Bitcoin Payments Market Overview

The global bitcoin payments market was valued at $850.55 billion in 2021, and is projected to reach $3788.2 billion by 2031, growing at a CAGR of 16.3% from 2022 to 2031. Growing demand for operational efficiency, transparency, secure data, remittances in developing nations, and enhanced capital optimization in modern financial payment systems contribute to the growth of the market.

Market Dynamics & Insights

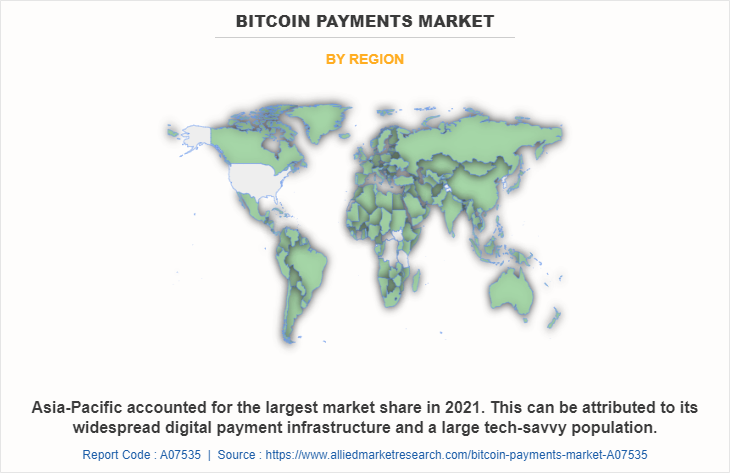

- The bitcoin payments industry in Asia-Pacific held the largest share of 41% in 2021.

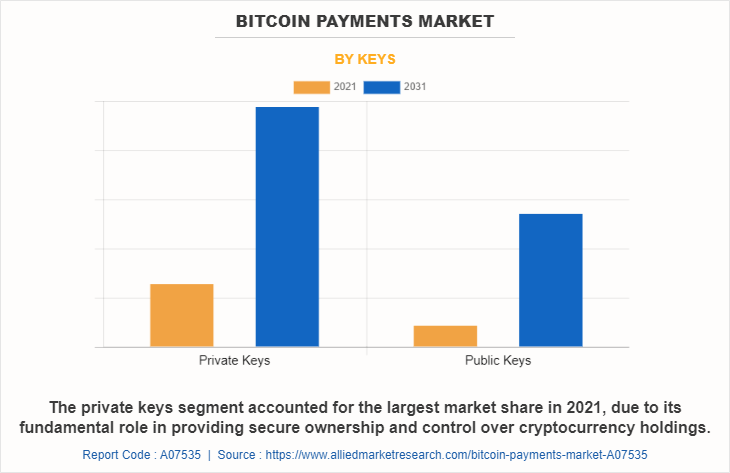

- By keys, the private keys segment dominated the market, accounting for the revenue share of 75% in 2021.

- By component, the hardware segment dominated the market, accounting for the revenue share of 53% in 2021.

- By application, the retail segment is the fastest growing segment in the market, growing at a CAGR of 20.2% from 2022-2031.

Market Size & Future Outlook

- 2021 Market Size: $850.55 Billion

- 2031 Projected Market Size: $3788.2 Billion

- CAGR (2022-2031): 16.3%

- Asia-Pacific: dominated the market in 2021

- North America: Fastest growing market

What is Meant by Bitcoin Payments

A bitcoin payment gateway is a payment processor for digital currencies, similar to the payment processors, gateways, and acquiring bank credit cards use. Bitcoin payments enable users to accept digital payments and receive fiat currency immediately in exchange. Although bitcoin is a purely digital currency, it can be kept secure in analog form. Paper wallets can be used to store bitcoin offline, which removes the possibility of the cryptocurrency being stolen by hackers or computer viruses.

Furthermore, Bitcoin has begun to be accepted as payment mode at many merchants. Payment gateways act as transaction facilitators between merchants and customers for processing payments. Moreover, Bitcoin payment gateways are companies taking on the perceived risk of bitcoin payments by using their wallets to facilitate transactions between merchants and their customers.

Increase in need for operational efficiency and transparency in financial payment systems, rise in demand for remittances in developing countries, increase in the data security, and improvements in capital optimization are the major factors that drives the bitcoin payments market growth. Moreover, high implementation cost and lack of awareness of bitcoin among the people in developing nations hamper the growth of the market. Furthermore, increase in demand for bitcoin among banks, and financial institutions and untapped potential in emerging economies are expected to provide lucrative opportunities for the bitcoin payments market expansion during the forecast period.

The report focuses on growth prospects, restraints, and trends of the bitcoin payments market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the bitcoin payments market.

Bitcoin Payments Market Segment Review

The bitcoin payments market is segmented on the basis of key, component, application, and region. By key, it is bifurcated into private keys and public keys. By component, it is divided into hardware, software, and services. The hardware segment is further bifurcated into hot wallet and cold wallet. By application, it is segregated into E-commerce, retail, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By key, the private keys segment attained the highest growth in 2021. This is attributed to the fact that private key cryptography promises a lot of security benefits in an open network like blockchain. Private key assures confidentiality of the data that is shared by using a pair of keys. The public and private keys that are linked to each other make sure that the data or information that is sent is kept secret from others. It maintains confidentiality by encrypting the data using a public key and decrypting it on the other end using its corresponding private key. Moreover, private keys are much faster and easier to implement. To encrypt or decode a file, the system uses a single, reversible mathematical equation. As a result, symmetric encryption uses fewer computer resources than symmetric encryption.

By region, Asia-Pacific attained the highest growth in 2021. This is attributed to the rise in demand for blockchain across a variety of cross-border payments and wallets for digital identification systems. In addition, other important drivers include the quick development of maintaining transaction records, verifying certificates, and linking bar codes with digital codes, as well as government initiatives and support to simplify documentation processes, cut bureaucracy, and boost government efficiency in the region.

The report analyzes the profiles of key players operating in the bitcoin payments market such as B2BinPay, Binance, Bitpay, Circle Internet Financial Limited, Coingate, Coinpayments, Inc., CoinsPaid, Moon Pay Limited, OpenNode, Paxful, Inc., Paypal, Spectro Finance OU, Utrust, VeriFone, Inc., ZebPay, CONFIRMO, and Plisio, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the bitcoin payments market size.

COVID-19 Impact Analysis

The COVID-19 pandemic had a moderate impact on the bitcoin payments industry as the demand for cryptocurrencies like Bitcoin rapidly increased during the pandemic and more people started investing in bitcoin. However, there was also huge losses incurred by the traders those who traded in Bitcoin. Moreover, many people used bitcoins for making payments but there were also a large section of people who did not intent to receive bitcoin payments. Therefore, the COVID-19 had a moderate impact on the bitcoin payments industry.

What are the Top Impacting Factors in Bitcoin Payments Industry

Rise in need for Transparency in the Payment System

The bitcoin payments market is rapidly growing owing to improved data transparency and independency across payments in banks, financial services, insurance, and various other business sectors. The use of bitcoin across banking industries provides various benefits such as sending and receiving payment transparently and storing customers detail information securely for next purpose. For instance, PayPal, an American-based company, operating in an online payment systems entered into the bitcoin payment market on October 21, 2020 and announced that customers will be able to buy and sell Bitcoin and other virtual currencies using their PayPal accounts. In addition, Mastercard with the partnership of Island Pay launched the world’s first CBDC-linked Card on February 10, 2021. Thus, number of such developments across the major players drives the growth of the market. Furthermore, innovative blockchain distributed technology protocols are expected to replace the need for certain organizational solutions and allow diverse players to share payment transparently across the company. Such systems bring transparency to supply chains, helping in elimination of environmental crimes and others. Therefore, these factors boosts the adoption bitcoin payment.

Lack of Awareness about Bitcoin Among People

Lack of awareness about bitcoin among various emerging countries restricts growth of the market across the globe. The global economy sector is moving toward a digital eco-system, which includes lending services, money transfer, and investment services. The newest and most promising digital payment system, which is bitcoin, is emerging across the globe. Blockchain is a currency exchange platform that allows people to use cryptocurrency such as bitcoin for tracking transactions and enables the transfer of information and value. Distributed ledger technology has spread from cryptocurrency to a wide number of applications in the financial and government industry. However, numerous people and financial & government industries across developing nations such as India, Africa, and Australia are less aware regarding transactions made using bitcoin payment, which hampers growth of the bitcoin payment market across the globe.

Untapped Potential on Emerging Economies

Developing economies offer significant opportunities for cryptocurrency payment to expand their business by offering easier access to capital and financial services. Bitcoin, the most famous of these cryptocurrencies, has already permitted many people and companies to develop and flourish, as their source of income. The economy is slowly shifting to adapt to these needs and bitcoin has a great potential in satisfying them. Evolving demographics, rise in consumerism and openness toward new technologies such as IoT, Blockchain, and others provide lucrative opportunities for bitcoin transactions across developing nations. According to Oxford Business Group, Nigeria is one of the leading country for Bitcoin and cryptocurrency adoption due to use it as a means of sending remittances. In addition, the central bank of Philippines approved 16 cryptocurrency exchanges. This leads to the fact that the country is becoming one of the world’s largest adopter of bitcoin Furthermore, rise in smartphone penetration in Latin America and Africa enables mobile payment service providers to offer sophisticated services on mobile phones. This is considered as the bitcoin payments market opportunity.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bitcoin payment market analysis from 2021 to 2031 to identify the prevailing bitcoin payments market outlook.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bitcoin payments market share segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global bitcoin payments market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bitcoin payments market trends, key players, market segments, application areas, and market growth strategies.

Bitcoin Payments Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.8 trillion |

| Growth Rate | CAGR of 16.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 283 |

| By Keys |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Paxful, Coinpayments, Utrust, Zebpay, Verifone, SpectroCoin, MoonPay, Circle, PayPal, B2BinPay, Binance, Bitpay, OpenNode, Coinspaid, Coingate |

Analyst Review

Bitcoin transactions are messages, like email, which are digitally signed using cryptography and sent to the entire Bitcoin network for verification. Transaction information is public and can be found on the digital ledger known as the 'blockchain.' The history of each and every Bitcoin transaction leads back to the point where the bitcoins were first produced or 'mined’. Moreover, a public ledger records all bitcoin transactions and copies are held on servers around the world. Anyone with a spare computer can set up one of these servers, known as a node. Consent on who owns which coins is reached cryptographically across these nodes rather than relying on a central source of trust like a bank. In addition, every transaction is publicly broadcast to the network and shared from node to node. Every ten minutes or so these transactions are collected together by miners into a group called a block and added permanently to the blockchain.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on April 2022, Nium, a cross-border payments firm based in Singapore, announced the launch of a new API-based solution that will allow businesses to start accepting cryptocurrency payments. The newly launched product is called Crypto Accept. It allows online sellers to accept Bitcoin (BTC) and Ethereum (ETH) before expanding to other digital assets in 2023. Payments are sent to internet merchants' accounts in U.S. dollars or other fiat currencies the next business day, allowing vendors to expand their market and enhance their online payment experiences while avoiding price volatility. Nium partnered with crypto payments processor BitPay to launch the Crypto Accept feature. Consumers can choose their preferred cryptocurrency wallet and scan a QR code to complete the transaction. The service will verify that digital currency is available and settle the transaction in the merchant's chosen currency. Therefore, these strategies will provide major lucrative opportunities for the growth of the bitcoin payment market.

Some of the key players profiled in the report include B2BinPay, Binance, Bitpay, Circle Internet Financial Limited, Coingate, Coinpayments, Inc., CoinsPaid, Moon Pay Limited, OpenNode, Paxful, Inc., Paypal, Spectro Finance OU, Utrust, VeriFone, Inc., ZebPay, CONFIRMO, and Plisio, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Increase in need for operational efficiency and transparency in financial payment systems, rise in demand for remittances in developing countries, increase in the data security, and improvements in capital optimization are the major factors that drive the growth of the bitcoin payment market.

The bitcoin payment market is segmented on the basis of key, component, application, and region. By key, it is bifurcated into private keys and public keys. By component, it is divided into hardware, software, and services. The hardware segment is further bifurcated into hot wallet and cold wallet. By application, it is segregated into E-commerce, retail, and others.

Asia-Pacific is the largest regional market for Bitcoin Payments

The estimated industry size of Bitcoin Payments is projected to reach $3,788.19 billion by 2031

B2BinPay, Binance, Bitpay, Circle Internet Financial Limited, Coingate, Coinpayments, Inc., CoinsPaid, Moon Pay Limited, OpenNode, Paxful, Inc., Paypal, Spectro Finance OU, Utrust, VeriFone, Inc., ZebPay, CONFIRMO, and Plisio, Inc.

Loading Table Of Content...

Loading Research Methodology...