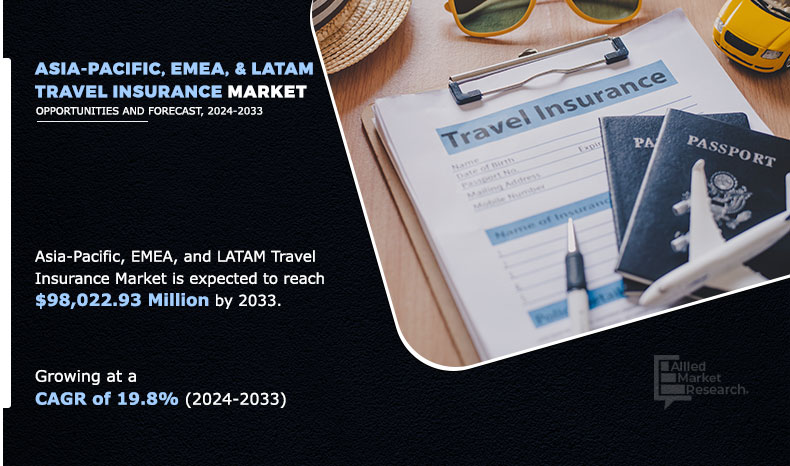

Asia-Pacific, EMEA, and LATAM Travel Insurance Market Statistics: 2033

The Asia-Pacific, EMEA, and LATAM travel insurance market was valued for $15,692.76 million in 2023 and is estimated to reach $98,022.93 million by 2033, exhibiting a CAGR of 19.8% from 2024 to 2033.

Travel insurance is coverage designed to protect against risks and financial losses that can occur while traveling. The risks range from minor inconveniences such as missed airline connections and delayed luggage all the way to more serious issues including injuries or major illness. Travel insurance policies are usually available for both international tourists as well as domestic travelers. Moreover, travel insurance can provide travelers with a sense of security and safety while visiting a foreign land.

The increasing volume of travel and tourism activities is a key driver for the Asia-Pacific, EMEA, and LATAM travel insurance market, as more people seek insurance coverage for potential risks during their trips. In addition, rising awareness of travel-related risks, such as medical emergencies or trip cancellations, has fueled the demand for travel insurance as a means of protection. In addition, regulatory requirements in certain countries or destinations mandating travel insurance contribute to market growth across Asia-Pacific, EMEA, and LATAM.

However, the lack of awareness regarding travel insurance policies among users limits the growth of this market. Contrarily, new technological developments in the travel insurance industry are anticipated to provide lucrative growth opportunities to the market in the upcoming years. Moreover, the emerging markets offer potential for market expansion, as more individuals from these regions travel and seek insurance coverage. Lastly, partnerships and collaborations with airlines, travel agencies, and online travel platforms can enhance distribution channels and tap into a wider customer base, creating opportunities for cross-selling and market growth across Asia-Pacific, EMEA, and LATAM.

On the basis of end user, the family travelers segment dominated the Asia-Pacific, EMEA, and LATAM travel insurance market in 2023, and is expected to continue this trend during the forecast period. This is attributed to the increasing number of family vacations, growing awareness of travel risks, and the need for comprehensive coverage that protects multiple members under a single policy. In addition, travel insurance products tailored to family needs, including kid-friendly policies and multi-trip coverage, further drive this segment's dominance in the market. However, the business travelers’ segment is expected to witness highest growth, due to the increasing frequency of corporate travel, heightened awareness of potential travel disruptions, and the need for comprehensive coverage against risks such as medical emergencies, flight cancellations, and lost documents, future propels the business travelers’ segment in Asia-Pacific, EMEA, and LATAM travel insurance market.

Segment Review

The Asia-Pacific, EMEA, and LATAM travel insurance market is segmented on the basis of insurance cover, distribution channel, end user, age group, and region. By insurance cover, it is fragmented into single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance. By distribution channel, the market is divided into airlines, banking organizations, ferry operators, insurance brands, online travel agency (OTA), railway operators, travel agents/tour operators, and others. By end user, it is classified into senior citizens, education travelers, business travelers, family travelers, and others. By age group, it is segregated into 1-17 years old, 18-30 years old, 31-49 years old, and above 50 years. By region, it is analyzed across Europe, Asia-Pacific, and LAMEA.

Competition Analysis

The report analyzes the profiles of key players operating in the Asia-Pacific, EMEA, and LATAM travel insurance market such as Allianz Partners, American International Group, Inc., Assicurazioni Generali S.p.A, Aviva Plc., AXA, Berkshire Hathaway Specialty Insurance Company, Chubb Limited, ERGO Travel Insurance Services Ltd., Generali Global Assistance And Insurance Services, Insurefor.com, Just Insurance Agents Limited, PassportCard Deutschland GmbH, TICORP Limited, Trailfinders Ltd., and Zurich Insurance Company Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the Asia-Pacific, EMEA, and LATAM travel insurance market.

Recent developments in the Asia-Pacific, EMEA, and LATAM Travel Insurance Market

In July 2022, AXA announced that it has partnered with ROCK Insurance Group. The strategic partnership sees the company underwrite several ROCK Insurance Group’s travel insurance policies including Jet2, Onthebeach, Travel Republic, Insurefor, Leisure Guard and Big Blue, among others. The policies cover single trip, annual multi-trip and backpacker travel insurance, alongside cover for Gadgets and Car Hire Excess Protection.

In July 2022, Zurich Insurance Group Insurance launched the Travel VIVA Insurance Plan, the first-in-market insurance to provide protection during the quarantine period upon returning to Hong Kong. The plan offers free extension of the covered period and overseas quarantine hotel coverage upon infection or compulsory quarantine after departure.

In February 2021, Chubb partnered with global online travel company Travix. The collaboration sees the offer of Chubb's comprehensive travel insurance plans to customers using Travix websites when making their travel arrangements.

In July 2020, Insurefor.com launched a new product to protect consumers against COVID-related issues both pre-departure and while abroad. The new product includes pre-departure cover for cancellation, if travelers test positive for COVID-19 (even if this is at the airport) and cannot travel. It also covers emergency medical care and repatriation while travelling should they contact the virus while abroad.

By Age Group

31-49 Years Old segment is projected as one of the most lucrative segments.

Top Impacting Factors

Rapid growth in tourism

Rise in tourist population, owing to increase in disposable income, extensive coverage for holidays, and easy online travel booking options, have led to growth in the tourism industry. For instance, a recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA) in 2021, revealed that 57% of them were expected to be traveling within two months of the pandemic’s containment, and 72% of them are anticipated to do so as soon as they can meet friends and family.

By Insurance Cover

Single-Trip Travel Insurance segment is projected as one of the most lucrative segments.

Further, with the increase in tourism, there has been an increase in several incidences such as cancelled flights, accidents, health issues, theft or loss of baggage, natural calamities, and other such occurrences of uncertainties during travel. Hence, to mitigate risks associated with such incidences, consumers opt for travel insurance. Therefore, rapid rise in tourism propels the growth of the Asia-Pacific, EMEA, and LATAM travel insurance market.

By End User

Family Travelers segment is projected as one of the most lucrative segments.

Lack of awareness regarding travel insurance policy

The lack of awareness regarding travel insurance policies across Asia-Pacific, and EMEA serves as a significant restraint in these regions. Many travelers in these regions are either unaware of the benefits of travel insurance or do not understand the coverage options available for them. This knowledge gap leads to lower adoption rates, as potential customers do not perceive the necessity or value of such policies. In addition, cultural factors and varying levels of market maturity further contribute to this lack of awareness, hindering the growth and penetration of travel insurance products in these regions. Effective educational initiatives and targeted marketing strategies are essential to overcome this barrier and promote the advantages of travel insurance.

By Distribution Channel

Insurance Brands segment is projected as one of the most lucrative segments.

Expansion of products and services

Travel insurance has immense potential to expand existing products and services in the market. Companies normally include trip cancellation & interruption, medical, evacuation, baggage, and flight insurance. Thus, insurers are expected to have lucrative opportunities to innovate and expand their offerings by including specific coverages such as pre-existing medical condition, identity theft or political evacuation, and others. For instance, in February 2022, Vistara entered into an association with Allianz Partners to provide insurance services to its customers. This enabled the option to avail travel insurance while booking their domestic or international flights. Further, these coverages are generally provided in a combination or bundled offerings; thereby, becoming difficult for consumers to choose specific requirements from the plans. Hence, to eliminate these factors, travel insurance providers are expected to have an opportunity for product expansion in the upcoming years.

By Region

Asia-Pacific segment is projected as one of the most lucrative segments.

Key Benefits for Stakeholders

- The study provides an in-depth Asia-Pacific, EMEA, and LATAM travel insurance market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the Asia-Pacific, EMEA, and LATAM travel insurance market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the Asia-Pacific, EMEA, and LATAM travel insurance industry.

- The quantitative analysis of the Asia-Pacific, EMEA, and LATAM travel insurance market for the period 2022–2032 is provided to determine the Asia-Pacific, EMEA, and LATAM travel insurance market potential.

Asia-Pacific, EMEA, and LATAM Travel Insurance Market Report Highlights

| Aspects | Details |

| By Insurance Cover |

|

| By Distribution Channel |

|

| By End User |

|

| By Age Group |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

According to the CXO's of leading market players, the Asia-Pacific, EMEA, and LATAM travel insurance market is experiencing significant growth due to several factors. Firstly, the increased number of travelers and the availability of travel insurance through online vendors and intermediaries have contributed to a surge in adoption. This presents an opportunity for companies to capitalize on the growing customer base. Additionally, the COVID-19 pandemic has heightened health risks while traveling, leading to a higher demand for travel insurance. Many local governments and authorities are mandating travel insurance for foreign visitors, further driving the market growth. For instance, travel insurance is mandatory for travelers visiting countries in the Schengen Area of Europe. The insurance must meet specific requirements, including a minimum coverage of $ 32,500 for medical emergencies and repatriation.

In addition, the partnerships and acquisitions by key players provide several opportunities for market growth. For instance, in June 2023, Blink Parametric and Newpoint's GetCover.com entered a strategic partnership to introduce a range of customized online travel insurance products. The collaboration focuses on incorporating a cutting-edge parametric flight delay solution into the travel insurance policies, catering to eligible policyholders. This innovative offering leverages real-time data to provide timely coverage and compensation in the event of flight delays.

The partnership aims to enhance the overall travel insurance experience by offering tailored solutions that address the specific needs and concerns of travelers. Moreover, with the rise in demand for travel insurance covers, various companies have expanded their current services to continue with the rising demand. For instance, in June 2023, FijiCare launched a new travel insurance product. The comprehensive travel insurance product includes coverage for medical expenses, including hospitalization and COVID-19 coverage, the repatriation of mortal remains, accidental death, and trip curtailment.

Loading Table Of Content...