Automotive PVC Artificial Leather Market Research, 2033

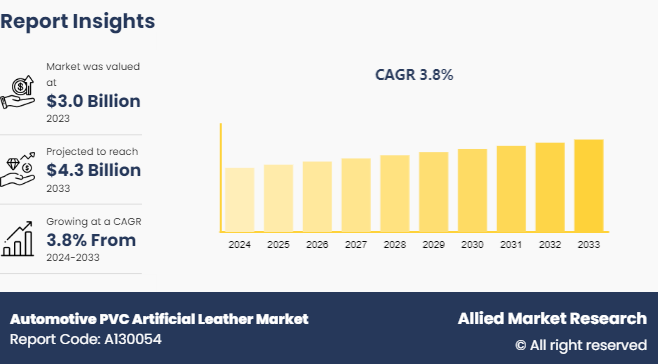

The global automotive PVC artificial leather market was valued at $3.0 Billion in 2023, and is projected to reach $4.3 Billion by 2033, growing at a CAGR of 3.8% from 2024 to 2033.

Market Introduction and Definition

The automotive PVC artificial leather market refers to the sector of the automotive industry that focuses on the production, distribution, and sale of synthetic leather made from polyvinyl chloride (PVC) for use in vehicle interiors. PVC artificial leather, also known as vinyl leather or faux leather, is a man-made material designed to mimic the look and feel of genuine leather while offering advantages such as durability, easy maintenance, and cost-effectiveness. PVC artificial leather provides a luxurious appearance at a fraction of the cost of genuine leather, making it an attractive option for both manufacturers and consumers looking to reduce costs without compromising on quality. In addition, PVC artificial leather is highly durable, with excellent resistance to scratches, abrasion, and punctures, which is essential for the longevity of automotive interiors.

In the automotive setting, PVC artificial leather is commonly used to upholster car seats, door panels, dashboard covers, and other interior components. It provides an aesthetic appeal such as genuine leather while more resistant to wear and tear, moisture, and sunlight exposure. In addition, PVC artificial leather can be manufactured in a wide range of colors, textures, and finishes to suit different design preferences and automotive brands. The automotive PVC artificial leather market is influenced by various factors, including trends in interior design, consumer preferences for premium or eco-friendly materials, regulatory requirements regarding vehicle safety and emissions, and fluctuations in raw material prices. Manufacturers of PVC artificial leather compete in the market based on factors such as product quality, design versatility, pricing, and sustainability initiatives. Overall, the automotive PVC artificial leather market significantly enhances the aesthetic appeal, comfort, and durability of vehicle interiors while offering practical advantages and cost savings compared to genuine leather alternatives.

Key Takeaways

- The automotive PVC artificial leather market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive PVC artificial leather industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Strategies and Developments

- In December 2022, Kyowa Leather Cloth Company Limited, a world-leading manufacturer of synthetic leather materials for automotive interiors launched the Sobagni consumer brand featuring fashion and everyday items made from its synthetic leather material, using Roland DG’s LEF2-300 benchtop flatbed UV printer to create a range of colorful designs.

- In October 2023, Asahi Kasei Corporation invested in U.S.-based startup Natural Fiber Welding (NFW) , a producer of non-petroleum-based leather alternatives for car interiors. This strategic partnership enables another major step to support global automotive original equipment manufacturers (OEMs) in reducing the environmental burden of automobiles and will strengthen the company's position during the automotive PVC artificial leather market forecast.

- In August 2023, Schaeffler India Limited acquired the aftersales B2B e-commerce platform Koovers. Koovers is a Bengaluru-based private limited business that uses a B2B e-commerce platform to provide spare parts solutions to Indian aftermarket workshops. The purchase offers the best possible synergy for Schaeffler's upcoming after-sales operations in India. It will play a significant role in the rapidly expanding and changing aftermarket digital landscape and serve as a major facilitator for the aftermarket ecosystem, including distribution partners.

Key Market Dynamics

The cost-effective nature of PVC artificial leather and advancement in manufacturing technology are the two main factors driving the automotive PVC artificial leather market growth. Furthermore, the rise in automotive production and increase in preference for leather alternatives are critical factors offering the growth of automotive PVC artificial leather market opportunity. Moreover, growing environmental issues and increasing regulatory complexities are two major factors acting as restraints for the growth of the automotive PVC artificial leather market.

PVC artificial leather is less expensive to produce in comparison to natural leather, thus making it a better alternative for automotive manufacturers. This cost-effectiveness helps in decreasing the complete production costs of vehicles. Technological advancements are leading to significant improvements in the quality and appearance of PVC artificial leather. In addition, modern production techniques help in providing more realistic textures and finishes that closely mimic natural leather, enhancing the aesthetic appeal of car interiors.

Market Segmentation

The automotive PVC artificial leather market size is segmented into type, sales channel, and region. Based on type, the market is divided into seat leather, door panel leather, and instrument panel leather. By sales channel, the market is bifurcated into OEM and aftermarket. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

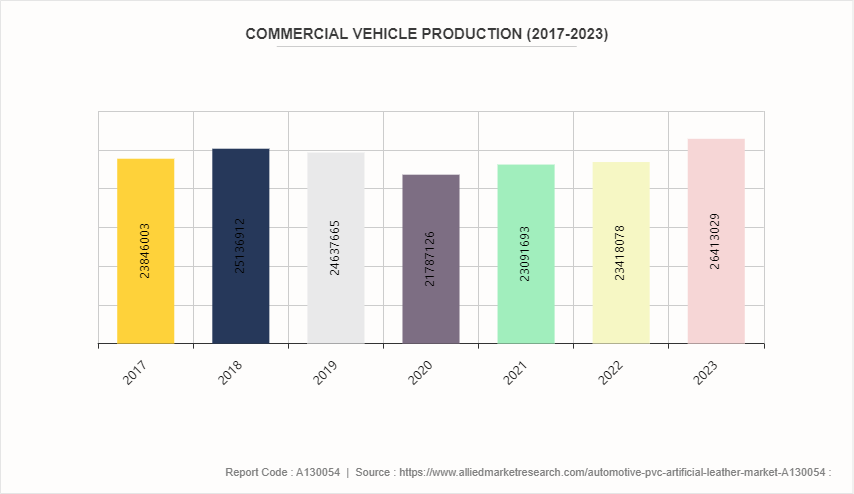

- In North America, the emphasis on sustainable vehicles and advanced manufacturing technologies is gaining prominence. The market is characterized by a high demand for premium vehicles with customized interiors, driving the need for high-quality (polyvinyl chloride) PVC artificial leather. As per the OICA source, North America region produced 12, 571, 636 units in the light commercial vehicle category in 2023.

- Europe is a significant market for automotive PVC artificial leather, with demand driven by the presence of leading automotive manufacturers and a strong emphasis on luxury and comfort features in vehicles. For instance, as per the OICA source, total of 93, 546, 599 vehicle units were produced in 2023. Stringent regulations regarding vehicle emissions and interior air quality also influence the adoption of PVC artificial leather materials that meet environmental standards. The automotive market in the region is characterized by a preference for premium and high-quality interior materials, driving demand for innovative PVC artificial leather products. As per the OICA source, total of 93, 546, 599 units were produced in 2023.

- The Asia-Pacific region is a major hub for automotive manufacturing, with countries such as China, Japan, South Korea, and India leading production volumes. For instance as per OICA source, China produced 30, 160, 966 vehicle units, Japan produced 8, 997, 440 vehicle units, South Korea produced 4, 243, 597 vehicle units, and India produced 5, 851, 507 vehicle units in 2023. Rapid urbanization, rising disposable incomes, and increasing demand for passenger vehicles are fueling the growth of the automotive PVC artificial leather market in this region. Cost-effectiveness, coupled with improving product quality and aesthetics, makes PVC artificial leather an attractive option for both domestic and export-oriented automotive production in Asia-Pacific.

- Economic recovery and increasing vehicle ownership in countries such as Brazil and Mexico are boosting demand for automotive interiors, including PVC artificial leather. As per OICA, Brazil produced 2, 324, 838 vehicle units in 2023, and Mexico produced 4, 002, 047 vehicle units in 2023.

- The hot climate in different parts of the Middle East is necessitating the utilization of materials with high UV and heat resistance, that PVC artificial leather can offer. For instance, as per Washington Post source, in July 2023, the heat index reached 152 degrees in the Middle East, nearly at the limit of human survival.

- Economic development in countries such as South Africa, Nigeria, Egypt, and Kenya is driving increased vehicle sales. For instance, as per OICA source, South Africa produced 633, 337 vehicle units in 2023. Urbanization is leading to greater demand for personal and public transportation vehicles, which in turn is boosting the demand for automotive interior materials such as PVC artificial leather. For instance, as per Statista source, in 2022, Gabon had the highest urbanization rate in Africa, with over 90 percent of the population living in urban areas. Libya and Djibouti followed at around 81 percent and 78 percent.

Competitive Analysis

The major players operating in the automotive PVC artificial leather market include Benecke Kaliko, Scientex Berhad, Fujian Polytech Technology, Schaffler India, Canadian General Tower (CGT) , Premier Polyfilms Limited, H.R. Polycoats Pvt. Ltd., Polyfabs, Longyue Leather, Nan Ya Plastics Corporation, Asahi Kasei, and Vortex Flex Pvt Ltd, The players have adopted product launch, acquisition, and investment strategies to increase their market share in the automotive PVC artificial leather industry.

The other players in the automotive PVC artificial leather market share include Kyowa Leather Cloth, Wise Star, Mayur Uniquoters, Jiangsu Zhongtong Auto Interior Material, Xiefu Group, MarvelVinyls, Vulcaflex, Super Tannery Limited, RMG Polyvinyl India Limited, Veekay Polycoats, and Leo Vinyls.

Industry Trends

- The rise of electric vehicles, which often feature modern and sustainable interior designs, is contributing to the increased use of PVC artificial leather in the U.S. region and driving the growth of automotive PVC artificial leather market trends. For instance, as per the article published by The International Council on Clean Transportation, electric vehicle (EV) sales increased from about 125, 000 million in quarter 1 of 2021 to 185, 000 million in quarter 4 of 2021 and from about 300, 000 million in quarter 1 of 2023 to 375, 000 million in quarter 3 of 2023.

- Key automotive manufacturing hubs in states such as Michigan, Ohio, and California are playing significant roles in driving and pushing the demand and innovation for polyvinyl chloride (PVC) artificial leather solution

- Due to increasing emphasis on fuel efficiency and sustainability, automakers are continuously searching for lightweight materials to reduce vehicle weight and improve fuel economy in the Europe region. Furthermore, as per OICA source, the total number of light vehicle units produced in 2023 in Europe was 2, 203, 861 compared to 1, 948, 917 units in 2022. PVC artificial leather, is a lighter and genuine leather, that helps in achieving weight reduction targets without compromising on interior quality and comfort.

- Manufacturers are investing in research and development (R&D) to improve the quality, durability, and environmental sustainability of PVC artificial leather. For instance, Nan Ya Plastics Corporation, the world’s largest Taiwanese plastic secondary processor, invested $70.8 million in research and development activities in 2023. The research and development (R&D) include the development of innovative coatings, embossing techniques, and production processes to enhance the texture, appearance, and performance of synthetic leather materials.

Key Sources Referred

- Asahi Kasei

- Motor India

- Kyowha Co.

- Volza.com

- Mckinsey Trends

- Central Leather Research Institute

- Kering.Com

- Research Gate

- Statista

- OICA

- Washington Post

- Nan Ya Plastics Corporation Annual Report

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive PVC artificial leather market analysis from 2024 to 2033 to identify the prevailing automotive PVC artificial leather market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive PVC artificial leather market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive PVC artificial leather market trends, key players, market segments, application areas, and market growth strategies.

Automotive PVC Artificial Leather Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.3 Billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 7 |

| By Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | veekay polycoats limited, RMG Polyvinyl India Limited, Scientex Berhad, Fujian Polytech Technology, Leo Vinyls, Jiangsu Zhongtong Auto Interior Material, Schaffler India, H.R. Polycoats Pvt. Ltd., Kyowa Leather Cloth, Premier Polyfilms Limited, Vulcaflex, Canadian General Tower (CGT), Xiefu Group, MarvelVinyls, Vortex Flex Pvt Ltd, Mayur Uniquoters, Longyue Leather, Benecke Kaliko, Wise Star, Polyfabs, Nan Ya Plastics Corporation |

Rise in trend of electric vehicles, which often feature modern and sustainable interior designs, is contributing to the increased use of PVC artificial leather in the U.S. region.

Seat leather is the leading application of the automotive PVC artificial leather market.

Asia-Pacific is the largest regional market for Automotive PVC Artificial Leather.

$4.3 billion is the estimated industry size of the Automotive PVC Artificial Leather.

Benecke Kaliko, Scientex Berhad, Fujian Polytech Technology, Schaffler India, Canadian General Tower (CGT), Premier Polyfilms Limited, H.R. Polycoats Pvt. Ltd., Polyfabs, Longyue Leather, Nan Ya Plastics Corporation, Vortex Flex Pvt Ltd., Kyowa Leather Cloth, Wise Star, Mayur Uniquoters, Jiangsu Zhongtong Auto Interior Material, Xiefu Group, MarvelVinyls, Vulcaflex, Super Tannery Limited, RMG Polyvinyl India Limited, Veekay Polycoats, and Leo Vinyls.

Loading Table Of Content...