Artificial Intelligence In BFSI Market Research, 2032

The global artificial intelligence in bfsi market was valued at $22.5 billion in 2022, and is projected to reach $368.6 billion by 2032, growing at a CAGR of 32.5% from 2023 to 2032.

Artificial Intelligence (AI) in BFSI is a form of technology that allows financial institutions to automate or improve processes and tasks related to banking, finance, and investments. AI technologies enable financial institutions to gain access to large amounts of data, analyze it quickly and accurately, and make decisions quickly and effectively. This technology can help increase the efficiency of services and operations across the BFSI sector.

The increase in preferences for personalized financial services and rise in technological advancements are fostering the growth of the artificial intelligence in BFSI market. The use of predictive analytics powered by AI allows financial institutions to anticipate customer needs. AI can offer personalized recommendations for financial products, and investment opportunities, by analyzing historical data and predicting future trends, enhancing the overall customer experience. Moreover, protecting finances against unauthorized access and providing new ways with the help of technologies for customers to save personal data and build trust boost the growth of the market. In addition, increase in the demand for AI based security features drives the artificial intelligence in BFSI market growth.

However, lack of awareness and privacy concerns are the major factors that hamper the growth of the artificial intelligence in BFSI market. AI in BFSI is prone to privacy and security vulnerabilities since it relies on data collection to respond to user questions. Building AI in BFSI apps with high privacy and security requirements, as well as monitoring mechanisms, will assist end-users gain trust in solution, which will lead to more chatbot usage over time. Contrarily, the rise in digitalization in the banking sector presents significant opportunities for the artificial intelligence in BFSI industry. The digitalization of banking services enhances customer engagement through online and mobile platforms. AI, when integrated into these digital channels, enables personalized interactions, real-time assistance, and tailored financial recommendations. This not only improves customer satisfaction but also fosters stronger and more meaningful relationships.

The artificial intelligence in BFSI market report focuses on growth prospects, restraints, and trends of the artificial intelligence in BFSI market analysis. The study provides Porter‐™s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the artificial intelligence in BFSI market.

Segment Review

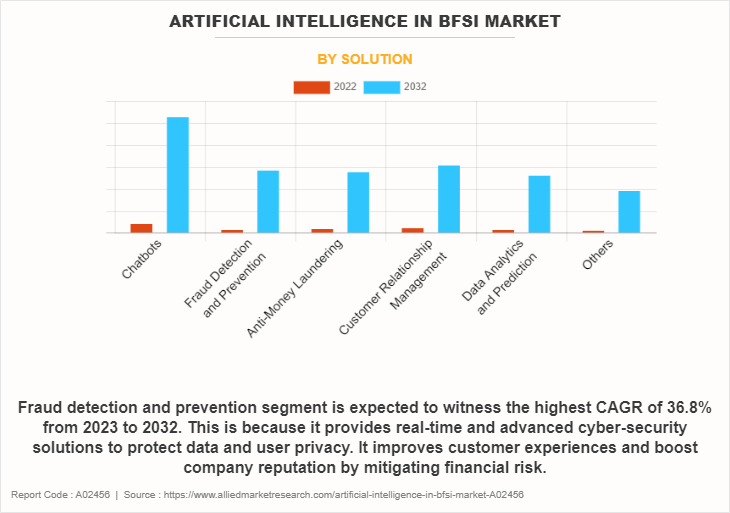

The artificial intelligence in BFSI market is segmented on the basis of offering, solution, technology and region. On the basis of offering, it is categorized into hardware, software, and services. On the basis of solution, it is classified into chatbots, fraud detection & prevention, anti-money laundering, customer relationship management, data analytics & prediction, and others. On the basis of technology, it is divided into machine learning, natural language processing, computer vision, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of solution, the chatbots segment attained the highest artificial intelligence in BFSI market size in 2022, owing to the fact that chatbots, which are powered by natural language processing, provide banks and other financial institutions the access to quickly assist common customer service queries, enhance on-boarding processes, and improve sales effectiveness.

On the basis of region, North America held the highest artificial intelligence in BFSI market share in 2022. This is attributed to the fact that North America region is witnessing an increase in the number of AI-driven startups, which are providing innovative solutions to the BFSI sector. These startups are leveraging the latest technologies to develop solutions that are tailored to the needs of the BFSI sector.

The report analyzes the profiles of key players operating in the artificial intelligence in BFSI market such as Amazon Web Services, Inc., Baidu, Inc., Google LLC, Intel Corporation, IBM Corporation, Microsoft Corporation, Oracle, SAP SE, Salesforce, Inc., and Palantir Technologies Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the artificial intelligence in BFSI market.

Market Landscape and Trends

The BFSI industry is vulnerable to fraud, and AI plays a key role in enhancing security measures. AI-powered algorithms analyze large amounts of data in real-time to identify unusual patterns and identify possible fraudulent activities. This proactive approach further strengthens the industry‐™s ability to prevent financial fraud and protect organizations and consumers. Moreover, AI enables the development of financial services based on individual customer information and behavior. Machine learning algorithms analyze customer data to determine preferences, spending habits and financial goals. This information can then be used to create personalized product recommendations, personalized financial advice and banking services, ultimately improving customer satisfaction and loyalty.

In addition, the availability of increased computing power, easily accessible through advances in hardware and cloud computing, plays an important role in the development of AI within the BFSI sector. The availability of high-performance computing resources has enabled financial institutions to implement AI solutions with greater ease and flexibility. Furthermore, the implementation of AI based technologies such as AI for BFSI such as robotic process automation (RPA) and natural language processing is expected to open new scope of opportunities for the artificial intelligence in BFSI market during the forecast period.

Top Impacting Factors

Increase in the Demand for AI based Security Features

The BFSI sector operates in an environment of rapidly evolving cyber threats. Traditional security measures often fail to protect against sophisticated attacks. The demand for AI-based security features is driven by the need for adaptive and intelligent solutions that can continuously analyze, detect, and respond to emerging threats in real time. Moreover, AI enables advanced authentication mechanisms beyond traditional username and password management. Face recognition, voice recognition, and iris scanning are examples of biometric authentication methods powered by AI. This technology increases the security of user accounts and transactions, and reduces the risk of unauthorized access. In addition, AI facilitates continuous security monitoring, enabling financial institutions to maintain a 24/7 alert posture of potential threats. Automated monitoring, combined with the ability of AI to analyze large amounts of data in real time ensures a proactive approach to cybersecurity, reducing the risk of security breaches. Therefore, these factors drive the growth of the artificial intelligence in BFSI market.

Increase in Preferences for Personalized Financial Services

The use of predictive analytics powered by AI allows financial institutions to anticipate customer needs. AI can offer personalized recommendations for financial products, and investment opportunities by analyzing historical data and predicting future trends, enhancing the overall customer experience. In addition, AI-driven algorithms are increasingly being used to create customized investments. AI can tailor investments to meet the specific needs of individual investors, for profitability earnings have been positive and consistent with their financial goals by considering factors such as risk tolerance, investment objectives and market conditions. Further, in the insurance sector, AI contributes to personalized offerings by assessing individual risk profiles. AI can customize insurance policies to provide optimal coverage while adjusting premiums based on individual risk assessments by analyzing factors such as lifestyle, health data, and historical insurance claims. Thus, these factors drive the growth of the artificial intelligence in BFSI market.

Developments in Technology

Technological advancements such as in chatbots, robo-advisors for financial products, and smart wallets are some of the factors that fuel the market growth. The market is also driven by rise in fraud detection, risk mitigation, back-end office works with thousands of people processing customer requests, and enabling financial institutions to deliver better and more resilient services to their customers with the help of technology. Moreover, protecting finances against unauthorized access and providing new ways with the help of technologies for customer to save personal data and build trust boost the growth of the artificial intelligence in BFSI market. In addition, the evolution of cloud computing has facilitated the seamless integration of AI applications in BFSI. Cloud infrastructure provides the scalability and flexibility required to deploy and manage AI solutions efficiently. This reduces the burden on on-premises infrastructure and allows financial institutions to leverage AI capabilities without substantial upfront investments. Therefore, these factors foster the growth of the artificial intelligence in BFSI market.

Lack of Awareness and Privacy Concerns

The BFSI sector operates within a highly regulated environment. The evolving nature of AI technologies can present challenges in ensuring compliance with existing regulations. Financial institutions must navigate regulatory frameworks that may not have kept pace with the rapid advancements in AI, creating uncertainty and hesitation in adopting AI solutions. In addition, artificial intelligence in BFSI market is prone to privacy and security vulnerabilities since it relies on data collection to respond to user questions. Building AI in BFSI apps with high privacy and security requirements, as well as monitoring mechanisms, will assist end-users gain trust in solution, which will lead to more chatbot usage over time.

Furthermore, consumers are unfamiliar with solution, virtual assistants, and digital personal assistants, as well as their benefits. Moreover, rise in regulatory policies and ethical and privacy concerns surrounding artificial intelligence applications are expected to hamper the artificial intelligence in BFSI market. Moreover, the protection of both consumer interests and the stability of the financial system is a security concern for addressing public-private engagement across regulators, financial institutions, and beyond. Furthermore, inadequacy of trust while issuing customer data is expected to restrain the growth of artificial intelligence in BFSI market.

Developments in Digitalization in the Banking Sector

The digitalization of banking services enhances customer engagement through online and mobile platforms. AI, when integrated into these digital channels, enables personalized interactions, real-time assistance, and tailored financial recommendations. This not only improves customer satisfaction but also fosters stronger and meaningful relationships. Furthermore, digitization enables automated customer service processes, and chatbots and AI-powered virtual assistants play a key role in enhancing these automated services Customers can get instant answers to questions, perform tasks and access information seamlessly through AI-powered interfaces, and optimizing the overall functionality. In addition, blockchain technology adopted in digital transactions supports AI applications. Blockchain provides a decentralized ledger with security and transparency, while AI enhances transaction verification and fraud detection. This network of technologies contributes to the reliability and efficiency of digital communications within the BFSI sector. Therefore, rise in digitalization in the banking sector is expected to foster the growth artificial intelligence in BFSI market in the upcoming years.

The Emergence of Fintech Startups

Fintech startups leverage data analytics and artificial intelligence to deliver highly personalized artificial intelligence in BFSI services. They deliver customized recommendations, financial insights, and tailored solutions for individual users, increasing customer engagement and loyalty. Moreover, fintech startups often focus on niche markets or specific financial services, such as robo-advisors, peer-to-peer lending, or micro-investing platforms. These specialized services complement traditional artificial intelligence in BFSI apps and offer users a broader array of financial solutions.

In addition, fintech startups prioritize customer-centric solutions, and AI plays a crucial role in delivering enhanced customer experiences. AI-driven applications enable personalized interactions, efficient problem resolution through chatbots, and seamless user interfaces, fostering a positive and user-friendly experience for customers in the BFSI sector. Therefore, these trends are projected to further drive the growth of the artificial intelligence in BFSI market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the artificial intelligence in BFSI market forecast from 2022 to 2032 to identify the prevailing artificial intelligence in BFSI market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of artificial intelligence in BFSI market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the artificial intelligence in BFSI market segmentation assists in determining the prevailing artificial intelligence in BFSI market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global artificial intelligence in BFSI market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the artificial intelligence in BFSI market players.

- The report includes an analysis of the regional as well as global artificial intelligence in BFSI market trends, key players, market segments, application areas, and market growth strategies.

Artificial Intelligence in BFSI Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 368.6 billion |

| Growth Rate | CAGR of 32.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 425 |

| By Offering |

|

| By Solution |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Palantir Technologies Inc., GOOGLE LLC, Microsoft Corporation, Oracle, SAP SE, Intel Corporation, Baidu, Inc., Salesforce, Inc., IBM Corporation, Amazon Web Services, Inc. |

Analyst Review

Banks are continuously investing in the development of their artificial intelligence in BFSI applications, owing to the emergence of new technologies such as chatbots, bigdata, and blockchain, which is expected to transform the artificial intelligence in BFSI market. Moreover, financial institutions are creating investment strategies for their investors, transforming customer experience, and reducing costs through the automation of internal process by accelerating business with other prominent player in the market. However, higher implementation cost of technologies and rise in security concern are expected to restrain the market growth. A rapid growth of customer expectations is providing an opportunity for the players in the market to enhance and expand customer services with more personalized products and services. Further, the increase in digital transactions prompted the development of advanced cybersecurity measures and fraud prevention mechanisms within artificial intelligence in BFSI apps, ensuring the safety of online transactions. These driving factors collectively contribute to the continued growth and importance of the artificial intelligence in BFSI market.

The CXOs further added that market players have adopted strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in June 2023, Amazon Web Services, Inc. (AWS), announced that Banco Bilbao Vizcaya Argentaria, S.A. (BBVA), a global banking leader, will use AWS to deliver advanced analytics and data services in the cloud, taking a decisive step in its data and artificial intelligence (AI) transformation process. As part of its transformation into a data- and AI-driven organization, BBVA will use AWS to harness analytics and machine learning to transform its internal processes, improve risk management, drive growth, and provide innovative solutions for its customers. Therefore, such strategies are expected to boost the growth of the artificial intelligence in BFSI market in the upcoming years.

The artificial intelligence in BFSI market is estimated to grow at a CAGR of 32.5% from 2023 to 2032.

The artificial intelligence in BFSI market is projected to reach $368.6 billion by 2032.

The key players profiled in the report include artificial intelligence in BFSI market analysis includes top companies operating in the market such as Amazon Web Services, Inc., Baidu, Inc., Google LLC, Intel Corporation, IBM Corporation, Microsoft Corporation, Oracle, SAP SE, Salesforce, Inc., and Palantir Technologies Inc.

Increase in the demand for AI based security features, increase in preferences for personalized financial services, and developments advanced technologies contribute towards the growth of the market.

The key growth strategies of artificial intelligence in BFSI players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...