Battery Thermal Management System Market Research, 2030

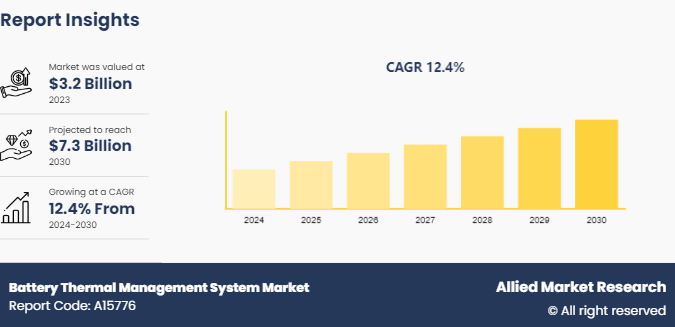

The global battery thermal management system market size was valued at $3.2 billion in 2023, and is projected to reach $7.3 billion by 2030, growing at a CAGR of 12.4% from 2024 to 2030.

Market Introduction and Definition

A battery thermal management system (BTMS) refers to the technology and methods used to maintain the optimal temperature range of batteries, particularly lithium-ion batteries. The primary function of a BTMS is to ensure that the battery operates efficiently, safely, and with an extended lifespan by preventing it from overheating or becoming too cold. BTMS is crucial in a variety of applications where battery performance is critical, including electric vehicles (EVs) , portable electronics, and energy storage systems.

Batteries, especially those used in high-demand applications such as EVs, generate significant heat during operation. If not properly managed, this heat can lead to thermal runaway, a condition where the battery temperature uncontrollably rises, potentially causing fires or explosions. Conversely, operating a battery in excessively cold conditions decrease its efficiency and shorten its lifespan. Therefore, a robust BTMS is essential to maintain the battery within its optimal temperature range, enhancing safety, performance, and longevity.

BTMS is critical in the automotive industry, particularly with the rise of electric vehicles. Electric vehicles rely on large battery packs to store and provide energy for propulsion. These battery packs generate substantial heat during charging and discharging cycles. An effective BTMS in EVs ensures that the battery remains within an optimal temperature range, improving efficiency and safety while extending the battery's lifespan. This is achieved through various cooling methods such as air cooling, liquid cooling, and phase change materials.

Key Takeaways

- The battery thermal management system industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period in battery thermal management system market statistics.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global battery thermal management system market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the battery thermal management system market report.

- The battery thermal management system market share is highly fragmented, with several players including Robert Bosch GmbH, GENTHERM, VALEO, Dana Limited, MAHLE GmbH, Hanon Systems, VOSS Automotive, Inc, 3M, Grayson Automotive Services Limited, ContiTech Deutschland GmbH. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the battery thermal management system market growth.

Market Segmentation

The battery thermal management system market is segmented into propulsion, technology, vehicle type, battery type, and region. On the basis of propulsion, the market is divided into battery electric vehicle (BEV) , plug-in hybrid electric vehicle (PHEV) , and fuel cell electric vehicle (FCEV) . On the basis of technology, the market is classified into active systems, and passive systems. On the basis of vehicle type, the market is categorized into passenger vehicles, commercial vehicles, and others. On the basis of battery type, lithium-ion battery, nickel-metal hydride (NiMH) battery, lead-acid battery, and solid-state battery. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, countries such as the U.S. and Canada are leading in the adoption of electric vehicles. The use of BTMS is widespread among EV manufacturers based in these countries to ensure battery performance and longevity, particularly in regions with varying climates.

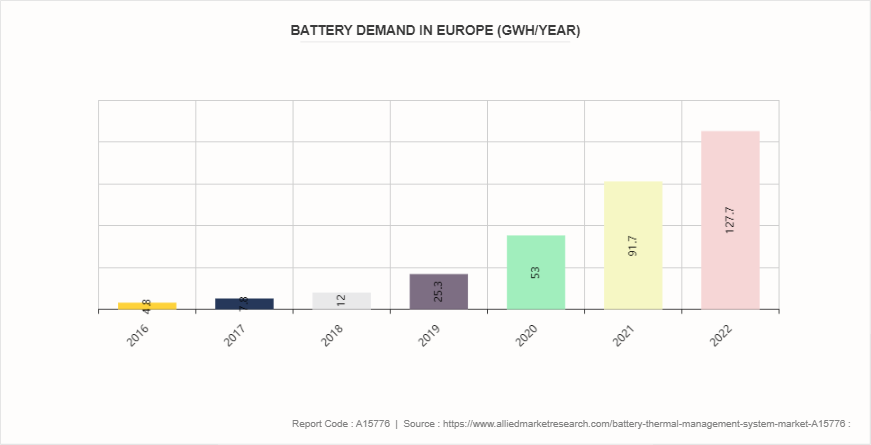

Europe, with countries such as Germany, Norway, the Netherlands, and France at the forefront of electric vehicle adoption, also sees extensive use of BTMS. The cold climates in parts of Europe necessitate efficient thermal management systems to mitigate temperature extremes and ensure battery efficiency and durability. In 2023, Europe experienced a significant surge in new electric car registrations, totaling nearly 3.2 million vehicles, marking a nearly 20% increase compared to the previous year. Within the European Union alone, sales amounted to 2.4 million, also reflecting robust growth rates. This trend mirrors developments in China, underscoring sustained market strength as the electric vehicle sector continues to mature. Notably, several European countries achieved significant milestones during the year. Germany, for instance, joined China and the U.S. as one of the few nations to surpass half a million new battery electric car registrations annually. Electric vehicles accounted for 18% of total car sales in Germany, with an additional 6% coming from plug-in hybrids.

Key Market Dynamics

Increase in adoption of electric vehicles is expected to drive the growth of battery thermal management system market. Electric vehicles offer a cleaner alternative to traditional internal combustion engine (ICE) vehicles, which are major contributors to air pollution and greenhouse gas emissions. The increase in awareness of climate change and the need to reduce carbon footprints have prompted both consumers and governments to embrace EVs. Governments around the world are implementing stringent emissions regulations and providing incentives such as tax breaks, subsidies, and rebates to promote the adoption of electric vehicles. These policies not only encourage consumers to switch to EVs but also compel automakers to invest heavily in electric mobility solutions, thereby boosting the demand for advanced BTMS.

Moreover, the rise of micro-mobility solutions, such as electric scooters and bikes, is contributing to the increased need for efficient BTMS. As urban areas grapple with traffic congestion and pollution, micromobility options provide a convenient and eco-friendly alternative for short-distance travel. These compact electric vehicles rely heavily on efficient thermal management to maintain battery performance and ensure safety in densely populated urban environments. The proliferation of micromobility solutions underscores the importance of BTMS in a diverse range of electric vehicles beyond traditional passenger cars. The U.S. Department of Transportation reports that Americans drive an average of 13, 476 miles annually, which breaks down to about 36.92 miles per day. Given the average energy consumption of an electric vehicle (EV) , a home EV charger would need approximately 11.81 kWh each day to fully recharge the battery for the distance driven.

However, high initial costs in developing and implementing advanced battery thermal management systems is expected to restrain the growth of the battery thermal management system market during the forecast period. The high initial costs associated with the development and implementation of advanced battery thermal management systems (BTMS) present a significant restraint, particularly for small and medium-sized manufacturers (SMEs) aiming to enter or expand within the market. This financial barrier encompasses various aspects of BTMS deployment, from research and development (R&D) expenditures to the actual integration costs in vehicle manufacturing and energy storage systems. The complexity of BTMS technology contributes substantially to its cost. Developing effective thermal management systems involves intricate engineering and material science considerations. These systems must efficiently regulate battery temperatures to optimize performance, ensure longevity, and enhance safety. Achieving these goals often necessitates the use of specialized materials, such as advanced heat exchangers, phase change materials, and thermal interface materials. These components are designed to withstand high temperatures, efficiently transfer heat, and maintain thermal stability within batteries, thereby increasing their cost.

Furthermore, the integration of Internet of Things (IoT) capabilities into the battery thermal management system (BTMS) provide lucrative opportunities in the battery thermal management system market forecast. The integration of Internet of Things (IoT) capabilities into battery thermal management systems (BTMS) represents a transformative leap forward in the management and optimization of electric vehicle (EV) and energy storage system (ESS) batteries. IoT integration enables real-time monitoring, predictive maintenance, and enhanced performance optimization, thereby fostering new service-based revenue streams and improving overall operational efficiency. Real-time monitoring is one of the primary benefits of IoT integration in BTMS. By equipping battery systems with sensors and connectivity modules, manufacturers and operators gain immediate access to critical data points such as temperature, voltage, current, and state of charge. This real-time data allows for continuous monitoring of battery health and performance metrics, providing insights into operational conditions and potential issues before they escalate. For instance, anomalies in temperature or voltage can be detected early, triggering alerts for proactive intervention to prevent overheating or potential battery failures. In 2023, Europe saw a significant surge in new electric car registrations, totaling nearly 3.2 million vehicles, marking a nearly 20% increase from the previous year. Within the European Union alone, sales amounted to 2.4 million electric vehicles, mirroring the strong growth rates observed across the continent. This trend parallels China's dynamic electric vehicle market, indicating continued robust growth as European markets mature. Moreover, several European countries achieved notable milestones in electric vehicle adoption during the year.

Competitive Analysis

Key market players in the battery thermal management system market include Robert Bosch GmbH, GENTHERM, VALEO, Dana Limited, MAHLE GmbH, Hanon Systems, VOSS Automotive, Inc, 3M, Grayson Automotive Services Limited, ContiTech Deutschland GmbH.

Industry Trends

- In May 2022, a leading global vehicle manufacturer chose BorgWarner's advanced battery management system (BMS) for its B-segment, C-segment, and light commercial vehicle platforms. This new BMS technology, scheduled for deployment starting mid-2023, aims to enhance battery pack performance, safety, and lifespan. BorgWarner’s BMS, designed for hybrid and electric vehicles, includes a master control unit that communicates with multiple cell management control units. This system monitors each battery cell’s state of charge, health, and temperature, while also accurately measuring the battery pack’s current and voltage.

- In March 2022, Battrixx, a manufacturer of lithium-ion battery packs for electric vehicles, completed the full acquisition of Pune-based Varos Technology Pvt. Ltd. Varos Technology specializes in developing IoT tools for EV infrastructure and battery management systems. This strategic partnership aims to enhance growth in the segment by creating synergies between Battrixx's products and services. Varos Technology will leverage its expertise to develop comprehensive battery management systems using cloud-based AI-driven analytic tools, which will help predict battery life and monitor battery performance.

- In March 2022, Matter, an Ahmedabad-based technological innovation start-up dedicated to providing new sustainable solutions, unveiled the development of a new high-speed mid-torque electric motor. Known as the Matter Drive 1.0 Motor, this advanced intelligent drive train features several key innovations, including an Integrated Intelligent Thermal Management System.

- In February 2022, BorgWarner Inc. entered into an agreement to supply High-Voltage Coolant Heaters (HVCH) for BMW Group's fully electric iX and i4 models. These heaters enhance the thermal management of the battery and cabin heating, significantly boosting the battery's reliability and driving range.

- As per the Society of Indian Automobile Manufacturers, in April 2022 to March 2023, Passenger Vehicle Exports increased from 5, 77, 875 to 6, 62, 891 units while Commercial Vehicle Exports decreased from 92, 297 to 78, 645, Three-Wheeler Exports decreased from 4, 99, 730 to 3, 65, 549 and Two Wheelers Exports decreased from 44, 43, 131 to 36, 52, 122 units over the same period last year

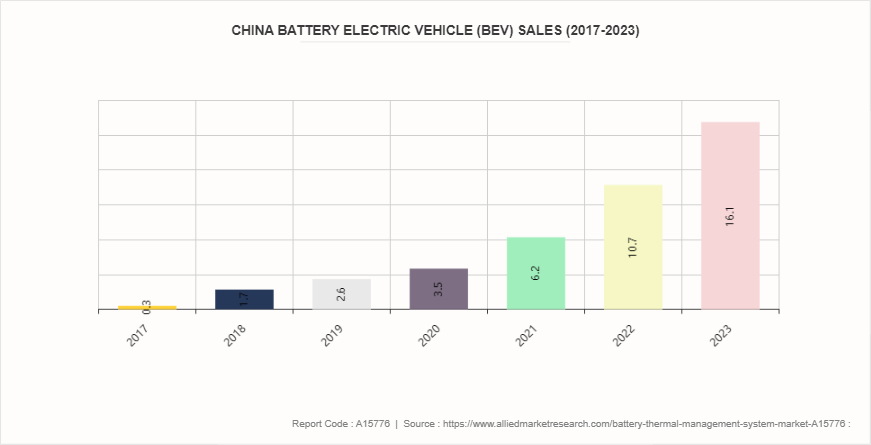

- According to the International Energy Agency, electric car sales approached 14 million in 2023, with China, Europe, and the U.S. accounting for 95% of these sales. China alone represented just under 60% of new electric car registrations, while Europe and the United States accounted for nearly 25% and 10% respectively. These regions together contributed to nearly 95% of the global electric car market, where electric vehicles hold a significant portion of the local automotive market.

Historic Trends of Battery Thermal Management System Market

- In the 1990s, thermal management systems for electric vehicles (EVs) were rudimentary and primarily relied on simple air-cooling methods. The focus was on developing basic cooling systems that could effectively dissipate heat generated by the batteries during operation.

- In the early 2000s, the adoption of liquid cooling systems marked a significant advancement in battery thermal management for electric vehicles. Liquid cooling systems were found to be more efficient than traditional air cooling methods. They could more effectively transfer heat away from the battery pack, which is crucial for maintaining optimal operating temperatures and extending battery life.

- In 2010 the emergence of all-electric vehicles like the Tesla Roadster and Nissan Leaf spurred further development in battery technology and thermal management. Liquid cooling remained dominant due to its efficiency. As EV range and performance increased, thermal management systems became crucial for maintaining battery efficiency and longevity. Automakers invested heavily in improving these systems.

- In 2020, solid-state batteries and other next-generation energy storage technologies spurred innovative advancements in battery thermal management. Solid-state batteries, which use solid electrolytes instead of liquid electrolytes, have different thermal characteristics compared to traditional lithium-ion batteries. Research focused on developing thermal management systems capable of efficiently dissipating heat from solid-state batteries to maintain their operational stability and longevity.

Key Sources Referred

- The International Trade Administration

- U.S. Department of Commerce

- International Energy Agency

- Department of Energy

- SAE International

- Infineon Technologies AG

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery thermal management system market analysis from 2024 to 2030 to identify the prevailing battery thermal management system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery thermal management system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery thermal management system market trends, key players, market segments, application areas, and market growth strategies.

Battery Thermal Management System Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 7.3 Billion |

| Growth Rate | CAGR of 12.4% |

| Forecast period | 2024 - 2030 |

| Report Pages | 300 |

| By Propulsion |

|

| By Technology |

|

| By Vehicle Type |

|

| By Battery Type |

|

| By Region |

|

| Key Market Players | GENTHERM, MAHLE GmbH, Hanon Systems, Robert Bosch GmbH, Grayson Automotive Services Limited, VALEO, 3M, VOSS Automotive, Inc, Dana Limited, ContiTech Deutschland GmbH |

The global battery thermal management system market was valued at $3.2 billion in 2023, and is projected to reach $7.3 billion by 2030, growing at a CAGR of 12.4% from 2024 to 2030.

Key market players in the battery thermal management system market include Robert Bosch GmbH, GENTHERM, VALEO, Dana Limited, MAHLE GmbH, Hanon Systems, VOSS Automotive, Inc, 3M, Grayson Automotive Services Limited, ContiTech Deutschland GmbH.

Asia-Pacific is the largest region for battery thermal management system.

Active system is the leading technology of battery thermal management system market.

The integration of Internet of Things (IoT) capabilities into the battery thermal management system (BTMS) are the upcoming trends of battery thermal management system market.

Loading Table Of Content...