Automotive Hybrid Starter Generator (HSG) Market Research, 2033

The global automotive hybrid starter generator market size was valued at $17.4 billion in 2023, and is projected to reach $26.3 Billion by 2033, growing at a CAGR of 4.5% from 2024 to 2033.

Market Introduction and Definition

Automotive Hybrid Starter Generators (HSG) are integrated systems that combine the functions of a starter motor and an alternator. They are crucial in hybrid vehicles for starting the engine, generating electricity, and enhancing fuel efficiency by providing additional power during acceleration and regenerating energy during braking. Furthermore, in hybrid vehicles, the HSG performs the initial engine start-up more efficiently. It can do this seamlessly during stop-start operations, which is crucial for fuel saving and reducing emissions in city driving.

The Automotive Hybrid Starter Generator (HSG) market refers to the industry segment that involves the production, distribution, and sales of integrated systems designed to enhance the performance and efficiency of hybrid vehicles. These systems combine the functions of a starter motor and an alternator to provide various benefits, including improved fuel efficiency, reduced emissions, and enhanced vehicle performance.

Key Takeaways

The automotive hybrid starter generator market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive hybrid starter generator industry participant along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In June 2022, Mahindra launched its new generation of Scorpio SUV in India that comes powered by a gasoline and a diesel engine. In addition, the car also features a start-stop feature.

In March 2023, Proton introduced its first mild-hybrid electric vehicle (MHEV) model, the X90. The XC90 model is equipped with a 48 V Belt-Starter Generator (BSG) motor, a DCDC converter, a 48 V lithium-ion battery, a battery management system, a recuperation braking system, and a hybrid module control system.

In April 2022, Maserati introduced the Maserati Grecale, a mild-hybrid vehicle in Italy. The hybrid powertrain comes in two outputs, with entry-level Grecale GTs getting a 296 hp version while up-level Modena trims getting 325 hp. All models come with all-wheel drive and eight-speed automatic gearboxes. The Maserati Grecale witnessed a sale of around 1, 704 units in 2022 in the country.

In March 2022, Maruti Suzuki launched a facelift of Baleno in India, which comes with micro-hybrid features such as the start-stop function.

Key Market Dynamics

The rise in demand for fuel efficiency is a significant driver of the automotive hybrid starter generator market size. Modern consumers are increasingly prioritizing fuel efficiency when purchasing vehicles. As fuel prices fluctuate and environmental awareness grows, buyers are seeking vehicles that offer better mileage and lower operating costs. Hybrid starter generators play a crucial role in enhancing the fuel efficiency of hybrid vehicles by optimizing engine performance and reducing fuel consumption. Furthermore, surge in vehicle production, and technological advancements have driven the demand for the automotive hybrid starter generator market share.

However, limited infrastructure for hybrid vehicles hampered the growth of the automotive hybrid starter generator market growth. Hybrid vehicles, particularly plug-in hybrids, require access to charging stations for optimal operation. In many regions, especially in developing countries, the number of charging stations is inadequate. This scarcity discourages consumers from purchasing hybrid vehicles, thereby reducing the demand for hybrid starter generators. Moreover, shift to electric vehicles, and technical challenges are major factors that hamper the growth of the automotive hybrid starter generator market forecast. On the contrary, rise in adoption of electric and hybrid vehicles is a lucrative opportunity for the automotive hybrid starter generator market size. Continuous improvements in hybrid vehicle technology, such as enhanced battery systems, more efficient electric motors, and advanced power management systems, are making hybrid vehicles more appealing. As these technologies advance, the performance and reliability of hybrid starter generators improve, driving their adoption in new vehicle models.

Fuel Efficiency and Emission Reduction Initiatives of Global Automotive Hybrid Starter Generator Market

Modern hybrid vehicles are increasingly adopting 48-volt architectures, which offer significant improvements in fuel efficiency and emission reductions. Different starter generator topologies, such as crankshaft-mounted (P1) , gearbox-mounted (P2/P3) , and rear-axle mounted (P4) systems, provide varying degrees of efficiency and complexity?. These combine the benefits of series and parallel hybrids, allowing vehicles to operate in electric, engine, or combined modes. This flexibility enhances overall efficiency and performance?. Furthermore, major automotive companies such as BOSCH, Continental, and DENSO are leading the market with innovations in hybrid starter generators. Recent developments include the introduction of 48V hybrid systems that integrate advanced gasoline engines and electrified gearboxes?.

The U.S. Department of Transportation has announced new fuel economy standards for model years 2024-2026, requiring a fleet average of 49 miles per gallon by 2026. These standards aim to reduce fuel consumption and greenhouse gas emissions significantly, driving the adoption of more efficient automotive technologies, including hybrid systems?.

Technologies such as belt starter generators (BSG) and integrated starter generators (ISG) enable functions such as start-stop systems and energy recovery during braking, contributing to lower emissions?. In addition, enhanced hybrid systems improve fuel economy by optimizing engine performance and providing electric boosts when necessary. This reduces the reliance on internal combustion engines and enhances overall vehicle efficiency.

Market Segmentation

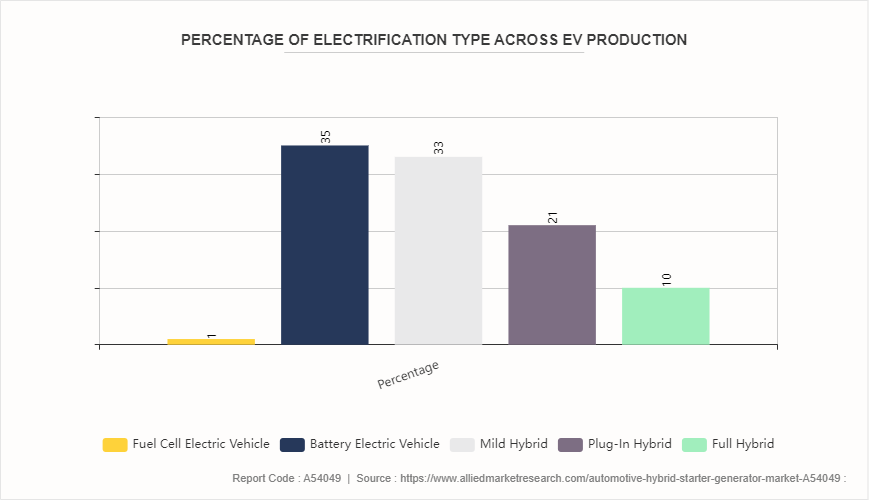

The automotive hybrid starter generator market is segmented into type, application, power rating, component and region. On the basis of type, the market is segmented into 12-Volt, 48-Volt, and Others. As per application, the market is segregated into passenger cars, light commercial vehicles, heavy commercial vehicles. On the basis of power rating, the market is divided into low power (up to 15 kW) , medium power (15-30 kW) , and high power (above 30 kW) . As per component, the market is segmented into electric motor/generator, power electronic controller, and battery. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America is home to many leading automotive manufacturers and technology companies that are at the forefront of hybrid vehicle innovation. Companies such as General Motors, Ford, and Tesla, along with key suppliers like BOSCH and Continental, are heavily investing in hybrid and electric vehicle technologies?. Strict environmental regulations have been put in place in the area with the goal of lowering emissions and increasing fuel economy. Automakers are compelled to embrace advanced hybrid technologies by regulatory organizations such as the National Highway Traffic Safety Administration (NHTSA) and the U.S. Environmental Protection Agency (EPA) . One good example is the Corporate Average Fuel Economy (CAFE) regulations, which require fleet averages throughout the sector to reach 49 mpg by 2026.

Asia-Pacific is one of the largest automotive hybrid starter generator market opportunity in the world, with significant production and sales volumes. Countries such as China and India have vast consumer bases and rapidly growing automotive industries, which drive the demand for advanced vehicle technologies, including hybrid systems. Furthermore, countries in the Asia-Pacific region, particularly China, Japan, and South Korea, have implemented robust policies to combat air pollution and promote sustainable transportation. Programs like China’s "Made in China 2025" and the National Intelligent Connected Vehicle (ICV) Strategy have significantly propelled the adoption of hybrid and electric vehicles. These policies include subsidies, tax incentives, and stringent emission regulations that encourage both manufacturers and consumers to shift towards hybrid technologies.

In March 2024, the Indian government announced that FAME II, a program designed to promote electric mobility throughout the nation, would be extended through 2024. Similarly, the Brazilian government is promoting the purchase of hybrid vehicles by lowering the tax rate, including plug-in hybrids, hybrid electric vehicles, and CNG hybrids.

In December 2022, Mazda Motor Corporation introduced a new hybrid vehicle model equipped with a strong hybrid mechanism that will allow it to be driven solely by a motor around 2025. The company plans to develop the HV in-house, adopting a "mild hybrid" mechanism to support the engine with a motor.

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive hybrid starter generator market such as Continental, ZF, BOSCH, Delphi, SEG-Automotive, Hyundai MOBIS, Mitsubishi Electric, DENSO, Valeo, and Hitachi Automotive Systems Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive hybrid starter generator market.

Industry Trends:

In February 2024, the automotive hybrid starter generator industry continued to advance with new technologies to boost vehicle efficiency and eco-friendliness. Mild hybrid technology (MHEV) is a significant innovation that integrates a 48V starter-generator and a lithium-ion battery. This system starts the engine, generates electricity, provides extra torque during rapid acceleration, and recovers energy during braking. It allows the engine to shut off during short stops, like at traffic lights, and restart almost instantly. MHEV technology delivers 10-15% fuel savings and significantly reduces harmful emissions.

In January 2021, the Dayco partnered with Maserati to optimize hybrid technology, Dayco developed a custom belt-integrated starter generator (BSG) hybrid system, known as P0 Architecture, for Maserati’s mild-hybrid electric vehicle (MHEV) engine in the Ghibli Hybrid. This partnership highlights Dayco's role in advancing hybrid technology in the automotive industry.

In April 2024, the Mercedes-Benz introduced its first mild-hybrid engine in the G-Wagon, marking a significant step towards greener technology. The new mild-hybrid system integrates a 48V starter-generator and a small lithium-ion battery to enhance fuel efficiency and reduce emissions. This setup provides additional torque during acceleration, supports engine start-stop functionality, and recovers energy during braking, making the G-Wagon more environmentally friendly while maintaining its renowned performance and luxury standards.

In March 2022, the Nexteer Automotive introduced a new eDrive product line with the launch of a 48 V integrated Belt-Driven Starter Generator (iBSG) that hybridizes conventional internal combustion engine (ICE) vehicles to help OEMs meet emissions and fuel efficiency regulations

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the Automotive hybrid starter generator Market segments, current trends, estimations, and dynamics of the Automotive hybrid starter generator market analysis from 2022 to 2032 to identify the prevailing Automotive hybrid starter generator market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Automotive hybrid starter generator Market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global Automotive hybrid starter generator Market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Automotive hybrid starter generator market trends, key players, market segments, application areas, and market growth strategies.

Automotive Hybrid Starter Generator Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 26.3 Billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 456 |

| By Type |

|

| By Application |

|

| By Power Rating |

|

| By Component |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric, Denso, BOSCH, Valeo, Hyundai Mobis Co Ltd., Delphi, Hitachi Automotive Systems Ltd., Continental AG, ZF Friedrichshafen AG, SEG-Automotive |

Upcoming trends in the automotive hybrid starter generator market include the adoption of more efficient and compact designs, integration with advanced control systems for improved energy management, and increasing use in hybrid and electric vehicles to enhance fuel efficiency and reduce emissions.

The leading application of the automotive hybrid starter generator market is providing start-stop functionality and electrical power assistance in hybrid and electric vehicles.

North America is the largest regional market for automotive hybrid starter generator

$26.3 billion is the estimated industry size of automotive hybrid starter generator market

Continental, ZF, BOSCH, Delphi, SEG-Automotive, Hyundai MOBIS, Mitsubishi Electric, DENSO, Valeo, and Hitachi Automotive Systems Ltd.

Loading Table Of Content...