Artificial Urinary Sphincter Implantation Device Market Research, 2033

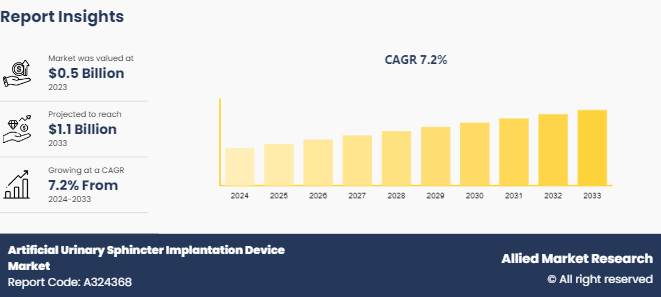

The global artificial urinary sphincter implantation device market size was valued at $0.5 billion in 2023, and is projected to reach $1.1 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033. The major factors driving the growth of the artificial urinary sphincter implantation device market are increasing prevalence of urinary incontinence, particularly among the aging population and those with certain medical conditions such as prostate cancer, which can result in sphincter damage. In addition, advancements in medical technology, leading to more effective and minimally invasive artificial urinary sphincter implantation device contribute significantly in the market growth. Rising awareness about treatment options for urinary incontinence and improvements in healthcare infrastructure, especially in developing regions, further drive the market growth.

Market Introduction and Definition

An artificial urinary sphincter implantation device is a medical apparatus designed to treat severe urinary incontinence, particularly in individuals who have lost control over their bladder due to weakened or damaged urinary sphincter muscles. This condition often arises from prostate surgery, neurological disorders, or congenital anomalies. The artificial urinary sphincter implantation device consists of three main components: a cuff that encircles the urethra, a pressure-regulating balloon placed in the abdomen, and a pump implanted in the scrotum or labia. The cuff maintains continence by exerting pressure on the urethra to prevent urine leakage. When the patient needs to urinate, they manually activate the pump, which temporarily deflates the cuff, allowing urine to pass. After urination, the cuff automatically re-inflates to resume its control over the urethra. The implantation of an artificial urinary sphincter implantation device is typically recommended when other less invasive treatments have failed. The procedure involves surgical placement of the device under anesthesia, followed by a period of recovery and adjustment.

Key Takeaways

- The artificial urinary sphincter implantation device market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major artificial urinary sphincter implantation device industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives

Key Market Dynamics

According to artificial urinary sphincter implantation device market forecast analysis the key factors driving the growth of the market are increasing prevalence of urinary incontinence, particularly among the aging population, rising awareness about urinary health, advancements in medical technology, and improved success rates of artificial urinary sphincter implantation procedures. Urinary incontinence, characterized by the involuntary leakage of urine, affects millions of individuals globally, with its incidence climbing due to an aging population and lifestyle factors. The condition is particularly prevalent among older adults, where it often results from weakened pelvic muscles, neurological disorders, or prostate surgeries in men. Women are also significantly affected, particularly after childbirth or menopause. According to a 2023 article by National Library of Medicine, 7% to 37% of women ages 20 to 39 report some degree of urinary incontinence. The growing prevalence of the urinary incontinence is expected to demand for effective treatment options, including surgical interventions like artificial urinary sphincter implantation device. Thus, the increasing prevalence of the urinary incontinence is expected to drive the AUS implantation device market size.

Furthermore, according to artificial urinary sphincter implantation device market opportunity analysis technological advancements is expected to contribute significantly in the market growth. Innovations in materials and design have led to the development of more reliable and biocompatible AUS devices, enhancing patient outcomes and reducing complication rates. Advanced materials such as silicone and titanium improve the durability and functionality of the devices, while the integration of new, minimally invasive surgical techniques has made the implantation process safer and more efficient. Furthermore, advancements in imaging technologies and diagnostic tools have enabled more accurate placement and customization of AUS devices, tailored to individual patient anatomy and needs. The incorporation of smart technology and remote monitoring capabilities has also revolutionized post-operative care, allowing for continuous tracking of device performance and early detection of potential issues. Thus, the technological advancement is expected to drive the AUS implantation device market size.

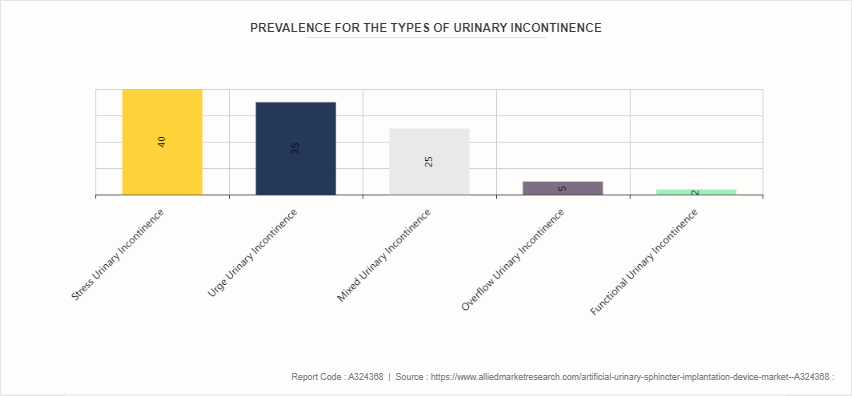

Urinary Incontinence Prevalence Based on Type

Urinary incontinence is the involuntary leakage of urine, a condition that can significantly impact quality of life. It affects millions of people worldwide, with higher prevalence among women, particularly as they age. There are several types of urinary incontinence, including stress incontinence, urge incontinence, overflow incontinence, and functional incontinence. Stress incontinence occurs when physical activity or exertion, such as coughing or lifting heavy objects, puts pressure on the bladder, leading to leakage. Urge incontinence, or overactive bladder, involves a sudden and intense urge to urinate followed by an involuntary loss of urine. Overflow incontinence happens when the bladder cannot empty completely, causing it to overflow and leak. Functional incontinence is related to physical or mental impairments that hinder timely bathroom access. Causes of urinary incontinence vary and can include weakened pelvic floor muscles, hormonal changes, neurological disorders, urinary tract infections, and certain medications. According to the artificial urinary sphincter implantation device market growth analysis the rise in prevalence of the urinary incontinence is expected to contribute significantly in the growth of the market.

Market Segmentation

The artificial urinary sphincter implantation device market is segmented into type, gender, end user, and region. By type, the market is divided into AMS 800 and other. By gender, the market is divided into male and female. As per end user, the market is divided into hospitals, specialty clinics, and ambulatory surgery centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America is expected to dominate the artificial urinary sphincter implantation device market share owing to substantial research and development activities, a strong presence of major key players, well-established healthcare systems, high adoption of advanced medical technologies, and increasing prevalence of urinary incontinence. In the Asia-Pacific region, rapid market expansion is anticipated due to improving healthcare infrastructure, rising healthcare expenditures, and increasing awareness among the population regarding effective urinary incontinence management solutions. Countries like China and India are witnessing significant market growth due to rise in geriatric population and increasing healthcare investments.

- According to a 2023 article by National Library of Medicine, approximately 13 million Americans experienced urinary incontinence in 2023.

- According to 2022 fact sheet by Invest India, hospital sector in India is expected to grow at CAGR of 18.24% from 2021 to 2027.

- According to an article published by United Nations Population Fund, by 2050, one in four people in Asia and the Pacific will be over 60 years old.

Industry Trends

- According to a 2023 article by National Library of Medicine, around 423 million people (20 years and older) worldwide experience some form of urinary incontinence. The rise in urinary incontinence is expected to contribute significantly in the growth of the artificial urinary sphincter implantation device market size.

- In a study presented at American Urological Association (AUA) Annual Meeting 2024, Fox Chase Cancer Center showed that in men who have undergone surgery for prostate cancer, the function of artificial urinary sphincters for stress urinary incontinence was improved when radiation was used as an adjuvant therapy rather than as a salvage therapy.

- According to a 2023 article by National Library of Medicine, artificial urinary sphincter (AUS) is considered to be the gold standard for surgical treatment of male non-neurogenic stress urinary incontinence (SUI) .

- According to a 2023 article by International Continence Society, the most widely implanted artificial urinary sphincter in Europe and the United States is the AMS 800

Competitive Landscape

The major players operating in the artificial urinary sphincter implantation device industry include Boston Scientific Corporation, Zephyr Surgical Implants, Rules-Based Medicine, GT Urological LLC, Uromedica, Inc, MyoPowers Medical Technologies SAS, Promedon SA, UroMems, Inc, CooperSurgical Inc., and Laborie Medical Technologies Inc. Other players in the artificial urinary sphincter implantation device market are Creo Medical Ltd, Affluent Medical and Silimed Medical Devices.

Recent Key Strategies and Developments

- In January 2022, ICU Medical, Inc. acquired Smith’s Medical, a medical device company. This helped the company gain a strong position on a global level in the medical industry & technology sector.

- In February 2024, UroMems announced that it has successfully met the six-month primary endpoint for the first-ever female patient implanted with the UroActive System, the first smart automated artificial urinary sphincter (AUS) to treat stress urinary incontinence.

- In March 2024, Affluent Medical, announced the successful first-in-human implantation of the minimally invasive medical device Artus for the treatment of urinary incontinence.

Key Sources Referred

- National Library of Medicine

- Center of Disease Control and Prevention

- American Urological Association

- United Nations Population Fund

- International Continence Society

- World Health Organization

- Invest India

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the artificial urinary sphincter implantation device market segments, current trends, estimations, and dynamics of the artificial urinary sphincter implantation device market analysis from 2023 to 2033 to identify the prevailing artificial urinary sphincter implantation device market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the artificial urinary sphincter implantation device market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global artificial urinary sphincter implantation device market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global artificial urinary sphincter implantation device market trends, key players, market segments, application areas, and market growth strategies

Artificial Urinary Sphincter Implantation Device Market , by Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.1 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Gender |

|

| By End User |

|

| By Region |

|

| Key Market Players | Uromedica, Inc, Cooper Surgical, Inc., LABORIE Medical Technologies Inc., Rules-Based Medicine, UroMems, Inc, Boston Scientific Corporation, GT Urological LLC, MyoPowers Medical Technologies SAS, Zephyr Surgical Implants, Promedon SA |

The global artificial urinary sphincter implantation device market was valued at $0.5 billion in 2023

The forecast period for Artificial Urinary Sphincter Implantation Device Market is 2024-2033.

Major key players that operate in the Artificial Urinary Sphincter Implantation Device Market are Boston Scientific Corporation, Zephyr Surgical Implants, and CooperSurgical Inc

The base year is 2023 in Artificial Urinary Sphincter Implantation Device Market

The market value of Artificial Urinary Sphincter Implantation Device Market is projected to reach $1.1 billion by 2033

Loading Table Of Content...