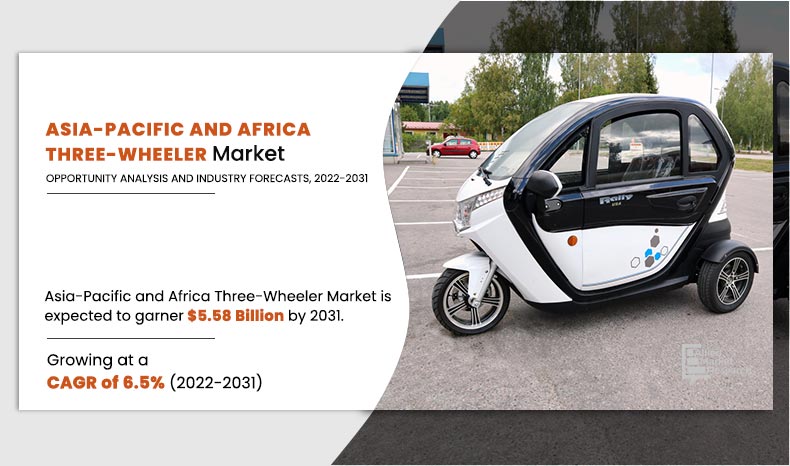

The Asia-Pacific and Africa three-wheeler market was valued at $3.05 billion in 2021, and is projected to reach $5.58 billion by 2031, registering a CAGR of 6.5% from 2022 to 2031.

A three-wheeler is a three wheeled vehicle propelled by petrol/CNG, diesel, or electric motor. Three-wheelers are generally used as a commercial vehicle to transport passenger and goods. Three-wheeler mobility depends on the maneuverability, affordability, and door-to-door transport. As many developing countries, especially in Asia-Pacific and Africa require faster and significantly cheaper option for public and goods transport, which further propels the demand for three-wheeler in the region.

Manufacturers expand three wheeled vehicle product lineup to meet the demands for vehicles. Moreover, vehicle manufacturers are coming up with advanced models to cater changing customer needs. For instance, in April 2022, Mahindra & Mahindra Ltd.’s subsidiary Mahindra Electric Mobility Limited announced the launch of the Alfa CNG three-wheeler passenger and cargo vehicles. The vehicles were powered by a 395 cm3 water-cooled engine which was capable of producing 23.5 Nm torque.

Furthermore, the vehicles were prices at around $3,100 (INR 2,75,000). Moreover, Electric three-wheeler is expected to witness exponential growth during the forecast period owing to the increasing government regulation/support for electric vehicles and popularity of zero-emission vehicle in commercial vehicles sector. The electric three-wheeler is relatively inexpensive, highly efficient, and environment friendly, which is the main factor behind its increasing demand in the global market. In addition, as awareness of vehicle emissions and environmental issues has witnessed a rise, society's preference for electric vehicles, especially public transport, has increased significantly. For instance, in December 2021, Mahindra Electric Mobility launched a passenger e-3W ‘Treo’ three-wheeler in Maharashtra, India. The vehicle can be charged anywhere through a 16A socket using the onboard portable charger and a usable driving range of 130 km per charge.

The three-wheeler market is segmented on the basis of type, vehicle type, and region. Depending on type, the market is divided into petrol/ CNG, diesel, and electric. On the basis of vehicle type, it is categorized into passenger carrier and load carriers. Region wise, in the present scope the three-wheeler market is analyzed across Asia-Pacific, and Africa.

The Asia-Pacific and Africa three-wheeler market is segmented into type, vehicle type, and region. By type, the market has been categorized into petrol/ CNG, diesel, and electric. By vehicle type, the market has been classified into passenger carrier and load carriers. Region wise, the market has been analyzed across Asia-Pacific, and Africa.

Some leading companies profiled in the Asia-Pacific and Africa three-wheeler market report comprises Bajaj Auto Ltd, Piaggio & C. SpA, Atul Auto Limited, Chongqing Zongshen Tricycle Manufacture Co. Ltd, J.S. Auto Pvt Ltd, Kinetic Green Energy & Power Solutions Ltd, Mahindra & Mahindra Ltd, Saera Electric Auto Pvt. Ltd, Terra Motors Corporation and TVS Motor Company. The leading companies are adopting strategies such as product launches and business expansion to strengthen their market position.

In February 2022, Piaggio & C. S.P.A’s subsidiary, Piaggio Vehicles Private Limited (PVPL) inaugurated its first electric three-wheeler experience center in Kolkata. This allowed the Italian commercial vehicle manufacturer to enter the West Bengalmarket in India and better market its three-wheeler vehicles to its customers.

In January 2022, Mahindra & Mahindra Ltd.’s subsidiary Mahindra Electric Mobility Limited launched its new electric three-wheeler e-Alfa Cargo. The e-Alfa Cargo came with a payload capacity of 310 kg and was capable of covering a distance of 80 km. The model had a peak power of 1.5kW, allowing the vehicle to reach a top speed of 25 km/h.

In April 2020, Kinetic Green Vehicles launched an e-fogger, e-sprayer range, and UV sanitizer. The e-fogger and sprayer come mounted atop the company's battery-operated electric three-wheeler, Safar. This acted as an affordable choice for disinfection amid the COVID-19 pandemic.

In March 2020, Bajaj Auto ltd. launched 14 BS-6 compliant three-wheeler commercial vehicles. Its wide range of commercial three-wheelers were available in BS-VI technology across its brands Maxima, Maxima Cargo, and RE. Furthermore, the RE brand came with fuel injection (FI) technology in a 236 cc Engine across three fuel options that include CNG, LPG and petrol.

An inclination toward the use of electric three-wheeler as an eco-friendly & efficient solution for commute

Continuously growing global carbon emission by combustion of fuel has been one of the foremost concerns for governments and environmentalists for the past few years, which as result, bolsters the demand for three-wheeler across the Asia-Pacific and Africa; thereby, supplementing the growth of the market. Furthermore, the increase in fuel prices at the international level, growth in pollution, and traffic congestion, especially in urban areas have further increased the acceptance of three-wheeler across many countries of Asia-Pacific & Africa. For instance, in March 2019, cab giant Ola launched an entire fleet of Bajaj and Piaggio auto-rickshaws in the Liverpool area to overtake Uber. In addition, relatively higher running and maintenance costs of petrol/ CNG & diesel propelled three-wheeler accelerates to a shift in preference for three-wheeler for shorter transits, which, in turn, drives the three-wheeler market growth.

In addition, the battery is the main component of an electric three-wheeler. As of 2020, most e-three-wheelers used lithium-ion or lead-acid batteries. Lithium batteries work efficiently even in bad weather. New developments in battery chemistry should help improve the efficiency of lithium-ion batteries in a three-wheeler. Shortly, the demand for lithium-ion family batteries is expected to surge with the growing number of electric three-wheelers on the road. For instance, in September 2022, Omega Seiki Mobility (OSM) recently launched a new electric-three-wheeler ‘ViCKTOR’ in India. The vehicle comes with a 20 kWh Lithium-Ion battery pack and provides a range of 250 km on a single charge.

By Type

Electric segment is projected as the most lucrative segments

A rise in the demand for last-mile connectivity

Many companies in e-commerce, pharma, textiles, retail, FMCG, and other utility segments such as dairy, poultry, and gas, prefer three-wheelers as a last-mile connectivity solution as they offer excellent maneuverability at affordable prices. For instance, an India-based company uses three-wheeler to provide first and last-mile delivery services to e-commerce and food tech players such as Amazon, Swiggy, and Bigbasket. Furthermore, governments of many countries in Asia-Pacific and Africa are very keen to convert their last-mile delivery fleet to electric due to added benefits offered by electric three-wheelers. For instance, in September 2022, the Indian startup Dandera Ventures launched the OTUA-electric cargo three-wheeler to target last-mile delivery and logistic use.

According to Mahesh Babu, MD & CEO, of Mahindra Electric, there is a very vast need for last-mile delivery across various countries, especially during the pandemic. With the effective integration of advanced technology, design, and workflow, many leading players are trying to bring the upfront cost of electric three-wheelers, which is further anticipated to opt for a three-wheeler as a last-mile connectivity solution. For instance, in 2021, Amazon India partnered with Mahindra Electric to deploy EVs in its delivery fleet. Amazon India announced that its fleet of delivery vehicles will include 10,000 electric vehicles by 2025, which is expected to bring down the overall transportation cost considerably.

Increase in fuel cost

Three-wheeler engines mostly depend on petrol or diesel in many counties of Asia and Africa region. The high cost of fuel in many parts will hamper the three-wheeler market in the region. In the past decade, fuel prices have witnessed a significant rise. Furthermore, owing to the limited supply of crude oil, the prices are anticipated to increase in the near future. The pandemic has also created a negative impact on the refineries. Furthermore, in countries such as India, high level of excise duty and VAT contributes to 63% of petrol and 60% of diesel costs. The impact of taxes on fuel prices was not that significant during the initial months of the lockdown as global crude prices collapsed completely.

However, the prices are expected to increase as global activities increase and, in that case, higher taxes will increase the prices more with every upward revision. These increased prices are foreseen to negatively impact petrol/CNG and diesel three-wheeler in the near future. However, increasing fuel prices is indirectly forcing the end user’s inclination toward the three-wheelers. For instance, in March 2022, according to National Development and Reform Commission, retail gasoline prices will rise by 750 yuan ($118) a ton and diesel prices by $100.4 a ton in China.

By Vehicle Type

Load Carrier segment is projected as the most lucrative segment

Growth in a trend of shared mobility

Shared mobility services reduce city congestion and decrease overall vehicle emissions. Therefore, digitally enabled car-sharing and ride-hailing manage travel needs most smartly and also provide a hassle-free and environmentally sound alternative to private car ownership. This sharing & ride-hailing activity includes the entire process from travel planning to payments can be handled by a single mobile app.

In the coming years, ride-hailing services are projected to play a major role in this space by reducing manual tasks and minimizing overall time & cost. This trend is further projected to strengthen the growth of the three-wheeler market in Asia-Pacific and Africa three wheeler market. The number of users relying on ride-sharing applications has increased in recent years. For instance, in October 2020, Uber launched its ride-hailing services in 30 cities for expanding its business across the globe. Similarly, in December 2020, the Ride-hailing app Rapido extended its three-wheeler auto-rickshaw services to 11 more cities, spreading across the National Capital Region and Rajasthan, Gujarat, Uttar Pradesh, Punjab, and Andhra Pradesh. To create awareness and promote new services, the key players offer discounts, free rides, and coupon facilities to customers.

COVID-19 Impact Analysis

The production of vehicles was stunted globally, owing to the pandemic yet the automotive manufacturers focused on the development of new products and announced strategic expansion and collaboration across the industry. These factors were responsible for fluctuation in sales of three wheelers across the world. The progressive reduction in severe restrictions measures is anticipated to promote growth in sales of the three wheeler market in Asia-Pacific and Africa region.

By Region

Load Carrier segment is projected as the most lucrative segment

KEY BENEFITS FOR STAKEHOLDERS

- This study presents the analytical depiction of the Asia-Pacific and Africa three wheeler market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall Asia-Pacific and Africa three wheeler market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the Asia-Pacific and Africa three wheeler market with a detailed impact analysis.

- The current Asia-Pacific and Africa three wheeler market is quantitatively analyzed from 2021 to 2031 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Asia-Pacific and Africa Three-wheeler Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By VEHICLE TYPE |

|

| By REGION |

|

| Key Market Players | SAERA ELECTRIC AUTO PVT. LTD., BAJAJ AUTO LTD., ZUPERIA AUTO PVT. LTD, TERRA MOTORS CORPORATION, PIAGGIO & C. S.P.A, TVS MOTOR COMPANY, KINETIC GREEN VEHICLES, MAHINDRA & MAHINDRA LTD., ATUL AUTO LIMITED, J.S. AUTO PVT LTD. |

Analyst Review

The Asia-Pacific and Africa three-wheeler market is projected to witness high growth rate owing to growing need for affordable commercial vehicles with low maintenance cost. Companies in this industry are adopting various innovative techniques to provide end-users with better fuel economy and low operating cost along with lesser emissions.

Further, last mile connectivity and shared mobility are projected to strengthen the three-wheeler demand. Many E-commerce players are very keen to adopt gasoline as well as electric three-wheeler in their fleet, owing to its excellent maneuverability, low maintenance and operating cost even for the shorter transits. In addition, the current adoption rate of electric three-wheeler is expected to significantly bring down the upfront cost in coming years. Increase in penetration of electric vehicles will also help in reducing environmental impact. However, the high cost of battery, battery life cycle, and lack of electric vehicle charging infrastructure are major factors that could hamper the growth of the three-wheelers in the Asia-Pacific & Africa market. In addition, increase in fuel prices in many countries such as India, which is the one of the prominent manufacturer and consumer of three-wheeler, may hinder the growth of petrol/CNG and diesel propelled three-wheelers.

Among the analyzed regions, Asia-Pacific accounted for the highest revenue in the market in 2022. However, Africa is expected to grow at a considerable growth rate, predicting lucrative opportunities for the key players operating in the three-wheeler market.

Loading Table Of Content...