The global blind spot detection (BSD) system market was valued at $3.9 billion in 2021, and is projected to reach $13.7 billion by 2031, growing at a CAGR of 13.7% from 2022 to 2031.

Blind spot detection (BSD) system is a type of advanced driver assistance system which detects objects within a blind spot with the help of unique sensors. Mostly, image sensors are used to transmit an image to the monitor to provide vital information to the driver. These sensors initiate an alarm after sensing the presence of an object within the blind spot. Moreover, different automobile companies have other names for BSD system such as blind-spot monitoring, and blind-spot information system. Furthermore, the purpose of blind spot detection system is to increase safety by reducing the risk of collisions caused by drivers and to reduce the frequency of accidents.

The growth of the global blind spot detection system market is propelling, due to high demand for safety features, stringent safety rules and regulations, and increased demand for comfort while driving. However, high initial cost and complex structure, and lower efficiency in bad weather conditions are the factors hampering the growth of the market. Furthermore, technological advancements are the factor expected to offer growth opportunities during the forecast period.

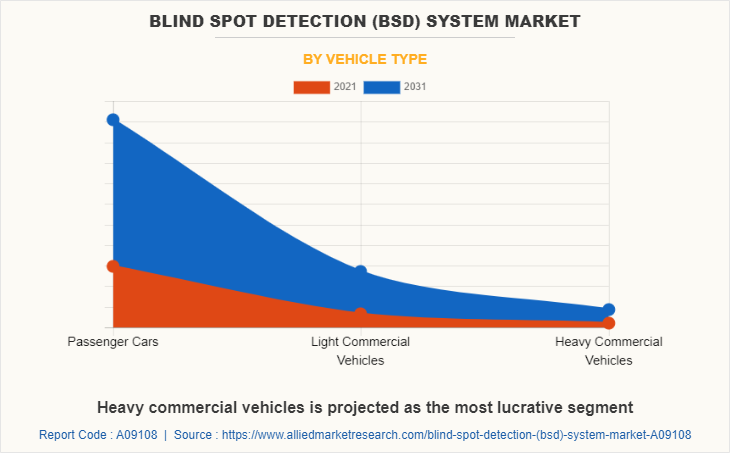

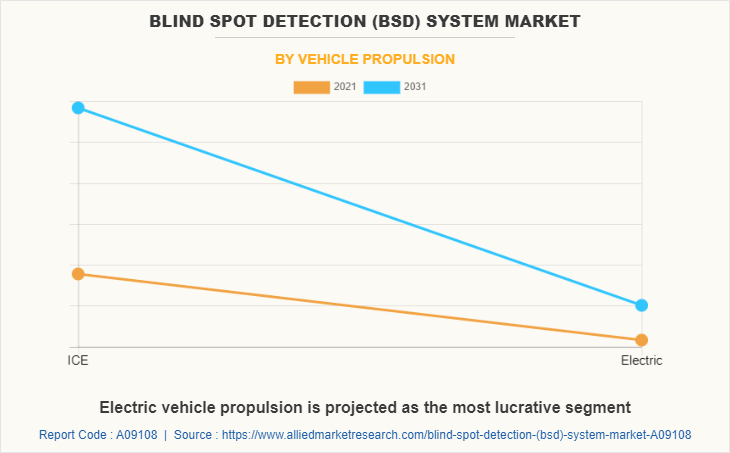

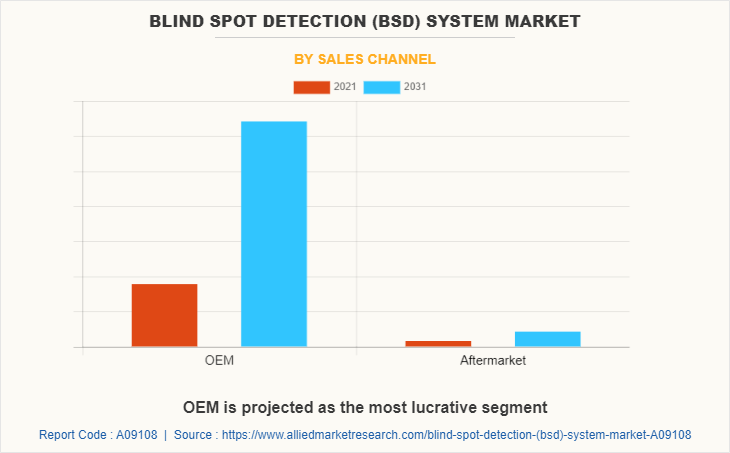

The blind spot detection system market is segmented on the basis of technology, vehicle type, vehicle propulsion, sales channel, and region. By technology, it is segmented into ultrasound, radar, and camera. By vehicle type, it is classified into passenger cars, light commercial vehicles, and heavy commercial vehicles. By vehicle propulsion, it is fragmented into ICE and electric. By sales channel, it is categorized into OEM and aftermarket. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the blind spot detection system market report comprises Autoliv, Inc., Borgwarner Inc., Continental AG, Denso Corporation, Hyundai Mobis, Magna International Inc., Panasonic (Ficosa International), Robert Bosch GmbH, Sensata Technologies, and Valeo SA, VBOX Automotive, and Xiamen Autostar Electronics CO., Ltd.

High demand for safety features

The demand for safety features, such as parking assistance, collision avoidance systems, lane departure warnings, traction control, electronic stability control, tire pressure monitors, airbags, and telematics is in demand due to increase in number of road accidents across the globe. Vehicles with installed BSD can detect and classify certain objects on the road, and alert driver according to the road conditions. In addition, these systems can also automatically decelerate or stop the vehicle depending on the road conditions. Furthermore, it is observed that there is a tremendous increase in the death rates due to road accidents.

For instance, according to World Health Organization’s report, nearly 1.25 million people die in road accidents each year. Moreover, road traffic injuries leading to death are higher among teenagers. These factors are leading to the growing demand for safety features in vehicles. Automobile companies are developing and introducing safety features to meet the needs of the customers. Thus, high demand for safety features drives the growth of the blind spot detection system market.

Stringent safety rules and regulations

Countries have implemented laws and regulations for vehicles to install safety systems such as blind spot detection system, lane departure warning system and tire pressure monitoring system in their vehicles within a stipulated time period. For instance, the Indian government has made amendments to the motor vehicle act, to mandate the use of advanced brake systems in all new models of commercial vehicles starting from April 2022. Technologies such as drowsiness monitoring system, lane departure system, driver monitoring system along with the presence of airbags in vehicles, wearing of seat belts by the passengers, child safety system, pedestrian safety system, and others are made mandatory by countries to be installed in the vehicles.

Moreover, automobile manufactures need to obtain safety ratings from organizations such as the Insurance Institute of Highway Safety (IIHS), New Car Assessment Program (NCAP), and International Centre for Automotive Technology (ICAT) to access the sales license of vehicles in the market. Thus, all these safety rules and regulations made by the government is expected to boost the growth of the blind spot detection system market in the coming years.

Increased demand for comfort while driving

Consumers are inclined toward comfort while driving due to the increase in purchasing power. Application of advanced driver assistance system, such as adaptive cruise control and parking aid systems, have been introduced to provide comfort to drivers. However, the driver can overrule the system at any time. Other systems such as intelligent parking system, adaptive cruise control system, night vision system, and others, which support the driver for lateral control of the vehicle are in continuous development phase.

In addition, the demand for driver assistance applications has significantly increased in the recent years due to increase in the purchasing power of consumers and has influenced consumers to shift from normal driving to comfort driving. Moreover, the per capita income of consumers has increased due to improvement in the economic condition of several emerging countries. This factor fuels the growth of the blind spot detection system market.

High initial cost and complex structure

The high cost associated with installing applications in vehicles is expected to reduce the growth of the blind spot detection system market, as this factor increases the cost of the car. Factors such as higher cost involved in the installation of blind spot detection system is leading to the higher cost of cars. The prospect of providing premium features in vehicles incurs additional expenses to consumers in the form of hardware, applications, and telecom service charges, which eventually hamper the growth of the blind spot detection system industry.

Moreover, the serviceability of the vehicle is difficult, and requires skilled workers due to several electronic components and sensors. Complex structure of systems reduces the shelf life of vehicles. Thus, high initial cost and complex structure is expected to have a significant impact on the growth of the blind spot detection system market.

Lower efficiency in bad weather conditions

Environmental changes largely act as a restraint for blind spot detection system. This is due to the fact that sensor or camera associated with blind spot detection system face difficulty in tracking moving objects during bad weather conditions. The blind spot detection system does not work effectively in bad weather conditions. Vision-based systems especially have poor outcomes in bad weather and low light conditions.

Moreover, other environmental factors such as lightening & thunder storm, and heavy rain also affect the market growth. Hence, low efficiency in bad weather conditions hamper the adoption of blind spot detection system across the globe.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blind spot detection (BSD) system market analysis from 2021 to 2031 to identify the prevailing blind spot detection (BSD) system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blind spot detection (BSD) system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blind spot detection (bsd) system market trends, key players, market segments, application areas, and market growth strategies.

Blind Spot Detection (BSD) System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13.7 billion |

| Growth Rate | CAGR of 13.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 303 |

| By Technology |

|

| By Vehicle Type |

|

| By Vehicle Propulsion |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Hyundai Mobis, Bosch Mobility Solutions, Valeo Group, Delphi Technologies, Preco Electronics, VBOX Automotive, Continental AG, Denso Corporation, Autoliv, Inc., Magna International Inc., Ficosa International SA, Xiamen Autostar Electronics Co., Ltd. |

Analyst Review

The global blind spot detection (BSD) system market is expected to witness significant growth due to high demand for safety features, stringent safety rules and regulations, and increased demand for comfort while driving.

Companies are installing a wider range of features and technologies to their vehicles to provide comfort to consumers and to increase the sales. In addition, technological advancement in electronic components, such as sensors and smartphones which are supported with wireless communication & cloud systems provides better surrounding information and improves the safety of the consumers.

Moreover, some manufacturers are introducing new blind spot detection sensor for integration in autonomous vehicles, which is expected to be implemented in the near future. For instance, in 2020, Hesai, a Japanese LiDAR sensor manufacturer unveiled its blind spot detection sensor PandarQT designed for autonomous vehicles at the CES 2020. Thus, technological advancements are anticipated to provide a remarkable growth opportunity for the key players operating in the blind spot detection system market.

The global blind spot detection system market was valued at $3.9 billion in 2021, and is projected to reach $13.7 billion by 2031, growing at a CAGR of 13.7% from 2022 to 2031.

The leading companies include Autoliv, Inc., Borgwarner Inc., Continental AG, Denso Corporation, Hyundai Mobis, Magna International Inc., Panasonic (Ficosa International), Robert Bosch GmbH, Sensata Technologies, and Valeo SA, VBOX Automotive, and Xiamen Autostar Electronics CO., Ltd.

The leading application is passenger cars.

The largest regional market is Europe.

The upcoming trends include technological advancements due to high demand for safety features and introduction of strict safety regulations.

Loading Table Of Content...