Bioprocess Bags Market Research, 2033

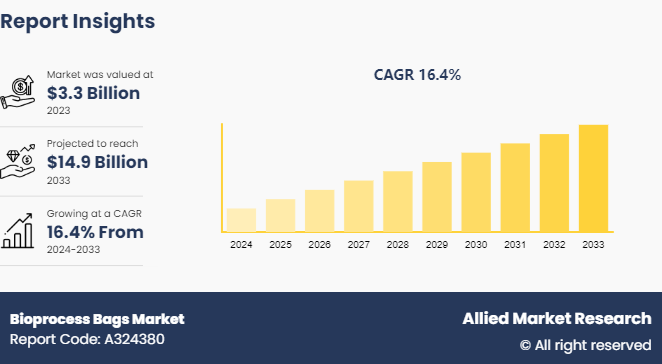

The global bioprocess bags market size was valued at $3.3 billion in 2023, and is projected to reach $14.9 billion by 2033, growing at a CAGR of 16.4% from 2024 to 2033. The bioprocess bags market is driven by the increasing demand for biopharmaceuticals, which necessitates efficient and scalable production processes. The adoption of single-use technologies, such as bioprocess bags, offers cost-effectiveness, reduced contamination risk, and operational flexibility. Additionally, advancements in bioprocessing technologies and regulatory support are further boosting growth during bioprocess bags market forecast.

Market Introduction and Definition

Bioprocess bags, also known as single-use or disposable bags, are specialized containers used in biotechnology and pharmaceutical industries for the sterile containment and processing of liquids. These bags are typically made from flexible, sterile materials such as polyethylene or polypropylene, engineered to withstand a wide range of biological processes without contamination. Bioprocess bags offer several advantages over traditional stainless-steel tanks, including reduced cleaning requirements, minimized risk of cross-contamination, and increased flexibility for smaller batch productions. They are integral to modern biomanufacturing processes, supporting the production of vaccines, biopharmaceuticals, cell therapies, and other biological products with stringent quality and safety standards.

Key Takeaways

- The bioprocess bags industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major bioprocess bags market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The bioprocess bags market size is driven by several factors including increasing demand for biopharmaceuticals, advancements in single-use technologies, and the growing emphasis on cost-effective manufacturing processes. Bioprocess bags offer advantages such as reduced cross-contamination risks, easier handling, and faster turnaround times compared to traditional stainless-steel systems. These benefits drive their adoption across biopharmaceutical manufacturing, particularly in cell culture and vaccine production. However, the market faces restraints such as concerns over leachables and extractables, which can limit their use in sensitive applications. Despite these challenges, opportunities lie in expanding applications in personalized medicine and regenerative therapies, where flexibility and scalability are crucial. For instance, the use of bioprocess bags in gene therapy production showcases their potential to meet stringent regulatory requirements while enabling efficient manufacturing processes.

Market Segmentation

The bioprocess bags industry is segmented into type, workflow, end user, and region. On the basis of type, the market is bifurcated into 2D bioprocess bags, 3D bioprocess bags, and others. By workflow, the market is divided into upstream process, downstream process and process development. By end user, the market is divided into pharmaceutical & biopharmaceutical companies, CMOs & CROs, and academic & research institute. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America has highest bioprocess bags market share and is experiencing significant growth driven by several key factors. One of the primary drivers is the increasing demand for biopharmaceuticals, including vaccines, monoclonal antibodies, and gene therapies, which require efficient and scalable production processes. The adoption of single-use technologies, such as bioprocess bags, is growing due to their cost-effectiveness, reduced risk of contamination, and operational flexibility compared to traditional stainless-steel systems.

Additionally, advancements in bioprocessing technologies and materials are enhancing the performance and reliability of bioprocess bags, further boosting their adoption. Regulatory support and guidelines from agencies such as the FDA are also encouraging the use of single-use systems in biopharmaceutical manufacturing. Furthermore, the presence of a well-established biopharmaceutical industry, coupled with increasing investments in research and development, is propelling market bioprocess bags market growth. The trend towards personalized medicine and the need for rapid and flexible production processes are further contributing to the rising demand for bioprocess bags in North America.

Industry Trends

- Biopharmaceutical and biotechnology companies are increasingly adopting single-use technologies, including bioprocess bags, due to their cost-effectiveness, flexibility, and reduced risk of contamination compared to traditional stainless-steel systems.

- The growing demand for biopharmaceuticals, such as monoclonal antibodies, vaccines, and cell therapies, has fueled the need for scalable and flexible manufacturing solutions provided by bioprocess bags.

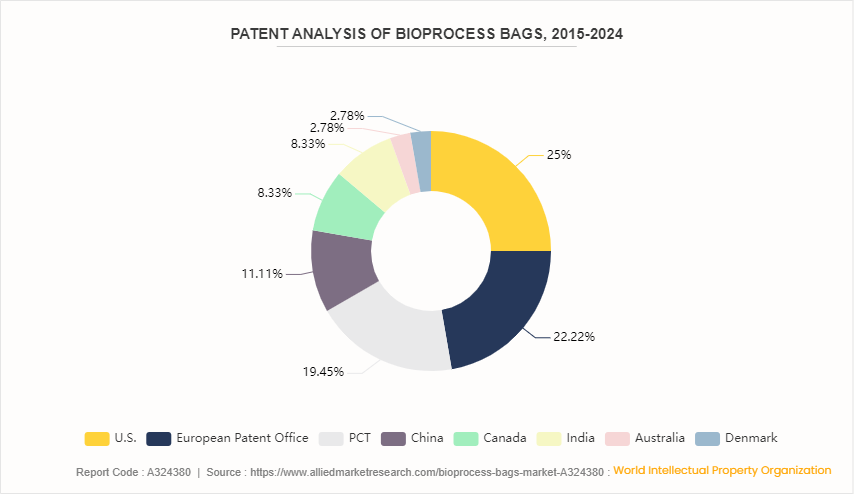

Patent Analysis, By Country, 2015-2024

U.S. witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. European Patent Office has 22.2% of the total number of patents, followed by PCT at 19.4% and China at 11.1%.

Competitive Landscape

The major bioprocess bags market share holder operating in the market include Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Danaher Corporation (Pall Corporation) , GE Healthcare, Saint-Gobain Performance Plastics, Lonza Group AG, Eppendorf AG, Meissner Filtration Products, Inc., PBS Biotech, Inc. Other players in Bioprocess bags market includes Entegris, Inc., Broadley-James Corporation, Parker Hannifin Corporation, Compagnie de Saint-Gobain S.A., Repligen Corporation, and so on.

Recent Key Strategies and Developments

- In April 2022, Thermo Fischer Scientific, Inc. announced the launch of a new manufacturing plant in Ogden, Utah, which will provide technology and materials required for the creation of novel treatments and vaccines. The building is a component of Thermo Fisher's USD 650 million investment to provide a stable bioprocessing manufacturing capacity for essential components utilized in the development of biologics and vaccines, such as the COVID-19 vaccine. With this investment, the business will be able to address the growing need for single-use technologies and support the advancement of novel vaccinations and treatments. The facility is estimated to be worth USD 44 million.

- In March 2022, ILC Dover LP, specializing in innovative single-use solutions for biotherapeutics and pharmaceutical processing, launched liquid single-use bioprocessing bags, representing the first of many new products for handling and supply of sterile liquids for the biotherapeutics market. This expansion is a continuation of ILC Dover’s solution set across the entire biotherapeutic and pharmaceutical manufacturing workflow, from powder containment and handling, through sterile liquid handling and pre-filled liquid and powder bags.

- In February 2021, Saint-Gobain launched extremely effective cell culture bags for T-cell growth. T-cells, a vital part of the immune system and a key component of cell-based treatments for the treatment of numerous diseases, can develop and expand in a sterile and regulated environment thanks to these new cell culture bags.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the Bioprocess bags market segments, current trends, estimations, and dynamics of the Bioprocess bags market analysis from 2023 to 2033 to identify the prevailing Bioprocess bags market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Bioprocess bags market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Bioprocess bags market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Bioprocess bags market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- National Perinatal Epidemiology and Statistics Unit (NPESU)

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

Bioprocess Bags Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.9 Billion |

| Growth Rate | CAGR of 16.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type |

|

| By Workflow |

|

| By End User |

|

| By Region |

|

| Key Market Players | Saint-Gobain Performance Plastics., Thermo Fisher Scientific Inc., Danaher Corporation, Sartorius AG, PBS Biotech, Inc. , Lonza Group AG, Merck KGaA, GE Healthcare, Meissner Filtration Products, Inc., Eppendorf AG |

The bioprocess bags market is driven by the increasing demand for biopharmaceuticals, which necessitates efficient and scalable production processes. The adoption of single-use technologies, such as bioprocess bags, offers cost-effectiveness, reduced contamination risk, and operational flexibility. Additionally, advancements in bioprocessing technologies and regulatory support are further boosting market growth.

Bioprocess bags, also known as single-use or disposable bags, are specialized containers used in biotechnology and pharmaceutical industries for the sterile containment and processing of liquids.

The Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Danaher Corporation (Pall Corporation), GE Healthcare held a high market position in 2023.

The base year is 2023 in bioprocess bags market.

The forecast period for bioprocess bags market is 2024 to 2033.

The market value of bioprocess bags market in 2033 is $14.9 billion.

The total market value of bioprocess bags market is $3.3 billion in 2023.

Loading Table Of Content...