Assembly Automation Market Research, 2032

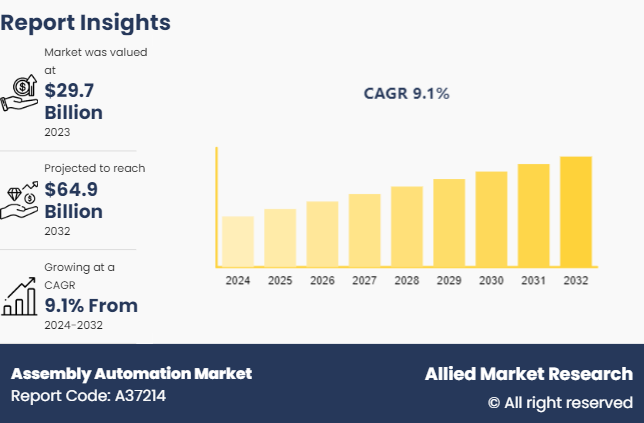

The Global Assembly Automation Market was valued at $29.7 billion in 2023, and is projected to reach $64.9 billion by 2032, growing at a CAGR of 9.1% from 2024 to 2032.

Market Dynamics

Assembly automation involves using technology and machinery to handle tasks in the manufacturing process that were traditionally done by hand. This includes employing robotics, conveyor systems, automated guided vehicles (AGVs) , and computerized control systems to assemble components into final products. The aim is to enhance production efficiency, improve product quality, lower labor costs, and reduce human error.

Assembly automation industry uses various techniques and tools, such as pick-and-place robots, automated fastening systems, and vision inspection systems to streamline operations. It is extensively used in industries like automotive, electronics, and consumer goods, facilitating high-volume production with consistent precision and reliability. By automating repetitive and complex tasks, manufacturers can achieve greater scalability and flexibility in their production processes.

Key Takeaways

The assembly automation market growth study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major assembly automation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global assembly automation markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The assembly automation market is experiencing rapid growth due to the rise in need for efficiency and productivity in manufacturing, advancements in robotics and AI, and the demand for high-quality, consistent output. Major industries like automotive, electronics, and consumer goods use automation to remain competitive.

However, the market faces certain restraints and challenges. High initial setup and maintenance costs can be prohibitive for small and medium-sized enterprises. In addition, integrating automation systems with existing processes can be complex, and there are concerns about job displacement.

Despite the challenges, the emergence of Industry 4.0 and the Internet of Things (IoT) promises connected and intelligent automation systems. Increase in adoption in emerging economies, driven by industrial growth and technological advancements, offers substantial market expansion potential. Furthermore, innovations in AI, machine learning, and collaborative robots (cobots) are expected to open assembly automation market opportunity for enhancing efficiency and flexibility in assembly automation.

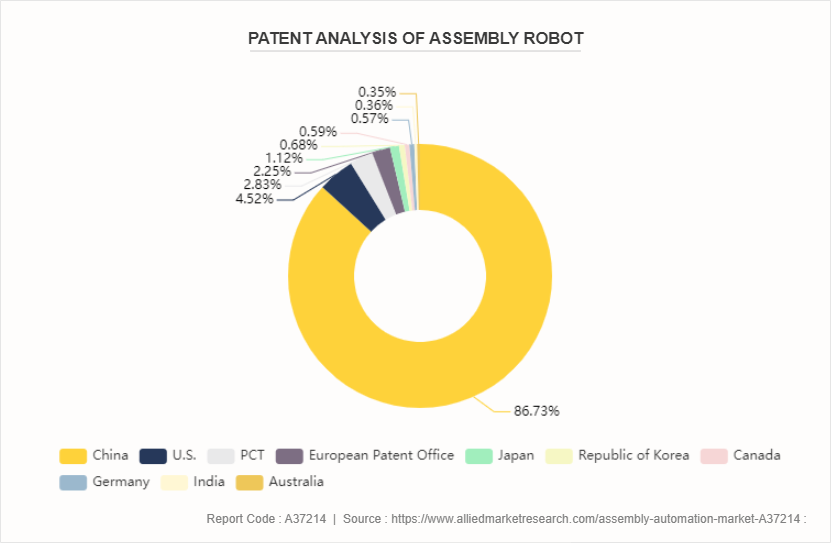

Patent Analysis of Global Assembly Automation Market

The market is analyzed according to the patents filed by China, U.S., PCT, European Patent Office, Japan, Republic of Korea, Canada, Germany, India, and Australia. Approvals from these patent holders are followed by high adoption of assembly robots and initiatives associated with enhancing assembly line production at regional and global level. Therefore, these countries have the maximum number of patent filings.

Market Segmentation

The assembly automation market is segmented into product type, and application. On the basis of product type, the market is divided into central control system, robot automation equipment, and others (conveyors and feeders, automated guided vehicles) . As per application, the market is segregated into automotive, 3C industry, and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East & Africa.

Market Segment Outlook

Based on product type, the robot automation equipment segment held the highest market share in 2023, accounting for more than half of assembly automation market size due to its unparalleled versatility, precision, and efficiency. Robots excel in handling diverse assembly tasks across industries, from automotive to electronic.

Based on application, the automotive segment held the highest market share in 2023, accounting for nearly half of the assembly automation market share. The automotive industry requires high-volume production with precise assembly processes. Automation is crucial for meeting production targets while ensuring consistent quality and efficiency.

Regional/Country Market Outlook

The assembly automation market in the Asia-Pacific region is set for significant growth, driven by the robust manufacturing sector and the increasing use of automation technologies. Nations like China, Japan, India, South Korea, and Taiwan are leading this expansion, particularly in automotive, electronics, and consumer goods industries. For instance, China's automotive sector is embracing automation to meet rising demand, while Japan is known for its advancements in robotics and precision engineering. Prominent players in the APAC assembly automation market include ABB Ltd., Fanuc Corporation, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, and Omron Corporation. These companies adopt strategies like product innovation, strategic partnerships, and geographical expansion to maintain their market leadership. ABB, for instance, focuses on collaborative robots for flexible automation, while Fanuc Corporation integrates AI and IoT into its robotic systems. These initiatives position these players as top players in the evolving landscape of assembly automation across the APAC region.

In September 2022, Alcatel Submarine Networks (ASN) inaugurated Europe’s largest private 5G network at its submarine systems production and assembly site in Calais, France. This deployment is a significant step in ASN’s Industry 4.0 strategy, aiming to modernize industrial processes, optimize operational performance, and improve working conditions.

In March 2024, Robotnik Automation SLL highlighted the benefits of mobile manipulator robots for assembly lines. Its RB-KAIROS+ robots are designed to streamline assembly processes with great precision, offering flexibility, efficiency, space optimization, and safety. These robots are particularly beneficial in industries such as automotive, electronics, aerospace, and food, where assembly tasks are frequent and demanding.

In June 2024, Panasonic Life Solutions India introduced the country’s first AI-powered MINAS A7 Servo System, designed to reduce human operation time by 90%. This system is expected to deliver the highest motion performance and precise automatic tuning, which was previously only achievable by human experts.

Competitive Landscape

The major players operating in the Assembly Automation market forecast include ABB Ltd., Fanuc Corporation, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Omron Corporation, KUKA AG, Rockwell Automation, Inc., Schneider Electric SE, Bosch Rexroth AG and Kawasaki Heavy Industries Ltd.

Other players in Assembly Automation market include Fives Group, ATS Automation Tooling Systems Inc., Comau SpA, Universal Robots (Teradyne Inc.) and others.

Recent Key Strategies and Developments

In June 2024, Rockwell Automation, Inc. announced RapidLaunch, a new platform from Rockwell Automation offering a standardized automotive controls solution that is globally recognized, scalable, and supports multiple languages.

In June 2024, B&R Industrial Automation presented adaptive solutions for MedTech and Pharma at ACHEMA 2024 in Frankfurt. It showcased AI-enhanced, IIoT-connected, adaptive automation technology that addresses the challenges in assembly and packaging of medical devices and pharmaceuticals.

Industry Trends:

In December 2022, MIT's Computer Science and Artificial Intelligence Laboratory (CSAIL) researchers created a novel algorithm capable of autonomously constructing products. Praised for its precision, effectiveness, and adaptability across diverse and intricate real-world assemblies, the algorithm efficiently identifies the sequence for assembling multipart components and subsequently finds plausible motion paths for each step.

In Germany, Motek, the international trade fair for automation in production and assembly, is set to take place from October 8 to 11, 2024, in Stuttgart. This event will showcase intelligent solutions in production and assembly automation, feed technology, material flow, and industrial handling.

In April 2024, in the UK, Amazon Innovation Labs announced an investment of more than $755.79 million in robotics research, primarily focused on improving assembly automation processes.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the assembly automation market analysis from 2024 to 2032 to identify the prevailing assembly automation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the assembly automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global assembly automation market trends, key players, market segments, application areas, and market growth strategies.

Assembly Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 64.9 Billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Schneider Electric SE., Rockwell Automation, Inc., Kuka AG., Bosch Rexroth AG, ABB Ltd., Mitsubishi Electric Corporation, Omron Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., FANUC Corporation |

Increasing adoption of Industry 4.0 technologies, the integration of 3D printing with automated assembly lines and Improved machine vision technology are the upcoming trends of assembly automation market

Automotive is the leading application of assembly automation Market

Asia-Pacific is the largest regional market for assembly automation.

The assembly automation market was valued at $29.73 billion in 2023.

ABB Ltd., Fanuc Corporation, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Omron Corporation, KUKA AG, Rockwell Automation, Inc., Schneider Electric SE, Bosch Rexroth AG and Kawasaki Heavy Industries Ltd. are the top companies to hold the market share in assembly automation.

Loading Table Of Content...