Antiscalants/Scale Inhibitors Market Research, 2032

The global antiscalants/scale inhibitors market was valued at $3.5 billion in 2022, and is projected to reach $5.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Antiscalants inhibit the formation and precipitation of crystallized mineral salts that form scale in industrial water systems such as boilers and cooling towers.They are used to prevent the formation of mineral scales in industrial water systems, such as boilers, cooling towers, and reverse osmosis membranes. These scales are formed when minerals, such as calcium, magnesium, and silica, precipitate out of the water and deposit on surfaces, causing fouling, corrosion, and reduced efficiency.

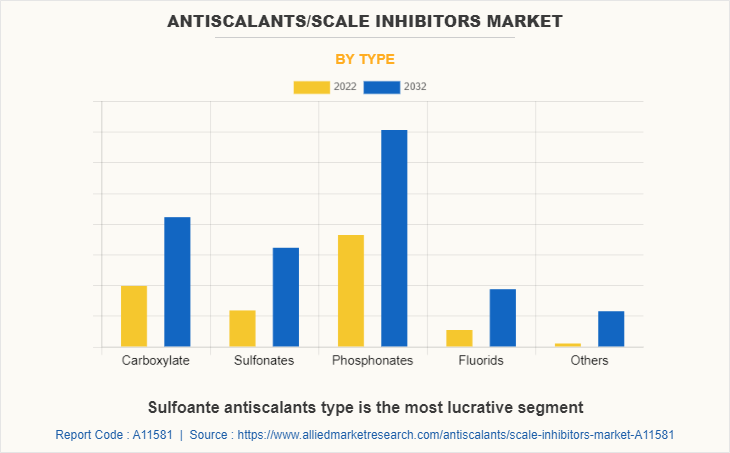

Antiscalants are classified into various types on the basis of their chemical composition, such as carboxylate, sulfonates, phosphonates, fluorides, and others. They work by inhibiting the growth and aggregation of mineral crystals, thereby preventing the formation of hard and insoluble scales. This is done by either interfering with the crystal growth process or by binding them to the mineral ions in the water and making them less likely to form scales.

Antiscalants are commonly used in industrial applications where water is used as a coolant or in manufacturing processes. They are typically added to the water before it enters the system. Antiscalants help to improve system performance, reduce maintenance costs, and extend equipment life by preventing scale buildup.

As the global population continues to increase, the energy demand also increases. According to the U.S. Energy Information Administration (EIA), world liquid fuels production averaged about 100 million barrels per day in 2022, and fit is expected to rise by an average of 1.6 million barrels per day in both 2023 and 2024. The oil and gas industry seeks to optimize production and extend the life of wells, it is increasingly turning to techniques such as water flooding, which involves injecting water into the reservoir to increase pressure and push more oil or gas to the surface. This process can also increase the likelihood of scaling, making antiscalants essential to maintain production.

In addition to that, the antiscalant market is expected to grow due to the requirement for clean raw materials and has many end-user applications across various industries demand for clean water for industrial, residential, and research purposes, which drives the market during the forecast period. The rise in the adoption of membrane-based water treatment technologies, such as reverse osmosis and nanofiltration. These technologies are highly effective at removing salts and other contaminants from water, but they are also prone to scaling.

Carboxylate antiscalants help to prevent scaling and extend the lifespan of these membranes which increases the demand for carboxylate antiscalants. Carboxylate antiscalants are becoming more popular in emerging markets such as Asia-Pacific and Latin America. Rapid industrialization and urbanization are driving demand for water treatment chemicals, including carboxylate antiscalants, in these regions. In addition to that, carboxylate antiscalants help to prevent scaling and fouling in food and beverage production equipment such as heat exchangers and evaporators. The increase in demand for food and beverage products due to population growth and change in dietary habits is expected to drive the growth of the antiscalants market.

However, antiscalants may not be effective against all scales and deposits. Some antiscalants may be ineffective against certain types of organic deposits or in high-temperature applications. Furthermore, some antiscalants may have a negative impact on the environment, particularly if not handled or disposed of properly. This can cause water contamination and other environmental problems. All these factors hamper the market growth.

Antiscalants are essential in the water treatment industry since they help to prevent scaling and fouling of membranes and other equipment, which leads to better water quality and reduced contaminants. Antiscalants improve equipment efficiency by preventing scaling and fouling, resulting in lower energy consumption and operating costs. The increase in global demand for clean water is driving the demand for antiscalants, including sulfonate antiscalants. This is particularly in regions with water scarcity and where desalination plants are becoming more common.

In addition to that, the oil and gas industry is a major user of sulfonate antiscalants, to prevent scale formation in drilling equipment and pipelines. As oil and gas exploration expands, there is an increase in demand for sulfonate antiscalants. Governments around the world are implementing stringent regulations on water quality and industrial waste management. This is driving the demand for antiscalants that are compliant with environmental regulations. U.S. Environmental Protection Agency (EPA) established guidelines and regulations for the safe and sustainable reuse of wastewater. The EPA recognizes that the reuse of wastewater can be an important water resource, particularly in areas where water scarcity is a concern.

Advancements in antiscalant technology, including sulfonates antiscalants are driving growth in the market. New formulations are being developed that are more effective and environment friendly, which is expected to further increase demand for sulfonate antiscalants.All these factors are anticipated to offer new growth opportunities for the antiscalants market during the forecast period.

The antiscalants market is segmented on the basis of type, method, end-use industry, and region. By type, the market is segmented into carboxylate, sulfonates, phosphonates, fluorides, and others. The phosphonates type accounted for 32% antiscalants market share in 2022 and is expected to maintain its dominance during the forecast period. The industrial sector is the largest consumer of phosphonates antiscalants due to their extensive use in cooling towers, boilers, and desalination plants.

The demand for phosphonates antiscalants is expected to grow further due to increasing industrialization and the growing need for sustainable water treatment solutions. Emerging economies such as China and India are witnessing a surge in demand for phosphonates antiscalants due to rapid industrialization and urbanization. The growth of these economies is expected to drive the demand for phosphonates antiscalants during the forecast period.

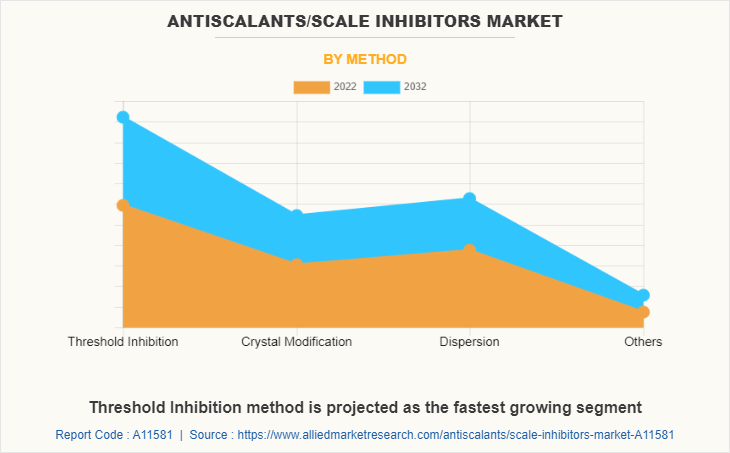

By method, the market is categorized into threshold inhibition, crystal modification, dispersion, and others. The threshold inhibition segment accounted for 40% antiscalants market share in 2022 and is expected to maintain its dominance during the forecast period. Threshold inhibition is based on the fact that the formation of scale depends on the concentration of the scaling mineral in the solution. By adding an antiscalant at a concentration below the saturation level of the scaling mineral, the antiscalant forms a thin layer on the surface of the mineral and prevents it from forming larger deposits.

Threshold inhibition is commonly used in industrial applications such as cooling towers, boilers, and desalination plants, where it is important to prevent scaling while minimizing the amount of antiscalant used. Threshold inhibition is an effective and cost-effective method for preventing scaling by carefully controlling the concentration of antiscalant added to the system. All these factors increase the demand for threshold inhibition antiscalants.

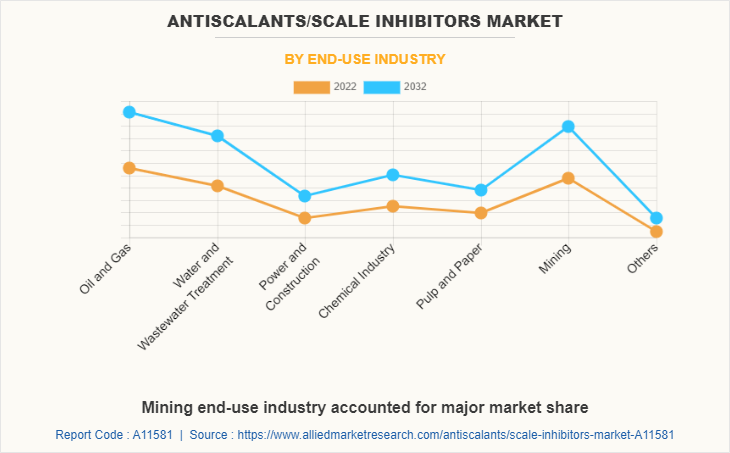

The end-use industry covered in the report includes oil & gas, water & wastewater treatment, power & construction, chemical industry, pulp & paper, mining, and others. Oil & gas segment accounted for 22% antiscalants market share in 2022 and is expected to maintain its dominance during the forecast period. Antiscalants are used in the oil and gas industry to prevent the formation of scale deposits, which accumulate on the inside of pipes, tanks, and other equipment, reducing their efficiency and causing equipment failure. They work by inhibiting the formation of scale by preventing the growth and aggregation of mineral crystals. They can be added directly to the oil and gas stream or applied to the surface of the equipment to prevent scale buildup.

Unconventional oil and gas extraction methods, such as hydraulic fracturing and shale gas extraction, require large amounts of water and can result in significant scale formation. As these methods become more prevalent, the demand for antiscalants is likely to increase.

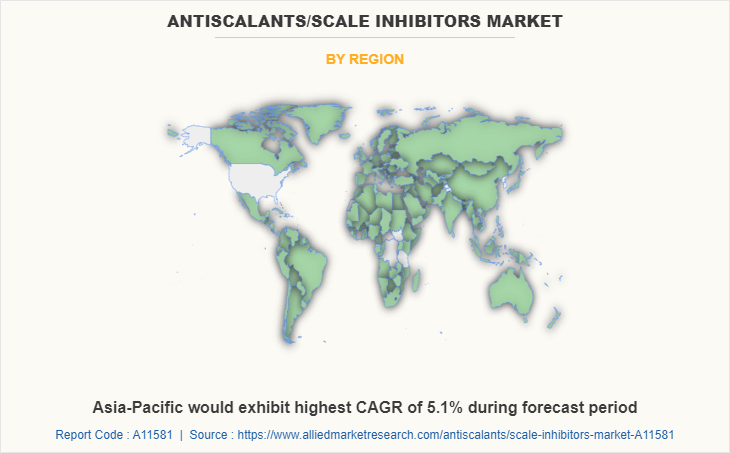

By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, Asia-Pacific accounted for the major antiscalants market share in 2022 and is expected to maintain its dominance during the forecast period. The Asia-Pacific region is expected to be the fastest-growing market for antiscalants, the rise in the population in Asia-Pacific increases the demand for water treatment solutions to ensure clean and safe drinking water. In addition to that, many countries in the Asia-Pacific region including China, India, and Indonesia are experiencing rapid industrialization, which is driving the demand for antiscalants in a variety of industries such as power generation, oil and gas, and mining. All these factors are anticipated to offer new growth opportunities for antiscalants in Asia-Pacific during the forecast period.

Key players in the antiscalants industry include Kemira Oyg, Clariant AG, General Electric, Dow Inc., Ashland, Avista Technologies, Solvay, Solenis, and Lenntech B.V.

Key Regulations:

- The National Sanitation Foundation (NSF) is an independent organization that develops standards and certification programs for products that come into contact with drinking water. Antiscalants must meet NSF standards to be used in potable water treatment systems.

- Occupational Safety and Health Administration (OSHA) sets standards for workplace safety, including the handling and storage of chemicals such as antiscalants. Employers must provide training and protective equipment to employees who work with these chemicals.

- The European Chemicals Agency (ECHA) regulates the use of chemicals in the European Union (EU) under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. Antiscalants must be registered with REACH and meet certain safety standards before they can be used in the EU.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the antiscalants/scale inhibitors market analysis from 2022 to 2032 to identify the prevailing antiscalants/scale inhibitors market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the antiscalants/scale inhibitors market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global antiscalants/scale inhibitors market trends, key players, market segments, application areas, and market growth strategies.

Antiscalants/Scale Inhibitors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.5 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 382 |

| By Type |

|

| By Method |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Solvay, BASF SE, General Electric, Avista Technologies , Lenntech B.V., Solenis, Ashland, Dow Inc., Clariant AG, Kemira Oyg |

Analyst Review

According to the opinions of various CXOs of leading companies, the antiscalants market is expected to witness increased demand during the forecast period. As oil and gas production moves to more difficult environments such as deepwater and unconventional resources such as shale, the water used in these processes becomes more saline and contains higher levels of scaling minerals. This increases the chances of scaling and the need for antiscalants.

Antiscalants prevent the formation and precipitation of crystallized mineral salts, which form scales. They are used to prevent the formation of mineral scales in industrial water systems, such as boilers, cooling towers, and reverse osmosis membranes. Minerals such as calcium, magnesium, and silica precipitate out of the water and deposit on surfaces, causing fouling, corrosion, and decreased efficiency.

The market is being driven by rising demand for antiscalants in the oil and gas industry and cost-effective solutions for the prevention of scale formation. As water is recycled and reused, the concentration of scaling minerals increases, making antiscalants necessary to prevent scaling and maintain equipment performance. These facts indicate that the antiscalants market is expected to expand considerably throughout the projected period.

Growing demand for antiscalants in oil & gas industry and cost-effective solution for preventing scale formation are the upcoming trends of antiscalants/scale inhibitors market in the world

Oil and gas industry is the leading application of antiscalants/scale inhibitors market

Asia-Pacific is the largest regional market for antiscalants/scale inhibitors market

The antiscalants/scale inhibitors market valued for $3.5 billion in 2022 and is estimated to reach $5.5 billion by 2032, exhibiting a CAGR of 4.7% from 2023 to 2032.

Clariant AG, General Electric, Dow Inc., Ashland, Avista Technologies, and Solvay are the top companies to hold the market share in antiscalants/scale inhibitors market

Loading Table Of Content...

Loading Research Methodology...