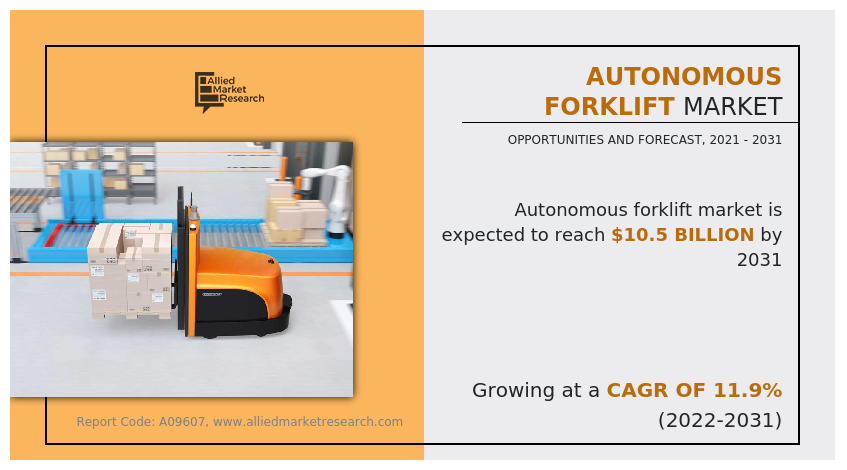

The global autonomous forklift market size was valued at $3.5 billion in 2021, and is projected to reach $10.5 billion by 2031, growing at a CAGR of 11.9% from 2022 to 2031.

Autonomous forklifts are also known as self-propelled forklifts that lift goods without human assistance. All storage services can be handled individually. This eliminates the need for human labor for warehouse operations. Defects introduced by human intervention in warehouse operations can be conveniently managed with the advent of automated forklifts. The rapid growth of the logistics and construction industries has increased the demand for autonomous devices. The need to handle heavy loads in material handling and supply chains is driving the demand for automated forklifts. Advances in technology have also increased the efficiency of industrial trucks. Automated forklifts make a significant contribution to optimizing intralogistics processes. This ensures that the right part is always in the right place at the right time. This technology helps drivers avoid potential hazards by calculating the safest maneuver in difficult situations. This will significantly reduce accidents.

In addition, autonomous material handling systems reduce costs typically incurred by medical, labor, training, and costs associated with the destruction of equipment, facilities, and unsold products by manual forklifts. Traditional forklift operators incur additional labor costs that machines cannot automate and can be reduced to conceptual, value-added positions that can be allocated more strategically. Rising labor costs and the availability of full-time workers, as well as changing workforce demographics, can make it difficult for businesses to retain well-trained forklift operators. High turnover also leads to expensive training programs for new hires and retiring operators, not to mention a growing labor shortage in the market as the demand for skilled workers steadily increases.

The global autonomous forklift market is expected to experience significant growth due to surging demand for automation solution in various industries, reduction of labor cost in organizations, and increase in safety, accuracy & productivity. However, lack in flexibility of autonomous forklift and high initial investment cost hamper the growth of the market. On the contrary, growth in e-commerce industry and incorporation of industry 4.0. to foster growth are the major factors that are expected to provide lucrative opportunities for the market growth during the forecast period.

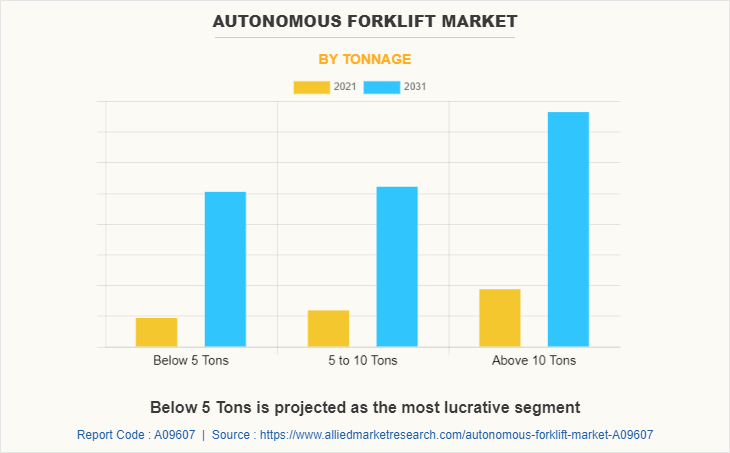

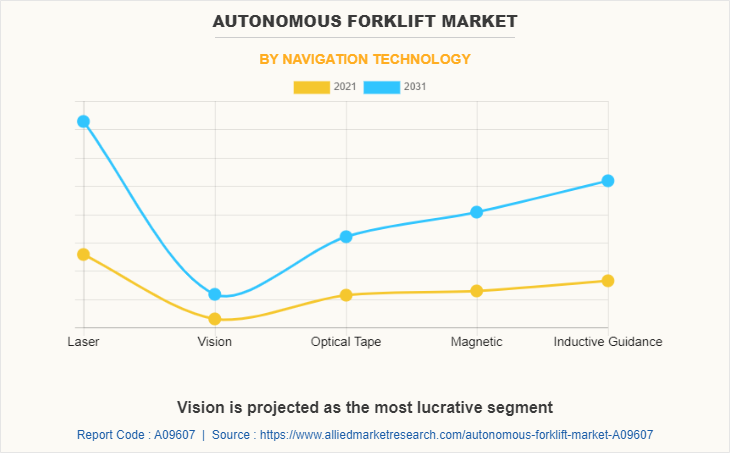

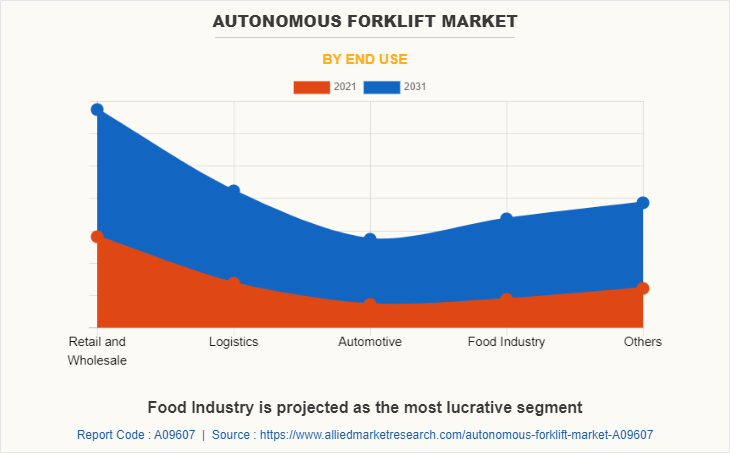

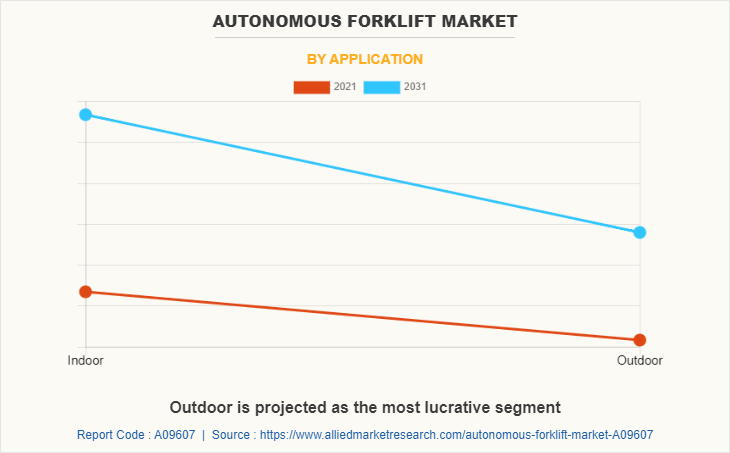

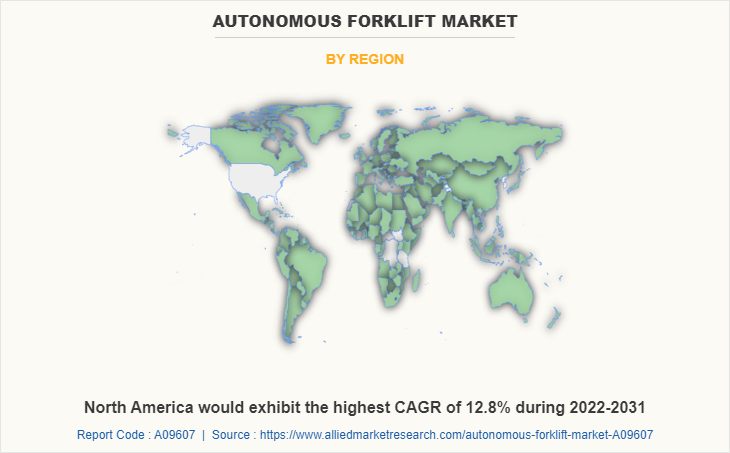

The autonomous forklift market is segmented into tonnage, navigation technology, end-use, application and region. By tonnage, the market is classified into below 5 Tons, 5-10 Tons, and above 10 Tons. On the basis of navigation technology, it is segregated into laser, vision, optical tape, magnetic and inductive guidance. Depending on end-use, it is classified into retail & wholesale, logistics, automotive, food industry and others. By application, the market is classified into indoor and outdoor. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include Agilox Services GmbH, Balyo, Hyster-Yale Materials Handling, Hyundai Construction Equipment Co., Ltd., Jungheinrich AG, KION Group AG, Mitsubishi Logisnext Co., Ltd., Oceaengineering International, Inc., Swisslog AG, and Toyota Industries Corporation.

Surging demand for automation solution in various industries

In recent years, the adoption of automation solution has increased significantly as they are a reliable solution for material handling, which in turn results in increased production capacity of the industries. These material handling solutions are used to decrease the physical damage to the goods (usually caused due to human operators) and increase efficiency of the operation. Autonomous forklift is adopted in almost all the industries such as logistics, automotive, food & beverages, manufacturing, and others. In addition, companies operating in the e-commerce industry in India are adopting autonomous solution for enhance productivity and reduced labor cost. For instance, Flipkart is using artificial intelligence (AI) powered bots that enable bots and humans to work together efficiently. Around 350 AI-powered bots monitored autonomous forklift assist operators to process almost 4,500 shipments per hour at twice the speed with remarkable accuracy. Furthermore, company claims that with the adoption of these bots the throughput and storage capacity has doubled as well. Thus, increasing demand for automation will further help in driving demand of autonomous forklift market.

Reduction of labor cost in organizations

Cost related to human labor includes payroll taxes, salary increase, vacation time, healthcare coverage, and others. However, by replacing human labor with autonomous forklift, a company is required to pay a single expense for the equipment, which is considered as initial investment. Adoption of autonomous forklift increases efficiency and reduces cost by automating a process in warehouses as well as at production lines. In addition, autonomous forklift can provide most value in long term cost benefit by addressing labor challenges and scaling businesses to meet demands ensuring productivity and profitability. Thus, reduction in labor cost of a company, owing to adoption of autonomous forklift drives growth of the market.

Lack in flexibility of autonomous forklift

Operations in warehouses sometimes need flexibility such as ability to handle multiple tasks. Autonomous forklift is most effective in operations that include repetitive tasks as they are programmed to do so. If a task is not repetitive, then it can be carried out more efficiently by humans. Thus, manually operated material handling equipment are more flexible than autonomous forklift. For instance, forklift operator performs job of moving goods with different format and different time lag. Autonomous forklift cannot perform these operations as they can be programmed to perform tasks that require fixed working format. Thus, lack in flexibility of autonomous forklift is anticipated to restrain growth of the autonomous forklift markets.

Growth in e-commerce industry

The e-commerce market continues to grow at a significant rate. Increase in demand for consumer products has led to rise in requirement of warehousing space, for storage of products, which are then distributed to retail stores in bulk, via pallet loads, and cases. Various distribution strategies and warehouse technologies are adopted to distribute the products to the location without any damage. To reduce time and space, forklift is used in the warehouses to place and arrange materials or goods in a proper manner. As per the usage, these trucks are available in different models such as counterbalanced sit-down riders, swing-reach turrets, and order pickers, with different power options including electric, natural gas, diesel, autonomous and gasoline. For instance, in May 2021, according to UNCTAD, a United Nation Conference on Trade and Development expert, the share of the global e-commerce sector's retail sales increased dramatically from 16% to 19% in 2020.

Similarly, according to the India Brand Equity Foundation (IBEF) organization, India's e-commerce is expected to reach $99 billion by 2024, growing 27.00% compared to 2019-2024, with food and fashion apparel expected to be major products in it. Thus, developments and growth in the e-commerce industry will further provide opportunities for global autonomous forklift market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autonomous forklift market analysis from 2021 to 2031 to identify the prevailing autonomous forklift market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the autonomous forklift market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global autonomous forklift market trends, key players, market segments, application areas, and market growth strategies.

Autonomous Forklift Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.5 billion |

| Growth Rate | CAGR of 11.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 345 |

| By Tonnage |

|

| By Navigation Technology |

|

| By End Use |

|

| By Application |

|

| By Region |

|

| Key Market Players | Toyota Industries Corporation, Swisslog Holding AG, KION GROUP AG, Hyundai Construction Equipment Co., Ltd., Mitsubishi Logisnext Co., Ltd., Hyster-Yale Materials Handling, Inc.,, Jungheinrich AG, Oceaneering International, Inc., BALYO, AGILOX Services GmbH |

Analyst Review

According to the insights of CXOs of leading companies, the global autonomous forklift market is expected to grow at a remarkable rate in the future, owing to a rise in demand for autonomous forklift in warehouses. The market players are focusing on the development of autonomous forklift due to less maintenance, and offer more performance as compared to traditional forklift, which increases the demand for autonomous forklift during the forecast period. For instance, in April 2022, Gideon launched Trey, an automated forklift for loading and unloading trailer. Trey fully autonomous assists in loading and unloading pallets, saving workers time by over 80%. It works safely, consistently, and reliably in dynamic environments and works along with people.

Autonomous forklift can provide dynamic flexibility, scalability, and reliability, enable compliance with safety requirements, and avoid contamination. Automation reduces product damage and eases the impact of repetitive and physically demanding tasks in highly complex manufacturing workflows. Developments in the e-commerce business drive the growth of the global autonomous forklift market. In addition, a rise in investments in the infrastructure industry developments, and increase in adoption of technological advanced autonomous forklift are anticipated to propel the growth of the market. However, a lack in flexibility of autonomous forklift, and the high cost associated with maintenance of autonomous forklift are expected to hamper the market growth.

The key players profiled in this report include Agilox Services GmbH, Balyo, Hyster-Yale Materials Handling, Hyundai Construction Equipment Co., Ltd., Jungheinrich AG, KION Group AG, Mitsubishi Logisnext Co., Ltd., Oceaengineering International, Inc., Swisslog AG, and Toyota Industries Corporation.

The global autonomous forklift market was valued at $3,484.1 million in 2021, and is projected to reach $10,453.3 million by 2031, registering a CAGR of 11.9% from 2022 to 2031

Asia-Pacific is the largest regional market for Autonomous Forklift

Retail And Wholesale is the leading application of Autonomous Forklift Market

Introduction of above 10 tons autonomous forklifts are the upcoming trends of Autonomous Forklift Market in the world

Loading Table Of Content...