Banking Software Market Research, 2032

The global banking software market was valued at $11.7 billion in 2022, and is projected to reach $69.9 billion by 2032, growing at a CAGR of 19.8% from 2023 to 2032.

The back-end software that is used for the processing of day-to-day transactions performed by the bank and broadcast updates to accounts along with several other financial records is known as banking software. Intense competition is occurring in the banking industry due to the lowering of switching barriers and the arrival of several next-generation banks. Quick services are provided by the key players of the market at a very low price to attract new customers.

In addition, banking software enables an individual to exchange banking services online in real-time. These solutions allow users to access their accounts and carry out primary transactions from any branch office. Banking software systems are rapidly becoming the backbone of modern banks as they look over various tasks such as journal entries, creation & management of accounts, balances, transactions, and others. Such software uses an agile architecture that allows the bank to make quick fixes and changes in the software without interrupting the customer’s digital experience,

Increase in demand for digital banking solutions and the surge in adoption of cloud-based solutions is boosting the growth of the global banking software market. in addition, the increase in the use of mobile banking the positively impacts growth of the banking software market. However, security issues and privacy concerns and high implementation cost is hampering the banking software market growth. On the contrary, an increase in the adoption of an Artificial Intelligence-based banking system is expected to offer a remunerative banking software market opportunity for expansion during the forecast period.

Segment Review

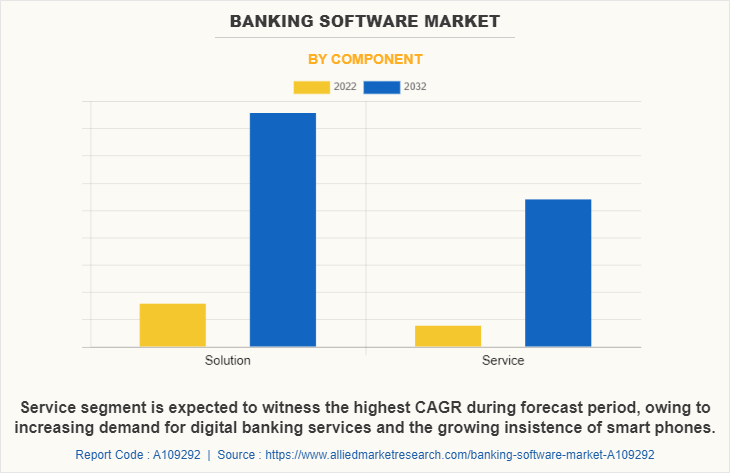

The banking software market is segmented on the basis of component, deployment mode, end user, and region. On the basis of component, the market is categorized into software and service. On the basis of deployment mode, the market is fragmented into on-premise and cloud. On the basis of end user, the market is bifurcated into banks and financial institution. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of component, the software segment holds the highest banking software market share as it provides personalized services, accelerates throughput, and reduces operational costs. However, the service segment is expected to grow at the highest rate during the forecast period. These services reduce managing concerns efficiently with personalized assistance and optimized performance development.

Region wise, the banking software market size was dominated by North America in 2022, and is expected to retain its position during the forecast period, owing to rise in adoption of banking software in small & medium enterprises to ensure effective flow of financial activities. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the growing adoption of web-based and mobile-based business applications in the sector of banking.

The key players that operate in the banking software industry are Oracle Corporation, SAP SE, Tata Consultancy Services Limited, Finastra International Limited, IBM Corporation, EdgeVerve Systems Limited, Fidelity National Information Services Inc, Fiserv Inc, Microsoft Corporation, and Salesforce.com, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking software industry.

Key Benefits

Banking software applications provide customers with one of the most secure transactions, and as a result, users can assign their banks. In addition, the interface is user-friendly and simple to navigate, and as a result, customers can perform most banking operations without or with minimal help. Banking software also helps the overall operation of a bank. It gives all bank employees a standardized process for receiving customer information, posting transactions, and making changes to an account. This will minimize the cost and inconvenience of errors. The reputation of a bank depends on its accuracy.

Well-designed backend software will also help reduce costs by streamlining the operation. When banks are ready to release a new financial product, it can be done across the entire organization at once. Reports to comply with oversight regulations become much simpler when all of the information is quickly accessible. Moreover, one of the big advantages of a custom solution is scalability. Banking software partners can develop programs that will meet banks current needs and anticipate where banks plan to go in the next few years. With the right basic infrastructure, your core banking solution can easily adapt to new products and services as businesses grow. banking software programs only work if all the pieces fit together properly. Custom-designed banking software allows for the full integration of your banking system. This means that it can process information from ATMs just as easily as it does a bank employee's desktop computer or a customer's mobile app.

Digital Capability

Digital transformation aims to integrate computer technologies into an organization's business processes, strategies, and products. Organizations implement digital transformation to improve employee and customer engagement and services and increase competitiveness. Moreover, In the banking sector, digital transformation requires migrating to digital and online services. It typically requires making changes to backend processes to facilitate automation and digitization. To compete with digital-native companies, banks must deliver an end-to-end digital customer experience, integrating the technologies to perform previously manual tasks. In addition, the increase in adoption of technologies such as the cloud, big data, and artificial intelligence (AI) is changing the landscape of banking industry.

In addition, the integration of such technologies with the banking process assists in advancing their visualization capabilities, resolving customer queries, and making complicated data usable. Moreover, these technologies help in increasing connectivity and providing advanced security methods in banks & financial institutions and also helps to develop the bank reconciliation software market. For instance, according to SAS insights, 30% of the employees in the banking industry rely on and trust AI driven outputs and utilize them for enhanced business analysis.

Furthermore, AI-based banking software provides real time insights to end-users and helps to improve network security, accelerating digital businesses and offering a better customer experience. The rising adoption of such technologies is expected to create numerous opportunities for players in the core banking software market. Key companies focus on completing partnerships and collaborations with other players to launch advance solutions based on core technologies such as AI and others. For instance, in January 2023, Temenos launched the next generation of its AI-driven, corporate Lending solution to enable banks to consolidate global commercial loan portfolios and unify servicing all on the Temenos banking platform.

Furthermore, Cloud computing is the most popular technology in banking and finance. Cloud-based services improve operations, increase productivity, and deliver products and services instantly. Integrating with the cloud also allows banks to use banking APIs. These APIs facilitate data sharing and improve the overall customer experience. Digital assistants and chatbots leverage AI-based banking tools to provide customers with the information they need to solve various problems. AI is also useful for analyzing and managing data, securing it, and improving the customer experience. For example, AI-based analytics can process consumer data in seconds to detect recurring patterns. Machine learning is a related concept, allowing banks to collect, store, and compare customer data in real time. One of the main benefits of using ML for banking is fraud detection. Machine learning solutions can easily detect changes in user behavior and take rapid, preventative action.

Moreover, the solution simplifies complex loan processing and lifecycle management across lending lines and geographies, addressing the needs of large tier one as well as regional banks, many of which are struggling to seize the growth opportunity in corporate lending due to disparate systems and a lack of integration. These technical developments in improved AI standards will significantly pave numerous opportunities for global market growth.

Top Impacting Factors

Increase in Demand for Digital Banking Solutions

With the growing adoption of digital technologies, customers are expecting more efficient and convenient banking services. Banking system software providers offer solutions that allow banks and financial institutions to offer digital banking services such as online banking, mobile banking, and digital payments fueling market growth in this space. Moreover, banks and financial institutions are prioritizing improving their customer experience to stay ahead of the competition in the market. Banking system software solutions offer personalized, seamless experiences to customers, propelling demand for these solutions.‐¯‐¯Moreover, BPOs are adopted by various banks and financial institutions for the better management of their business operations while offering improved collaboration, simplified compliance, productivity, and risk management. In addition, BPOs are being adopted increasingly,‐¯ as they offer effective planning and streamlining of data under one platform, which helps in regulating operational costs, enhancing decision-making, and increasing sales. With the increase in focus of banks toward improving their operational and business process efficiency, the adoption of BPO in BFSI is expected to grow in the upcoming years. This subsequently fuels the growth of the banking software market.

Surge in Adoption of Cloud-based Solutions

During the COVID-19 pandemic, an upsurge in demand for cloud-based services supported banks to sustain disruptions. In addition, major firms are also concentrating on introducing added items to obtain an advantage over rivals in the market. Customers of the latest items would receive complete banking capability. Its goal is to hasten business use of the cloud. For instance, in February 2023, Oracle Corporation launched banking cloud services, a new suite of componentized, composable services for the banking industry.

Moreover, the cloud-native, software-as-a-service (SaaS) suite will give corporate and retail banks the ability to modernize their banking applications to meet customer demands. Furthermore, it is anticipated that increasing adoption of Payment-as-a-Service (PaaS), Big Data, remote banking solutions, and cybersecurity will spur market expansion during the projected period. This factor has led to a surge in demand for cloud-based banking systems, thereby fueling the growth of the banking software market outlook.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the banking software market forecast from 2023 to 2032 to identify the prevailing banking software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the banking software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the banking software market analysis of the regional as well as global banking software market trends, key players, market segments, application areas, and market growth strategies.

Banking Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 69.9 billion |

| Growth Rate | CAGR of 19.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 251 |

| By Deployment Mode |

|

| By End User |

|

| By Component |

|

| By Region |

|

| Key Market Players | Oracle Corporation., Salesforce.com, Inc., Microsoft Corporation, Tata Consultancy Services Limited, Fiserv Inc, SAP SE, IBM Corporation, Finastra International Limited, EdgeVerve Systems Limited, Fidelity National Information Services Inc |

Analyst Review

Banking software consists of financial applications that include automating tools to satiate the needs of the banking sector. Moreover, banking software provides tailored solutions to meet potential customers' needs. Worldwide, mid, and large-size institutions can access innovative technology and cost-effective banking solutions owing to banking software.??

Key providers in the banking software market are Oracle Corporation, SAP SE, and Microsoft Corporation. With the growth in demand for banking software solutions, various companies have established acquisition strategies to increase their solutions offerings in AI solutions. For instance, in April 2022, Fiserv, Inc. acquired Finxact, a company that delivers a cloud-native Core as a Service, enabling fast, streamlined innovation without technology upheaval. Through this acquisition, Fiserv, Inc. would be able to speed up the capability of financial institutions and fintech to provide sorted digital banking experiences to its customers. Further, such strategies drive market growth.??

In addition, with the surge in demand for banking software, several companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in February 2023, Oracle Corporation unveiled the Oracle Banking Cloud Services. The new Oracle Banking Cloud Services is the latest suite of composable cloud-native and componentized services. Additionally, this is the world’s most exhaustive suite of cloud-native SaaS solutions so that banks of all sizes would be able to innovate with security, speed, and scale without compromising their current environments. For instance, in January 2022, Microsoft Corporation came into partnership with HDFC Bank, India’s largest private sector bank. Under this partnership, Microsoft Corporation would be able to enhance the bank’s digital workplace transformation with Microsoft 365 and would improve employee and customer experience.?

The banking software market is estimated to grow at a CAGR of 19.8% from 2023 to 2032.

The banking software market is projected to reach $69,872.19 million by 2032.

Increase in demand for digital banking solutions and the surge in adoption of cloud-based solutions is boosting the growth of the global banking software market. in addition, increase in use of mobile banking the positively impacts growth of the banking software market. However, security issues and privacy concerns and high implementation cost is hampering the banking software market growth. On the contrary, increase in the adoption of Artificial Intelligence based banking system is expected to offer remunerative opportunities for expansion of the banking software market during the forecast period.

The key players profiled in the report include Oracle Corporation, SAP SE, Tata Consultancy Services Limited, Finastra International Limited, IBM Corporation, EdgeVerve Systems Limited, Fidelity National Information Services Inc, Fiserv Inc, Microsoft Corporation, and Salesforce.com, Inc.

The key growth strategies of banking software market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...