Automatic Bending Machine Market Research, 2031

The global automatic bending machine market size was valued at $2.1 billion in 2021, and is projected to reach $3.6 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031.

Automatic bending machine is used to bend tool using a linear or rotating move. Automatic bending machines are used to bend pipe, tube, metal sheet, and bar. Bending process can be classified as form-bound bending or free-from bending. it involves heating or cold forming in these processes. Automatic bending machine utilizes mechanical force to press stock material tubes, sheet metal, or pipes against the die. The materials is pushed to conform to the designed shape of the die.

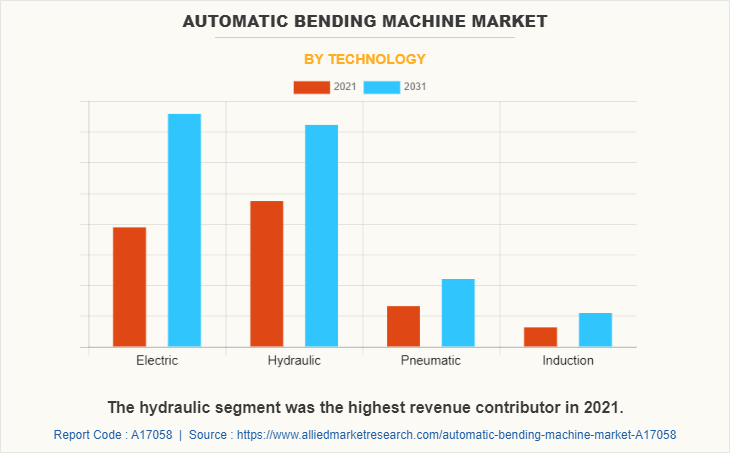

Bending machines are available in three types manual, semi-automatic, and automatic. In semi-automatic bending, the workpiece is fed manually, which prolongs the process and increases the possibility of error Loading and unloading workpieces is simple in an automatic bending machine, making the machine useful for bending workpieces that are heavy and have complex shapes.. The automatic bending machines are of electric, pneumatic, hydraulic, and induction types. Electric bending machines are preferred over other types due to their high accuracy and low power consumption. Hence, due to its user-friendliness and high precision, the market for automatic bending machines is expected to grow.

Increase in population in developing economies such as China, India, and the U.S. has led to rapid urbanization and industrialization, which is expected to boost development of the residential, manufacturing, and industrial sectors, thus increasing the demand for automatic bending machine. According to the United Nations (UN), around 68% of the global population is expected to live in urban areas by 2050. This is expected to result in increase in construction and infrastructural activities around the globe and increase in demand for automatic bending machines. Automatic bending machines play a vital role in automotive industry as they reduces the cycle time when compared with manual bending machines. In automotive industry the demand for hybrid vehicles and electric vehicle is increasing. The customers are shifting towards cleaner fuels and this gave rise to design and development of new technology in the automobile sector which requires advanced and automated machines which will ensure parts produced with precision and accuracy.

Moreover, many key players are investing in better software for automated machines. These CAD/CAM and CNC coding software helps in improving the processing of automated machines and reduces rejection rate of produced parts. For instance, TRUMPF acquired TRUMPF Metamation Pvt. Ltd., a company that develops CAD and CAM software applications and machine control solutions. With improved software TRUMPF has strengthened its automatic machine portfolio.

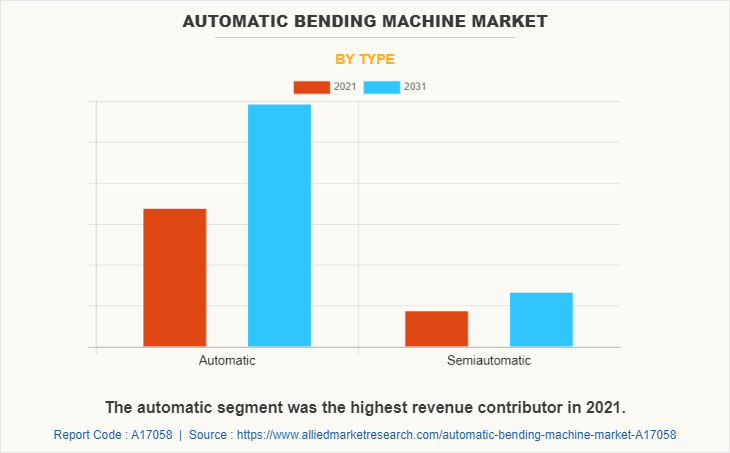

On the basis of type, the automatic segment has accounted for the highest revenue in 2021 and is expected to register significant CAGR during the automatic bending machine market forecast period. Automatic bending machines are widely used in shipbuilding, automotive, and aviation industry. The automatic bending machine is used for bending ship’s profiles into frames for ships. In addition, it is used in automotive industry as it reduces the cycle time when compared with manual bending machines. The parts to be produced are heavy and require precision, which can be achieved by automatic bending machine.

On the basis of technology, the hydraulic segment has generated the highest revenue in 2021. Hydraulic automatic bending machines offer high accuracy of bending as compared to other technological types. A hydraulic bending machine works with a pressure sequence generated by a hydraulic motor, and this equipment is mainly used for bending hard metal pipes. The machine is equipped with dies to continue bending and is also equipped with clamping cylinders to prevent material from slipping out of the clamps.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the automatic bending machine market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 on the market. This has led to the reopening of automatic bending machine companies at their full-scale capacities. This is expected to help the market recover by the end of 2022. After COVID-19 infection cases begin to decline, automatic bending machine manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

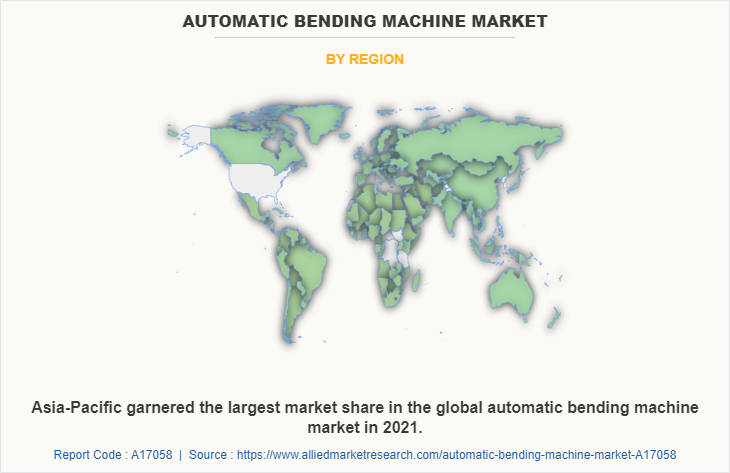

Asia-Pacific dominated the market in 2021, accounting for the highest automatic bending machine market share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to increasing in manufacturing industries such as automotive, aviation, and metal in countries such as India, China, and Japan. Moreover, increase in infrastructure activities in this region are creating demand for automatic bending machines. Thus, all such factors are expected to drive the automatic bending machine market growth in Asia-Pacific.

The automatic bending machine market is segmented into Type, Technology and Application. By type, the market is categorized into automatic and semi-automatic. Depending on technology, it is fragmented into electric, hydraulic, pneumatic, and induction. On the basis of application, it is categorized into tube/pipe, metal sheet, and bar. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competition Analysis

Key companies profiled in the automatic bending machine industry report include Amada Co., Ltd., AMOB, Baileigh Industries, Inc., BLM Group, Bystronic, Danobatgroup, Euromac, HACO, Horn Machines Tools, Inc., PEDAX GmbH, Pines Engineering & H&H Tooling, Prima Industrie S.p.A., Shuz Tung Machinery Industrial Co., Ltd., Soco Machinery, Transfluid Maschinenbau GmbH, TRUMPF, and WAFIOS AG.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automatic bending machine market analysis from 2021 to 2031 to identify the prevailing automatic bending machine market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automatic bending machine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear automatic bending machine market overview of the present position of the market players.

- The report includes the analysis of the regional as well as global automatic bending machine market trends, key players, market segments, application areas, and market growth strategies.

Automatic Bending Machine Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.6 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 262 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Soco Machinery, Pines Engineering & H&H Tooling, Euromac, WAFIOS AG, TRUMPF, Transfluid Maschinenbau GmbH, Shuz Tung Machinery Industrial Co., Ltd, AMOB, PEDAX GmbH, Danobatgroup, Bystronic, Amada Co. Ltd, Baileigh Industries, Inc., BLM Group, Horn Machines Tools, Inc., HACO, Prima Industrie S.p.A. |

Analyst Review

The automatic bending machine market has witnessed significant growth in past few years, owing to increase in manufacturing sectors and industrialization. Moreover, increase in demand for automation in factories is increasing the employment of smart manufacturing technologies for the merchandise development and production process. In addition, rise in demand from various other sectors such as electronics, construction, and automotive boost the market growth.

Furthermore, automated bending machines are cost-effective and have minimal maintenance requirements, making them ideal for use in small industries. In addition, automated bending machines are employed in the bending of tubes and pipes, metal sheets, and bars due to their simple and durable construction.

Furthermore, key players such as Amada Company, Bystronic, and TRUMPF offer automated bending machines. For instance, in January 2020, Bystronic launched Mobile Bending Cell 80, compact and powerful bending solution for the market that enables both automated and manual bending. Its Industrial Internet of Things (IIoT) solutions are aimed at helping manufacturers prepare for Industry 4.0 through an arrangement of networked machining and access to manufacturing data. As a result, such factors provide lucrative growth in the automatic bending machine market.

The global automatic bending machine market size was valued at $2,109.7 million in 2021.

The global automatic bending machine market size is projected to reach $3,620.6 million by 2031.

Asia-Pacific is the largest regional market for Automatic Bending Machine.

The metal sheet segment is the leading application of Automatic Bending Machine Market.

Growth of the automotive industry and increase in construction activities globally are the upcoming trends of Automatic Bending Machine Market in the world.

Few factors that are expected to hinder the automatic bending machine market growth include, fluctuating prices of raw materials.

The product launch is key growth strategy of Automatic Bending Machines industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...