Automotive Tensioner Market Insights, 2032

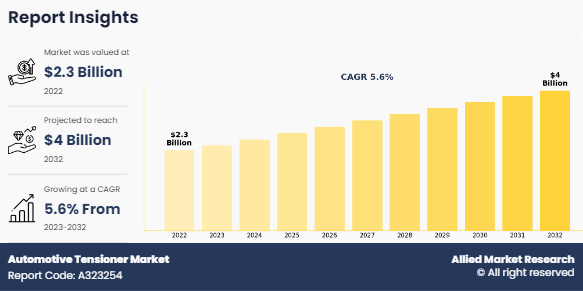

The global automotive tensioner market size was valued at $2.3 billion in 2022, and is projected to reach $4.0 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032.

Report Key Highlighters:

- The automotive tensioner market forecast study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive tensioner market share is highly fragmented, into several players including NTN Corporation, ALT America Inc, Litens Automotive Group, Dayco Incorporated, Gates Corporation, KMC Automotive Transmission Co., Ltd, GMB Corporation, Zhejiang Renchi Auto Parts Co., Ltd., Muhr and Bender KG, and CR product limited. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Automotive tensioners are mechanical components used in automobiles, tensioners maintain belt and chain tension in different engine parts such as the water pump, air conditioning compressor, alternator, power steering pump, and timing components. They are essential for making sure the chains or belts run smoothly, silently, and without sliding, which might cause failure or damage to the engine. Automotive tensioners are an essential component of a vehicle because they keep optimal tension between the belts and chains, thus improving overall vehicle efficiency and helping in reducing noise and vibration from the engine.

The growth of the automotive tensioner market growth is driven by increasing production and sales of automobiles, growing inclination towards lightweight vehicles, and increasing emission regulations around the globe. However, factors such as regular maintenance & component failure and increasing inclination toward EV are anticipated to hinder the market growth rate during the forecast period. On the contrary, expansion in emerging markets and increasing research and development are expected to provide lucrative growth opportunities for market growth.

In recent years, the demand for lightweight vehicles has increased due to growing demand for fuel-efficient vehicles and enhanced performance. As lighter weight vehicles require less fuel to propel and also improve the overall vehicle performance such as increased acceleration and improved handling. To reduce the overall vehicle weight, OEMs are focusing on reducing the weight of the components used in the vehicle, including automotive tensioners. The manufacturers operating in the market are utilizing lightweight materials such as advanced alloys, polymer composites, and bio-based materials to reduce weight. Tensioner manufacturers utilize optimal engineering and designing solutions to reduce the overall weight of tensioners. The demand for lightweight vehicles is anticipated to continue during the forecast period and thus will create market demand for lightweight automotive tensioners.

However, automotive tensioners are among the crucial components in any vehicle. They maintain optimum tension between belt and chains. Without adequate tension, the belt of the chain may slip, resulting in an overall vehicle or component failure. Likewise, tensioner used in engines synthesizes the movement of engine parts, resulting in precise timing, combustion, and performance. Although tensioners are crucial to the vehicle's functioning, they are also quite prone to damage. The components of tensioners are at the highest risk of breakdown due to continuous exposure to heat and other environmental factors such as moisture and exposure to dirt and debris. Due to automobile tensioners’ exposure to extreme environments, they are highly prone to component failure and require continuous maintenance to perform optimally, thus restraining the automotive tensioner market trends.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On June 2, 2023, NTN Corporation launched its new twin-arm auto tensioner for accessory and drive belt systems. The new automotive tensioner optimizes and automatically adjusts the auxiliary drive belt system's tension in mild hybrid electric vehicles (MHEVs') engines. The tensioner adopts a mechanism that suppresses excessive belt runout and adjusts the belt tension, which enables different vehicle driving modes, further reducing noise and vibrations from the engine and improving fuel efficiency.

- In September 2023, Litens Automotive Group introduced its 999420A belt tensioner. According to the company, the new tensioner has additional advantages over the initially developed equipment design, making it possible for a single technician to repair belt tensioners efficiently.

- On January 27, 2022, Dayco Incorporated introduced its heavy-duty 2-piece tensioner, the product is specifically developed for Detroit Diesel 13 and 15 series engines. In comparison to a single one-piece tensioner, the manufacturer divided the device into an outside and inner tensioner, reducing the installation time in half. In addition, the tensioner was designed to be more durable and easier to install.

Segmental Analysis

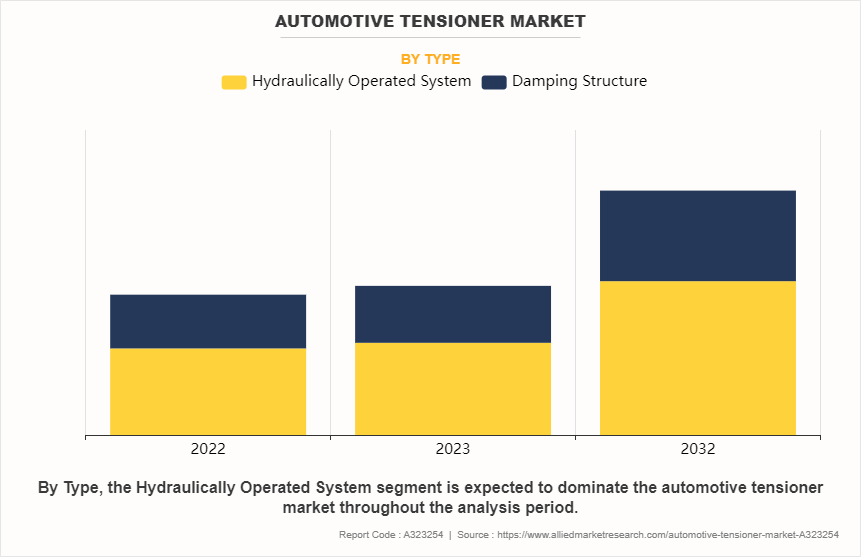

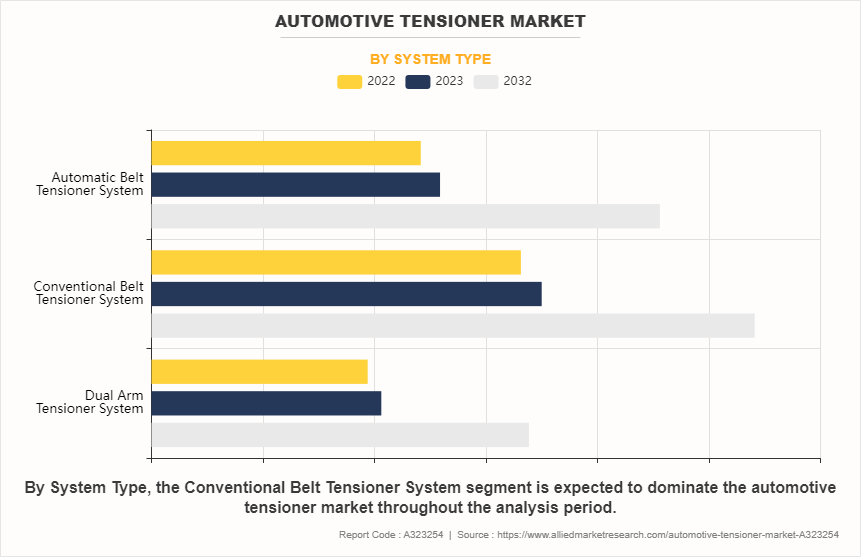

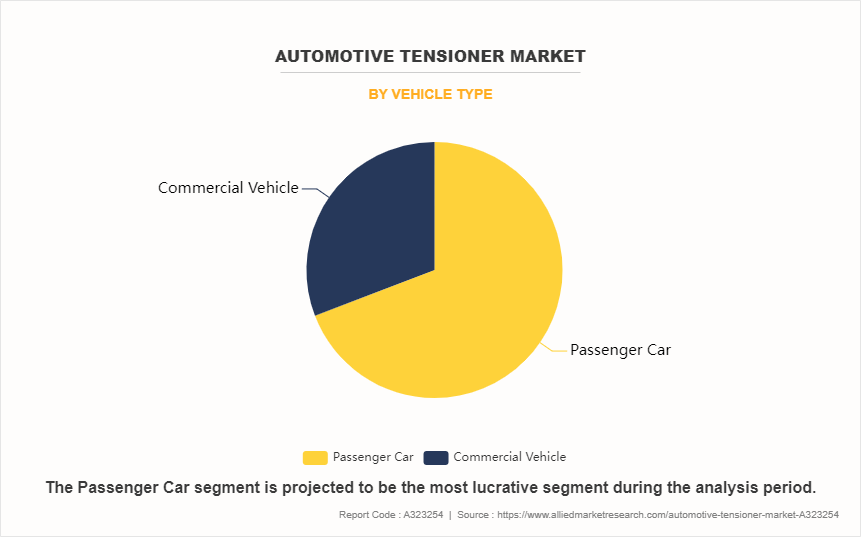

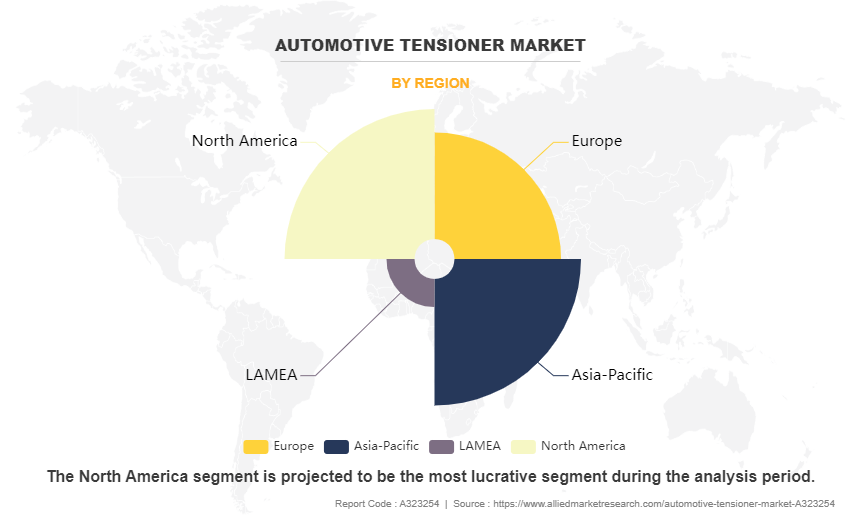

The automotive tensioner market analysis is segmented on the basis of type, system type, vehicle type and region. Based on type, the market is bifurcated into hydraulic-operated systems and damping structures. On the basis of system type, the market is analyzed into dual-arm tensioner systems, conventional belt tensioner systems, and automatic belt tensioner systems. By vehicle type, the global market is segmented into passenger cars and commercial vehicles. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

By Type

By type, the global automotive tensioner market has been bifurcated into hydraulic operated system and damping structure. The hydraulic operated system accounted for the largest market share in 2022, as it offers precise control and is commonly used in modern engines with variable valve timing systems. Moreover, these systems provide precise and consistent chain tension throughout varying engine operating conditions and are also easy to maintain. Moreover, these systems provide precise and consistent chain tension throughout varying engine operating conditions and are also easy to maintain.

By System Type

On the basis of system type, the global market has been segmented into dual arm tensioner system, conventional belt tensioner system, and automatic belt tensioner system. The conventional belt tensioner system accounted for the largest market share in 2022, owing to simple design and lower maintenance costs of the system; this reduces the overall complexity of the system and lowers the possibility of component failure. However, the automatic belt tensioner system is anticipated to grow at the fastest CAGR as automatic belt tensioners lower the possibility of belt slippage, early wear and tear, and component damage, as they do not require manual adjustment.

By Vehicle Type

By vehicle type, the market is analysed across passenger cars and commercial vehicles. Passenger vehicles segment holds the largest market share due to the higher production volume of passenger cars. The demand for automotive tensioners in passenger vehicles is driven by factors such as the increasing adoption of fuel-efficient engines with features such as variable valve timing, which rely heavily on timing chains and require proper tensioning. Commercial vehicles segment is expected to grow at a significant rate due to increasing investments in infrastructure development and growing demand from the logistics sector, leading to a rise in demand for commercial vehicles. Moreover, strict emission regulations are driving the adoption of advanced engines in commercial vehicles, which often utilize timing chains and require efficient automotive tensioners. Furthermore, a growing focus on fleet management and reducing downtime are also anticipated to drive the market demand during the forecast period.

By Region

Region-wise, North America held the largest market share in 2022, driven by several factors such as government incentives, growth in environmental awareness, and significant investments in the automotive industry. Strict emission regulations by the Environmental Protection Agency (EPA) are pushing automotive manufacturers to adopt advanced technologies that improve fuel efficiency and reduce emissions. Asia-Pacific is anticipated to show the strongest growth rate owing to several factors such as growing population, which is leading to an increase in demand for vehicles. Moreover, economic development in the region has resulted in an expanding middle class with greater disposable income which translates to increased vehicle ownership and spending on car maintenance, including replacing components like automotive tensioners.

Increasing Production and Sales of Automobiles

Over the last decade globally there has been an increase in sales of automobiles, majorly due to technological advancement in the automobile industry and increase in disposable income among people, especially in the developing regions. For instance, according to the European Automobile Manufacturer Association global car sales increased by over 9% in the first three quarters of 2023.

The increase in sales of automobiles is due to strict government regulations related to vehicle emissions, which resulted in increased consumer shifts towards hybrids and alternative fuel vehicles. The growing consumer trend toward buying hybrid vehicles is due to government support towards purchase of hybrid and alternative fuel vehicles by providing tax benefits and subsidies. Also, many countries globally have introduced vehicle scrapping policies, which include replacing old vehicles to lower CO2 emissions emitted through them. For instance, India, in April 2020, introduced BS6 norms, which outlines a permissible amount of emission from a vehicle. The country also introduced a vehicle scrapping policy which outlines that all unfit vehicles above 15 years need to be scrapped. The increase in sales of automobiles is anticipated to positively drive the growth for automotive tensioner during the forecast period.

Increased Inclination Towards EV

There has been an increased inclination of consumers toward electric vehicles in recent years, which is hindering the market demand for automotive tensioner. The growing demand for electric vehicles is due to a decrease in the cost of EVs, development of battery technology, and growth in charging infrastructure. The demand for electric vehicles is anticipated to continue to grow in coming years due to rising fuel prices and strong government support for the adoption of the technology. Thus, the growing demand for EV will continue to hinder the growth of automotive tensioners during the forecast period.

Expansion in Emerging Markets

There has been growth in sales and production of automobiles from countries such as India, China, Brazil, Mexico, and others. This country has seen higher adoption rates of smart mobility solutions due to stronger government regulations, increase in fuel prices, and a rise in the trend toward adopting non-fossil fuel-based vehicles. Governments in these countries are putting pressure on vehicle manufacturers to reduce carbon emissions caused by diesel fuel combustion and tackle growing greenhouse gas emissions. These resulted in growing research and development activities in the automobile industry. Similarly, global vehicle manufacturers are investing in this region to produce vehicles due to the availability of a strong labor force. The growing production and sales of automobiles in this country are expected to positively create demand for automotive tensioners during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive tensioner market analysis from 2022 to 2032 to identify the prevailing automotive tensioner opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive tensioner market trends, key players, market segments, application areas, and market growth strategies.

Automotive Tensioner Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Type |

|

| By System Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | ALT America Inc, Muhr and Bender KG, Gates Corporation, CR product limited, Zhejiang Renchi Auto Parts Co., Ltd., Litens Automotive Group, Dayco Incorporated, KMC Automotive Transmission Co., Ltd, NTN Corporation, GMB Corporation |

Weight reduction of the component are the upcoming trend in the market.

Passenger car are the leading application of automotive tensioner.

North America is the largest market for automotive tensioner.

The automotive tensioner market was valued at $2300.3 in 2022.

NTN Corporation, Dayco Incorporated, Gates Corporation, Muhr and Bender KG and GMB Corporation are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...