Automotive Ethernet Market Insights, 2031

The global automotive ethernet market was valued at USD 2.1 billion in 2021 and is projected to reach USD 8.8 billion by 2031, growing at a CAGR of 14.4% from 2022 to 2031.

Automotive ethernet is a physical network that is primarily used to link automotive parts via wiring (wired network). Automotive ethernet offers a number of essential functionalities, such as Diagnostic Over Internet Protocol (DoIP-based) diagnostics, in-vehicle connectivity, and connection between electric vehicles and charging stations. Additionally, compared to the conventional wiring harness, automotive ethernet significantly reduces the weight and cost of vehicles. The leading automotive companies including General Motors, Hyundai, and Volkswagen, are implementing ethernet technology across all automotive vehicles such as passenger cars and commercial vehicles.

In recent years, the global adoption of electric vehicles (EVs) has shown progress. Automobile producers have invested a lot of money in the development of electric vehicles. The federal government has taken a number of initiatives to hasten the production of electric vehicles for both the consumer and commercial markets. The widespread adoption of electric vehicles has been spurred by technological development and the growth of the entire ecosystem, including improvements in chipsets and modules, the accessibility of lithium-ion batteries, and the modernization of charging infrastructure. Automotive ethernet offers connection for a variety of applications, including advanced driver-assistance system ADAS, infotainment, body and comfort, and engine. Offering high bandwidth applications that can operate at either high or low speeds, it addresses the problems that designers and engineers face while integrating numerous systems. Ethernet is a very important technology for communication networks in EVs as it allows powerful data transmission. EV communication architectures that are built on ethernet networks will accelerate activities for creating standards in order to promote ethernet technology in the automotive industry.

The worldwide automotive vehicles market is being greatly advanced by application and automation, and as a result, the demand for flexibility, bandwidth, and in-car networks is changing. Automotive network design and cybersecurity are heavily reliant on emerging technologies like automotive ethernet. In order to boost the acceptance of automotive ethernet applications, a large number of reputable cable and connector makers, automotive tier-1s, and top automobile OEMs are stepping forward. For instance, the inclusion of the "OPEN Alliance SIG" was announced in April 2021 by industry titans in the automotive and technology sectors such BMW AG, Toyota Motor Corporation, AB Volvo, and others. The OPEN Alliance SIG is a non-profit group that collaborates with leading automotive companies to boost the adoption of automotive ethernet-based communication. This collaboration significantly reduces cabling costs and overall network complexity. In the upcoming years, such corporate activities are estimated to contribute to the automotive ethernet market expansion.

One of the main factors hindering the growth of the global automotive Ethernet market is the increase in cyber security assaults. Additionally, the limits on manufacturers and the announced industrial shutdown are greatly impacting the global automotive Ethernet market size.

The automotive sector is largely contributing to harmful carbon emissions. For instance, according to a study by the US Environmental Protection Agency, the transportation sector was responsible for around 29% of all U.S. greenhouse gas emissions in 2019. Thus, it is anticipated that the use of the "two low-power" variants of automotive ethernet will rise dramatically, which primarily aids in reducing CO2 emissions. Additionally, various companies are involved in developing cutting-edge automotive ethernet solutions to boost their adaptability. For instance, Microchip Technology Inc., a major supplier of mixed-signal, Flash-IP, and microcontroller solutions, has declared the formal release of the energy-saving LAN8770 EtherGREEN technology in July 2020. This offers ultra-low wake-up and power sleep modes in addition to low-power operating. Such technological advancements are estimated to propel the global automotive Ethernet market growth during the forecast period.

The key players profiled in this report include Vector Informatik GmbH, NXP Semiconductors N. V., Marvell Semiconductor, Inc., Molex, Broadcom Inc., Microchip Technology Inc., Aukua Systems, Keysight Technologies, Cadence Design Systems, Inc, and Texas Instruments Incorporated.

The global automotive ethernet market is segmented on the basis of component, vehicle type, application, and region. By component, the market is sub-segmented into hardware, software, and services. By vehicle type, the market is sub-segmented into passenger cars and commercial vehicles. By application, the market is classified into chassis, infotainment, driver assistance, power train, body & comfort, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The automotive ethernet market is segmented into Component, Application and Vehicle Type.

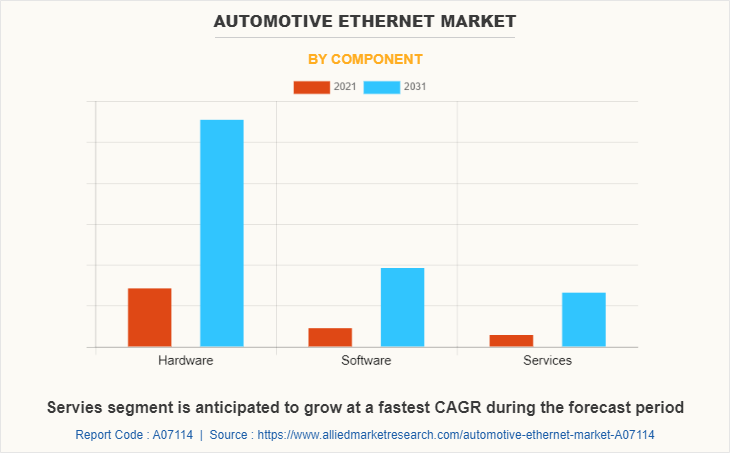

By component, the hardware sub-segment dominated the global automotive Ethernet market share in 2021, whereas the services sub-segment is projected to be the fastest growing during the forecast period. Automotive OEMs largely incorporate the ethernet hardware components such as gateways, bridges, routers, repeaters, and others. This is majorly owing to the growing demand for infotainment and ADAS (advanced driver-assistance systems). Important businesses like NXP are also developing unique products, which have a huge impact on the worldwide automotive ethernet industry. For instance, NXP Electronics, one of the biggest suppliers of automotive semiconductors, has announced plans to introduce a "multi-gigabit ethernet switch" in February 2020. The switch was created to assist automakers in providing the high-speed network required for fully integrated linked vehicles. During the projection year, such product improvements may potentially further fuel the growth of the component segment.

The services sub-segment is anticipated to show the fastest growth during the forecast period. This is majorly owing to the implementation, consulting, and training & support services among the OEM manufacturers to address the in-vehicle network complexity. Additionally, the growing number of problems encountered when installing an ethernet system in vehicles due to compatibility is estimated to boost the automotive ethernet industry demand during the projected timeframe.

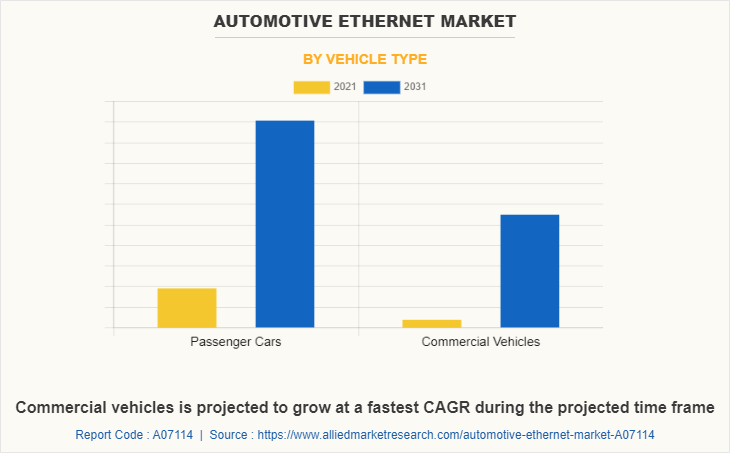

By vehicle type, the passenger cars sub-segment dominated the global automotive Ethernet market share, and the commercial vehicles sub-segment is anticipated to be the fastest growing sub-segment during the forecast period.

The improvement in the economy, technological advancements in passenger vehicles such as the incorporation of a driver assistance system, and the rise in disposable incomes have contributed to the significant expansion of the passenger cars sub-segment of the automotive ethernet market. Additionally, automotive ethernet offers a host of crucial benefits like low cost, increased bandwidth, and adaptable and scalable technology that facilitates the incorporation of different technologies in automotive vehicles. For instance, the ADAS features like lane departure warning and surround-view parking widely used the automotive ethernet technology. These aspects are promoting the growth of the passenger cars sub-segment during the forecast period.

During the analysis period, it is anticipated that the combination of digitization and rising infrastructure investments will further increase demand for the commercial vehicle segment. In addition, various industry players are implementing strategic alliances in order to boost the adoption of automotive ethernet technology. For instance, in 2018, a strategic alliance was announced between Molex, a leader in data communications and commercial vehicle technology, and Aquantia, a major competitor in high-speed transceivers. According to this partnership, both businesses will endeavor to increase data bandwidth in connected and autonomous automobiles by utilizing "Aquantia Multi-Gig Automotive Ethernet" technologies in the Molex 10 Gbps Automotive Ethernet Network. Such cutting-edge innovations are anticipated to boost the demand for commercial vehicles sub-segment during the projected timeframe.

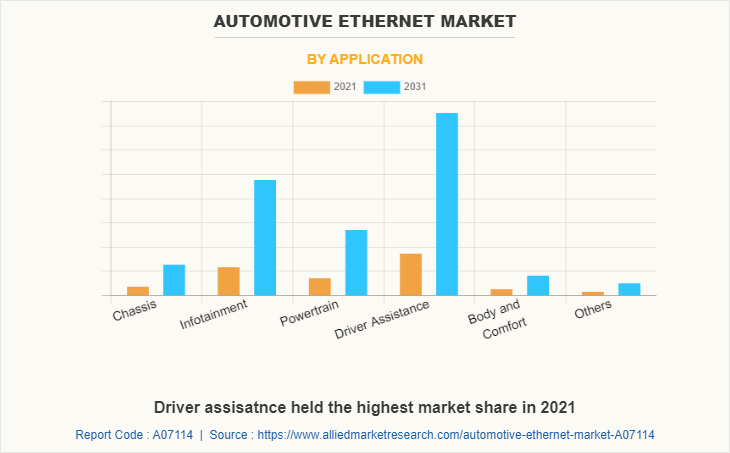

By application, the driver assistance sub-segment held the dominant market in the automotive ethernet and it is anticipated to show the fastest growth during the forecast period. The demand for the driver assistance sub-segment is being driven by a quick shift in customer preferences towards technologically-advanced automotive vehicles and a strong need for safe & fuel-efficient automobiles. Additionally, the significant increase in customer demand for vehicle infrastructure integration with high-tech gadgets is driving OEMs (Original Equipment Manufacturers) to provide in-car infrastructure in response to the rising demand for next-generation autonomous and connected vehicles.

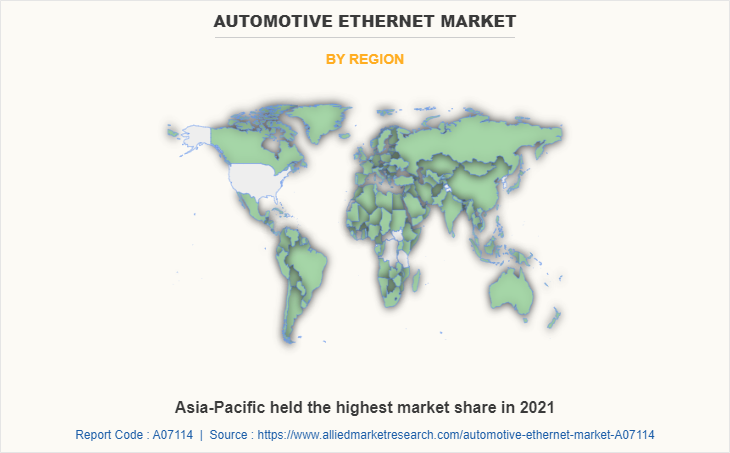

By region, the Asia-Pacific dominated the global market in 2021 as well as it is projected to show the fastest growth during the analysis timeframe. Due to technical advancements, stable socio-political environments, and significant economic growth, the automobile industry in the Asia-Pacific has seen a noticeable transition. In terms of both global automobile manufacture and sales, the Asia-Pacific area makes up the largest portion. The automotive sector has been fueled by a large consumer base and rising disposable income in emerging nations like India, China, and Malaysia. Therefore, there are abundant chances for car OEMs and automotive ethernet companies such as Mitsubishi, NEXCOM International Co., Ltd., and DASAN Networks, Inc. active in the area to boost income.

Impact of COVID-19 on the Global Automotive Ethernet Industry

- The market for automotive ethernet systems has been considerably impacted by the COVID-19 pandemic. The pandemic's negative effects have been seen throughout the entire automotive industry.

- Due to the government's imposition of a lockdown, manufacturing facilities and production have been halted down. As a result, numerous auto ethernet makers are now vulnerable due to the coronavirus.

- The majority of auto manufacturers have stopped operating all of their plants in the impacted areas as a result of the lack of workers, which has an impact on production.

- Due to the fact that automakers have somehow started creating vehicles in order to comply with government laws, manufacturers are producing ethernet at a rapid rate, which has an impact on both the installation and production of vehicles.

- However, the automotive industry began to rebound and experience growth in the final quarter of 2020. In the final three months of 2020, sales of passenger and commercial vehicles rose in North America, Asia-Pacific (APAC), and Europe.

- Along with this, government programs and initiatives for the deployment of connected vehicles and the integration of enhanced safety features are crucial since they reduce total costs for both manufacturers and consumers.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive ethernet market analysis from 2021 to 2031 to identify the prevailing automotive ethernet market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the automotive ethernet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive ethernet market trends, key players, market segments, application areas, and market growth strategies.

Automotive Ethernet Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Molex, Texas Instruments, Cadence, AUKUA SYSTEMS, Dryv.io, Marvell, DASAN Networks., Microchip, Broadcom, NXP, Keysight Technologies, Vector Informatik |

Analyst Review

The advanced driver assistance systems (ADAS) and growing use of smart entertainment systems in cars, along with the lowering cost of ethernet technology, are the key factors projected to drive revenue growth of the global automotive ethernet market during the forecast period. In addition, investing in the connected automobile concept can open up profitable potential for market players is expected to fuel revenue growth of the market in the forecast timeframe.

However, the difficulty of switching from conventional in-vehicle connectivity to ethernet which will hinder the expansion of the global market and is expected to hamper the market revenue growth during the forecast period. Investments in the connected car concept is anticipated to open up new market opportunities which can provide lucrative opportunities to the key players.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by the end of 2031. Technical advancements, stable socio-political environments, and significant economic growth are the key factors responsible for dominating position of Asia-Pacific in the global automotive ethernet market.

Vector Informatik GmbH, NXP Semiconductors N. V., Marvell Semiconductor, Inc., Molex, Broadcom Inc., Microchip Technology Inc., Aukua Systems, Keysight Technologies, Cadence Design Systems, Inc, and Texas Instruments Incorporated are the major players in the automotive ethernet market.

Asia Pacific will provide more business opportunities for the global automotive ethernet market in future.

The application & automation and technological advancements in the automotive sector are significantly the major market driving factors in the automotive ethernet market. In addition, government policies, growth in the consumer economy, and OEM’s investments are the key drivers boosting electric vehicle (EV) production, thus it is expected to fuel revenue growth of the market in the forecast timeframe.

The introduction of micro-electromechanical systems (MEMS) associated with advanced driver-assistance system (ADAS), the emergence of connected vehicles, and the technological advancements of infotainment and IoT equipment is anticipated to boost the automotive Ethernet market in the upcoming years.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global automotive ethernet market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...