BMI) of 30 or greater. It is widely recognized as the largest and fastest-growing public health problem in developed and developing countries. Anti-obesity drugs are medications prescribed to help people who are overweight. These drugs work by suppressing appetite, increasing metabolism, or blocking the absorption of fat from food. Some of the commonly prescribed anti-obesity drugs include phentermine, sibutramine, orlistat, and liraglutide.

Market Dynamics

The key factor that drives the growth of the anti-obesity drugs market share is significant rise in the prevalence rate of obesity, surge in the health risks associated with being overweight or obese, and the increase in the number of research and development activities on several potential drug molecules that target both obesity and type 2 diabetes mellitus by key market players. For instance, in June 2021 Novo Nordisk announced that the U.S. Food and Drug Administration (FDA) has approved Wegovy for once weekly semaglutide 2.4 mg injection in the U.S. for chronic weight management. Rise in number of clinical trials for the treatment of obesity is expected to drive the anti-obesity drugs market growth. For instance, major companies such as ERX Pharmaceuticals, Amgen, Allysta Pharmaceuticals, Eli Lilly and others are developing potential drug alternatives to improve the obesity treatment scenario.

Furthermore, increase in R&D activities among key players for the development of anti-obesity drugs with less side effects is one of the major factors anticipated to foster the growth of the anti-obesity drugs market share. For instance, in December 2021, Tonix Pharmaceuticals Holding Cor Innovent Biologics company, which is engaged in the development of anti-obesity medication, announced its topline results from its Phase II clinical trial (NCT04904913) of IBI362, a glucagon-like peptide 1 receptor (GLP-1R) and glucagon receptor (GCGR) dual agonist in China for obesity treatment.

However, the stringent regulatory compliance for the approval of anti-obesity drugs and potential side effects of anti-obesity drugs such as increased blood pressure and heart rate hampers the growth of the anti-obesity drugs market size. Conversely rise in the prevalence of obesity rate and increase in awareness regarding obesity treatment in emerging economies such as India, China, Mexico, and Brazil are anticipated to create new opportunities during the forecast period.

Global Anti-Obesity Drugs Market Segmental Overview

The anti-obesity drugs market is segmented on the basis of drug type, mechanism of action, distribution channel, and region. By drug type, the market is bifurcated into prescription drugs, and over the counter drugs. By mechanism of action, the market is divided into centrally acting anti-obesity drugs and peripherally acting anti-obesity drugs. By route of administration, the market is bifurcated into oral route and subcutaneous route. By distribution channel, the market is classified into hospital pharmacies, retail pharmacies and online pharmacies. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

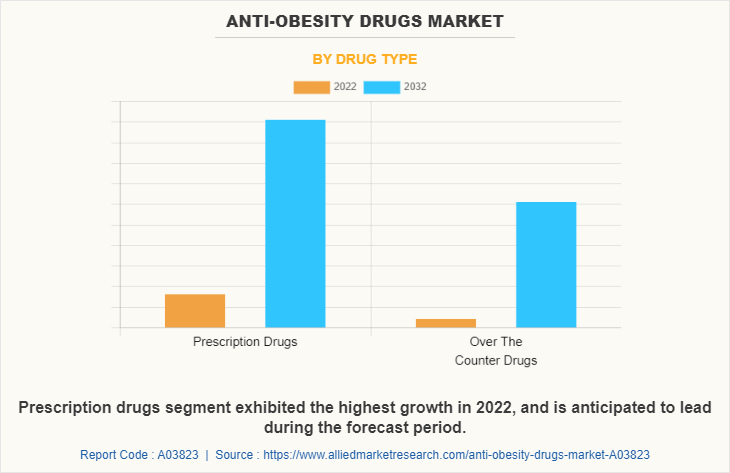

By Drug Type

The anti-obesity drugs market is segmented into prescription drugs, and over the counter drugs. In 2022, the prescription drugs segment accounted for the largest share of the market and is projected to exhibit the fastest market growth during the forecast period, owing to rise in the prevalence of obesity and increase in the number of anti-obesity drugs in the pipeline phase are the key factors that drive the growth of the market.

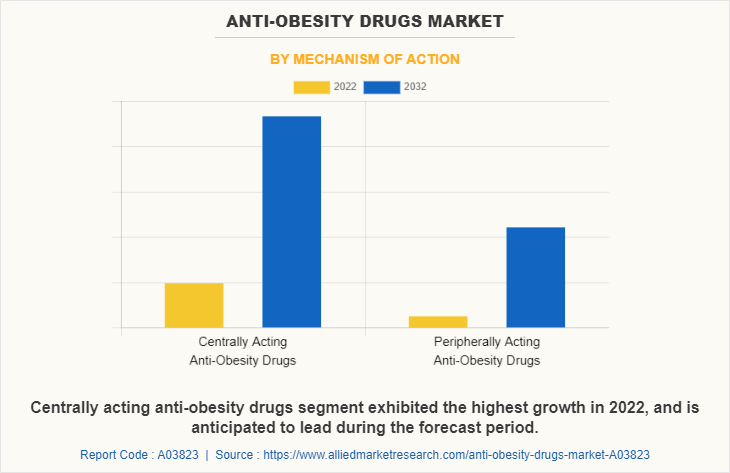

By Mechanism of Action

The anti-obesity drugs market is segmented into centrally acting anti-obesity drugs and peripherally acting anti-obesity drugs. In 2022, the centrally acting anti-obesity drugs segment accounted for the largest share of the market and is projected to exhibit the fastest market growth during the forecast period, owing to rise in awareness among people regarding the availability of centrally acting anti-obesity drugs and increase in number of product approvals across the world.

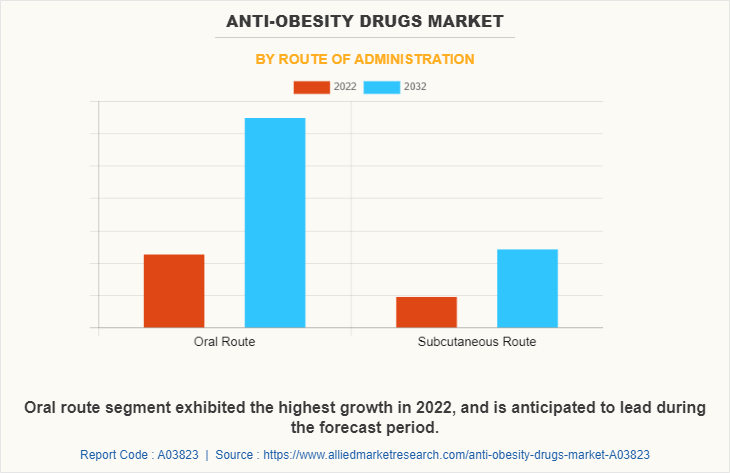

By Route of Administration

The anti-obesity drugs market is bifurcated into oral route and subcutaneous route. In 2022, the oral route segment accounted for the largest share of the market and is projected to exhibit the fastest market growth during the forecast period, owing to the fact that oral medications are typically more cost-effective than other forms of administration, such as injections or infusions, which require more resources and equipment.

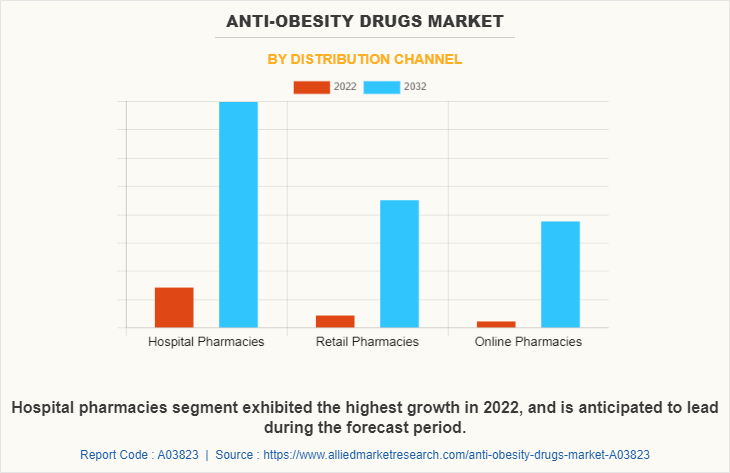

By Distribution Channel

The anti-obesity drugs market is segmented into hospital pharmacies, retail pharmacies and online pharmacies, the hospital pharmacies segment exhibited the highest growth in 2022, and is anticipated to lead during the forecast period, owing to rise in prevalence of obesity and surge in demand for prescription based anti-obesity drugs.

By Region

The anti-obesity drugs market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The anti-obesity drugs market is mainly driven by the increase in the obese population and high healthcare expenditure on anti-obesity drugs. Furthermore, rise in the awareness among the population regarding severe chronic diseases related to obesity and increase in number of clinical trials owing to a rise in investment by key market players in R&D activities are expected to fuel the market growth.

Asia-Pacific is expected to witness growth at the highest rate during the anti-obesity drugs market forecast owing to the increase in demand for anti-obesity drugs. Furthermore, the increase in prevalence of obesity and rise in the awareness about anti-obesity drugs in developing countries such as India, China, and South Korea contribute toward the growth of the anti-obesity drug market in the region.

Competition Analysis

The report provides competitive analysis and profiles of the major players in the anti-obesity drugs industry, such as Currax Pharmaceuticals LLC, Pfizer Inc, Novo Nordisk A/S, GlaxoSmithKline plc, Boehringer Ingelheim International GmbH, KVK Tech Inc, CHEPLAPHARM Arzneimittel GmbH, Gelesis Holdings, INC., VIVUS LLC, and Rhythm Pharmaceuticals.

Recent Product Launch in the Anti-obesity Drugs Market

- In June 2021 Novo Nordisk announced that the U.S. Food and Drug Administration (FDA) has approved Wegovy for once weekly semaglutide 2.4 mg injection in the U.S. for chronic weight management. Thus, launch of the new anti-obesity drugs will help the company to gain a strong foothold in the anti-obesity drugs industry.

- In June 2020 Gelesis announced that it has received approval to market Plenity, a novel weight loss treatment, in Europe. Gelesis received a Conformité Européenne (CE) mark for Plenity as a class III medical device indicated for weight loss in overweight and obese adultswith a Body Mass Index (BMI) of 25–40 kg/m2, when used in conjunction with diet and exercise.

- In April 2019 Gelesis announced that the United States Food and Drug Administration (FDA) has cleared the Company’s lead product candidate, PLENITY (Gelesis100), as an aid in weight management in adults with a Body Mass Index (BMI) of 25–40 kg/m2, when used in conjunction with diet and exercise.

Recent Partnership in Anti-obesity Drugs Market

- In June 2020 Gelesis announced a partnership with China Medical System Holdings Limited for the commercialization of Plenity in China. CMS is a well-established, innovation-driven specialty pharma company with a focus on sales and marketing in China.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anti-obesity drugs market analysis from 2022 to 2032 to identify the prevailing anti-obesity drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anti-obesity drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as anti-obesity drugs market trends, key players, market segments, application areas, and market growth strategies.

Anti-Obesity Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.4 billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 447 |

| By Drug Type |

|

| By Mechanism of Action |

|

| By Route of Administration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Boehringer Ingelheim International GmbH, Gelesis Holdings, INC., GlaxoSmithKline plc, KVK Tech Inc., Rhythm Pharmaceuticals, Pfizer Inc., Currax Pharmaceuticals LLC, Vivus LLC., CHEPLAPHARM Arzneimittel GmbH, Novo Nordisk A/S |

Analyst Review

According to the insights of CXOs, the anti-obesity drugs market is expected to witness significant growth in the future, owing to increase in the prevalence of obesity, rise in the development of new and innovative anti-obesity drugs, and surge in R&D activities by key market players.

The anti-obesity drugs market is expected to witness steady growth in the future. The increase in the prevalence of obesity and rise in awareness regarding obesity treatment fuel the growth of the market. In addition, surge in investments in R&D activities by pharmaceutical companies and increase in healthcare expenditure in developed countries like U.S. and Canada boost the growth of the market. However, the availability of alternative therapies for weight loss and the potential side effects of anti-obesity drugs hampers the growth of the market up to some extent during the forecast period.

North America is expected to dominate the anti-obesity drugs market during the forecast period, followed by Europe. In addition, emerging economies such as India, China, Mexico, and Brazil are expected to offer lucrative opportunities owing to surge in unhealthy and sedentary lifestyle, rise in geriatric population, and increase in prevalence of obesity are the key factors attributing to the growth of the market.

Anti-obesity drugs are prescribed medications that aid in weight loss in obese or overweight people. These medicines reduce appetite, speed up metabolism, or prevent the body from absorbing fat from food. Anti-obesity drugs can be classified into three main categories according to their mode of action. These include drugs inhibiting intestinal fat absorption, drugs suppressing food intake and drugs increasing energy consumption.

The total market value of the anti-obesity drugs market is $1605.36 million in 2022.

The forecast period for anti-obesity drugs market is 2023 to 2032.

The factors that restrain the growth of the market are potential side effects of anti-obesity drugs.

Increase in the prevalence of obesity, increase in number of clinical trials and increase in number of drugs in pipeline.

Yes, the competitive landscape is included in the anti-obesity drugs market report.

The overall impact of COVID-19 remains negative on the anti-obesity drugs market.

Top companies such as Currax Pharmaceuticals LLC, Pfizer Inc, Novo Nordisk A/S, GlaxoSmithKline plc, CHEPLAPHARM Arzneimittel GmbH, Gelesis Holdings, INC., Rhythm Pharmaceuticals held a high market position in 2022.

Loading Table Of Content...

Loading Research Methodology...