Biobank Management Systems Market Research, 2033

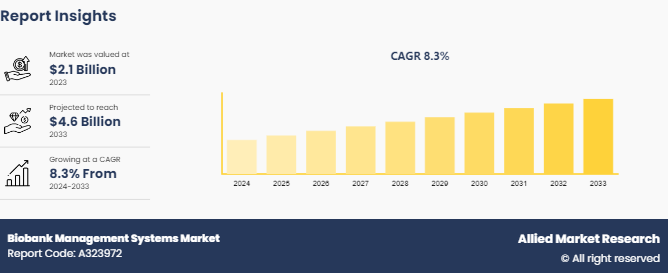

The global biobank management systems market size was valued at $2.1 billion in 2023, and is projected to reach $4.6 billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033. The major factor driving the growth of the biobank management systems market is the increase in demand for personalized medicine and precision healthcare, which requires extensive biological sample management and data integration capabilities. In addition, advancements in biotechnology and genomics have led to the generation of large volumes of data, necessitating efficient storage, retrieval, and analysis systems provided by biobank management solutions.

Market Introduction and Definition

Biobank management systems are sophisticated software solutions designed to efficiently manage the collection, storage, and distribution of biological samples and associated data. These systems play a crucial role in research, clinical trials, and healthcare by ensuring the integrity, traceability, and accessibility of biological specimens. Key features typically include specimen tracking, inventory management, and data integration capabilities to maintain detailed records of sample demographics, storage conditions, and usage history. Biobank management systems also incorporate security measures to safeguard sensitive information and compliance with regulatory standards such as Good Clinical Practice (GCP) and Good Laboratory Practice (GLP) . These systems enable researchers and healthcare professionals to streamline operations, accelerate discoveries, and improve patient care outcomes in biomedical research and personalized medicine initiatives by automating workflows and enhancing data accuracy.

Key Takeaways

- The biobank management systems market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major biobank management systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

According to biobank management systems market forecast analysis, the key factors driving the growth of the market are increase in biomedical research and development activities, surge in the number of biobanks, and rise in adoption of the biobank management systems. According to Regulatory Affairs Professionals Society, in 2021, there were around 2, 754 clinics engaged in providing stem cell therapies. Biobanks play a crucial role in storing biological samples and associated data, facilitating research into various diseases, drug discovery, and personalized medicine. As biomedical research expands, driven by advancements in genomics, proteomics, and personalized healthcare, the demand for efficient biobank management systems is expected to surge. These systems offer functionalities such as sample tracking, inventory management, and quality control, crucial for maintaining the integrity and usability of stored samples. Moreover, the integration of technologies like cloud computing and artificial intelligence enhances data management capabilities, improving the efficiency and scalability of biobanking operations. Thus, the rise in number of biobanks and rise in research and development activity in life science industry is expected to drive the biobank management systems market growth.

The surge in adoption of biobank management systems has emerged as a significant driver propelling growth in the biobank management systems market. These systems offer sophisticated tools for efficiently managing and tracking biological samples, data, and associated information within biobanks. Key factors fueling their adoption include increasing demand for personalized medicine, where comprehensive data management is critical for matching patients with tailored treatments. Moreover, regulatory requirements emphasizing proper sample storage and traceability further contributes to the adoption of the biobank management systems. Thus, the rise in adoption of the biobank management systems and growing trend towards laboratory automation is expected to contribute significantly in the growth of the biobank management systems market size.

Rise in Number of Biobanks Globally

The rise in the number of biobanks has emerged as a significant driver for the growth of the biobank management systems market. Biobanks, which store biological samples and associated data for research purposes, have proliferated due to increasing biomedical research activities, advancements in personalized medicine, and the growing importance of genetic and biomolecular research. These facilities play a crucial role in supporting medical research by providing access to large-scale collections of biological specimens, such as tissue, blood, and DNA samples, along with comprehensive data on donors and their health profiles. To manage these vast repositories efficiently, biobanks are increasingly adopting biobank management systems. These systems streamline sample tracking, inventory management, data integration, and ensure compliance with regulatory standards. As biobanks continue to expand globally, driven by collaborations between academic institutions, healthcare organizations, and pharmaceutical companies, the demand for robust biobank management systems is expected to escalate, fueling market growth in the coming years.

Top Biobanks Globally

Biobank | Country | Specimen Stored |

Biobank Graz | Austria | 20 million |

Shanghai Zhangjiang Biobank | China | 10 million |

All of Us Biobank | U.S. | 1 million |

The International Agency for Research on Cancer (IARC) Biobank (IBB) | U.S. | 0.56 million |

China Kadoorie Biobank | China | 0.5 million |

UK Biobank | UK | 0.5 million |

FINNGEN biobanks | Finland | 0.51 million |

Market Segmentation

The biobank management systems industry is segmented into sample type, application, and region. By sample type the market is divided into absorbable human tissue and organ samples, plant and animal samples and microbial samples. By application, the market is classified into regenerative medicine, life science research, clinical research, and environmental research. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the biobank management systems market share owing to substantial research and development activities in stem cell therapies, and strong presence of major key players. In addition, according to biobank management systems market opportunity analysis, Asia-Pacific region is expected to register significant growth in the forecast period owing to rise in research and development in precision medicine and growing number of biobank establishment in the region.

- According to the Biobank Resource Center, as of 2023, there are 340 registered biobanks, including both Canadian and international biobanks.

- In 2021, Lifecell, the India's first and largest stem cell bank, reported that around 50, 000 transplants have been done using stem cells across the globe.

- According to U.S. Food and Drug Administration, as of 2023, 29 cell and gene therapies have been approved.

Industry Trends

- According to the Biobank Resource Center, as of 2023, there are 340 registered biobanks globally.

- According to the U.S. Food and Drug Administration, as of 2023, 29 cell and gene therapies have been approved. Biobanks play a crucial role in storing, managing, and distributing biological samples critical for research and development in these advanced therapies.

- In July 2024, the Estonian Biobank at the University of Tartu introduced MinuGeenivaramu, a new online portal designed to offer participants detailed insights into their genetic health predispositions, medication compatibility, and ancestry. This platform not only provides valuable personal health information but also includes questionnaires aimed at gathering research data from users.

- In 2023, UK Biobank, the world’s most significant source of data and biological samples for health research, received $134.36 million fund to build a biobank facility at Bruntwood SciTech’s Manchester Science Park. This investment marks a substantial expansion in infrastructure for storing and managing biological samples and health data, crucial for advancing biomedical research. This expansion could drive demand for advanced biobank management systems capable of efficiently cataloging, tracking, and analyzing vast quantities of data and samples.

Competitive Landscape

The major players operating in the biobank management systems market include Agilent Technologies, CloudLIMS, AgileBio SARL, Modul-Bio, Autoscribe Informatics, Krishagni Solutions Pvt Ltd., Information Management Services, Inc., Technidata Inc, Azenta Inc, and Qiagen N.V. Other players in the Biobank Management Systems market include Promega Corporation, Tecan Group, Brooks Life Sciences, Biomatters Ltd., and Thermo Fisher Scientific.

Key Sources Referred

- National Library of Medicine

- U.S. Food and Drug Administration

- Biobank Resource Center

- Regulatory Affairs Professionals Society

- World Health Organization

- Biobank Resource Center

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biobank management systems market analysis from 2024 to 2033 to identify the prevailing biobank management systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biobank management systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biobank management systems market trends, key players, market segments, application areas, and market growth strategies.

Biobank Management Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.6 Billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Sample Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Qiagen N.V, CloudLIMS Technologies Pvt. Ltd., Agilent Technologies, Inc., Azenta Inc, AgileBio SARL, Krishagni Solutions Pvt Ltd, Autoscribe Informatics, Modul-Bio, Information Management Services, Inc, Technidata Inc |

The forecast period for Biobank Management Systems Market is 2024-2033.

The global biobank management systems market size was valued at $2.1 billion in 2023.

The market value of Biobank Management Systems Market is projected to reach $4.6 billion by 2033.

The base year is 2023 in Biobank Management Systems Market

Major key players that operate in the Biobank Management Systems Market are Agilent Technologies, CloudLIMS, AgileBio SARL, Modul-Bio, and Autoscribe Informatics

Loading Table Of Content...