Automotive Automatic Tire Inflation System (ATIS) Market Insights, 2030

The global automotive automatic tire inflation system (atis) market was valued at USD 658.10 million in 2020, and is projected to reach USD 2,262.9 miliion by 2030, growing at a CAGR of 13.3% from 2021 to 2030.

Automatic tire inflation system is a specially designed safety system, which is used to monitor tire air pressure and inflate the tire in case of low air pressure and simultaneously release excess air pressure from the vehicle tire while the vehicle is in motion. The system uses vehicle’s compressed air tanks or draws air from the surrounding using a self-contained pump to inflate or deflate the tire of the vehicle. It is essential for optimum vehicle performance on road. Automatic tire inflation system consists of a series of components such as numerous sensors and related electronics that increase safety and improve efficiency through optimized tire pressure. Moreover, with the advancement in technology followed by the introduction of advanced vehicles equipped with numerous safety features, the demand for automatic tire inflation system has increased, which eventually boosts the automotive ATIS market.

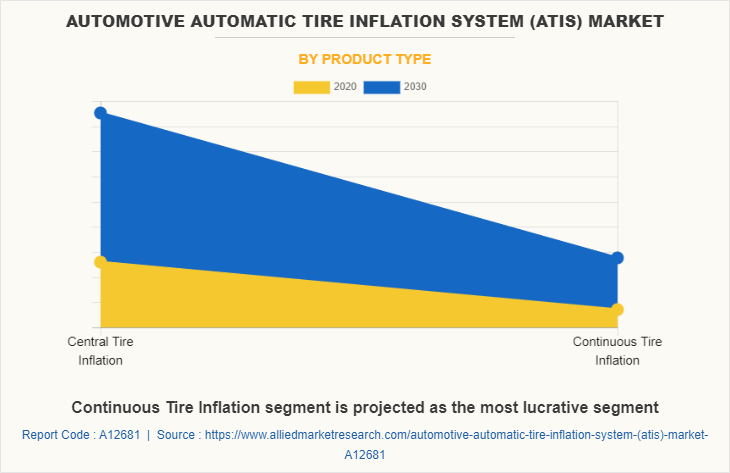

The growth of the global automotive automatic tire inflation system market is driven by factors such as increase in demand for all-terrain & military vehicles, surge in demand for incorporation of safety features in vehicles, and rise in demand for comfort while driving. However, high implementation cost & configuration complexity and nitrogen tires substituting compressed air tires hamper the growth of the market across the globe. On the contrary, technological advancements related to vehicles and integration of automatic tire inflation system with telematics are anticipated to offer remunerative opportunities for the growth of the global automotive automatic tire inflation system market. The global automotive automatic tire inflation system market is segmented into product type, application, sales channel, and region. Depending on product type, the market is categorized into central tire inflation and continuous tire inflation.

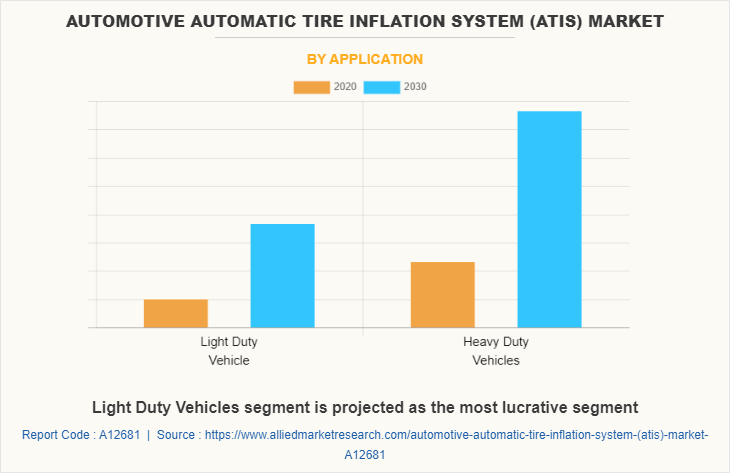

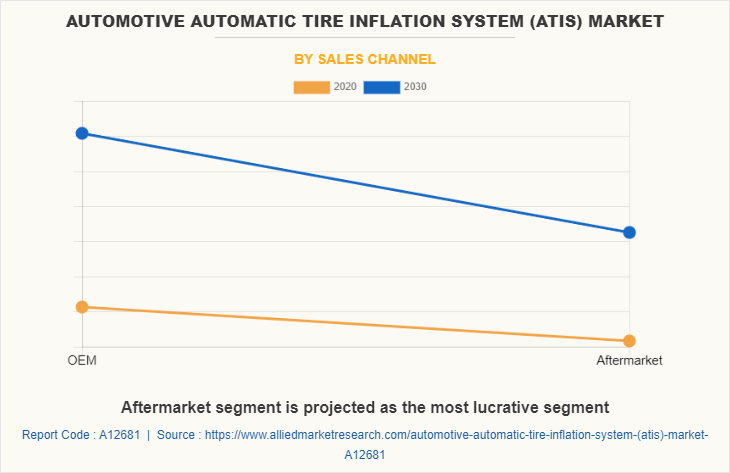

On the basis of application, it is bifurcated into light-duty vehicles and heavy-duty vehicles. By sales channel, it is fragmented into original equipment manufacturers (OEMs) and aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The key players profiled in the automotive automatic tire inflation system market report include Aperia Technology Inc., Bigfoot Equipment LTD, Dana Limited, FTL/IDEX (subsidiary of IDEX Corporation), Hendrickson USA, LLC, Meritor, Inc., Parker Hannifin Corp, SAF-HOLLAND SE, the Goodyear Tire & Rubber Company, and ti.systems GmbH.

Increase in demand for all-terrain and military vehicles

Utility all-terrain vehicles are versatile and find their application across a multiple sectors, including military, agricultural, construction, and forestry. As the military, agriculture, construction activities are increasing significantly, the demand for these vehicles is expected to escalate significantly, thus creating a positive impact on the growth of the automotive automatic tire inflation system market. Moreover, the need for advanced system such as telematics, tubeless tires, and self-inflator tires increased considerably, owing to surge in demand for off-highway vehicles across different countries, which is anticipated to open new avenues for the growth of the market across the globe.

In addition, key players operating in the industry have developed and introduced their automatic tire inflator system to be used in vehicles, which acts as a key growth driver of the automotive ATIS market. For instance, in October 2019, Aperia Technology Inc. upgraded its industry-first tire analytics platform Halo Connect, which offers new features such as precise vehicle location and service insights along with tracking tire tread depth and tire replacement time period to further simplify fleet tire maintenance decisions.

Furthermore, surge in demand for all-terrain vehicles in agriculture and military & defense applications across Asia-Pacific and North America is expected to foster the market growth, thus enabling key players to develop and introduce automatic tire inflator system to be used in different vehicles.

Incorporation of safety features in vehicles

Safety features such as engine performance analysis, tire pressure monitoring system, electronic stability control, airbags, and telematics-based features are in high demand due to increase in number of road accidents worldwide. Vehicles installed with safety features offered by advanced driver assistance system (ADAS) can detect and classify certain objects on the road and alert driver according to the road conditions as well as the condition of the vehicle. In addition, these systems ensure the safety and security of the vehicle as well as passengers on-board by creating an advanced alert related to the vehicle condition. Moreover, prominent players operating in the industry have developed advanced vehicle safety features, which include numerous subcomponents such as sensors and microcontrollers, which are intended to provide real-time information of the vehicle, thus ensuring safety of the vehicle. Moreover, increased government norms for inclusion of numerous safety features in vehicles creates a wider scope, thus supplementing the growth of the market across the globe.

High implementation cost & configuration complexity

Continuous technological advancements have necessitated the upgradation of system & software of automobiles required to keep them compatible with external environment. The cost of all components such as sensor, radio frequency, and fuzzy logics along with the assembly required in smart vehicles is significantly high. Numerous components & sensors are assembled in a single dielectric plate according to the compatibility, which incur high cost. In addition, this bulky system takes higher implementation cost, as it needs to be connected with wireless devices installed in vehicles for its proper operation. Therefore, high configuration complexity coupled with higher initial implantation cost limits the installation of automatic tire inflator system in vehicles, thus restraining the growth of the automotive ATIS market.

Integration of automatic tire inflation system with telematics

Telematics include advanced tracking devices and sensors installed in vehicles which send, receive, and store telemetry data of vehicular operations. It works on own onboard diagnostics systems (ODBI). ODBI decreases vehicle’s fuel consumption, improves safety, and reduces the possibility of cost manipulation by vehicle drivers due to the presence of on-board telematics system in vehicles. Owing to such benefits offered by telematics, automotive automatic tire inflation system is gaining high traction in the market, as it improves the performance of vehicle as well as ensures safety of the vehicle, thereby creating a positive impact on the growth of the market.

Moreover, the integration of ATIS with telematics makes air tire inflation system more reliable and advanced, as the system can perform automatically. Moreover, increase in concern over road safety and stringent regulations imposed by governments globally pertaining to the integration of automatic tire inflation systems in new vehicles is projected to open new avenues for the expansion of the automotive automatic tire inflation system market in the near future.

Key Benefits For Stakeholders

- This study presents the analytical depiction of the global automotive automatic tire inflation system (ATIS) market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents detailed impact analysis information related to the key drivers, restraints, and market opportunities.

- The current market is quantitatively analyzed from 2021 to 2030 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Automotive Automatic Tire Inflation System (ATIS) Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Sales Channel |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Parker Hannifin Corporation, Goodyear Tire & Rubber Co., Meritor Inc, ti systems GmbH, Hendrickson USA, Bigfoot Equipment LTD, FTL IDEX, Dana Limited, Aperia Technology Inc, SAF HOLLAND SE |

Analyst Review

In accordance with the insights of the CXOs of leading companies, North America is expected to dominate the global automotive automatic tire inflation system market in terms of revenue, owing to presence of robust automobile industry. In addition, it is a hub for many automotive manufacturers. Moreover, high demand for commercial & off-road vehicles in North America due to the prominent mining industry and expanding construction industry boosts the demand for automatic tire inflation systems. The current business scenario of the automotive automatic tire inflation system market has witnessed significant growth, owing to technological advancements in the automotive sector, surge in adoption of electric vehicles, and rise in demand for remote diagnostics systems. In addition, research & development in the tire industry to improve the frictional resistance property of tires to increase vehicle efficiency by about 1–1.4% boosted the adoption of automatic tire inflation system, especially in the developed countries such as the U.S., Germany, and the UK.

According to insights gathered from primary sources, increase in adoption of technologies in vehicles to improve fuel efficiency & passenger comfort and the government regulations & safety measures for tire inflation on vehicles have fueled the demand among aftermarket players. Moreover, companies operating across the globe are adopting numerous innovative technologies and investing in R&D projects. For instance, in September 2021, Hendrickson USA, LLC developed its existing tire pressure system with TIREMAAX PRO-LB, which helps eliminate the guesswork of tire pressure management by monitoring the pressure in air springs and reacting to changing loads automatically. Thus, adopting an improved automatic tire inflation system enhances the efficiency of tires, increases fuel efficiency, and reduces tire wear by providing sufficient air in each wheel.

Factors such as increase in demand for all-terrain & military vehicles, surge in demand for incorporation of safety features in vehicles, and rise in demand for comfort while driving. However, high implementation cost & configuration complexity and nitrogen tires substituting compressed air tires hamper the growth of the market across the globe. On the contrary, technological advancements related to vehicles and integration of automatic tire inflation system with telematics are anticipated to offer remunerative opportunities for the growth of the global automotive automatic tire inflation system market.

Among the analyzed regions, North America is the highest revenue contributor, followed by Europe, Asia-Pacific and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to maintain its lead during the forecast period, owing to increased demand for advanced features in vehicles across the Asian countries.

The global automotive automatic tire inflation system (ATIS) market was valued at $658.1 million in 2020, and is projected to reach $2,262.9 million by 2030.

North America is the largest region in Automotive Automatic Tire Inflation System (ATIS) Market

Nitrogen tires substituting compressed air tires, Integration of automatic tire inflation system with telematics are major trends in Automatic Tire Inflation System (ATIS) Market

The market is segmented into product type, sales channel, application, and region.

The key players profiled in the automotive automatic tire inflation system market report include Aperia Technology Inc., Bigfoot Equipment LTD, Dana Limited, FTL/IDEX (subsidiary of IDEX Corporation), Hendrickson USA, LLC, Meritor, Inc., Parker Hannifin Corp, SAF-HOLLAND SE, the Goodyear Tire & Rubber Company, and ti.systems GmbH.

The company profiles of the top players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top player’s operating in the industry along with their last three-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated

Loading Table Of Content...