Barite Market Research - 2027

The global barite market size was valued at $1.4 billion in 2019, and is projected to reach $2.4 billion by 2027, growing at a CAGR of 7.3% from 2020 to 2027. The barite industry growth is driven by an increase in demand from the oil and gas drilling industry, where barite is used as a weighting agent in drilling fluids. In addition, its rising use in the paints and coatings industry, due to its ability to enhance brightness, durability, and resistance to corrosion, is further boosting market growth. These dual applications are key factors propelling the expansion of the market.

Barite is a primary, naturally occurring, barium-based mineral, which exhibits high density and chemical inertness, making it an ideal mineral for many applications. It has a high specific gravity of 4.50 g/cm3 and Mohs hardness from 3.0 to 3.5. Barite, which may be found in a variety of colors, including yellow, brown, white, blue, gray, or even colorless, has a vitreous to pearly luster. It is found in conjunction with both metallic and nonmetallic mineral deposits. To be economically viable for extraction, barite needs to be the predominant material in a deposit. The types of deposits in which it is normally found include vein, residual, and bedded. Vein and residual deposits are of hydrothermal origin, while bedded deposits are sedimentary.

The growth of the global barite market is predominantly driven by increase in oil & gas drilling activities. Furthermore, increase in application of barite as a weighing agent in oil well drilling fluids to counteract certain pressures that result from well drilling operations significantly contributes toward the growth of the market. Surge in off-shore oil & gas drilling activities and increase in investment by major oil companies in deep and ultra-deep offshore exploration are expected to further augment the market growth during the forecast period. In addition, barite is used as a filler in paint and coating industries. Thus, the growth of the global barite industry is attributed to increase in paint and coating consumption in the construction, automotive, and general industries. Furthermore, rapid urbanization and industrialization in the emerging countries, such as India, China, and the countries of Southeast Asia, has surged the consumption of paints and coatings in the construction, automotive, and general industries application sectors. Owing to surge in consumption, the paints and coatings industries across these countries have increased their production volume, which eventually has surged the demand for barite. These factors are expected to drive the global barite market growth during the forecast period.

Moreover, substitution of barite for other minerals is expected to hinder the growth of the market. On the contrary, increase in aging population across the globe especially in the countries such as Japan and Australia and fast paced lifestyle have led to increase in diseases related to gastrointestinal tract. High purity form of barite is used in the gastrointestinal tract where its density prevents X-ray penetration. The outline of the gastrointestinal tract thus becomes visible allowing the determination of normal and abnormal anatomy. Thus, surge in number in of patients suffering from this ailment boosts the demand for barite across the medical industry for the examination of gastrointestinal tract disease or infection. This is likely to offer potential opportunities for the expansion of the market, globally. In addition, untapped oil reserves in emerging oil-producing regions such as Africa and Asia-Pacific is expected to offer lucrative opportunities to the players manufacturing barite-based weighting agents used in the oil & gas industry.

The global barite market size is segmented into form, grade, color, deposit type, end-use industry, and region. Depending on form, the market is categorized into lumps and powder. By grade, it is divided into up to grade 3.9, grade 4.0, grade 4.1, grade 4.2, grade 4.3, and grade above 4.3. On the basis of color, it is categorized into white & off-white, grey, brown, and others. As per deposit type, it is divided into residual, bedding, vein, and cavity filling. According to end-use industry, it is segregated into oil & drilling, paints & coatings, pharmaceuticals, rubber & plastics, textiles, adhesives, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major key players operating in the global barite market include Chinchana Group, Demeter O&G Supplies SN BHD, KIA Energy Company Ltd., NHAT HUY Group, General Electric, Ashapura Group, Halliburton, Sibelco, Schlumberger, and Sojitz Corporation. Other players operating in this market are P&S Group, Vietnam MRB Co. Ltd., International Earth Products LLC, Anglo Pacific Minerals, and Milwhite Inc.

Barite Market, By Geography

By Region

Asia-Pacific would exhibit an CAGR of 8.2% during 2020-2027.

Asia-Pacific accounted for the major share in 2019 in the global barite market, due to surge in population coupled with increase in energy demand, which has propelled oil & gas exploration activities in the Pacific Ocean especially in the South China sea. This is likely to surge the demand for barite across the region. In addition, barite is used as a filler in paint and coating industries. Rise in construction activities and surge in demand for paints & coatings from the automotive sector in the emerging countries, such as China, India, Japan, and the countries of Southeast Asia, are expected to drive the demand for paints and coatings, which, in turn, is likely to augment the demand for barite from paints & coatings manufacturers.

Barite Market, By Form

By Form

Powder is projected as the most lucrative segment.

The powder segment accounted for the major share in 2019 in the global barite market. Barite is used as filler in the manufacturing of rubber and plastics. Increase in plastic consumption in the construction, automotive, and electrical & electronics industries has led to surge in production of plastics. In addition, regulations to decrease gross vehicle weight to improve fuel efficiency and eventually reduce carbon emissions have promoted the use of plastics as a substitute to metals, including aluminum and steel, for the manufacturing of automotive components. Owing to this, the demand for barite from plastic manufacturers is expected to surge during the forecast period.

Barite Market, By Grade

By Grade

Grade 4.2 is projected as the most lucrative segment.

The grade 4.2 segment accounted for the major share in 2019 in the global barite market, owing to increase in demand for grade 4.2 barite as a filler in the rubber industry. Thailand is the largest rubber producing country in the world. According to Thai Rubber’s Association, the country’s natural rubber industry is likely to remain depressed in 2020 despite a sharp rise in demand for protective rubber gloves driven by the COVID-19 pandemic. As the coronavirus crisis has prompted many automotive factories, notably in the U.S. and Europe, to shut down or slow their production, resulting in lower rubber tire demand, the decline in demand for rubber is likely to affect the demand for barite during the forecast period.

Global Barite Market, By Color

By Color

Grey is projected as the most lucrative segment.

he grey color barite segment accounted for the major share in 2019 in the global barite market. This is attributed to the fact that grey color barite is widely used in used in oil drilling application. In addition, surge in offshore oil & gas exploration activities across the globe to meet the growing global demand for energy is expected to fuel the demand for grey color barite in the near future.

Barite Market, by Deposit Type

By Deposit Type

Bedding is projected as the most lucrative segment.

The bedding deposit segment accounted for the major share in 2019 in the global barite market. Barite obtained from bedded deposit is of grey color. Grey color barite is widely used as weighing agent in oil well drilling to counteract certain pressures that result from well drilling operations. Increase in offshore oil & gas exploration activities to meet the growing demand for energy across the globe is expected to surge the demand for grey color barite from the oil & gas industry which in turn is expected to surge the mining of grey barite from bedding deposit across the globe.

Global Barite Market, By End-Use Industry

By End-use Industry

Oil & Gas Drilling is projected as the most lucrative segment.

Based on end-use industry, the oil & gas drilling segment accounted for the major barite market share in 2019. Oil & gas drilling activity accounts for around 90.0% of global barite consumption. Rise in crude oil and petrochemical consumption across various industries such as transportation, plastics, energy, textiles, and paints & coatings has surged the oil & gas exploration activities in offshore sites. In addition, rise in investment in deep and ultra-deep offshore exploration activities is expected to further augment the market growth during the forecast period. Furthermore, increase in supply–demand gap on account of unstable political conditions in the Middle East and North Africa drives exploration activities in Eastern Europe and North America, which, in turn, is expected to have a positive impact on the global barite industry. Large sea shores possessed by various countries have driven efforts toward offshore oilfield excavations, which is likely to drive the growth of the market in coming years.

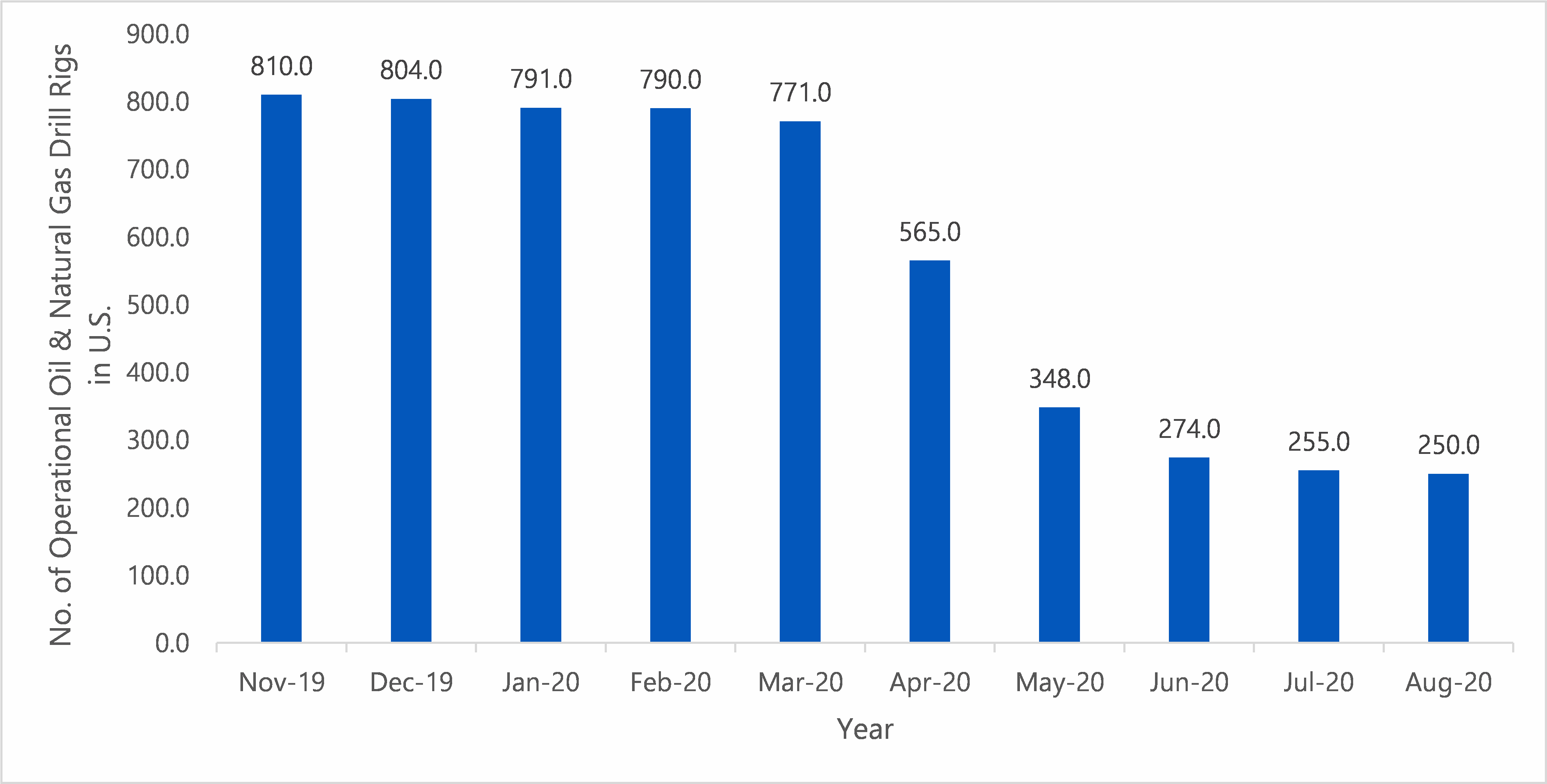

FIGURE: U.S. crude oil and natural gas drill rigs in operation

- According to the United Nations Industrial Development Organization (UNIDO), the MSME sector across the developing economies such as India, China, and countries of Southeast Asia has been worst affected due to COVID-19 outbreak and the lockdown imposed thereafter. This is expected to decline the demand of barite and its products. In addition, the demand for barite will gradually increase when government will lift the ongoing restriction and MSME sector will resume its operations.

- In the rubber industry, barite is used as filler for the rubber product, making the product waterproof. According to the Malaysian Rubber Council, in 2019, global rubber production was 28.8 million tons as compared to 29.2 million tons in 2018, thereby registering a decline in production rate by 1.4%. Thus, the global demand for barite across the rubber industry is expected to decline during the forecast period. However, in 2020, due to COVID-19 pandemic outbreak, the demand for safety gloves has been skyrocketed, which is expected to augment the demand for rubber in the gloves industry. This, in turn, has significantly increased the production of natural rubber. This is expected to surge the demand for barite from the rubber industry during the forecast period.

Historical Trends in the Barite Market

Early Uses (Pre-1900s): Barite was primarily used in the production of barium chemicals, and to a lesser extent, as a filler in rubber, paint, and glass industries.

Growth in Oil and Gas Industry (1920s-1950s): The discovery of barite's usefulness as a weighting agent in drilling mud for oil and gas wells led to a surge in demand. Barite’s ability to increase the density of drilling fluids made it essential for wellbore stability and pressure control.

Boom in Energy Sector (1970s-1980s): With the global energy crisis and the resulting increase in oil exploration, barite demand spiked. Its role in deep well drilling further expanded, as global oil companies sought new reserves in deeper, more challenging environments.

Stabilization and Diversification (1990s-2000s): While demand for barite remained tied to oil and gas exploration, new applications in pharmaceuticals, radiation shielding, and automotive brake linings helped diversify its uses. This led to a more stable market, less reliant on energy sector fluctuations.

Modern Era (2010s onwards): The barite market has seen fluctuating demand, driven by oil price volatility and environmental regulations. However, the rise of renewable energy exploration, along with continued oil drilling, keeps barite in demand.

Key benefits for stakeholders

- The barite market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the barite market forecast for the period 2020–2027.

- The report outlines the current barite market trends and future scenario of the global barite market from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- Key drivers, restraints, & opportunities and their detailed impact analysis are explained in the study.

Barite Market Report Highlights

| Aspects | Details |

| By Form |

|

| By Grade |

|

| By Color |

|

| By Deposit Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | ASHAPURA GROUP, CHINCHANA GROUP, DEMETER O&G SUPPLIES SN BHD, SIBELCO, HALLIBURTON, NHAT HUY GROUP, GENERAL ELECTRIC, SOJITZ CORPORATION, SCHLUMBERGER LIMITED, KIA ENERGY COMPANY LTD. |

Analyst Review

According to the analyst, surge in offshore oil & gas drilling activities across the globe to meet the growing global demand for energy drives the demand for barite in the global market. However, the outbreak of the COVID-19 pandemic in 2020 is expected to affect the demand of barite negatively as oil & gas drilling activities has been halted as oil producers are hampered with diminished demand due to excess supply. Barite are insoluble and alkali resistance due to which it is widely used across various industry verticals.

However, factors such as substitution of barite for other minerals are expected to hinder the growth of the barite market. In addition, untapped oil reserves in emerging oil-producing regions such as Africa and the Pacific Ocean; therefore, offer lucrative opportunities to the players manufacturing barite-based weighting agents used in the oil and gas industry.

This is expected to provide lucrative opportunities for barite market to grow in the near future. According to the analyst, the demand for barite witness significant growth in all the regions, owing to its favorable properties and demand in various industry verticals, which create opportunities for all players in the market.

Surge in off-shore oil & gas drilling activities and increase in investment by major oil companies in deep and ultra-deep offshore exploration are expected to faugment the market growth during the forecast period.

The global barite market was valued at $1.4 billion in 2019, and is projected to reach $2.4 billion by 2027, growing at a CAGR of 7.3% from 2020 to 2027.

Top companies in the barite industry are Chinchana Group, Demeter O&G Supplies SN BHD, KIA Energy Company Ltd., NHAT HUY Group, General Electric, Ashapura Group, Halliburton, Sibelco, Schlumberger, and Sojitz Corporation

Pharmaceutical industry is projected to increase the demand for barite Market

Oil & gas drilling is the leading segment in this market.

Major driver of the global barite market are increase in barite demand due to the U.S. shale oil drilling and escalating barite demand in paints & coatings industry in Asia-Pacific.

The demand for barite is likely to experience a downfall during the COVID-19 pandemic due to decline in production activities of paints and coatings, plastics, textiles, adhesive industries due to disrupted supply chain amid lockdowns. In addition, the U.S. is the largest oil-producing country in the world. Due to the outbreak of COVID-19 pandemic in 2020 oil producers across the U.S. are crippled with excess supply and diminished demand. As a result, the drill rig count in the U.S. has witnessed a sharp fall leading to reduced consumption of barite for drilling mud.

Loading Table Of Content...