Aviation Data Recorder Market Research, 2033

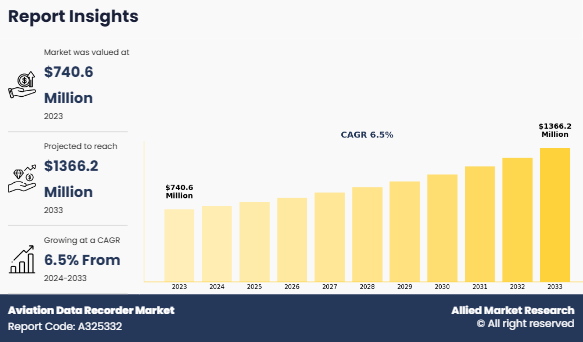

The global aviation data recorder market size was valued at $740.6 million in 2023, and is projected to reach $1.4 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

An aviation data recorder, also known as a black box, is an essential device in aircraft, designed to capture and store critical flight information for analysis, particularly during incident investigations. The primary types of aviation data recorders include flight data recorders, which monitor various parameters such as speed, altitude, and control settings, cockpit voice recorders, which capture audio communications within the cockpit, and mission data recorders used to record mission-specific data. With increased regulatory mandates and advancements in data capture, aviation data recorders play a pivotal role in enhancing flight safety, compliance, and operational efficiency across commercial and military aviation sectors.

Key developments

- July 2024: General Electric Company, through its subsidiary company GE Aerospace, signed a contract with South Korea's global airline, Korean Air to enhance safety, efficiency, and operational excellence by utilizing GE Aerospace’s industry-leading flight data monitoring system across the company. This strategy helps to empower Korean Air and its leading low-cost carrier, Jin Air, to enhance safety protocols and operational effectiveness through advanced analytics, automation, and high-speed processing of big data with high fidelity and quality.

- June 2024: Elbit Systems Ltd. received a contract from Textron Aviation to supply its KAPTURE Cockpit Voice (CVR) and Flight Data Recorders (FDR) to Textron Aviation across a range of its high-performance Cessna Citation jets. KAPTURE line of Cockpit Voice and Flight Data Recorders (CVR/FDR) is equipped with a lithium-free 90-day Underwater Locator Beacon (ULB). The CVR and CVFDR models come with a patented internal Recorder Independent Power Supply (RIPS).

- February 2024: Honeywell International Inc. signed a repair licensing agreement with AMETEK Singapore for flight recorders on Airbus A320, A330, and A340, and Boeing 737NG, 737Max, and 777 aircraft. This strategy extends the strategic collaboration between both parties, enhancing AMETEK’s recorder repair capabilities in the Singapore region and solidifying Honeywell’s position as an industry leader in flight recorders for the commercial aviation industry.

- July 2023: Safran collaborated with the Aeronautical Development Agency (ADA) to enhance the capability of light combat aircraft (LCA) Air Force mK2. This strategy helps to facilitate software modification for Unified Video Cum Digital Recorder (UVDR) Airborne unit & Ground Reply system (GRS).

- January 2023: L3HarrisTechnologies, Inc. developed and announced the availability of the off-the-shelf cohesive flight data recorder system for light aircraft and helicopters that meet the European Union Aviation Safety Agency’s ED-155 mandate. It is equipped with the L3Harris EFD-750 Standby connected to the L3Harrislightweight data recorder (LDR). It significantly helps to reduce installation, maintenance, and service time and expenses by eliminating the need to integrate, wire, test and connect numerous systems to an ED-155 certified recorder.

Market Dynamics

Stringent Safety Regulations to Propel the Demand for Aviation Data Recorder

Stringent safety regulations are a critical factor driving the growth of the aviation data recorder market share. Regulatory bodies such as the Federal Aviation Administration (FAA) and the International Civil Aviation Organization (ICAO) require advanced data recorders to ensure comprehensive documentation of flight conditions and cockpit activities. This regulatory focus aims to enhance safety by mandating high-performance recorders that can capture vast amounts of data, even under extreme conditions.

In commercial and military aviation, compliance with these regulations is not optional, making the installation of updated data recorders crucial. Governments globally are expanding and updating guidelines, requiring new and existing aircraft to be equipped with sophisticated data recording systems. For instance, many mandates now specify the need for extended recording time, larger data storage capacity, and improved crash survivability.

These requirements have increased the demand for cutting-edge flight, cockpit voice, and mission data recorders, encouraging aviation companies to invest in advanced systems to maintain operational compliance and reputation. As safety standards continue to evolve, the aviation data recorder market forecast is positioned for steady growth, driven by the need for recorders that meet and exceed the latest safety benchmarks.

Rising Replacement of Aging Aircraft Drives Demand for Aviation Data Recorders

The replacement of aging aircraft is a significant factor driving the growth of the aviation data recorder market industry. As the global fleet ages, airlines are upgrading to newer, more efficient models that comply with modern safety and data requirements. Many aging aircraft, originally equipped with older recording systems, lack the enhanced data capture and real-time analytics capabilities essential for today’s standards. Replacing these outdated models with advanced aircraft drives demand for data recorders, which are now a regulatory necessity.

For instance, data from the International Air Transport Association (IATA) indicates that the average age of commercial aircraft is expected to significantly decrease in the coming decade as airlines upgrade their fleets with newer, more fuel-efficient models. Thus, the rate of average annual retirements is projected to rise by 20-25% by 2030. Airlines retiring their older planes are simultaneously investing in advanced aircraft with next-generation data recording technology, designed to meet stringent safety requirements and real-time operational insights. This shift ensures compliance but also supports operational efficiency, making newer recorders a valuable asset for fleet management.

The replacement cycle thus fuels the market as airlines seek to modernize and comply with stricter regulatory mandates, enhancing aircraft safety and operational monitoring, making it clear that data recorders are central to the new fleet's structure.

High Costs of Advanced Data Recorders to Limit the Sales

High costs associated with advanced aviation data recorders can significantly hinder their adoption and sales in the market. Many advanced data recorders, which integrate features such as real-time data transmission and enhanced storage capabilities, are costly. For instance, advanced cockpit voice and data recorders (CVDR) may range over hundred thousand dollars, depending on their features and capabilities.

Such expenses pose challenges for smaller airlines and operators, especially those in emerging markets with limited budgets. These companies may prioritize essential equipment over high-cost data recorders, opting for lower-priced alternatives that might not offer the same advanced features. Also, existing fleet operators may hesitate to invest in new data recording technology due to the substantial capital outlay required, thereby delaying upgrades and replacements.

Moreover, these costs can also be challenging to justify, especially for operators who don’t see quick returns on their investment. As a result, reluctance to invest in high-cost advanced data recorders is expected to hamper the growth of the market, limiting overall sales despite the ongoing need for enhanced safety and compliance in the aviation industry.

Demand for connected aircraft systems to create lucrative opportunities in the market

The demand for connected aircraft systems is rapidly transforming the aviation industry, creating significant opportunities for data recorder manufacturers. As airlines increasingly adopt Internet of Things (IoT) technologies and digital solutions, the integration of data recorders with connected systems has become essential. These systems allow real-time data transmission, enabling airlines to monitor flight parameters, maintenance needs, and overall aircraft performance remotely.

This connectivity not only enhances operational efficiency but also improves safety management by providing critical insights into flight operations. For instance, advanced data recorders can share vital information with ground control, ensuring timely interventions when anomalies are detected. Furthermore, as regulatory bodies emphasize the need for better safety standards, the adoption of connected systems becomes more crucial.

The rise of smart and autonomous aircraft is also driving the demand for sophisticated data recorders capable of handling large volumes of data. According to industry forecasts, the aviation data recorder market growth is expected to grow substantially, leading to increased investment in data recording technologies. As a result, companies that can innovate and adapt their products to meet the needs of connected aircraft systems are poised to capture lucrative market shares, making it a promising opportunity in the evolving aviation landscape.

Segmentation

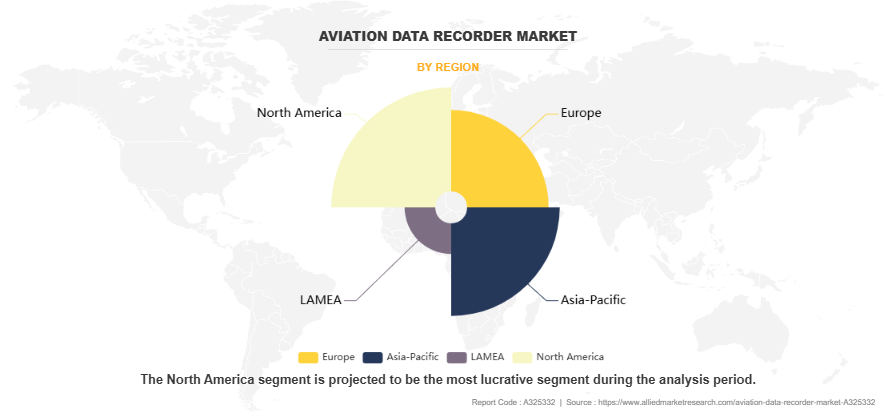

The aviation data recorder industry is segmented on the basis of product type, aircraft type, end user, and region. On the basis of product type, the market is classified into air vehicles digital data recorder, mission data recorder, and cockpit voice recorder. On the basis of aircraft type, the market is bifurcated into narrow body, wide body, business jets, and others. On the basis of end user, the market is categorized into commercial aircraft, and military aircraft. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America. and Middles East & Africa.

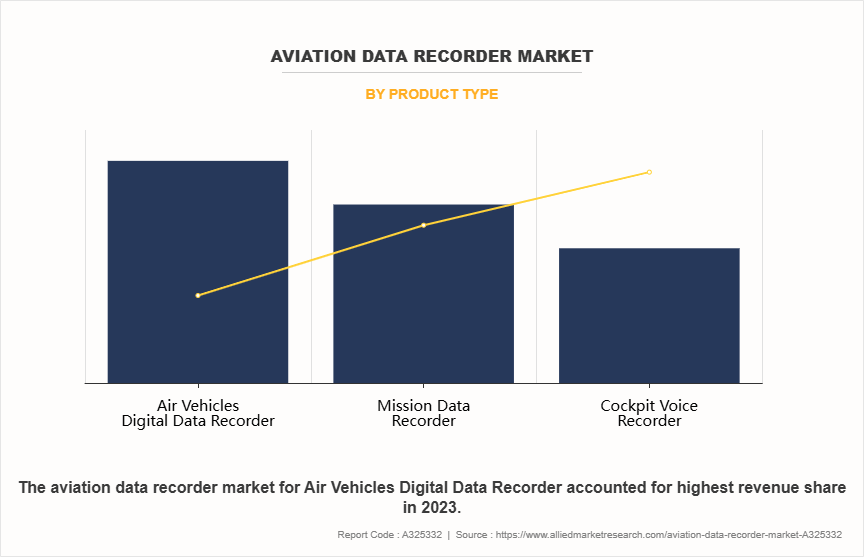

By Product Type

On the basis of product type, the market is classified into air vehicles digital data recorder, mission data recorder, and cockpit voice recorder. The air vehicles digital data recorder segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period due to the growing focus on real-time data analytics and predictive maintenance in aviation. As airlines and military operators prioritize enhanced flight performance and safety, these recorders provide critical operational insights. Increasing regulatory requirements for advanced data collection also supports sustained demand for this segment.

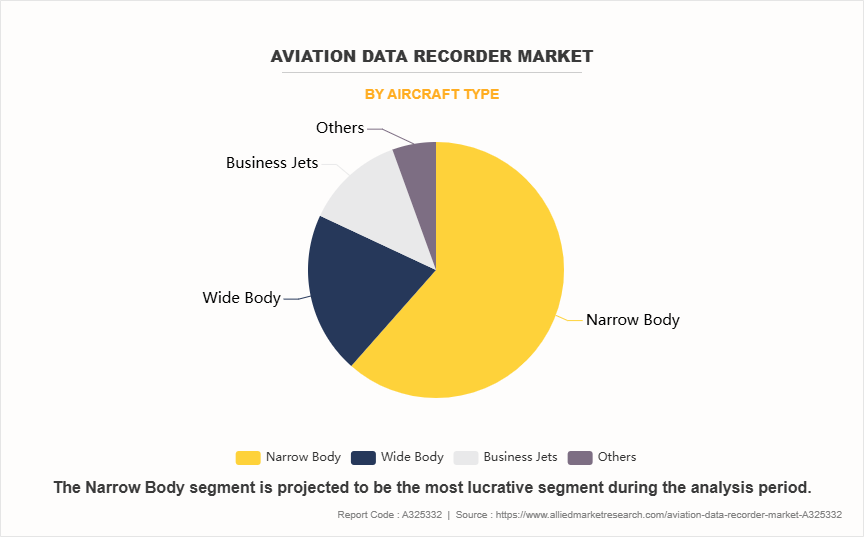

By Aircraft Type

On the basis of aircraft type, the market is bifurcated into narrow body, wide body, business jets, and others. The narrow body segment dominated the global market in the year 2023 as demand for single-aisle planes grows, driven by the surge in regional and low-cost airline travel. Narrow-body aircraft are ideal for short-haul routes, which are expanding globally. Enhanced fuel efficiency and regulatory compliance requirements also contribute to higher recorder installations in this dominant segment.

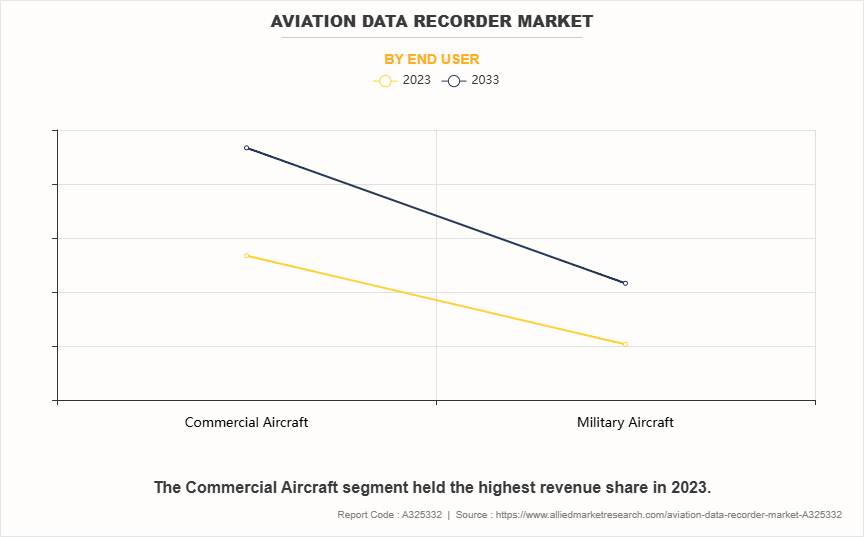

By End User

On the basis of end user, the market is categorized into commercial aircraft, and military aircraft. The commercial aircraft segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period as air travel demand increases, prompting airlines to expand and modernize their fleets. Enhanced safety regulations and global fleet upgrades drive the need for advanced data recorders in commercial aviation. Additionally, the growth of low-cost carriers worldwide contributes to sustained demand in this dominant market segment.

By Region

On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America region dominated the global market in the year 2023 due to its robust aviation industry, significant defense spending, and strict regulatory standards for safety and compliance. The region's advanced aerospace infrastructure and consistent investments in fleet modernization further support demand for aviation data recorders. Key market players and technological innovations in the U.S. solidify North America’s leading position.

Competition Analysis

The key players in the aviation data recorder market industry are Calculex Inc., Curtiss-Wright Corporation, Elbit Systems Ltd., General Electric Company, Hensoldt AG, Honeywell International Inc., L3Harris Technologies, Inc., Leonardo S.p.A., LX navigation d.o.o., Safran Group, Avionica, Appareo, Flight Data Vision, and Flight Data Technologies.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aviation data recorder market analysis from 2023 to 2033 to identify the prevailing aviation data recorder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aviation data recorder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aviation data recorder market trends, key players, market segments, application areas, and market growth strategies.

Aviation Data Recorder Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.4 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 333 |

| By Product Type |

|

| By Aircraft Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | LX navigation d.o.o., L3Harris Technologies, Inc., Flight Data Technologies, Safran, HENSOLDT, General Electric Company, CALCULEX, Inc., Avionica, Flight Data Vision, Honeywell International Inc., Leonardo S.p.A., Elbit Systems Ltd., Curtiss-Wright Corporation, Appareo |

The demand for connected aircraft systems, and real-time data analytics advancements are the upcoming trends of aviation data recorder market in the globe.

Narrow body is the leading aircraft type of aviation data recorder market.

North America is the largest regional market for aviation data recorder.

The estimated industry size of aviation data recorder in 2033 will be 1,366.2 Mn.

Mission data recorder is the fastest growing segment by product type.

Loading Table Of Content...

Loading Research Methodology...