Battery Holders Market Research, 2034

Market Introduction and Definition

The global battery holders market size was valued at $1.9 billion in 2023, and is projected to reach $4.2 billion by 2034, growing at a CAGR of 7.6% from 2024 to 2034. Battery holders are compartments designed to securely insert batteries, providing electrical contact between the battery terminals and the device. These holders come in various sizes and configurations to accommodate different battery types, such as AA, AAA, C, D, or coin cells. It is constructed from durable materials such as plastic and equipped with metal contacts, which ensure proper alignment and stable connections. Battery holders work by aligning the battery terminals with metal contacts, which conduct electricity to the connected circuit. Springs or clips often press the battery into place, maintaining contact and ensuring a consistent power flow to the device. In addition, battery holders facilitate easy battery replacement and prevent accidental disconnections.

Key Takeaways

The battery holders market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major battery holders industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The demand for portable electronic devices has driven the growth of the battery holders market share. The increase in use of smartphones, tablets, remote controls, medical devices, and other portable gadgets has led to higher requirements for efficient power solutions, thus driving the battery holders market growth. Battery holders provide secure connections and facilitate easy battery replacements for these devices. Manufacturers have introduced innovative battery holders designed for different sizes and configurations. For instance, in April 2024, Keystone Electronics launched a series of high-performance lithium battery holders aimed at improving device efficiency. In January 2024, Memory Protection Devices (MPD) introduced a compact holder model tailored for coin cell batteries, catering to the rise of smaller wearables and remote monitoring systems. Thus, the rise in wireless devices and battery-operated products, including smart home technology and wearables is anticipated to boost market growth in the coming years.

However, the risk of corrosion and connection failure significantly affects the demand for battery holders. Corrosion can damage the electrical conductivity of battery holders, leading to inefficient power transfer and potential device malfunctions. This issue is particularly higher in environments with high humidity or temperature fluctuations, where metal components are more prone to oxidation. Connection failure can also take place from poor design or the use of substandard materials, which results in unreliable contact between the battery and the holder. These problems may reduce the lifespan of electronic devices, create disruptions in performance, and lead to higher maintenance costs. Such risks deter both consumers and manufacturers from adopting specific battery holder models. Concerns regarding the reliability and durability of battery holders are expected to hinder market growth, as users prioritize products that ensure consistent performance without the risk of compromised connections and corrosion-induced damage.

Furthermore, the increase in use of electric vehicle (EV) battery modules has created new opportunities in the battery holders market. EVs rely on advanced battery systems that require secure, reliable connections to ensure consistent power delivery and safety. Battery holders designed for EV battery modules must support high power loads, resist vibration, and accommodate modular battery configurations. The rise in EV adoption, driven by global efforts to reduce carbon emissions and focus on sustainable transport, has increased demand for innovative battery holders that meet these specific requirements. For instance, the development of battery holders capable of supporting large lithium-ion cells or modular battery packs has become essential for efficient energy management in EVs. As automakers invest in research and development for improved EV performance and battery technology, the battery holders market is expected to experience more integration into these advanced vehicle systems.

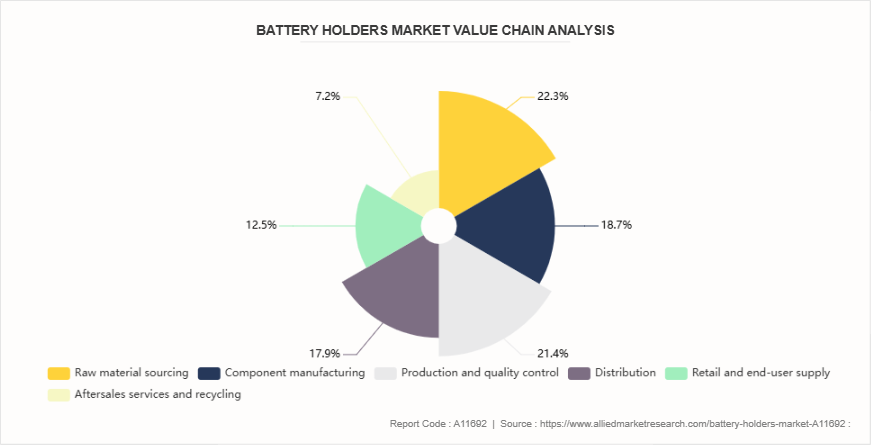

Value Chain of Global Battery holders Market

The value chain of battery holders begins with the sourcing of raw materials, including metals such as aluminum and steel, and various types of plastics such as polypropylene. Component suppliers provide these materials to manufacturers who design and produce battery holders with essential features, including corrosion resistance, durability, and secure electrical connections. The production process involves precision molding, assembly, and rigorous quality testing to meet stringent industry standards. Battery holders are then distributed to manufacturers in sectors such as automotive, aerospace, medical devices, and consumer electronics for integration into their products. Distributors and retailers further supply these products to end-users or companies. The value chain ends with aftersales services, recycling initiatives, and reuse efforts that align with sustainability goals and environmental regulations, which ensures a responsible lifecycle for battery holders.

Market Segmentation

The global battery holders market is segmented based on type, material, application, and region. Based on type, the market is classified into cylindrical battery holders, coin cell battery holders, 9V battery holders, AAA and AA battery holders, and others. Based on material, the market is divided into plastic, metal, and others. Based on application, it is categorized into consumer electronics, industrial equipment, medical devices, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for battery holders in North America is high owing to the strong focus on technology-driven solutions and strategic advancements in defense, aerospace, and medical devices. The U.S. Department of Defense, for instance, requires reliable battery holders for high-stress applications in military-grade electronics and automated aerial systems, where secure, vibration-resistant connections are essential in nature. In addition, the rapid expansion of medical technology, including portable diagnostic and monitoring devices, has encouraged manufacturers to develop precise and durable battery holders to ensure uninterrupted performance. Investment in smart infrastructure, such as connected grid systems and IoT-enabled devices, also contributes to the demand for battery holders in North America. The focus of North America on stringent quality standards and high-performance materials has made specialized battery holders a critical component across these sectors, thus driving market growth.

The Asia-Pacific region presents unique opportunities for the battery holders market owing to its expanding space technology sector, widespread use of robotics, and increasing demand for advanced consumer electronics. Countries such as India and South Korea are investing heavily in satellite technologies and self-operating systems, which require highly reliable battery holders for their operations in extreme conditions. In addition, the surge in robotics for industrial automation across manufacturing hubs like China presents a growing need for specialized battery holders capable of withstanding vibrations and providing secure connections in robotic systems. The growing market for portable medical devices in the region also creates demand for compact and durable battery holders. These diverse applications of battery holders in the Asia-Pacific region are expected to create multiple growth opportunities for market expansion.

Industry Trends:

Government policies focused on renewable energy and the adoption of electric vehicles are supporting growth in the battery holders market. These policies, which include tax incentives and subsidies, drive demand for energy storage solutions, thus boosting the need for reliable battery holders. Major companies are introducing innovative battery holders designed for advanced battery systems. For instance, in February 2024, TE Connectivity launched a new line of battery holders with improved safety features aimed at high-performance EV battery modules. The drive toward sustainable practices have led companies to incorporate eco-friendly materials like recyclable plastics such as polypropylene (PP) and corrosion-resistant metals like aluminum. Moreover, increased investment in research and development by major firms aligns with global shifts toward green technologies, creating a competitive and evolving market for battery holders market demand.

Competitive Landscape

The major players operating in the battery holders market include Keystone Electronics, Memory Protection Devices (MPD) , Harwin, TE Connectivity, Keystone EMEA, Bulgin, Hammond Manufacturing, Molex, Phoenix Contact, and Renata SA.

Recent Key Strategies and Developments

In February 2024, Belkin, a leading consumer electronics brand, launched a new Battery Holder for Apple Vision Pro, under its Future Ventures division, focusing on innovative solutions in content creation, AI, and robotics.

In July 2021, Linx Technologies launched five new nickel-plated coin-cell battery holders for compact IoT devices to expand their product line of battery holders.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery holders market analysis from 2024 to 2034 to identify the prevailing battery holders market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery holders market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery holders market trends, key players, market segments, application areas, and market growth strategies.

Battery Holders Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 4.2 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 381 |

| By Type |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bulgin, Renata SA, Keystone EMEA, TE Connectivity, Memory Protection Devices, Keystone Electronics Corp., Hammond Manufacturing Company Limited, Molex, Harwin, Inc., Phoenix Contact |

The global battery holders market was valued at $1.9 billion in 2023.

Upcoming trends in the battery holders market include increased demand for sustainable materials, miniaturization, and integration with smart technologies.

The residential has leading application of Battery Holders Market.

Based on region, North America held the highest market share in terms of revenue in 2023.

The major players operating in the battery holders market include Keystone Electronics, Memory Protection Devices (MPD), Harwin, TE Connectivity, Keystone EMEA, Bulgin, Hammond Manufacturing, Molex, Phoenix Contact, and Renata SA.

Loading Table Of Content...