Automotive LED Lighting Market Overview

The global automotive LED lighting market was valued at USD 16 billion in 2021, and is projected to reach USD 32.2 billion by 2031, growing at a CAGR of 7.4% from 2022 to 2031. Factors such as growth in emphasis toward road safety, increase in demand for advanced technology in vehicle, and rise in implementation of electronic systems in vehicle are anticipated to boost growth of the global automotive LED lighting market during the forecast period. However, high cost of LED lights and driver distraction due to ambient lighting are expected to hinder growth of the global market during the forecast period. Moreover, rise in implementation of government regulations and increase in demand for electric vehicles are anticipated to create opportunities for the automotive LED lighting industry during the forecast period.

Key Market Trend & Insights

- Adaptive lighting systems like AFS, ADB, and HBC enhance visibility and awareness.

- LAMEA region is expected to lead with the highest CAGR.

- Integration with ADAS, autonomous driving, and V2X boosts lighting tech adoption.

- Companies like Hella develop lighting that communicates with pedestrians for safety.

- Increasing vehicle production drives demand for advanced LED lighting features.

Market Size & Forecast

- 2031 Projected Market Size: USD 32.2 billion

- 2021 Market Size: USD 16 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 7.4%

Introduction

Lighting plays a vital role in automotive vehicles to illuminate the vehicle path, thus allowing the driver to get a clear visibility of the road. Along with meeting the need for illuminating the path of the driver, the lighting system helps other vehicle drivers and pedestrians on the road to detect the vehicle’s size, position, and direction of movement. It adds aesthetic look to both the interior and exterior parts of the vehicle and, at the same time, increases the conspicuity of the vehicle. The lighting system comprises lighting and signaling devices.

Nowadays, LED lighting technology has gained wide acceptance. Various vehicles are now equipped with DRLs, which include LEDs as the basic component. These lights are usually installed in premium cars such as Audi A7 and BMW X7, however with technological advancements and declining prices, these lights have found large application in economy vehicles. Several countries across the globe are establishing regulations for energy efficient vehicles and reducing the harmful CO2 emission from vehicles. As per European Commission’s regulation, the auto manufacturers are compelled to take effective measures to reduce CO2 emissions from the vehicles. Thus, auto manufacturers are turning toward eco-friendly LED lighting technologies due to its high-power efficiency and reduced CO2 emissions. Thus, these lights are finding various applications in headlights, turning lights, DRL, parking lights, and brake lights.

Market Segmentation

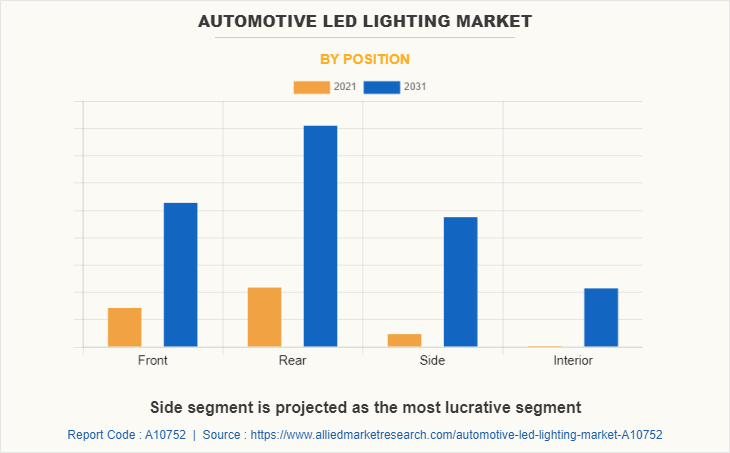

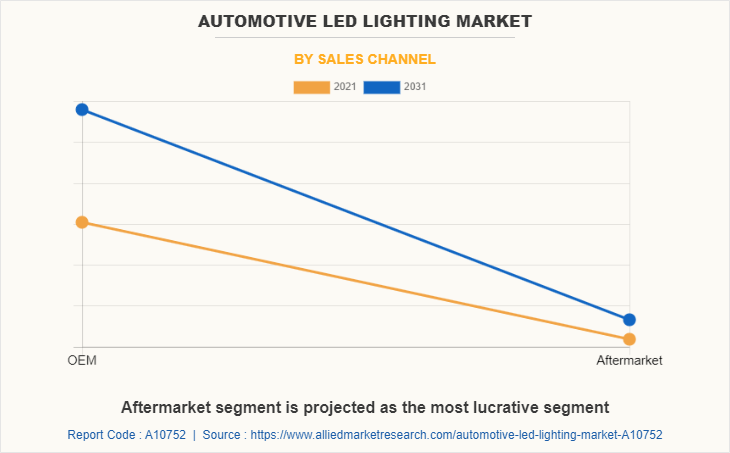

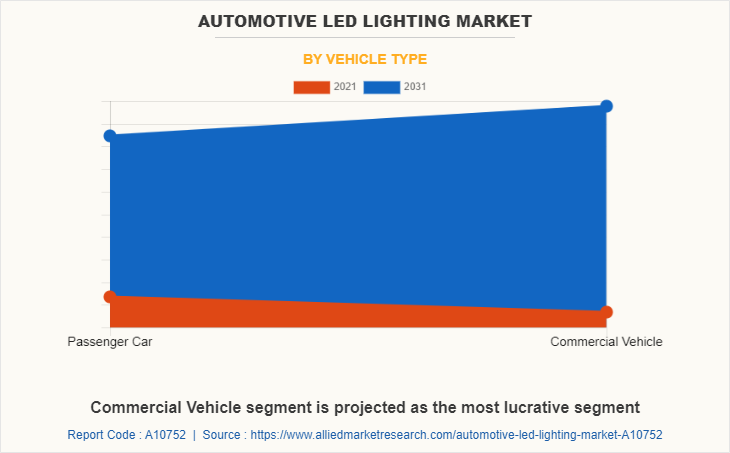

The automotive LED lighting market is segmented on the basis of position, sales channel, vehicle type, propulsion type, and region. By position, it is divided into front, rear, side, and interior. By sales channel, it is bifurcated into OEM and aftermarket. By vehicle type, it is categorized into passenger cars and commercial vehicles. By propulsion type, it is fragmented into ICE, electric, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players that operate in this automotive LED lighting market include

Which are the Top Automotive LED Lighting companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive LED lighting industry.

- APTIV

- Denso Corporation

- Federal-Mogul Corporation (Tenneco Inc.)

- Grupo Antolin

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- Koito Manufacturing Co., Ltd.

- Koninklijke Philips N.V.

- Marelli Holdings Co., Ltd.

- NXP Semiconductors

- Osram GmbH

- Robert Bosch GmbH

- Stanley Electric Co., Ltd.

- Valeo

- ZKW

What are the Top Impacting Factors

Key Market Driver

Growth in emphasis toward road safety

The demand for safety features along with adaptive lighting system has increased due to increase in number of road accidents worldwide. Vehicles with adaptive and advanced lightings can detect objects on the road; thereby, enabling the driver to take appropriate actions required. Rise in concern regarding road accidents, globally, fuels the demand for better safety features in vehicles, eventually leading to the installation of efficient lighting systems, which further boosts the growth of the automotive LED lighting market. Automotive lights are primarily installed to enhance the visibility in harsh environments and improve the vehicles conspicuity in critical conditions.

According to the World Health Organization’s report, nearly 1.25 million people die in road accidents each year, which includes a major portion due to improper lighting system in vehicle. Moreover, road traffic injuries leading to death are higher among teenagers. These factors increase the demand for adaptive and better lighting system in vehicles. Automobile companies, such as Hella KGAA HUECK & Co., are developing and introducing new lighting system equipped with different features such as communicating to the pedestrians to ensure safety and to meet the needs of the customers. Thus, rise in emphasis toward road safety drives the growth of the automotive LED lighting market.

Increase in demand for advanced technology in vehicle

With increased production and sales of vehicles across the globe, the demand for vehicles equipped with advanced technology has increased. This has led the vehicle manufacturers to develop and install latest components in the upcoming vehicle models. For instance, companies, such as Hella KGAA HUECK & Co., are developing and introducing new lighting system equipped with different features such as communicating to the pedestrians to ensure safety and to meet the needs of the customers.

Moreover, there are multiple new technologies such as Adaptive Front-Lighting System (AFS), and Adaptive Driving Beam (ADB) which are introduced by vehicle manufacturers in their vehicles to provide convenience and comfort. The Adaptive Front-Lighting System (AFS) improves visibility by aligning the illumination axis with the steering direction and illuminating the direction of travel. The system controls the light distribution on curved roads based on the low beam. With the popularization of automatic brakes and advanced driver assistance systems (ADAS), High Beam Control (HBC) systems based on the high beam can automatically switch between low and high beam based on data input from installed cameras. Combined with AFS systems, the two increase the levels of situational awareness for drivers. Adaptive Driving Beam (ADB) is an anti-glare high beam that automatically controls the illumination range based on the high beam. With this system, a distant high beam that improves distant visibility raises the illumination axis of the headlamps, and at low speeds, it has functions such as a wide-angle light distribution low beam that expands the illumination range to the left and right. In the future, in-vehicle lighting will likely be integrated into the vehicle mega-architecture to pursue synergistic effects with CASE technologies such as ADAS, autonomous driving, and V2X, as well as installing sensors in the lamp body, and expanding safety functions. Such developments in advanced lighting solutions are expected to propel the demand for automotive LED lighting market during the forecast period.

Restraints

High cost of LED lights

The high cost of LED lights is a crucial concern for the automotive LED lighting market. Nowadays, LED bulbs are used with projector headlights, which are more expensive than reflector headlights and require more space within the vehicle. Meanwhile, halogen, xenon, and LED lights are commonly used lighting technologies in high-end or premium vehicles, owing to their benefits, such as reduced power consumption, cooler temperatures, and longer self-life of LED lights. However, halogen lights have a major disadvantage of heating and energy-wasting, whereas LED bulbs are attributed with their high production cost materials such as indium gallium nitride, aluminum, gallium indium phosphide, and aluminum gallium arsenide. In addition, the complicated installation procedure for the acquisition of LED lights requires a high cost as compared to other options. This eventually increases the cost of LED lights used in automobiles; thus, restraining the growth of the automotive lighting market during the forecast period.

Opportunity

Increase in implementation of government regulations

Insufficient visibility was the prominent factor that accounted for increasing number of road accidents, globally. Governments across the world have formulated effective regulations pertaining to the use of lighting systems in automobiles. The European Union mandates the use of Daytime Running Lights (DRL) due to unfavorable weather conditions in this region. Currently, 17 countries in Europe have formulated effective legislations related to the installation of daytime running lights (DRLs). Since 2011, in European countries DRL have mandated for the cars, small delivery vehicles, buses, and trucks. The Motor Vehicles Safety Act (MVSA) in Canada mandated the use of DRLs in all vehicles. Additionally, numerous countries are taking active initiatives to curb CO2 emission levels in vehicles.

Moreover, developing countries such as Brazil, Russia, India, and China (BRIC) are witnessing a rapid growth in the sales of automobiles. Automobile manufacturers across the globe are focusing toward manufacturing the vehicles equipped with advanced technologies such as advanced driving system, adaptive lighting system, and various other systems, which ensure safety and increase comfort while driving. This is expected to increase the demand for LED lighting system. Thus, rise in demand for automotive in developing nations has led to the growth of automotive lighting market; thereby, enabling the manufacturers across the globe to adapt new strategies to introduce new LED lighting products for the safety of passengers. Thus, the government regulations for the safety and security across the globe are anticipated to boost the growth of the automobile lighting market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive LED lighting market analysis from 2021 to 2031 to identify the prevailing automotive LED lighting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive LED lighting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive LED lighting market trends, key players, market segments, application areas, and market growth strategies.

Automotive LED Lighting Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.2 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 362 |

| By Position |

|

| By Sales Channel |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | MAGNETI HOLDINGS CO., LTD., ZKW, Stanley Electric Co., Ltd., Koninklijke Philips N.V., HYUNDAI MOBIS, VALEO, DENSO CORPORATION, NXP SEMICONDUCTORS, HELLA GmbH, APTIV PLC, KOITO MANUFACTURING CO., LTD., FEDERAL-MOGUL CORPORATION, GRUPO ANTOLIN, OSRAM GmbH, Robert Bosch GmbH |

Analyst Review

The automotive LED lighting market is expected to witness significant growth, owing to reduced power consumption and longer life span. With rapid technological advancement, smaller, efficient, moisture- and vibration-resistant LED lights are available in the market. These lights have longer lifetime that can last for decades. The global automotive industry has experienced tremendous transformation in past few years. The ever-growing demand for passenger safety and comfort has made vehicle manufacturers focus incessantly on forming new design experiences by enabling efficient incorporation of new technologies, which propels the growth of automotive LED lighting market.

Factors such as growth in emphasis toward road safety, increase in demand for advanced technology in vehicle, and surge in implementation of electronic systems in vehicle are anticipated to boost growth of the global automotive LED lighting market during the forecast period. However, high cost of LED lights and driver distraction due to ambient lighting are expected to hinder growth of the global automotive LED lighting market during the forecast period. Moreover, increase in implementation of government regulations and surge in demand for electric vehicles are expected to create opportunities for the automotive LED lighting market in the future.

Moreover, to fulfil the changing demand scenarios, market participants have concentrated on product launch and product developments to offer a diverse range of products and meet new business opportunities. For instance, in June 2022, ZKW developed high tech LED lighting technology for new Volvo C40. The headlight of the all-electric electric crossover has a pixel module with 84 individually controllable LEDs. The high-tech light illuminates the road particularly efficiently, adapts dynamically to traffic, and avoids dazzling other road users. Moreover, in December 2021, OSRAM GmbH launched the brightest LED, currently available in the market for automotive front lighting. The leadframe-based components offer market-leading brightness specially developed for use in low beam and high beam solutions in cars. In addition, market participants are continuously focusing on agreement to match changing end-user requirements and automotive LED lightings. For instance, in April 2019, HELLA GmbH & Co. KGaA signed a strategic cooperation agreement with Liuzhou Wuling Automotive Industry Co. Ltd. for introducing lighting products that are competitive on technology, cost, quality, and various other parameters.

Key players that operate in this market include APTIV, Denso Corporation, Federal-Mogul Corporation (Tenneco Inc.), Grupo Antolin, HELLA GmbH & Co. KGaA, Hyundai Mobis, Koito Manufacturing Co., Ltd., Koninklijke Philips N.V., Marelli Holdings Co., Ltd., NXP Semiconductors, Osram GmbH, Robert Bosch GmbH, Stanley Electric Co., Ltd., Valeo, and ZKW.

The global automotive LED lighting market was valued at $16.02 billion in 2021, and is projected to reach $32.24 billion by 2031, registering a CAGR of 7.4% from 2022 to 2031.

The Key players that operate in this automotive LED lighting market include APTIV, Denso Corporation, Federal-Mogul Corporation (Tenneco Inc.), Grupo Antolin, HELLA GmbH & Co. KGaA, Hyundai Mobis, Koito Manufacturing Co., Ltd., Koninklijke Philips N.V., Marelli Holdings Co., Ltd., NXP Semiconductors, Osram GmbH, Robert Bosch GmbH, Stanley Electric Co., Ltd., Valeo, and ZKW.

Rear is the leading application of automotive LED lighting market

Asia-Pacific is the largest regional market for automotive LED lighting market.

Increase in demand for advanced technology in vehicle, and growing emphasis toward road safety are the upcoming trends of automotive LED lighting market

Loading Table Of Content...