The global automotive sensor fusion market size was valued at $1.1 billion in 2021, and is projected to reach $6.7 billion by 2031, growing at a CAGR of 20.9% from 2022 to 2031.

Sensor fusion is the ability to combine inputs from multiple radars, LIDAR, and cameras to create a single model or image of the vehicle's surrounding environment. The resulting model is more accurate as it balances the strength of various sensors. Vehicle systems can use the information provided by sensor fusion to support smarter actions. Sensor fusion collects data from each of these sensor types and uses software algorithms to provide the most comprehensive and accurate model of the environment. It can correlate data obtained from inside the vehicle through a process known as interior and exterior sensor fusion.

The fusion of sensor data plays a key role in current and future active vehicle safety systems. Development of new advanced sensors is incomplete without the use of improved signal processing techniques such as data fusion methods. Standalone sensors are unable to overcome certain physical limitations such as range and field of view limitations. Combining information from different sensors therefore increases the area around the vehicle covered by the sensors and increases the reliability of the overall system in the event of sensor failure.

Current trends in the development of autonomous vehicles show increased use of radar and other advanced sensors. Sensor fusion of camera and radar data offers the best solution in terms of system hardware complexity. Only two types of sensors are integrated and complement each other for system coverage, cameras for vision, and radar for obstacle detection.

Sensor fusion is one of the essential tasks in autonomous driving applications that fuse information obtained from multiple sensors to reduce the uncertainties compared to when sensors are used individually. Adoption of sensor fusion increases system integrity, reliability, and robustness for normal operation and provides additional benefits against sensor network attacks originating from the analog domain. By carefully implementing sensor fusion into their systems, automakers can mitigate the risk from malfunction or malevolent action that can cause injury to people, property, or economic prosperity. All sensors and models have a tolerance error and using multiple sensors that measure the same quantity can increase reliability and provide resilience to failure.

Stringent government standards for safety features, technical advantages provided by sensor fusion, and surge in demand for ADAS System are the major factors that propel the market growth. However, lack of sensor standardization and malfunctioning of vehicle electronic sensor system in developing countries are the major factors that hamper growth of the market. Furthermore, significant advancement of sensor & communication technology in vehicles and development of autonomous vehicles are the factors expected to offer growth opportunities during the forecast period.

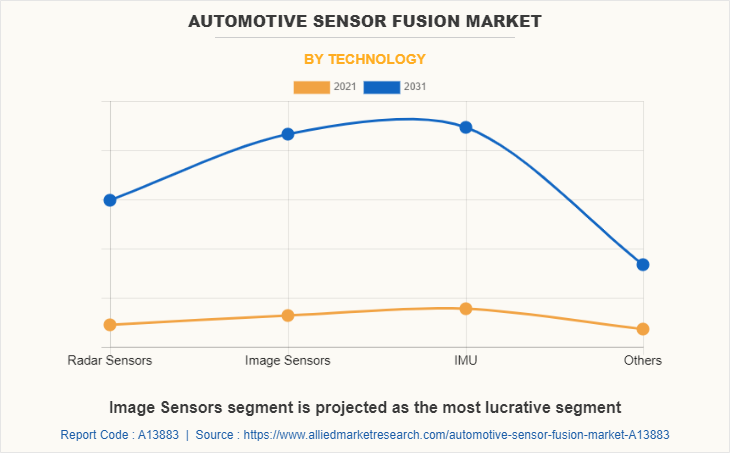

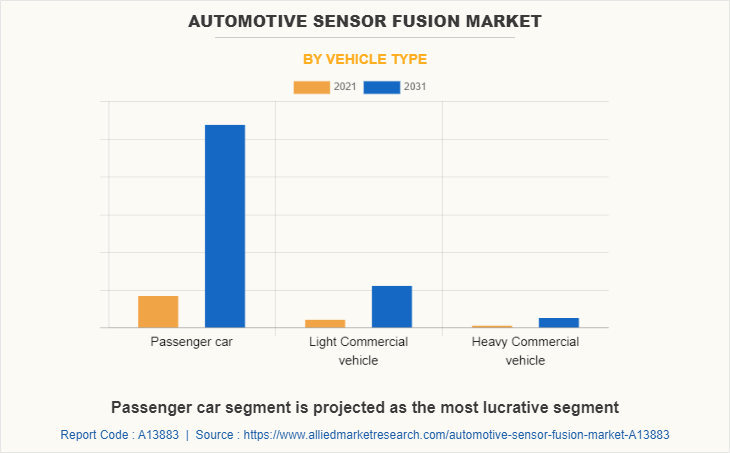

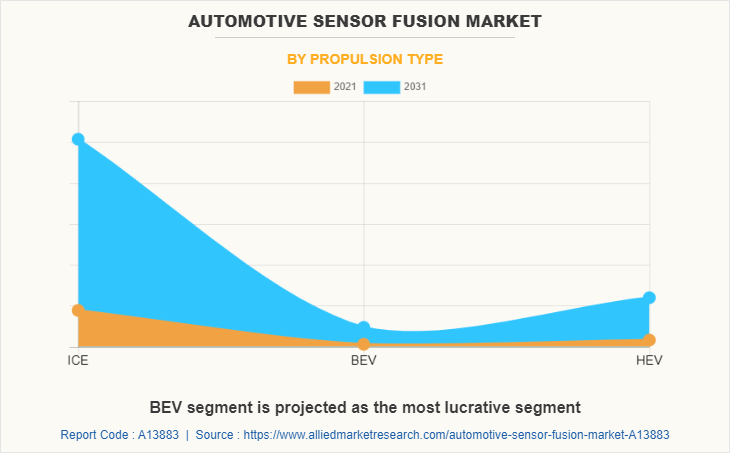

The automotive sensor fusion system market is segmented on the basis of technology, vehicle type, propulsion type, and region. By technology, it is fragmented into radar sensors, image sensors, IMU, and others. By vehicle type, it is classified into passenger car, light commercial vehicle, and heavy commercial vehicle. By propulsion type, it is categorized into ICE, BEV, and HEV. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

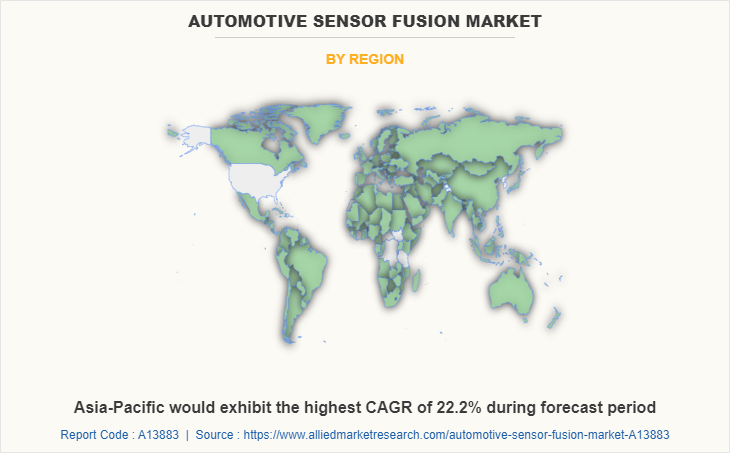

North America includes the U.S., Canada, and Mexico. The surge in adoption of advanced driver assistance systems (ADAS) and the rapid development of autonomous vehicle technology in commercial & passenger vehicles are factors driving the growth of the automotive sensor fusion market in the region. According to the National Highway Traffic Safety Administration (NHTSA), about 94% of accidents on U.S. roads are caused by human error such as drunk driving and speeding. These can be mitigated with self-driving cars, whose function can follow speed limits posted in certain regions. Stringent government regulations focused on improving road safety have led to the development of semi-autonomous and autonomous vehicles. These semi-autonomous and autonomous vehicles are integrated with advanced technologies such as GPS navigation, pedestrian detection, and road sign detection among others which has led to an increase in the popularity of these vehicles among customers. Various start-ups working on Level 4 vehicles are expected to receive funding to speed up their operations. For instance, in May 2021, Level 4 self-driving startup, We Ride announced the completion of its Series C funding. New investors include IDG Capital, Costone Capital, Cypress Star, Sky9 Capital, and K3 Ventures, with early investors including CMC Capital and QimingVenture. In autonomous vehicles, sensor fusion collectively takes inputs from radar, LiDAR, camera, and ultrasonic sensors to interpret environmental conditions for detection certainty. Therefore, the surge in the adoption of autonomous vehicles is expected to provide lucrative opportunities for the growth of the automotive sensor fusion market.

Companies developing strategies open new opportunities for sensor fusion technology in automotive sector is expected to drive the growth of the market. For instance, in April 2020, Foresight Autonomous Holdings Ltd, an innovator in automotive vision systems with headquarters in Israel, joined forces with FLIR Systems Inc to develop, market, and distribute Foresight's sensor-fusion-based QuadSight vision system, along with FLIR Systems' infrared cameras, to a broad range of potential clients.

Development of sensor fusion suite for autonomous vehicles to adapt to different driving environment scenarios is expected to propel the growth of the market. For instance, in March 2022, Baraja and Tier IV announced a new collaboration to research and develop a new software-defined sensor suite combining best-in-class LiDAR and HDR cameras. The suite combines Baraja's leading Spectrum-Scan LiDAR technology with Tier IV sensor fusion software and HDR cameras to optimize performance in the widest possible range of situations and environments for autonomous vehicles to deliver improved performance. Such developments are expected to boost the growth of the market during the forecast period.

Some leading companies profiled in the report are Aptiv, Elmos Semiconductor SE, Infineon Technologies AG, Mobileye, NVIDIA Corporation, NXP Semiconductors, Robert Bosch GmbH, STMicroelectronics, TDK Corporation, TE Connectivity, Texas Instruments, ZF Friedrichshafen AG. The leading companies are adopting strategies such as product launch and collaboration to strengthen their market position.

In December 2021, NXP Semiconductors N.V. announced a strategic partnership with Foxconn Industrial Internet Ltd., a subsidy company of Foxconn group to transform the car into the ultimate edge device. NXP is expected to provide FII with its comprehensive portfolio of automotive technologies. The initial phase of the joint project is projected to focus on developing a fully digital cockpit solution based on the NXP i.MX 8 QuadMax. The platform includes a digital cluster and heads-up display (HUD) system

In May 2022, Semiconductor developer STMicroelectronics announced details of its latest global shutter image sensor for driver monitoring systems (DMS). DMS continuously monitors a driver's head movements to detect signs of drowsiness or distraction, allowing in-vehicle systems to generate alerts to ensure occupant safety.

Stringent government standards for safety features

Automakers have accelerated their adoption of technology to prevent accidents and improve road safety. Moreover, the government takes initiatives to prevent road fatalities by making these technologies mandatory in vehicles. Road traffic accidents has significantly increased which encourages the government to introduce strict regulations related to safety features in vehicles. For instance, according to the National Crime Records Bureau (NCRB), more than 1.55 million people died in road crashes across India in 2021. Therefore, government of various countries require vehicles to install vehicle safety features to reduce the risk of accidents and improve driver and passenger safety. For instance, in September 2022, the Ministry of Road Transport and Highways (MoRTH) announced its plans to amend the Central Motor Vehicle Regulations (CMVR) to add safety features in order to improve the safety of vehicle occupants inside collisions. The European Union (EU) General Safety Regulation outlines all mandatory safety requirements that European car manufacturers must comply with. The standards include installation of advanced emergency braking system, accident data recording, crash test approved seat belt sensor, sensor for reversing, speed assistance in vehicles. Advance safety features such as collision prevention and mitigation, speeding warning and alerts, adaptive cruise control system use sensors such as RADAR, LiDAR, camera, and others to detect and identify objects, determine their movement. Sensor fusion technology combines data from these sensors to form a detailed image of the driving environment and use the information to support intelligent actions. Therefore, rise in government standards including the addition of various vehicle safety features provides significant opportunities for the growth of the market.

Technical advantages provided by sensor fusion

Sensor fusion is the process of using software algorithms to combine data from multiple sensors to create an equally comprehensive and accurate model of the environment. Sensors are fundamental to the perception of vehicle surroundings in an automated driving system, and the use and performance of multiple integrated sensors can directly determine the safety and feasibility of automated driving vehicles. Sensor fusion is one of the essential tasks in autonomous driving applications that fuses information obtained from multiple sensors to reduce the uncertainties compared to when sensors are used individually. Sensor fusion increases system integrity, reliability, and robustness for normal operation and provides additional benefits against sensor network attacks originating from the analog domain. By carefully implementing sensor fusion into their systems, automakers can mitigate the risk from malfunction or malevolent action that can cause injury to people, property, or economic prosperity. All sensors and models have a tolerance error and using multiple sensors that measure the same quantity can increase reliability and provide resilience to failure. Multiple sensor-based data fusion makes information more decisive, intelligent, sensible, and precise than single sensor-based data fusion.

Moreover, sensor fusion reduces operating costs by expanding the range of vehicles with autonomous capabilities. Sensor fusion creates high-precision information, which enables the use of low-power, low-precision sensors in IoT based networks. Another important advantage is the increased data exchange obtained through sensor fusion. Sensors in traditional systems process their inputs independently, so the decisions made by the system are only as accurate as the information provided by the individual sensors. Sensor fusion combines inputs from different sensors, such as cameras, LiDAR, and radar. Therefore, sharing multiple datasets enables smarter decision-making and improves vehicle safety. Domain controllers in sensor fusion systems do not have to wait for individual sensors to finish processing data before taking action based on that data. This improves performance in critical situations and improves driver safety. Therefore, such technical benefits offered by sensor fusion is expected to drive the growth of the automotive sensor fusion market.

Malfunctioning of Vehicle Electronic Sensor System

Autonomous vehicle systems receive sensor data, compute driving decisions, and send control signals to the cars. These systems are integrated with multi-sensor fusion (MSF) to fuse the sensor outputs and provide a more reliable picture of the surroundings to smooth out the uncertainties presented by sensor outputs. However, multi-sensor fusion (MSF) cannot perfectly reduce uncertainties because it lacks knowledge about which sensors provide the most accurate data and how to properly combine the data provided by the sensors. For instance, in bad weather conditions such as heavy rain, cameras are unable to detect objects such as motorcycles, cars, and bicycles, but at the same time radar detects the objects there is the challenge to combine the response of radar, lidar, and camera. As a result, severe effects may occur suddenly. In such scenarios, the customer discovered that MSF approaches in autonomous systems can mislead automobile control and result in major safety problems. This factor is anticipated to restraint the growth of the market.

Significant advancement of sensor and communication technology in vehicles

Advancements in sensor and communication technologies that improve navigation and object recognition, image processing algorithms, data analytics, and computer vision have created opportunities for automakers to discover a wide range of sensor solutions for the automotive industry. Increased opportunities offered by the vast amount of data collected by sensors and rise in adoption of smart devices are driving the integration of sensor fusion technology in automotive industry. Vehicle communication is expected to accelerate the development of sensor fusion for advanced vehicles. Connected autonomous vehicles (CAVs) (also known as connected autonomous vehicles and self-driving vehicles) are increasingly being developed to reduce traffic accidents, improve quality of life, and improve the efficiency of transportation systems. For instance, in October 2022, Audi demonstrated its Connected Vehicle to Everything (C-V2X) technology that is developed to improve road safety. The German car company has demonstrated various scenarios on the roads of Oceanside, California, in which C-V2X can help reduce the likelihood of collisions between vehicles and cyclists. Therefore, rise in adoption of connected cars leads to surge in development of advanced and efficient sensor and network technologies. Moreover, development of advanced sensor technology for connected vehicles enables devices to communicate with each other and with its environment. Communication technologies such as 5G, wireless sensor networks and narrowband IoT (NB-IoT) are expected to make connected vehicles truly autonomous. New technologies driving communication in the automotive IoT industry, including wireless sensor networks, 4G LTE, 5G, Bluetooth, Wi-Fi, NB-IoT, long range (LoRa), ultra-wideband (UWB), Zigbee, RFID, and vehicle communications Evaluate Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Vehicle-to-Everything (V2X) communications, and the-Air (OTA) software are expected to drive the demand for automotive sensor fusion. In addition, collecting and gathering accurate data about surroundings using sensors is a key aspect of connected car technology. Therefore, significant advancements in sensor technology and communications is expected to provide significant opportunities for the growth of the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive sensor fusion market analysis from 2021 to 2031 to identify the prevailing automotive sensor fusion market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive sensor fusion market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive sensor fusion market trends, key players, market segments, application areas, and market growth strategies.

Automotive Sensor Fusion Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.7 billion |

| Growth Rate | CAGR of 20.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 236 |

| By Technology |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | TE Connectivity, NVIDIA Corporation, ZF Friedrichshafen AG, Texas Instruments Inc., Robert Bosch GmbH, STMicroelectronics, Mobileye, Elmos Semiconductor SE, TDK Corporation, Infineon Technologies AG, NXP Semiconductors, Aptiv |

Analyst Review

The global automotive sensor fusion market is expected to witness growth during the forecast period owing to rise in demand for autonomous and stringent government standards for automotive safety. There is increase in development of sensor fusion technology to enable integration of a broad range of sensing and positioning technologies that can alert drivers of road hazards and help them avoid crashes. Moreover, an increase in stringent safety requirements that require vehicle models to be equipped with ADAS features are expected to drive the growth of the market. For instance, in November 2022, Konrad Technologies announced the opening of its Advanced Driver Assistance Systems (ADAS) Competence Center in Shanghai, China. Konrad Technologies continues to invest in local system development using ADAS XIL test benches. This includes ADAS hardware-in-the-loop (HIL) and multi-angle over-the-air (OTA) radar, lidar and camera target simulation to demonstrate sensor fusion closed loop test.

Automotive sensor fusion manufacturers invest in R&D to produce sensor fusion algorithms for both advanced driver assistance systems (ADAS) and automated vehicles. The development of autonomous vehicle technology has increased to save lives and reduce crashes, congestion, fuel consumption, and pollution. Autonomous vehicle manufacturers have invested a significant number of resources in developing self-driving car technology with the goal of fully commercializing the technology. Governments of various countries create legal frameworks and regulations to promote the adoption of autonomous vehicles. For instance, in Australia, the government plans to introduce a uniform regulatory approach to autonomous vehicles. In June 2021, the government announced its plans to create rules for driverless cars in place by 2026. The aim is to develop an end-to-end regulation to support the safe commercial deployment and operation of automated vehicles at all levels of automation. Therefore, surge in the adoption of autonomous vehicles is expected to drive the growth of the market.

Some major companies operating in the market include Aptiv, Elmos Semiconductor SE, Infineon Technologies AG, Mobileye, NVIDIA Corporation, NXP Semiconductors, Robert Bosch GmbH, STMicroelectronics, TDK Corporation, TE Connectivity, Texas Instruments, and ZF Friedrichshafen AG

The global automotive sensor fusion market was valued at $1.1 billion in 2021, and is projected to reach $6.7 billion by 2031, registering a CAGR of 20.9%.

North America is the largest regional market for automotive sensor fusion

Passenger car is the leading application of automotive sensor fusion market

Significant advancement of sensor & communication technology in vehicles and development of autonomous vehicles are the upcoming trends of automotive sensor fusion market

Loading Table Of Content...