Artificial Pancreas Devices Systems Market Research, 2033

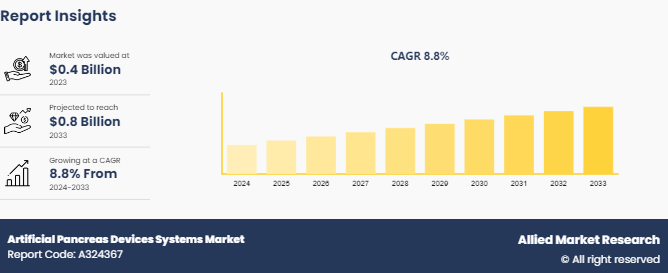

The global artificial pancreas devices systems market size was valued at $0.4 billion in 2023, and is projected to reach $0.8 billion by 2033, growing at a CAGR of 8.8% from 2024 to 2033. The major factors driving the growth of the artificial pancreas devices systems market are rising prevalence of diabetes, advancements in technology, and increasing awareness of diabetes management. In addition, the surge in demand for effective glucose monitoring and insulin delivery solutions is expected to contribute significantly to the growth of the market.

Market Introduction and Definition

Artificial pancreas systems, also known as closed-loop insulin delivery systems, are advanced medical devices designed to help individuals with type 1 diabetes manage their blood glucose levels more effectively. These systems integrate a continuous glucose monitor (CGM) with an insulin pump, and a sophisticated algorithm that interprets glucose readings and adjusts insulin delivery accordingly. The continuous glucose monitor continuously measures the glucose levels in the interstitial fluid, while the insulin pump administers insulin through a small catheter placed under the skin. The algorithm, acting as the brain of the system, processes the glucose data to predict trends and modulate insulin delivery, aiming to keep blood sugar levels within a target range. This technology reduces the burden of diabetes management by minimizing the need for manual insulin dosing and frequent blood glucose monitoring. The goal of artificial pancreas systems is to mimic the glucose-regulating function of a healthy pancreas, thereby improving glycemic control, reducing the risk of complications, and enhancing the quality of life for people with diabetes.

Key Takeaways

- The artificial pancreas devices systems market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major artificial pancreas devices systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives

Key Market Dynamics

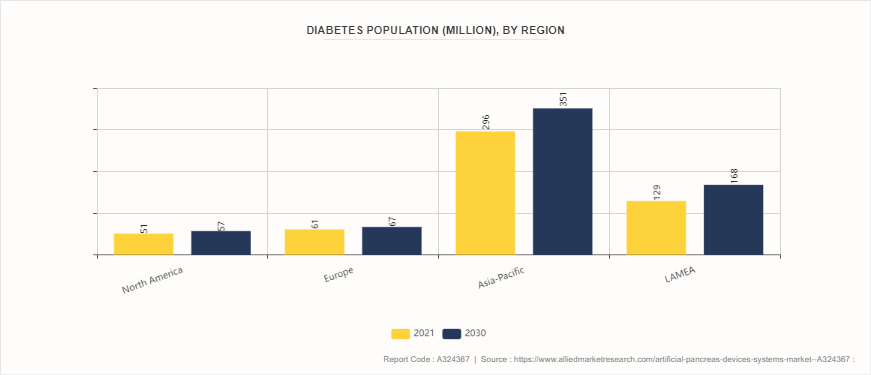

According to artificial pancreas devices systems market forecast analysis, the key factors driving the growth of the market are rise in prevalence of diabetes, surge in geriatric population, increase in awareness about the diabetes patient management, and favorable initiatives from public and private organizations. Over the past few decades, diabetes has become a global health concern, with the number of people diagnosed with the disease increasing rapidly. According to the American Diabetes Association, in 2021, 38.4 million Americans, or 11.6% of the population, had diabetes. Factors contributing to this growth include rise in geriatric population, sedentary lifestyles, unhealthy diets, and surge in obesity rates. This growing diabetic population, which includes both type 1 and type 2 diabetes patients, has created a substantial demand for advanced diabetes management solutions. Artificial pancreas device systems, which combine continuous glucose monitors (CGMs) and insulin pumps to automate blood glucose control, offer a revolutionary approach to managing diabetes. They provide real-time glucose monitoring and insulin delivery, mimicking the body's natural regulatory mechanisms more closely than traditional methods. Thus, the rise in prevalence of diabetes is expected to drive artificial pancreas devices systems market growth.

In addition, according to artificial pancreas devices systems market trends analysis, technological advancement in artificial pancreas devices is expected to drive market growth. Cutting-edge innovations in sensor technology, data analytics, and machine learning have significantly enhanced the accuracy, reliability, and user-friendliness of these systems. Continuous glucose monitoring (CGM) sensors, which have become more precise and less invasive, allow real-time tracking of blood glucose levels, thereby enabling dynamic and responsive insulin delivery. In addition, advancements in algorithms used for predictive analytics facilitate the automation of insulin dosing, reducing the burden on patients and improving glycemic control. In May 2024, an artificial pancreas developed by researchers at the University of Cambridge has been granted approval by the U.S. Food and Drug Administration (FDA) for use by individuals with type 1 diabetes aged 2 and older, including during pregnancy. For the first time, the FDA authorized the use of the artificial pancreas system in pregnancy. CamAPS FX, produced by Cambridge spinout company CamDiab, is an Android app that can be used to help manage glucose levels in people with type 1 diabetes, including during pregnancy. The app allows a compatible insulin pump and a compatible continuous glucose monitor to 'talk to each other, " creating an artificial pancreas. The integration of mobile and wearable technology has further revolutionized patient engagement and adherence, providing seamless connectivity and remote monitoring capabilities. These technological strides not only improve the clinical outcomes for individuals with diabetes but also drive consumer adoption and market growth by offering more convenient and effective management solutions. Thus, the technological advancement in artificial pancreas devices is expected to contribute significantly to the growth of the artificial pancreas devices systems market size.

Prevalence of Diabetes, by Region

According to artificial pancreas devices systems market analysis increasing prevalence of diabetes worldwide has significantly driven the growth of the artificial pancreas devices market. Diabetes, particularly type 1 and type 2, has become a global health crisis, affecting millions of people and leading to a rising demand for effective management solutions. The artificial pancreas, which automates blood glucose control, offers a promising technology to improve the quality of life for diabetes patients. As the number of diabetic patients surges there is a growing need for advanced medical devices that can provide continuous glucose monitoring and insulin delivery. This rise in diabetes cases is largely attributed to factors such as unhealthy lifestyles, increasing obesity rates, and an aging population.

Market Segmentation

The artificial pancreas devices systems industry is segmented into device type, end user and region. By device type the market is divided into threshold suspend device systems, control-to-range (CTR) systems, control-to-target (CTT) systems. By end user, the market is divided into hospitals, clinics, homecare. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the artificial pancreas devices systems market share in 2023 owing to substantial research and development activities in artificial pancreas devices, a strong presence of major key players, well-established healthcare systems, high adoption of advanced medical technologies, and increasing prevalence of diabetes. However, according to artificial pancreas devices systems market opportunity analysis Asia-Pacific region, rapid market expansion is anticipated due to improving healthcare infrastructure, rising healthcare expenditures, and increasing awareness among the population regarding effective management of chronic diseases such as diabetes. Countries like China and India are witnessing significant market growth due to large patient pools and increasing healthcare investments.

- According to 2023 article by American Diabetes Association, around 1.2 million Americans are diagnosed with diabetes every year.

- According to the International Diabetes Federation, the number of diabetic patients in Europe is expected to reach 69 million patients by 2045.

- According to the United Nations Population Fund, the elderly population (aged 60 and above) in India is 153 million as of 2023 and is expected to reach 347 million by 2050.

Industry Trends

- According to an article by the International Diabetes Federation, in 2021 around 537 million adults (20-79 years) were living with diabetes.

- In May 2024, A research team from the University of Virginia (UVA) Center for Diabetes Technology has demonstrated that incorporating artificial intelligence (AI) into an artificial pancreas system for regulating type 1 diabetes improves the system’s efficiency without sacrificing performance.

- In April 2024, the National Health Service (NHS) England announced that it is expected to provide artificial pancreas for children and adults with type 1 diabetes. The NHS England has allocated £2.5 million to local health systems to identify eligible patients and facilitate distribution. The system is projected to be available for children and young people under 18, pregnant women, and adults with an HbA1c reading of 58 mmol/mol (7.5%) or higher.

Competitive Landscape

The major players operating in the artificial pancreas devices systems market include Medtronic Plc, Bigfoot Biomedical, Johnson & Johnson, Tandem Diabetes Care, Inc., Pancreum, Inc., TypeZero Technologies, LLC, Beta Bionics, Insulate Corporation, Diabeloop, and Inreda Diabetic. Other players in the artificial pancreas devices systems market are Pancreum Inc, Hill-Rom Services and Midmark.

Recent Key Strategies and Developments

- In January 2024, Medtronic Plc, announced CE (Conformité Européenne) Mark approval for the MiniMed 780G system with Simplera Sync, a disposable, all-in-one continuous glucose monitor (CGM) requiring no fingersticks or overtape. Simplera Sync features an improved user experience with a simple, two-step insertion process and is half the size of previous Medtronic sensors.

Key Sources Referred

- National Library of Medicine

- American Diabetes Association

- Center of Disease Control and Prevention

- International Diabetes Federation

- United Nations Population Fund

- University of Virginia (UVA) Center for Diabetes Technology

- World Health Organization

- National Health Service (NHS)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the artificial pancreas devices systems market analysis from 2024 to 2033 to identify the prevailing artificial pancreas devices systems market.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the artificial pancreas devices systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global artificial pancreas devices systems market trends, key players, market segments, application areas, and market growth strategies.

Artificial Pancreas Devices Systems Market , by Device Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 0.8 Billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Device Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Pancreum, Inc, Tandem Diabetes Care, Inc., Johnson & Johnson, Bigfoot Biomedical, Inc., Inreda Diabetic, Medtronic plc, Insulate Corporation, Beta Bionics, Inc, Diabeloop, TypeZero Technologies, LLC |

The total market value of Artificial Pancreas Devices Systems Market is $0.4 billion in 2023.

The forecast period for Artificial Pancreas Devices Systems Market is 2024-2033.

The base year is 2023 in Artificial Pancreas Devices Systems Market

The market value of Artificial Pancreas Devices Systems Market in 2033 is $0.8 billion.

Major key players that operate in the artificial pancreas devices systems market are Medtronic Plc, Bigfoot Biomedical, Johnson & Johnson, Tandem Diabetes Care, Inc., and Pancreum, Inc.

Loading Table Of Content...